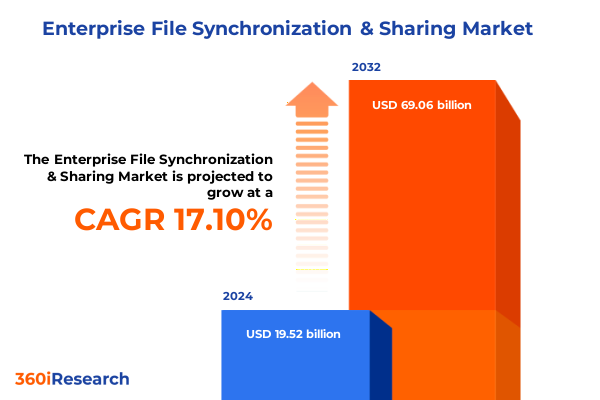

The Enterprise File Synchronization & Sharing Market size was estimated at USD 22.78 billion in 2025 and expected to reach USD 26.59 billion in 2026, at a CAGR of 17.16% to reach USD 69.06 billion by 2032.

Forging Resilient Collaboration Ecosystems in the Enterprise Through Secure, Seamless File Synchronization and Real-time Access Across Distributed Environments

In the contemporary enterprise environment, facilitating seamless collaboration across teams, locations, and devices has become a mission-critical capability. Enterprises increasingly rely on sophisticated file synchronization and sharing platforms to ensure that employees, partners, and contractors can access the right content at the right time without compromising security or regulatory compliance. As digital transformation accelerates, the demand for resilient, scalable, and integrated file services has intensified, creating new imperatives for IT leaders and business executives alike.

Against this backdrop, rapid adoption of cloud and hybrid infrastructures has reshaped how organizations think about data mobility. Remote and distributed workforces require real-time document updates, secure access controls, and frictionless user experiences that mirror consumer-grade applications. At the same time, escalating cybersecurity threats and stringent data sovereignty regulations raise the stakes for deploying solutions that strike a balance between openness and robust protection. Consequently, enterprises are evaluating a broad spectrum of vendors and architectural patterns to support their collaboration needs while aligning with wider digital innovation agendas.

This executive summary synthesizes critical developments in the enterprise file synchronization and sharing landscape, offering executives a concise yet comprehensive view of transformative trends, policy impacts, segmentation insights, regional dynamics, market leadership moves, and recommended actions. By weaving together these elements, this introduction sets the stage for informed strategic planning and confident decision making in a rapidly evolving domain.

Navigating a New Era of Intelligent, Secure, and Adaptive File Sharing Paradigms Driven by AI, Zero Trust, and Cloud-Native Innovations

The enterprise file synchronization and sharing landscape has undergone a profound metamorphosis, propelled by breakthroughs in artificial intelligence, zero trust security models, and cloud-native architectures. Organizations are no longer satisfied with simple file repositories; they now demand intelligence-driven systems that automatically classify content, detect anomalous behavior, and integrate seamlessly with broader enterprise applications. This shift toward cognitive collaboration environments underscores the fusion of machine learning algorithms with traditional file services to enhance productivity and risk mitigation.

Simultaneously, the imperative for granular access controls has given rise to zero trust frameworks that continuously evaluate user context, device posture, and file sensitivity before granting permissions. In practice, this has led to tighter integration between synchronization platforms and identity management services, enabling adaptive authentication and dynamic policy enforcement. Such convergence not only strengthens security postures but also enhances the end-user experience by reducing the need for repetitive credential prompts.

Moreover, the proliferation of cloud-native microservices architectures has facilitated modular deployment models, allowing enterprises to select and assemble capabilities such as content search, collaboration workspaces, and audit logging as needed. By embracing containerization and API-first design principles, leading vendors are fostering ecosystems where third-party developers can extend core functionality, further blurring the lines between file management and broader digital workplace solutions. This evolution signals a new era of adaptive, secure, and intelligent file sharing paradigms.

Assessing the Cumulative Ripple Effects of 2025 United States Tariffs on Enterprise File Synchronization Infrastructure, Costs and Strategic Deployments

The introduction of a new tranche of United States tariffs in early 2025 targeting storage hardware and networking components has reverberated across the enterprise file synchronization sector. Initially aimed at reshaping supply chains and encouraging domestic manufacturing, these levies have elevated the procurement costs of on-premises appliances and edge devices crucial to hybrid implementations. As a result, technology decision makers have been compelled to revisit total cost of ownership models, weighing the higher upfront capital expenditures against long-term gains in control and performance.

In response to cost pressures, several large enterprises accelerated their migration to public clouds, where operational expenses can be more predictable and hardware dependencies minimized. Conversely, organizations with strict data residency or latency requirements explored alternative sourcing strategies, forging alliances with regional vendors and leveraging open-source solutions to mitigate tariff impacts. This strategic pivot underscores the delicate balance between compliance, performance, and financial constraints in a landscape shaped by geopolitical policy shifts.

Furthermore, service providers and managed service integrators have adapted by offering tariff-aware bundling options that blend hardware, software licensing, and professional services into packaged solutions. Such offerings allow enterprises to outsource the complexities of hardware procurement and risk management, thus insulating internal teams from fluctuating import duties. Ultimately, the cumulative effect of these tariffs has driven innovation in procurement strategies, spurred diversification of solution architectures, and underscored the value of flexible consumption models.

Unlocking Deep Insights into Enterprise File Synchronization and Sharing Through Strategic Deployment, Service, and Industry Vertical Analysis

A nuanced understanding of market segmentation is essential for tailoring enterprise file synchronization strategies to organizational priorities. In terms of deployment mode, hybrid cloud architectures have gained prominence by allowing workloads to span public cloud platforms for scale and agility, while retaining sensitive data on private or on-premises infrastructure for enhanced governance. Private cloud solutions, conversely, appeal to organizations with rigorous compliance mandates, delivering customizable security controls and network isolation that align with internal standards. Public cloud offerings, meanwhile, emphasize rapid provisioning and seamless integration with broader digital services ecosystems.

When considering organization size, large enterprises typically require comprehensive suites that encompass advanced administrative controls, deep audit capabilities, and extensive professional services to orchestrate global rollouts. Small and medium enterprises often prioritize the speed of deployment and ease of use, selecting solutions that offer out-of-the-box integrations with productivity tools and streamlined management consoles to reduce operational overhead. This divergence in requirements highlights the importance of flexible licensing models and tiered service levels to accommodate varying scales of adoption.

Component type also influences purchasing decisions, as solutions alone deliver core synchronization and sharing features, whereas services-comprising managed and professional offerings-supplement technical expertise, custom integrations, and ongoing support. Managed services provide continuous oversight of the environment, including patch management, security monitoring, and usage optimization, while professional services offer targeted project engagements such as migration planning, policy design, and user training. Finally, industry vertical specialization further differentiates vendor value propositions, as sectors like banking, government, and healthcare impose unique regulatory and data sovereignty requirements, whereas industries such as media, manufacturing, and retail focus on high-volume content workflows and cross-functional collaboration dynamics.

This comprehensive research report categorizes the Enterprise File Synchronization & Sharing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Organization Size

- Component Type

- Deployment Mode

- Industry Vertical

Illuminating Regional Dynamics Shaping Enterprise File Synchronization and Sharing Adoption Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics exert a profound influence on enterprise file synchronization strategies, as local regulations, infrastructure maturity, and business practices shape adoption patterns across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, enterprises benefit from robust public cloud ecosystems and well-established data protection frameworks, encouraging widespread procurement of integrated file services. Corporate headquarters often drive global policy templates, mandating end-to-end encryption, continuous monitoring, and centralized governance to uphold corporate standards across North and South American operations.

Across Europe, the Middle East & Africa, stringent data privacy regulations such as GDPR and regional data localization mandates have reinforced the appeal of private and hybrid cloud deployments. Local cloud service providers have capitalized on these requirements by establishing data centers with specialized compliance certifications and bespoke security features. Furthermore, enterprises in this region often engage in multi-cloud strategies, combining global hyperscaler platforms with local specialized offerings to navigate a patchwork of national regulations while maintaining operational elasticity.

In Asia-Pacific, rapid digitalization and the rise of mobile-first work environments have driven significant uptake of public cloud-native file synchronization solutions. Emerging economies with expanding IT budgets show a growing appetite for AI-powered content services and collaborative workspaces. However, the region’s diverse regulatory landscape-from stringent cybersecurity laws to nascent data protection frameworks-necessitates adaptive architectures that can accommodate localized compliance controls without impeding scalability. Consequently, service providers are investing in localized support capabilities and modular deployment kits to meet the diverse needs of Asia-Pacific enterprises.

This comprehensive research report examines key regions that drive the evolution of the Enterprise File Synchronization & Sharing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Moves and Innovations from Leading Enterprise File Synchronization Providers to Drive Competitive Differentiation and Growth

Industry leaders are continually refining their portfolios through strategic partnerships, acquisitions, and technology innovations to capture competitive advantage in the enterprise file synchronization domain. One prominent provider has deepened its integration with leading productivity suites and identity platforms, embedding real-time co-authoring, automated metadata tagging, and context-aware policy enforcement directly into daily workflows. Another global vendor has bolstered its security capabilities through the acquisition of a zero trust specialist, enabling seamless policy translation between file services and broader network controls.

Several companies have also introduced AI-driven compliance tools that automatically identify regulated content, flag data handling exceptions, and generate audit reports that satisfy regional compliance standards. Meanwhile, a handful of emerging vendors are staking their differentiation on edge-optimized synchronization engines, designed to accelerate file transfers in low-bandwidth or high-latency scenarios. This diversification of technical architectures underscores the shifting balance between centralized cloud models and distributed edge deployments.

Beyond technology, market participants are forging alliances with managed service providers and system integrators to deliver end-to-end implementation and support services. By coupling their core platforms with specialized migration frameworks and user training programs, these vendors are addressing key barriers to adoption and accelerating time to value. Collectively, these strategic moves reflect a marketplace characterized by rapid innovation, deepening security integration, and intensifying competition for enterprise accounts.

This comprehensive research report delivers an in-depth overview of the principal market players in the Enterprise File Synchronization & Sharing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services, Inc.

- Box, Inc.

- Citrix Systems, Inc.

- Dell Technologies Inc.

- Dropbox, Inc.

- Egnyte, Inc.

- Google LLC

- Hewlett Packard Enterprise Company

- IBM Corporation

- Microsoft Corporation

- SugarSync, Inc.

- Syncplicity LLC

- VMware, Inc.

Empowering Enterprise Leaders with Actionable Strategies to Enhance Security, Integration, and User Experience in File Synchronization Deployments

To thrive in today’s dynamic enterprise file synchronization environment, industry leaders must adopt a multi-pronged strategy that addresses security, user experience, and integration imperatives. Practically speaking, deploying a zero trust framework across file services can significantly reduce risk by enforcing granular, context-driven access controls and continuous authentication checks. In parallel, harmonizing file synchronization platforms with existing identity and endpoint management tools streamlines administration and bolsters the overall resilience of the collaboration stack.

From a user perspective, prioritizing intuitive interfaces and seamless integration with day-to-day productivity applications fosters widespread adoption and minimizes support overhead. Tailored change-management programs, including role-based training sessions and on-demand help resources, can further accelerate user proficiency and ensure that security policies are adhered to without unduly hindering workflows. Furthermore, enabling mobile-optimized experiences-complete with offline access and automatic conflict resolution-ensures that distributed teams can remain productive regardless of connectivity constraints.

Lastly, organizations should embrace flexible consumption models that align with budgetary cycles and evolving technology roadmaps. By working closely with providers offering a mix of managed and professional services, enterprises can offload operational complexity while preserving the ability to pivot as business needs change. Taken together, these actions form a coherent blueprint for harnessing advanced file synchronization capabilities to drive secure, accessible, and scalable collaboration.

Deploying Rigorous Mixed-Method Research Approaches to Capture Comprehensive Insights into Enterprise File Synchronization and Sharing Trends

This research leverages a blended methodology combining primary and secondary approaches to deliver robust, actionable insights. Primary data was gathered through structured interviews with IT executives, security architects, and industry consultants, providing firsthand perspectives on deployment challenges, technology preferences, and organizational priorities. Complementing these interviews, surveys conducted across a cross-section of enterprise users yielded quantitative data on feature usage patterns, satisfaction levels, and anticipated technology investments.

Secondary research encompassed a comprehensive review of vendor white papers, technical case studies, regulatory publications, and press releases to map competitive landscapes and policy developments. Analysts performed rigorous data triangulation, validating survey findings against public filings and industry reports to ensure consistency and accuracy. In addition, thematic analysis techniques were applied to interview transcripts, identifying recurring themes related to security frameworks, deployment models, and regional compliance drivers.

To uphold methodological rigor, all data points underwent peer review by subject matter experts, and any discrepancies were reconciled through follow-up consultations. The result is a multi-layered research foundation that informs each section of this executive summary with precision and depth, providing enterprise stakeholders with the confidence to make informed strategic decisions in a complex, evolving market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Enterprise File Synchronization & Sharing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Enterprise File Synchronization & Sharing Market, by Organization Size

- Enterprise File Synchronization & Sharing Market, by Component Type

- Enterprise File Synchronization & Sharing Market, by Deployment Mode

- Enterprise File Synchronization & Sharing Market, by Industry Vertical

- Enterprise File Synchronization & Sharing Market, by Region

- Enterprise File Synchronization & Sharing Market, by Group

- Enterprise File Synchronization & Sharing Market, by Country

- United States Enterprise File Synchronization & Sharing Market

- China Enterprise File Synchronization & Sharing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Pivotal Insights to Reinforce Strategic Decision-Making in the Enterprise File Synchronization and Sharing Ecosystem

As enterprises navigate the intersection of digital transformation, security imperatives, and global policy shifts, a holistic understanding of the entity file synchronization landscape becomes indispensable. The integration of AI-driven services, zero trust frameworks, and cloud-native architectures has redefined stakeholder expectations, compelling organizations to pursue flexible, adaptive solutions that can scale with innovation agendas. Moreover, the 2025 tariff landscape has accelerated strategic realignments in sourcing, deployment, and vendor partnerships, underscoring the need for procurement models that absorb external shocks with minimal disruption.

Segment-specific considerations around deployment mode, organizational scale, service components, and industry verticals further reinforce the importance of tailored strategies. Equally, regional dynamics spanning the Americas, EMEA, and Asia-Pacific highlight the intricate interplay between regulatory frameworks, infrastructure maturity, and business imperatives. Against this backdrop, technology providers are differentiating through strategic acquisitions, AI-powered compliance offerings, and edge-optimized synchronization engines, creating a fiercely competitive environment that rewards innovation and strategic partnerships.

Collectively, these insights provide a roadmap for technology decision makers to align collaboration initiatives with broader enterprise goals. By synthesizing market drivers, competitive dynamics, and practical recommendations, this executive summary equips leaders to craft future-proof file synchronization strategies that foster secure, efficient, and collaborative work environments.

Unlock Exclusive Access to In-Depth Enterprise File Synchronization Insights by Partnering with Ketan Rohom for Your Strategic Research Needs

Engaging with an experienced guide can transform how enterprise stakeholders access, interpret, and apply market insights to strategic decision making. Ketan Rohom, Associate Director of Sales & Marketing at our firm, combines deep industry knowledge with a consultative approach to tailor research findings to each organization’s unique performance challenges and growth objectives. By aligning your IT architecture plans and budget cycles with granular insights into deployment modes, service offerings, and regulatory considerations, you can accelerate your digital collaboration initiatives with precision.

Whether you seek detailed comparative analyses of leading vendors, scenario planning around evolving tariff landscapes, or guidance on securing executive buy-in for modernization projects, partnering with Ketan ensures a seamless path to actionable intelligence. His expertise in guiding procurement processes and customizing deliverables helps clarify complex topics such as hybrid cloud orchestration, advanced security protocols, and multi-regional compliance frameworks. Reach out today to schedule a brief discovery call, explore tailored research packages, and embark on a journey toward data-driven confidence in your enterprise file synchronization strategy.

- How big is the Enterprise File Synchronization & Sharing Market?

- What is the Enterprise File Synchronization & Sharing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?