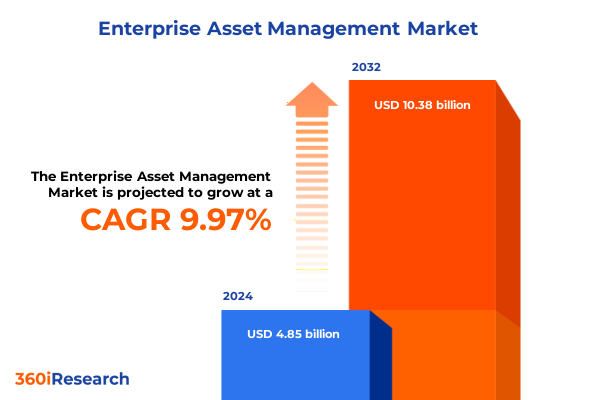

The Enterprise Asset Management Market size was estimated at USD 5.33 billion in 2025 and expected to reach USD 5.85 billion in 2026, at a CAGR of 9.99% to reach USD 10.38 billion by 2032.

Unveiling the Strategic Importance of Enterprise Asset Management in Enhancing Operational Efficiency and Regulatory Compliance Across Industries

Enterprise asset management has emerged as a foundational pillar for organizations committed to maximizing operational uptime while minimizing total cost of ownership. As businesses navigate increasingly complex asset portfolios, the integration of strategic asset lifecycle practices has transitioned from a back-office imperative to a board-level priority. Digitalization, evolving regulatory landscapes, and the drive for sustainability have collectively elevated the discipline into a key enabler of resilience and competitive differentiation.

Building on decades of incremental improvements, modern asset management solutions now encompass advanced capabilities such as real-time condition monitoring, predictive analytics, and integrated risk management. These transformative enhancements have proven essential for industries seeking to optimize maintenance schedules, mitigate unplanned downtime, and extend asset lifecycles. In this dynamic environment, leaders must understand how refined asset management programs can deliver measurable value across diverse operational contexts, from manufacturing floors to critical infrastructure networks.

Examining the Rapid Evolution of Enterprise Asset Management Through Digital Transformation, Predictive Analytics, and Sustainability-Driven Innovations

Over the past few years, the enterprise asset management landscape has undergone profound shifts driven by emerging technologies and heightened stakeholder expectations. The widespread adoption of Internet of Things sensors has enabled continuous data collection on equipment performance, paving the way for machine learning models to forecast impending failures with increasingly accurate lead times. As a result, organizations transition from reactive to predictive maintenance regimes, achieving significant cost savings and enhancing asset reliability.

Concurrently, the concept of the digital twin has moved from visionary proof-of-concept projects into mainstream deployment. Digital replicas of physical assets allow cross-functional teams to simulate stress scenarios, optimize operating parameters, and plan maintenance interventions in a virtual environment. The fusion of digital twin technology with cloud-native architectures has accelerated deployment cycles, enabling remote diagnostics and collaboration across geographically dispersed operations.

Meanwhile, sustainability mandates and stringent regulatory frameworks have compelled asset-intensive industries to integrate environmental, social, and governance metrics into their maintenance strategies. The drive toward net-zero objectives has led asset managers to re-evaluate energy consumption patterns, carbon footprints, and end-of-life disposal protocols. In parallel, cybersecurity considerations have become inseparable from asset management initiatives, as connected industrial control systems face growing threats. These transformative shifts collectively reaffirm that staying at the forefront of enterprise asset management requires a holistic approach, blending technological innovation with organizational agility.

Assessing the Compound Effects of United States Tariffs in 2025 on Asset Lifecycle Costs, Supply Chain Reliability, and Technology Adoption in Asset Management

In 2025, the cumulative impact of United States tariffs has introduced new complexities into the management of global asset portfolios. Tariffs on imported steel and aluminum have directly affected the cost of structural and mechanical components, prompting maintenance teams to reassess sourcing strategies for spare parts. As prices for raw materials experienced upward pressure, organizations have faced higher capital expenditures when upgrading asset fleets or conducting major overhauls.

Moreover, tariffs on equipment and subassemblies sourced from key manufacturing hubs have extended lead times for critical repairs. Maintenance planners have encountered delays as supply chains adapt to reconfigured trade routes and the reallocation of production facilities. This has highlighted the importance of strategic inventory buffers and has accelerated interest in domestic supplier partnerships to mitigate disruption risks.

Despite these headwinds, some organizations have leveraged the tariff-driven environment as an opportunity to localize their vendor ecosystems and strengthen end-to-end supply chain visibility. Investments in supplier performance management solutions have gained traction, offering real-time tracking of shipments and automated compliance checks. By integrating trade compliance workflows with asset management platforms, companies have improved tariff classification accuracy and reduced the administrative burden associated with cross-border transactions. In sum, the 2025 tariff landscape has underscored the value of a resilient asset procurement strategy and the need for adaptive maintenance frameworks that can absorb policy-driven shocks.

Deriving Insightful Perspectives from Organization Size, Deployment Mode, Component Selection, Asset Type, and Industry Vertical Segmentation in Asset Management

A nuanced understanding of market segmentation reveals diverse requirements across organizational dimensions and operational contexts. When examining organization size, it becomes clear that global enterprises demand scalable and highly configurable solutions capable of supporting extensive asset networks across multiple sites, whereas medium and smaller enterprises often prioritize rapid deployment and cost-effective, out-of-the-box functionality to meet immediate maintenance needs. This divergence in priorities drives distinct solution roadmaps and service offerings.

Similarly, deployment preferences delineate two primary paths: on-premise installations remain favored by organizations with stringent data residency or customization mandates, while cloud-based architectures have surged ahead due to their agility and lower total cost of ownership. Within the cloud segment, private cloud models appeal to enterprises seeking dedicated infrastructure and enhanced security controls, whereas public cloud options satisfy the needs of organizations willing to trade some customization for rapid scaling and predictable subscription pricing.

Component segmentation further distinguishes between core software platforms and complementary professional services. While software vendors compete on advanced analytics, user experience, and integration capabilities, service providers differentiate through domain expertise in implementation, change management, and long-term support engagements.

Asset type plays a pivotal role in shaping solution design and implementation complexity. Managing facilities assets requires a focus on HVAC, building automation, and safety compliance, whereas infrastructure asset portfolios emphasize lifecycle risk modeling, condition assessments, and capital planning. Production equipment demands tight integration with manufacturing execution systems to synchronize maintenance activities with production schedules, and transportation fleets necessitate telematics integration for real-time location and condition monitoring.

Industry verticals introduce further layers of specialization. Energy and utilities providers focus on regulatory reporting and grid reliability, healthcare organizations prioritize uptime for critical medical devices and compliance with stringent quality standards, manufacturing firms seek to maximize throughput and minimize unplanned stoppages, mining and metals operators require heavy-duty equipment diagnostics in remote locations, oil and gas companies manage complex wellhead and pipeline infrastructures, and transportation and logistics businesses concentrate on fleet availability and route optimization. Together, these segmentation axes inform product roadmaps, service designs, and go-to-market strategies for asset management solution providers.

This comprehensive research report categorizes the Enterprise Asset Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Organization Size

- Deployment Mode

- Component

- Asset Type

- Industry Vertical

Uncovering Regional Dynamics and Growth Drivers in the Americas, Europe Middle East and Africa, and the Asia-Pacific Within Enterprise Asset Management

Regional dynamics within the enterprise asset management landscape exhibit distinct growth trajectories and strategic imperatives. In the Americas, robust investments in digital infrastructure and strong vendor ecosystems have driven high adoption rates of cloud-enabled asset management platforms. North American organizations, in particular, have led early deployments of predictive maintenance solutions, leveraging wide-scale sensor networks and digital twin technologies to optimize capital-intensive asset classes. Latin American markets are gradually embracing these innovations, often through hybrid cloud and on-premise models that address data sovereignty concerns.

In Europe, the Middle East, and Africa, regulatory initiatives around environmental reporting and energy efficiency have catalyzed demand for advanced asset analytics. European utilities and manufacturing firms are integrating sustainability metrics into maintenance workflows, while regional vendors are building partnerships to deliver localized support. In the Middle East, large infrastructure projects are fostering the adoption of standardized asset management frameworks, and Africa’s growing mining sector is investing in condition-based monitoring to reduce unplanned downtimes.

The Asia-Pacific region represents the fastest-growing market, driven by rapid industrialization, government-funded infrastructure programs, and an increasing emphasis on smart city initiatives. Industrial conglomerates in East Asia have pioneered the convergence of Internet of Things, big data analytics, and artificial intelligence to enable zero-downtime maintenance strategies. Southeast Asian economies are following suit by modernizing legacy maintenance systems through scalable public cloud deployments. Across South Asia and Oceania, cross-sector collaborations are forging new pathways for integrated asset management solutions tailored to local regulatory and operational requirements.

This comprehensive research report examines key regions that drive the evolution of the Enterprise Asset Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Enterprise Asset Management Vendors and Their Strategic Initiatives Shaping Market Direction and Technological Advancements

A diverse array of vendors is shaping the competitive landscape of enterprise asset management through targeted investments and strategic alliances. Established software providers offer comprehensive suites that span asset lifecycle planning, maintenance execution, and performance analytics, continuously enhancing their platforms with advanced machine learning algorithms and low-code customization capabilities. At the same time, specialized upstarts are carving out niches by delivering purpose-built solutions for specific verticals, such as heavy industries or critical infrastructure, and by leveraging modular architectures that integrate tightly with broader industrial Internet of Things ecosystems.

Strategic partnerships have become essential for vendors aiming to accelerate time to value and expand their market reach. Alliances between asset management software firms and industrial automation manufacturers are enabling seamless data flow from control systems into maintenance workflows. In parallel, collaboration with management consulting firms has broadened professional service offerings, combining domain expertise with technical implementation services.

Moreover, mergers and acquisitions continue to redefine the market structure. Larger platform providers are acquiring analytics startups and IoT specialists to bolster their predictive maintenance portfolios, while smaller firms are forging reseller agreements to access global distribution channels. These developments have intensified competitive pressures, driving innovation in user experience, mobile field workforce enablement, and integration with enterprise resource planning and supply chain systems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Enterprise Asset Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Bentley Systems, Incorporated

- Emerson Electric Co.

- General Electric Company

- Hexagon AB

- Honeywell International Inc.

- IFS AB

- Infor, Inc.

- International Business Machines Corporation

- Oracle Corporation

- SAP SE

- Schneider Electric SE

- Siemens AG

Strategic Recommendations for Industry Leaders to Harness Advanced Asset Management Capabilities, Drive Digital Transformation, and Achieve Operational Resilience

To capitalize on emerging opportunities, industry leaders should implement a cohesive roadmap that aligns technological investments with broader operational objectives. First, organizations must prioritize the integration of artificial intelligence-driven predictive maintenance tools, ensuring they are underpinned by robust data governance frameworks and cross-functional stakeholder alignment. This entails establishing centralized data repositories and embedding analytics into daily maintenance decision processes.

Next, a phased migration toward cloud-native architectures can unlock greater scalability and accelerate time to value. By adopting a hybrid cloud strategy, companies can balance the need for data sovereignty with the agility of public cloud environments. This approach also facilitates the deployment of digital twin models across dispersed sites.

Investing in workforce enablement is equally critical. Upskilling maintenance technicians to interpret predictive alerts, manage remote diagnostics, and execute condition-based maintenance tasks can transform asset reliability outcomes. Structured training programs and change management initiatives should be designed in tandem with technology rollouts.

The pursuit of sustainability goals must be woven into asset management strategies. Organizations should incorporate environmental impact assessments, regulatory compliance tracking, and carbon accounting into maintenance planning. A clear linkage between asset performance and ESG metrics will not only optimize resource utilization but also future-proof operations against tightening environmental regulations.

Finally, resilient supply chain frameworks should be established through strategic supplier partnerships and digital compliance workflows. This enables agile response to policy changes, such as tariffs, and ensures uninterrupted access to critical components. By embedding procurement and compliance data into asset management platforms, decision-makers gain real-time visibility into lead times, costs, and risk exposures.

Detailing the Comprehensive Research Methodology Incorporating Primary Interviews, Secondary Data Analysis, and Rigorous Validation Techniques

The research methodology employed for this study synthesizes both qualitative and quantitative approaches to deliver a rigorous and holistic market analysis. Primary research included structured interviews with senior maintenance executives, asset reliability specialists, and IT decision-makers across diverse industry verticals. These firsthand insights offered nuanced perspectives on deployment challenges, technology prioritization, and evolving service models.

Secondary research leveraged a curated set of credible sources such as regulatory publications, industry white papers, vendor product documentation, and specialized trade journals. Publicly available financial filings and procurement tender data provided empirical context for competitive benchmarking and market trend validation. Throughout this process, data triangulation techniques ensured consistency between primary feedback and desk research findings.

Quantitative data was complemented by an expert validation panel comprised of asset management consultants, systems integrators, and subject matter experts. This collaborative review enabled the identification of anomalies, refinement of segmentation frameworks, and confirmation of cross-regional applicability. Additionally, geospatial analytics tools were used to map adoption patterns and pinpoint high-growth corridors.

Finally, a rigorous quality assurance protocol was applied, encompassing peer reviews and editorial audits to ensure methodological transparency, reproducibility, and adherence to industry research standards. This comprehensive approach underpins the credibility and actionable value of the insights presented throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Enterprise Asset Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Enterprise Asset Management Market, by Organization Size

- Enterprise Asset Management Market, by Deployment Mode

- Enterprise Asset Management Market, by Component

- Enterprise Asset Management Market, by Asset Type

- Enterprise Asset Management Market, by Industry Vertical

- Enterprise Asset Management Market, by Region

- Enterprise Asset Management Market, by Group

- Enterprise Asset Management Market, by Country

- United States Enterprise Asset Management Market

- China Enterprise Asset Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Forward-Looking Implications to Guide Asset Management Strategies and Investment Decisions in an Evolving Landscape

The collective analysis underscores that enterprise asset management has evolved from a reactive, break-fix model into a proactive, data-driven discipline central to operational excellence. Technological advancements in predictive analytics, digital twin modeling, and cloud-native architectures are reshaping how organizations prioritize asset investments and manage lifecycle risk. At the same time, macroeconomic factors such as trade policy shifts and sustainability mandates demand more resilient procurement and compliance frameworks.

Segmentation insights reveal divergent requirements based on organization size, deployment preferences, functional components, asset typologies, and industry verticals. Regional dynamics further highlight that while the Americas and EMEA pursue maturity through regulatory alignment and digital enhancements, Asia-Pacific leads in scaling innovative solutions amid ambitious infrastructure programs. In parallel, vendor strategies centered around strategic alliances, acquisitions, and modular architectures continue to intensify competition and drive customer-centric innovation.

For decision-makers, the imperative is clear: embracing a holistic asset management strategy that integrates advanced technologies, cultivates workforce capabilities, and embeds sustainability goals into maintenance programs will be critical for achieving long-term resilience. As the market continues to evolve, leaders who proactively refine their operating models will secure a distinct competitive advantage.

Engage with Associate Director for Customized Enterprise Asset Management Insights and Secure Access to the Complete Market Research Report Today

To unlock the full depth of insights, strategic analysis, and actionable guidance contained in this comprehensive enterprise asset management study, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. By engaging in a brief consultation, you can receive a tailored overview that aligns with your organization’s unique asset management challenges and priorities.

During this discussion, you will have the opportunity to explore customized data breakdowns, clarify methodology details, and understand how the findings can translate into your specific operational context. Furthermore, Ketan Rohom can provide a detailed outline of supplementary deliverables such as interactive data dashboards, scenario-based planning tools, and executive presentation materials.

Reach out today to secure your organization’s competitive edge and ensure you have the authoritative guidance necessary to navigate the complexities of enterprise asset management. Let us help you transform insight into impact and drive enduring operational excellence.

- How big is the Enterprise Asset Management Market?

- What is the Enterprise Asset Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?