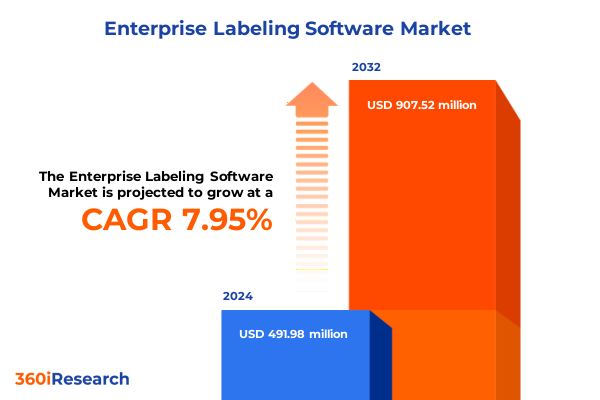

The Enterprise Labeling Software Market size was estimated at USD 531.97 million in 2025 and expected to reach USD 578.07 million in 2026, at a CAGR of 8.26% to reach USD 927.52 million by 2032.

Exploring the Strategic Imperatives Driving the Enterprise Adoption of Labeling Software in a Highly Regulated and Digitally Transformed Marketplace

The rapid pace of digital transformation coupled with stringent regulatory frameworks has thrust enterprise labeling software into the spotlight as a strategic imperative rather than a mere operational tool. Organizations across industries are recognizing that accurate traceability and compliance enforcement are non-negotiable requirements in global supply chains. As product life cycles accelerate and consumer demand for transparency intensifies companies must adopt solutions that streamline labeling processes and deliver end-to-end visibility.

In parallel the convergence of cloud computing and emerging technologies such as artificial intelligence and the Internet of Things has created new opportunities for labeling software that extends beyond static barcodes. Today’s platforms are designed to integrate seamlessly with enterprise resource planning systems manufacturing execution systems and customer relationship management tools thereby ensuring that labeling is not an isolated task but an integral component of broader digital ecosystems. This evolution positions the labeling solution as a cornerstone of operational excellence enabling dynamic label generation real-time compliance checks and adaptive workflows.

As decision-makers navigate an increasingly complex landscape marked by tariff fluctuations cybersecurity risks and evolving industry standards it becomes essential to ground strategic choices in a robust understanding of market dynamics. This executive summary lays the foundation for identifying key trends disruption vectors and strategic levers that will shape the competitive landscape of enterprise labeling software.

Understanding the Multifaceted Technological and Operational Disruptions Reshaping Enterprise Labeling Software Ecosystems Across Industries

Over the last several years the enterprise labeling software market has undergone a dramatic metamorphosis as organizations grapple with unprecedented levels of operational complexity and technological convergence. The advent of cloud-native architectures has catalyzed a shift from traditional on-premise deployments to more agile hybrid and cloud environments enabling global teams to collaborate seamlessly and access centralized resources irrespective of geographic boundaries. Additionally the integration of machine learning-powered validation engines is redefining quality control by automating error detection and ensuring adherence to evolving regulatory requirements.

Concurrently the proliferation of the Internet of Things and edge computing has extended labeling capabilities beyond the shop floor. Devices at the edge can now generate context-aware labels based on upstream sensor data enhancing traceability in industries such as pharmaceuticals where batch integrity is critical. Alongside these technological advancements industry stakeholders are embracing continuous improvement methodologies borrowed from manufacturing excellence practices leading to more iterative deployment cycles and incremental feature rollouts.

These transformative shifts are not isolated phenomena; rather they form a cohesive narrative of convergence between IT and operational technology. With end users demanding more sophisticated analytics and real-time monitoring capabilities labeling software providers are rearchitecting their offerings to serve as integral pillars of digital supply chains rather than standalone point solutions.

Analyzing the Broad Economic Effects of United States Tariff Measures on Enterprise Labeling Software Infrastructure and Supply Chains in 2025

The introduction of new tariff measures by the United States in early 2025 has introduced fresh economic variables that reverberate across the enterprise labeling software ecosystem. Tariffs targeting specific hardware components such as barcode printers scanners and consumables have driven procurement costs upward for many manufacturers and logistics operators. This has prompted organizations to revisit their hardware strategy often consolidating device portfolios or extending replacement cycles to mitigate immediate outlays.

Moreover the indirect impact of increased duties on electronic components has led software providers to reconsider on-premise licensing models that rely on local infrastructure. As a result many vendors have accelerated their pivot to subscription-based cloud deployments where the capital expenditure burden is reduced and hardware maintenance responsibilities shift away from end users. This strategic realignment not only addresses cost pressures but also aligns with broader digital transformation agendas centered around OpEx-driven IT investments.

Finally these tariff dynamics have underscored the importance of supply chain agility. Companies are diversifying their procurement sources and exploring regional partnerships to circumvent tariff exposure. At the same time labeling software platforms are being enhanced with modules that track component origin and regulatory thresholds ensuring that compliance checks are seamlessly embedded within the labeling workflow.

Illuminating Key Segmentation Dimensions and Core Usage Patterns Driving Strategic Differentiation in Enterprise Labeling Software Markets

An in-depth look at the enterprise labeling software market reveals divergent strategic priorities when analyzed through multiple segmentation lenses. Deployment type emerges as a critical determinant of both functionality and financial model with pure cloud adopters emphasizing rapid scalability and remote management while hybrid users seek a balance between localized control and cloud-based orchestration. Meanwhile organizations that maintain on-premise installations continue to value data sovereignty and integration with legacy systems.

When examining component breakdowns software modules that encompass design validation and regulatory reporting occupy a significant share of attention compared with ancillary services. Yet within services themselves there is a tension between managed offerings which provide end-to-end operational oversight and professional services tailored to customer-specific integrations and customization projects. End users in highly regulated sectors such as Banking Financial Services and Insurance and Healthcare often prioritize professional engagements to ensure strict compliance, whereas sectors like IT and Telecom and Manufacturing increasingly leverage managed services for continuous optimization.

Organizational size also influences adoption patterns. Large enterprises tend to negotiate enterprise-wide agreements that bundle software licenses with ongoing maintenance and strategic consulting, while small and medium businesses favor modular add-ons that can be deployed quickly and scaled on demand. Finally application cases differ significantly: customer communication initiatives rely on dynamic label generation for marketing and packaging customization, human resources document management benefits from standardized document tagging and version control, and invoice processing drives adoption of optical character recognition and structured data extraction within labeling workflows.

This comprehensive research report categorizes the Enterprise Labeling Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Organization Size

- End-Use Industry

- Application

- Deployment Type

Mapping Regional Market Maturity and Emerging Opportunities Across the Americas Europe Middle East Africa and Asia Pacific Labeling Software Landscapes

Regional analysis of the labeling software landscape uncovers distinct maturity levels dynamics and growth trajectories. In the Americas there is a pronounced emphasis on governance frameworks and regulatory compliance, spurred by FDA mandates and traceability regulations in sectors such as food and beverage and life sciences. North American enterprises typically favor cloud deployments for enhanced collaboration across distributed operations while also investing heavily in AI-based analytics for label quality assurance.

In Europe Middle East and Africa regulatory complexity is magnified by data privacy mandates such as GDPR and localized labeling requirements across multiple jurisdictions. This mosaic of regulations has catalyzed demand for adaptive software that can auto-generate localized content and align with cross-border customs documentation. EMEA organizations are also among the earliest adopters of hybrid models to address data residency concerns and mitigate latency issues in mission-critical processes.

Over in Asia-Pacific the landscape is characterized by rapid industrialization and government-driven digital initiatives. Countries such as China and India are investing in smart manufacturing programs that incorporate IoT and automated labeling within factory 4.0 frameworks. Regional providers often differentiate through low-code integration platforms and multilingual labeling capabilities to support diverse linguistic and regulatory environments across APAC markets.

This comprehensive research report examines key regions that drive the evolution of the Enterprise Labeling Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Solution Providers and Emerging Innovators Shaping the Competitive Landscape of Enterprise Labeling Software Technologies

The competitive arena of enterprise labeling software is anchored by a blend of established incumbents and innovative challengers. Longstanding vendors with deep domain expertise have fortified their positions through continuous feature enhancements that address regulatory compliance, supply chain traceability and integration capabilities with ERP and MES systems. Simultaneously a cadre of emerging companies is reshaping the market through focused investments in AI driven analytics and low-code development environments that empower business users to configure complex labeling workflows without extensive IT involvement.

Strategic alliances are another hallmark of this space as providers partner with hardware manufacturers cloud infrastructure leaders and system integrators to deliver end-to-end solutions. Such collaborations not only accelerate time-to-value but also broaden the installed base by leveraging partner ecosystems. In addition mergers and acquisitions are becoming more commonplace as market leaders seek to bolster their portfolios with specialized modules for areas like serialized tracking RFID integration and advanced localization.

Looking ahead the companies best positioned for sustained growth will be those that can balance innovation with operational reliability. Providers that offer modular architectures capable of seamless expansion, combined with robust managed services offerings, will stand out as the digital supply chains of tomorrow demand both agility and unwavering compliance controls.

This comprehensive research report delivers an in-depth overview of the principal market players in the Enterprise Labeling Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AstroNova Inc

- Avery Dennison Corporation

- Brady Corporation

- Honeywell International Inc.

- Kallik Ltd

- Loftware, Inc.

- SATO Holdings Corporation

- Seagull Scientific, Inc.

- Seiko Epson Corporation

- TEKLYNX International B.V.

- Toshiba Tec Corporation

- Zebra Technologies Corporation

Implementing Strategic Initiatives and Best Practices to Enhance Enterprise Labeling Software Adoption and Operational Excellence Across Organizations

Industry leaders seeking to maximize the value of labeling software should prioritize a holistic integration strategy that treats labeling as an integral component of digital supply chains rather than an isolated function. By embedding labeling workflows directly into ERP and warehouse management platforms companies can eliminate manual handoffs reduce error rates and accelerate time-to-market. Additionally establishing cross-functional governance teams with representation from IT quality assurance and compliance ensures that new deployments address both technical performance and regulatory mandates from the outset.

Another critical recommendation involves embracing cloud-first approaches where viable to shift capital expenditures toward operational expense models. This not only alleviates the upfront burden of hardware procurement but also enables continuous feature updates and scalability aligned with business growth. It is equally important to leverage managed services for routine maintenance and support, freeing internal teams to focus on strategic initiatives such as process optimization and data analytics.

Moreover decision-makers should conduct periodic reviews of their labeling environment to assess tariff impacts and supply chain vulnerabilities, adjusting sourcing strategies or exploring alternative hardware configurations as needed. Finally cultivating partnerships with software vendors that offer flexible professional services will facilitate customized integrations and targeted training programs, accelerating user adoption and unlocking the full potential of labeling software investments.

Outlining Rigorous Multi-Phase Research Methodologies and Analytical Frameworks Employed to Ensure Comprehensive Labeling Software Market Insights

The research underpinning this executive summary was conducted through a rigorous multi-phase methodology designed to ensure comprehensive coverage and analytical precision. The initial phase involved extensive secondary research across regulatory bodies industry publications and technology whitepapers to map the current state of labeling software trends and tariff developments. This foundational work informed the development of targeted discussion guides for subsequent primary research engagements.

In the second phase a series of in-depth interviews was conducted with senior stakeholders including IT directors compliance officers and supply chain managers from leading enterprises across Banking Financial Services and Insurance Healthcare IT and Telecom Manufacturing and Retail. These qualitative insights provided context around deployment preferences customization requirements and future investment plans. To validate and quantify these themes a structured survey was then administered to a broader base of professionals across both large enterprises and SMEs, enabling cross-segmentation analysis.

Finally the data collected was triangulated through cross-referencing vendor disclosures, public financial filings, and real-world case studies. Our analytical framework incorporated both top-down and bottom-up perspectives, ensuring that the findings reflect a balanced view of market dynamics. Rigorous peer reviews and data validation checkpoints were embedded throughout the process to guarantee accuracy and reliability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Enterprise Labeling Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Enterprise Labeling Software Market, by Component

- Enterprise Labeling Software Market, by Organization Size

- Enterprise Labeling Software Market, by End-Use Industry

- Enterprise Labeling Software Market, by Application

- Enterprise Labeling Software Market, by Deployment Type

- Enterprise Labeling Software Market, by Region

- Enterprise Labeling Software Market, by Group

- Enterprise Labeling Software Market, by Country

- United States Enterprise Labeling Software Market

- China Enterprise Labeling Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Summarizing Critical Findings and Strategic Imperatives for Stakeholders Navigating the Evolving Enterprise Labeling Software Ecosystem

This executive summary has illuminated the critical forces shaping the enterprise labeling software arena and identified strategic pathways for stakeholders striving to maintain a competitive edge. Key technological enablers such as cloud migration, AI-driven quality control, and edge-enabled traceability are no longer optional luxuries but foundational elements of modern labeling infrastructures. Simultaneously evolving regulatory frameworks and tariff landscapes demand a proactive approach to compliance and sourcing strategies.

Segmentation analysis underscores the importance of tailoring solutions by deployment model, organizational scale, industry vertical and application. Enterprises must evaluate the trade-offs between cloud agility hybrid flexibility and on-premise control, while also balancing the relative merits of software modules and managed versus professional service engagements. Regional insights highlight that success in the Americas hinges on stringent governance, in EMEA on localization and data privacy considerations, and in APAC on multilingual support and smart manufacturing integration.

As the market matures the companies that demonstrate seamless integration capabilities robust compliance offerings and adaptive service models will distinguish themselves. By adhering to the actionable recommendations-ranging from cross-functional governance frameworks to tariff-aware procurement strategies-industry leaders can not only mitigate risk but also harness the full potential of their labeling software investments. The findings presented herein are intended to guide decision-makers toward informed strategies that accelerate innovation, safeguard regulatory adherence, and drive measurable business impact.

Exclusive Access Invitation to Secure Comprehensive Enterprise Labeling Software Market Intelligence Through Direct Engagement with Ketan Rohom

We invite you to secure unparalleled strategic insights and actionable intelligence tailored to your organization’s unique challenges and ambitions by engaging directly with Ketan Rohom Associate Director Sales & Marketing at 360iResearch. This comprehensive market intelligence resource will equip you with a deep understanding of the technological innovations regulatory dynamics deployment strategies and competitive positioning that define the enterprise labeling software landscape.

By partnering with Ketan you will gain exclusive access to detailed executive summaries in-depth segment analyses and regionally focused intelligence that accelerate decision-making and optimize investment planning. Each insight is crafted to deliver tangible business outcomes whether you are evaluating cloud migration strategies assessing tariff exposure or refining your product roadmap.

Arrange a customized consultation to explore how these findings align with your strategic objectives and operational requirements. Reach out now to schedule an in-depth walkthrough of the research and secure early adopter privileges including preferential briefings and priority support. Elevate your competitive advantage and power your labeling software initiatives with the critical market foresight you need to succeed.

- How big is the Enterprise Labeling Software Market?

- What is the Enterprise Labeling Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?