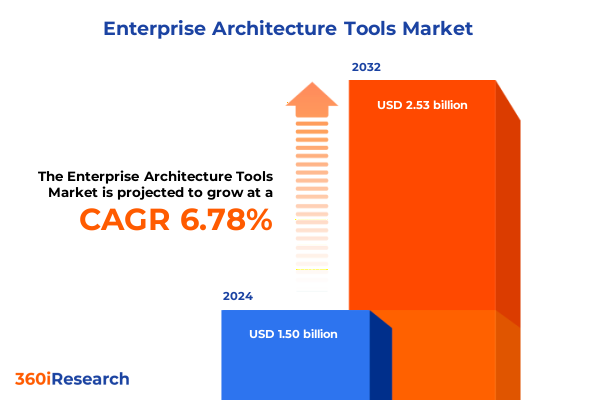

The Enterprise Architecture Tools Market size was estimated at USD 1.60 billion in 2025 and expected to reach USD 1.71 billion in 2026, at a CAGR of 7.94% to reach USD 2.73 billion by 2032.

Building a Comprehensive Understanding of Enterprise Architecture Tools and Their Role in Driving Organizational Agility and Strategic Alignment

The evolving complexity of technology-driven organizations necessitates a clear, holistic view of how enterprise architecture tools support strategic objectives and operational effectiveness. As enterprises navigate rapid digital transformation, these platforms have emerged as foundational elements that unify disparate systems, streamline decision-making, and accelerate time to value. This introduction establishes the context for understanding how modern organizations leverage enterprise architecture tools to align their IT investments with business imperatives, mitigate risk, and foster a culture of continuous improvement.

In addition, enterprise architecture tools serve as the connective framework that translates high-level business goals into executable roadmaps, bridging the gap between C-suite vision and day-to-day technical execution. By modeling process flows, capturing stakeholder requirements, and visualizing technology landscapes, these solutions empower leaders to anticipate change, optimize resource allocation, and improve cross-functional collaboration. Moreover, as organizations grapple with legacy system consolidation, regulatory compliance, and emergent security threats, the strategic importance of a unified architectural perspective cannot be overstated.

Consequently, this executive summary will guide readers through the transformative shifts redefining the market, examine external economic factors affecting adoption, distill key segmentation and regional insights, highlight influential vendors, and present actionable recommendations for decision-makers. The following sections will provide a structured narrative that illuminates the current landscape, uncovers critical trends, and charts a path toward sustainable enterprise architecture maturity.

Exploring the Transformative Shifts Shaping Enterprise Architecture Practices from Cloud Adoption to Intelligent Automation Integration

Over the past several years, the enterprise architecture landscape has undergone a significant metamorphosis driven by fundamental shifts in technology and organizational priorities. The migration to cloud-native environments has compelled architecture teams to reevaluate legacy processes and embrace platforms that support hybrid and multi-cloud deployments. By extending modeling capabilities to encompass cloud constructs, these tools now offer the flexibility required for seamless infrastructure orchestration and workload portability.

Furthermore, the rise of low-code and no-code development paradigms has elevated the need for architecture frameworks that integrate citizen-developer contributions without sacrificing governance. This convergence has led to the emergence of collaboration tools designed to facilitate real-time stakeholder engagement, version control, and approval workflows. Additionally, artificial intelligence and machine learning are progressively embedded into repository engines, enabling automatic discovery of system interdependencies and proactive impact analysis.

Consequently, enterprises are witnessing a shift from static, documentation-centric approaches to dynamic, analytics-driven environments where continuous modeling and simulation inform strategic decision-making. These transformative trends underscore the growing expectation that enterprise architecture tools not only catalog current states but also predict future scenarios, optimize IT asset utilization, and accelerate digital innovation.

Analyzing the Far-Reaching Consequences of 2025 United States Tariffs on Enterprise Architecture Tool Supply Chains and Cost Structures

The implementation of cumulative tariffs by the United States in 2025 has introduced multifaceted challenges affecting the procurement, licensing, and deployment of enterprise architecture solutions. Imported hardware components, including servers and storage arrays used to host architecture platforms, have experienced increased duty obligations, prompting many organizations to reevaluate existing infrastructure plans. As a result, some enterprises have accelerated migration to subscription-based cloud offerings, aiming to reduce reliance on on-premises capital expenditures and mitigate potential tariff impacts.

Moreover, software vendors with offshore development centers have responded to elevated cross-border costs by adjusting pricing models, imposing supplementary fees for maintenance and support services. Consequently, enterprise buyers are increasingly scrutinizing total cost of ownership and exploring regional vendors capable of delivering comparable functionality at a more favorable cost structure. In parallel, the complexity of global supply chains has urged procurement teams to implement stricter vendor risk assessments, ensuring continuity of service and compliance with evolving trade regulations.

Additionally, the broader economic ripple effects of these tariffs have influenced budget allocations for digital initiatives. With IT leaders under pressure to justify spend, enterprise architecture programs must demonstrate clear ROI through improved governance, reduced technical debt, and accelerated time to market. In addressing these conditions, successful organizations are combining strategic vendor negotiations with internal process optimizations to preserve momentum in their architecture modernization journeys.

Unveiling Critical Segmentation Insights Across Component Types Deployment Modes Enterprise Sizes and Industry Verticals

Dissecting the market through the lens of component type reveals that analytics and reporting modules are increasingly valued for their ability to generate actionable intelligence across complex technology landscapes. Organizations now demand sophisticated dashboards that correlate architecture artifacts with performance metrics, enabling the continuous refinement of both IT ecosystems and business processes. Meanwhile, collaboration and stakeholder engagement capabilities have become integral to fostering transparency; these modules support role-based access, comment threads, and integrated approval workflows, ensuring alignment across distributed teams.

Equally, model and design tools remain the cornerstone of enterprise architecture frameworks, facilitating the visualization of process maps, application portfolios, and infrastructure diagrams. These engines often integrate simulation features that allow practitioners to forecast the impact of strategic shifts, such as data center rationalization or service-oriented architecture adoption. At the same time, repository tools underpin the entire platform by providing centralized storage, version control, and metadata management-attributes essential for maintaining consistency and supporting auditability.

Shifting focus to deployment mode, cloud-hosted solutions continue to outpace on-premises installations due to their scalability, automatic updates, and lower upfront investment barriers. Nevertheless, certain regulated and highly secure environments still display a preference for on-premises deployments, where full control over data residency and system configuration is paramount. Further, large enterprises leverage hybrid architectures to balance agility with governance, while medium and small organizations often opt for turnkey subscriptions that expedite time to value.

Turning to enterprise size, large organizations exhibit complex, multi-domain architecture requirements and typically invest in premium, end-to-end suites. Medium-sized businesses seek modular solutions that can be tailored to specific functional needs, whereas smaller enterprises favor integrated platforms offering fundamental modeling and reporting features. Finally, when evaluating industry verticals, financial services firms emphasize regulatory compliance and risk modeling; energy and utilities providers prioritize grid resilience and asset management; government entities require standardized frameworks and security clearances; healthcare organizations focus on patient data integrity and system interoperability; IT and telecom enterprises target innovation roadmaps and network evolution; manufacturers concentrate on production line optimization; and retail and consumer goods companies align architecture initiatives with omnichannel customer experiences.

This comprehensive research report categorizes the Enterprise Architecture Tools market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Deployment Mode

- Enterprise Size

- Industry Vertical

Gaining Key Regional Insights into Enterprise Architecture Tool Adoption and Growth Dynamics Across the Americas EMEA and Asia-Pacific

Regional analysis highlights that enterprises in the Americas continue to spearhead adoption, driven by mature digital transformation agendas and a strong presence of cloud service providers. U.S. and Canadian organizations emphasize integration with enterprise resource planning and customer relationship management systems, while Latin American markets are rapidly catching up, leveraging architecture tools to leapfrog legacy constraints. Additionally, North American regulatory frameworks around data privacy and cybersecurity have heightened focus on architecture governance and compliance features.

In Europe, Middle East, and Africa, regulatory complexity and a diverse technology ecosystem shape demand for flexible, multi-jurisdictional solutions. Western European enterprises often seek products that support stringent data sovereignty requirements, whereas Middle Eastern organizations prioritize rapid deployment and scalability. African markets, although nascent in tool adoption, are increasingly exploring architecture platforms to support smart city and digital infrastructure initiatives.

Asia-Pacific demonstrates a dynamic and heterogeneous landscape, with established economies such as Australia and Japan investing heavily in AI-driven analytics, while Southeast Asian nations adopt cloud-first strategies to address infrastructure gaps. China and India present vast growth potential, supported by government modernization programs and rising demand from both public and private sectors. Across the region, vendor partnerships with local system integrators amplify market reach and facilitate customization to meet specific compliance and language needs.

This comprehensive research report examines key regions that drive the evolution of the Enterprise Architecture Tools market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Enterprise Architecture Tool Providers Their Strategic Positioning and Competitive Differentiators in a Crowded Market

The competitive landscape is characterized by a blend of specialized boutique firms and broad-suite technology providers vying for market prominence. Leading vendors differentiate through integrated platforms that encompass modeling, analysis, and governance capabilities, while others focus on deep vertical expertise to address sector-specific requirements. Certain challengers have garnered attention by embedding AI-driven discovery engines within their repositories, automating the mapping of application interdependencies and reducing manual efforts.

Strategic partnerships also play a pivotal role, as alliances with cloud hyperscalers and system integrators extend solution footprints and enable rapid implementation. Vendors that maintain extensive certification programs and cultivate vibrant user communities benefit from accelerated innovation cycles and peer-driven best practices. Furthermore, several market players have introduced consumption-based pricing models, reflecting a shift toward usage-aligned billing that resonates with organizations seeking financial flexibility.

In addition, product roadmaps increasingly emphasize open-architecture principles and API-first design, empowering customers to build custom integrations and avoid vendor lock-in. As the ecosystem matures, the ability to co-innovate with customers, support emerging frameworks, and integrate with adjacent technology stacks will determine long-term success. Leaders in this space invest in continuous R&D, leverage cross-domain insights, and commit to transparent governance policies to maintain credibility and foster trust.

This comprehensive research report delivers an in-depth overview of the principal market players in the Enterprise Architecture Tools market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avolution Pty Ltd

- IBM Corporation

- LeanIX GmbH

- MEGA International S.A.S.

- Orbus Software Ltd.

- Planview Inc.

- QualiWare A/S

- Quest Software Inc.

- SAP SE

- Software AG

- Sparx Systems Pty Ltd

- ValueBlue B.V.

Delivering Actionable Recommendations for Industry Leaders to Harness Enterprise Architecture Tools for Sustainable Competitive Advantage

Industry leaders should prioritize the adoption of modular and scalable architecture platforms that can evolve alongside shifting business priorities. By selecting solutions with robust analytics and simulation functionalities, decision-makers can gain forward-looking insights that guide infrastructure investments and process transformations. Moreover, implementing comprehensive governance frameworks that integrate policy enforcement and compliance monitoring ensures that architecture initiatives remain aligned with regulatory mandates and internal standards.

Furthermore, organizations should cultivate cross-functional collaboration by leveraging stakeholder engagement modules to facilitate stakeholder buy-in and maintain alignment across business and IT teams. Training programs and community of practice forums help accelerate adoption and embed architecture thinking within corporate culture. In addition, enterprises are advised to pilot AI-enabled discovery engines on critical system landscapes to assess the potential for automation in maintaining up-to-date architecture repositories and reducing manual workload.

Lastly, cultivating strategic relationships with vendors and systems integrators empowers organizations to negotiate flexible commercial terms, access specialized expertise, and co-develop innovations. Establishing metrics for architecture maturity and ROI-such as service delivery lead time, change-failure rates, and cost optimization-provides clear benchmarks for continuous improvement. By following these recommendations, industry leaders can position themselves at the forefront of digital transformation and leverage enterprise architecture as a strategic asset.

Detailing a Rigorous Research Methodology Combining Primary Expert Engagement Secondary Research and Triangulated Data Analysis

This study employs a rigorous, multi-phase approach that combines primary research, secondary literature review, and data triangulation to ensure robust insights. Primary research included in-depth interviews with C-level stakeholders, enterprise architects, and solution providers to capture firsthand perspectives on tool adoption drivers, barriers, and emerging requirements. Supplementing these interviews, workshops and surveys provided quantitative data on feature prioritization and deployment preferences.

Secondary research encompassed a thorough examination of vendor documentation, industry white papers, regulatory filings, and published case studies to contextualize qualitative findings. Publicly available information from technology consortia and standard-setting bodies informed the assessment of best practices and compliance frameworks. Data triangulation techniques were applied to reconcile discrepancies between different information sources and validate key themes.

Finally, proprietary modeling tools were used to map vendor capabilities against market needs, ensuring comprehensive coverage of component types, deployment modes, enterprise sizes, and industry verticals. Peer reviews by independent experts and ongoing feedback loops with select participants enhanced the credibility and reliability of the research. This methodology ensures that the findings and recommendations presented herein rest on a solid foundation of empirical evidence and expert judgment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Enterprise Architecture Tools market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Enterprise Architecture Tools Market, by Component Type

- Enterprise Architecture Tools Market, by Deployment Mode

- Enterprise Architecture Tools Market, by Enterprise Size

- Enterprise Architecture Tools Market, by Industry Vertical

- Enterprise Architecture Tools Market, by Region

- Enterprise Architecture Tools Market, by Group

- Enterprise Architecture Tools Market, by Country

- United States Enterprise Architecture Tools Market

- China Enterprise Architecture Tools Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Concluding Reflections on the Evolutionary Trajectory of Enterprise Architecture Tools and Implications for Future Business Success

The evolution of enterprise architecture tools reflects a broader imperative for organizations to marry strategic vision with tactical execution. As digital transformation initiatives intensify, these platforms have transcended their historical roles as passive documentation systems to become active engines for innovation and governance. The insights distilled in this report underscore the importance of adaptable, analytics-driven solutions capable of guiding decision-making in an increasingly complex technology landscape.

Whether grappling with the effects of global trade policies, responding to rapid shifts in deployment paradigms, or navigating the diverse needs of multiple industry verticals, organizations must adopt a holistic approach to their architecture practice. Leveraging the right blend of component types, deployment options, and governance frameworks will enable companies to unlock operational efficiencies and maintain strategic alignment in the face of continuous change.

In conclusion, enterprise architecture tools stand as cornerstones of digital resilience, empowering stakeholders to anticipate organizational challenges, optimize resource use, and drive sustainable competitive advantage. The path forward lies in selecting platforms that balance innovation with control, supporting both immediate operational demands and long-term strategic goals.

Contact Associate Director Ketan Rohom Today to Secure Your In-Depth Enterprise Architecture Tools Market Research Report

Don’t miss the chance to equip your organization with unparalleled insights into the enterprise architecture tools landscape. To explore the comprehensive market research report and learn how these tools can unlock efficiency, foster innovation, and drive strategic alignment, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engage with Ketan to discuss tailored licensing packages, value-added consulting services, and bespoke onboarding options designed to maximize your return on investment. By partnering with Ketan, you’ll gain priority access to expert briefings, supplementary datasets, and post-publication support to ensure you extract actionable intelligence for your digital transformation initiatives. Secure your competitive advantage and empower your decision-makers with the clarity and depth of analysis only this report can provide-contact Ketan Rohom today.

- How big is the Enterprise Architecture Tools Market?

- What is the Enterprise Architecture Tools Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?