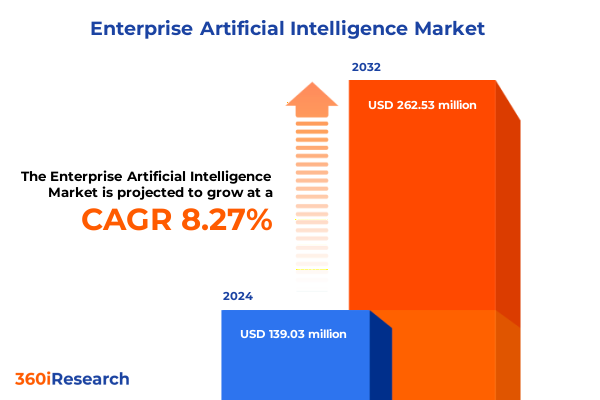

The Enterprise Artificial Intelligence Market size was estimated at USD 148.44 million in 2025 and expected to reach USD 163.17 million in 2026, at a CAGR of 8.48% to reach USD 262.53 million by 2032.

Charting the Emergence of Enterprise AI under Rapid Technological Advances and Evolving Market Dynamics Shaping Tomorrow’s Competitive Edge

In an era where artificial intelligence is reshaping every facet of business operations, enterprises face the imperative of integrating AI capabilities not as a peripheral innovation but as a core strategic asset. Across industries, leading organizations are leveraging advanced machine learning models, natural language processing engines, and computer vision frameworks to enhance decision making, streamline workflows, and deliver superior customer experiences. At the same time, evolving economic conditions, geopolitical tensions, and the proliferation of data privacy regulations have introduced new layers of complexity for technology decision makers.

Considering these factors, this executive summary aims to provide a clear-eyed overview of the trends, forces, and strategic considerations that private sector and public sector leaders must address when charting their AI journey. By examining transformative disruptions, policy shifts such as the 2025 U.S. tariff adjustments, nuanced segmentation landscapes, regional adoption patterns, and competitive imperatives, the following sections equip stakeholders with a holistic understanding of the market’s trajectory. This analysis sets the foundation for informed decision making, guiding organizations toward investments that balance innovation, risk mitigation, and return on AI initiatives.

Navigating Unprecedented AI-Driven Market Realities and Strategic Imperatives to Forge Resilient Competitive Strategies in a Rapidly Shifting Ecosystem

Over the past 24 months, breakthroughs in deep learning architectures and the commercialization of generative AI platforms have fundamentally redefined enterprise priorities. Organizations have shifted from exploratory pilot programs to scaled deployments across customer service, predictive maintenance, and supply chain orchestration. Augmenting this evolution, edge AI and federated learning have gained traction, enabling real-time insights without compromising data sovereignty. Meanwhile, cloud providers continue to invest in optimized hardware instances and turnkey AI services, reducing barriers to entry and accelerating time to value.

Concurrently, regulatory landscapes are materializing around AI ethics, data protection, and algorithmic accountability. Governments in North America, Europe, and Asia-Pacific are introducing frameworks that demand transparency and robustness, compelling enterprises to adopt governance practices earlier in their AI lifecycle. These policy evolutions, paired with the rising emphasis on sustainable and explainable AI, are catalyzing cross-functional collaboration between technology, legal, and risk teams. As a result, the competitive environment favors organizations that can harmonize technical prowess with ethical rigor and operational resilience.

Assessing the Comprehensive Repercussions of 2025 U.S. Tariffs on AI Ecosystems and Their Ripple Effects across Hardware, Software, and Services

Beginning January 1, 2025, the United States implemented targeted increases to Section 301 tariffs affecting semiconductors and related hardware components, elevating duty rates to 50 percent for advanced integrated circuits under Harmonized Tariff Schedule entries 8541 and 8542. This adjustment has directly influenced the cost structure of AI-optimized processors, GPUs, and AI accelerator modules, prompting hardware providers and enterprise buyers to reassess sourcing strategies and total cost of ownership. Moreover, existing 25 percent duties on critical minerals, steel, and aluminum products remain in force, further impacting data center infrastructure investments and server manufacturing.

These tariffs have catalyzed a strategic pivot toward domestic production and diversification of supply chains. Several service providers have accelerated partnerships with U.S.-based foundries, while multinational software companies have invested in regional development hubs to mitigate exposure to import levies. In parallel, professional services firms have seen an uptick in engagements advising on tariff engineering, bonded warehouse utilization, and tariff classification optimization. Collectively, the 2025 U.S. tariff regime has realigned cost considerations, risk assessments, and investment roadmaps for enterprise AI deployments across hardware, software, and managed services.

Unveiling Critical Insights from Multifaceted AI Market Segmentation Perspectives to Illuminate Value Drivers across Components, Technologies, and Verticals

A multifaceted segmentation analysis reveals the nuanced value drivers shaping enterprise AI adoption. When viewed through the lens of components, hardware offerings calibrated for inference and training workloads coexist with a growing array of software frameworks and managed, professional, and support services designed to accelerate implementation and reduce operational complexity. In the realm of technology classifications, foundational models built on machine learning-ranging from supervised, unsupervised, and reinforcement learning-to computer vision and natural language processing each carry distinct integration and optimization considerations.

Examining enterprise scale, large organizations deploy AI at enterprise-wide scale to extract synergies across global operations, while medium and small enterprises prioritize point solutions that deliver rapid ROI. Deployment modes, whether cloud-native, hybrid architectures, or fully on-premise solutions, are chosen based on factors such as data sensitivity, latency requirements, and total cost imperatives. Application domains span customer engagement through predictive analytics, monitoring and control for real-time operational insights, process automation to streamline repetitive tasks, and risk management to enhance decision accuracy. Finally, across industry verticals-BFSI, government, healthcare, IT & telecom, manufacturing, and retail-AI adoption curves vary based on regulatory complexity, data maturity, and capital intensity, underscoring the importance of tailored go-to-market approaches and solution portfolios.

This comprehensive research report categorizes the Enterprise Artificial Intelligence market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Enterprise Size

- Deployment Mode

- Application

- Industry Vertical

Illuminating Strategic Regional Dynamics Shaping Enterprise AI Adoption across Americas, Europe Middle East & Africa, and Asia-Pacific Growth Trajectories

Regional dynamics are pivotal in determining enterprise AI strategy and investment priorities. In the Americas, a combination of strong venture capital activity, robust cloud infrastructure, and progressive data privacy frameworks has fostered rapid experimentation and scaling of AI use cases in sectors such as financial services, healthcare, and retail. Conversely, Europe, the Middle East, and Africa present a diverse mosaic of regulatory regimes, ranging from the EU’s stringent AI Act provisions to Middle Eastern national AI strategies, which collectively spur demand for compliance-centric solutions and localized support services.

Asia-Pacific markets demonstrate a dual-speed adoption curve: leading economies drive demand for cutting-edge AI-enabled manufacturing and telecom innovations, while emerging markets are leveraging AI cloud services to accelerate public sector modernization and digital inclusion programs. These regional distinctions inform how enterprises strategize partnerships, localize deployments, and prioritize investments in data governance and model explainability, ensuring that AI solutions align with cultural, legal, and economic contexts across global operations.

This comprehensive research report examines key regions that drive the evolution of the Enterprise Artificial Intelligence market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Prominent Industry Players Steering the Enterprise AI Revolution with Key Competitive Differentiators and Innovation Portfolios Driving Market Leadership

The enterprise AI landscape is characterized by the presence of global technology leaders, specialist software innovators, and service-focused consultancies. Large cloud providers distinguish themselves through extensive AI-as-a-service portfolios and proprietary silicon roadmaps, enabling rapid model provisioning and elastic capacity. Meanwhile, specialized AI boutiques offer vertical-specific platforms that narrowly address the unique risk profiles and operational challenges of sectors such as banking, life sciences, and heavy industry.

Complementing these technology providers, system integrators and consultancy firms have deepened their AI capabilities, combining domain expertise with data science talent to offer end-to-end transformation programs. Partnerships between software vendors and professional services organizations are increasingly common, facilitating seamless transitions from proof of concept to pilot to scale. Through strategic acquisitions, co-development agreements, and ecosystem alliances, these companies continue to expand their footprints, refine solution portfolios, and strengthen customer success frameworks to capture the next wave of enterprise AI demand.

This comprehensive research report delivers an in-depth overview of the principal market players in the Enterprise Artificial Intelligence market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Amazon Web Services, Inc.

- Anthropic PBC

- C3.ai, Inc.

- Capgemini SE

- Cisco Systems, Inc.

- Cognizant Technology Solutions Corporation

- Dataiku

- DataRobot, Inc.

- DeepL SE

- DominData Lab, Inc.

- Google LLC

- H2O.ai, Inc.

- Hewlett Packard Enterprise Development LP

- Infosys Limited

- Intel Corporation

- International Business Machines Corporation

- Jasper AI, INC.

- Microsoft Corporation

- NVIDIA Corporation

- OpenAI Group PBC

- Oracle Corporation

- Palantir Technologies Inc.

- Persado, Inc.

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- ServiceNow, Inc.

- Snowflake Inc.

- Tata Consultancy Services Limited

- Wipro Limited

Equipping Industry Leaders with Pragmatic Actions to Capitalize on Enterprise AI Transformation while Anticipating Evolving Regulatory and Technology Trends

To capitalize on enterprise AI opportunities, organizations must begin by defining clear business objectives that align with overarching digital strategies. Establishing cross-functional governance bodies ensures that data privacy, ethics, and compliance are integrated from the outset, reducing downstream risks and accelerating time to production. Investing in modular architectures-combining on-premise, hybrid, and cloud components-enables incremental scaling of workloads while preserving flexibility and cost control.

Additionally, companies should cultivate internal AI literacy and data science competencies through targeted training programs and strategic talent acquisition. Building strategic partnerships with niche technology providers, local research institutions, and specialized integrators can augment internal capabilities and provide access to domain-specific accelerators. Finally, continuous performance monitoring and feedback loops, paired with robust model management frameworks, are essential for ensuring sustained accuracy, explainability, and regulatory compliance as AI systems evolve and expand their operational scope.

Outlining Rigorous Methodologies Underpinning Robust Enterprise AI Market Research and Analysis Frameworks

This research is grounded in a combination of primary and secondary methodologies designed to yield a comprehensive and balanced market perspective. Primary research included in-depth interviews with senior executives, CIOs, and data science leads at leading enterprises, as well as detailed surveys of technology providers and service firms. These engagements provided qualitative insights into strategy drivers, adoption barriers, and operational best practices.

Secondary research entailed rigorous analysis of public filings, government policy announcements, tariff schedules, industry consortium reports, and academic publications. Data triangulation techniques were applied to validate findings and reconcile discrepancies across sources. Market segmentation frameworks were developed through iterative validation with subject-matter experts, ensuring that component, technology, enterprise size, deployment mode, application, and vertical classifications accurately reflect current industry structures.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Enterprise Artificial Intelligence market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Enterprise Artificial Intelligence Market, by Component

- Enterprise Artificial Intelligence Market, by Technology

- Enterprise Artificial Intelligence Market, by Enterprise Size

- Enterprise Artificial Intelligence Market, by Deployment Mode

- Enterprise Artificial Intelligence Market, by Application

- Enterprise Artificial Intelligence Market, by Industry Vertical

- Enterprise Artificial Intelligence Market, by Region

- Enterprise Artificial Intelligence Market, by Group

- Enterprise Artificial Intelligence Market, by Country

- United States Enterprise Artificial Intelligence Market

- China Enterprise Artificial Intelligence Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Core Findings to Illuminate the Path Forward in Enterprise AI Advancement and Strategic Decision-Making

This executive summary has highlighted the confluence of technological innovation, regulatory evolution, and macroeconomic factors reshaping enterprise AI initiatives. Organizations that strategically address the cost impacts of hardware tariffs, leverage nuanced segmentation insights, and tailor solutions to regional dynamics are positioned to lead in their respective markets. The competitive landscape will continue to evolve as companies refine their AI and data governance approaches, optimize deployment models, and forge ecosystem partnerships.

Ultimately, the ability to marry technical agility with ethical and compliance-minded practices will determine which enterprises sustain long-term value creation from AI investments. As the market transitions from proof-of-concept experimentation to mission-critical deployments, stakeholders must maintain vigilance, continuously adapt to policy changes, and invest in scalable architectures that can respond to the next wave of AI-driven disruption.

Engaging Direct Consultation to Obtain In-Depth Enterprise AI Market Research Insights with Our Sales & Marketing Expert

To delve deeper into the enterprise artificial intelligence landscape and arm your organization with strategic insights, we invite you to connect with our Associate Director of Sales & Marketing, Ketan Rohom, to acquire the full market research report. His expertise in translating complex data into actionable plans ensures you will receive tailored support in navigating AI adoption, regulatory challenges, and competitive positioning. Reach out to secure your copy of the comprehensive study, which includes detailed analyses of market drivers, tariff impacts, segmentation insights, regional dynamics, company profiles, and recommended roadmaps for success. Empower your team with the intelligence needed to harness AI’s transformative power and achieve sustainable competitive advantage in 2025 and beyond.

- How big is the Enterprise Artificial Intelligence Market?

- What is the Enterprise Artificial Intelligence Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?