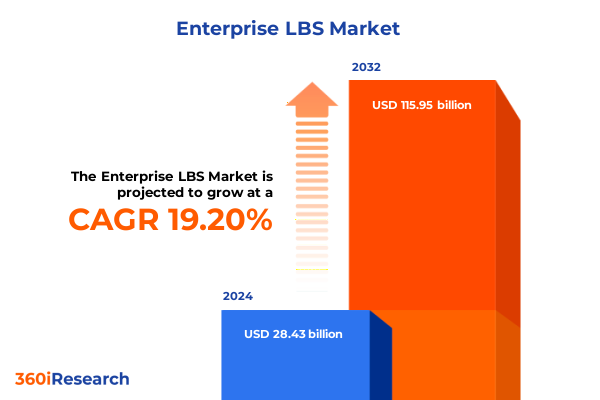

The Enterprise LBS Market size was estimated at USD 33.90 billion in 2025 and expected to reach USD 39.88 billion in 2026, at a CAGR of 19.20% to reach USD 115.95 billion by 2032.

Setting the Scene for Enterprise Location-Based Services Adoption Amidst a Rapidly Evolving Digital and Regulatory Landscape Dynamics

In today’s environment, enterprises across industries are increasingly adopting location-based services to optimize operations, enhance customer experiences, and unlock new revenue streams. The proliferation of connected devices and the maturation of mobile and Internet of Things technologies have provided unprecedented levels of real-time data capture and processing. Organizations are leveraging geospatial intelligence not only to track assets and manage fleets but also to deliver personalized services, navigate compliance considerations, and drive decision making at every level. This shift is underpinned by a convergence of digital transformation initiatives that prioritize data-driven insights and operational resilience, compelling firms to integrate location awareness as a foundational capability.

At the same time, regulatory landscapes and data privacy frameworks are evolving rapidly, reshaping how location data can be collected, stored, and utilized. Decision makers must navigate stringent requirements while harnessing the power of advanced analytics, artificial intelligence, and edge computing to extract value from complex geospatial datasets. Meanwhile, the rollout of fifth-generation mobile networks and the rise of low-power wide-area network protocols are expanding connectivity footprints and redefining performance benchmarks for location services. This introduction sets the stage to explore how these intersecting forces are reshaping expectations for enterprise location-based services across the global marketplace.

Unveiling the Major Technological and Operational Transformations Shaping Enterprise Location-Based Services Across Industries and Use Cases

Enterprise location-based services are experiencing a profound transformation driven by both technological breakthroughs and evolving operational priorities. Advances in low-latency networks and edge computing architectures have significantly reduced response times for location queries, enabling mission-critical applications such as real-time asset tracking and field service dispatching to operate with minimal delay. Concurrently, the integration of artificial intelligence and machine learning is enhancing route optimization algorithms, anomaly detection, and predictive analytics, equipping organizations with the ability to anticipate maintenance needs and optimize resource allocation before disruptions occur.

Beyond core network and analytics enhancements, the convergence of augmented reality and geospatial data is opening new avenues for immersive user experiences. Field technicians can now utilize wearable devices to visualize underground utilities, while warehouse operators deploy AR overlays to streamline pick-and-pack workflows. These developments are complemented by the emergence of hybrid deployment models, where private cloud environments handle sensitive geolocation datasets in compliance with data sovereignty mandates, while public cloud platforms support scalable processing and global accessibility. Together, these shifts are redefining what is possible with enterprise location-based services and setting fresh performance and security expectations across industries.

Assessing the Broad Economic and Strategic Consequences of the 2025 United States Tariffs on Enterprise Location-Based Service Solutions

The introduction of new tariff measures by the United States in 2025 has introduced additional layers of complexity and strategic recalibration for enterprises relying on imported hardware and component solutions. Shipments of location tracking devices, networking equipment, and specialized sensors have become subject to heightened duties, thereby elevating procurement costs for those organizations operating on tight hardware margins. In response, many firms are revisiting their supply chain strategies, evaluating options to shift production to domestic facilities or nearshore partners in order to mitigate the impact of these incremental costs and preserve budgetary flexibility.

Cost inflation is not the only consequence-heightened duties have also driven manufacturers to accelerate design innovations aimed at reducing reliance on tariffed components. Wildcards such as dual-mode radios and sensor fusion techniques are being incorporated to lower part counts and avoid tariff classifications. Moreover, firms are re-examining their deployment methodologies, placing greater emphasis on software-driven services that can be delivered remotely, thereby reducing the need for physical upgrades and new hardware purchases. This cumulative impact of tariff policy is reshaping vendor roadmaps and prompting a holistic reappraisal of capital expenditure priorities across the enterprise location-based services market.

Dissecting Key Market Segments to Unearth Actionable Insights into Organization Sizes Deployment Modes Components Applications and Industry Verticals

A granular analysis of market segments reveals divergent adoption patterns and strategic priorities across organization size, deployment mode, component architecture, application, and industry vertical. Large enterprises, with their extensive operational footprints and robust IT budgets, tend to gravitate towards hybrid deployments that blend private cloud security with public cloud scalability, whereas small and medium enterprises often favor all-in cloud solutions to minimize capital outlay. When it comes to deployment, the allure of private cloud stems from its compliance and customization benefits, while public cloud appeals through flexible consumption models; within these, private instances offer dedicated performance, and public services deliver broad geographic reach.

In assessing component preferences, organizations are deliberating between services and solutions. Consulting and integration support provide bespoke implementation pathways, whereas hardware, platform, and software packages enable turnkey functionality across edge devices, mapping engines, and analytics dashboards. Application usage further differentiates the landscape: GPS and RFID-based asset tracking remains a foundational use case, complemented by geofencing, workforce management, and indoor positioning, while fleet management leverages both route optimization and telematics to enhance delivery and logistics flows. Across industry verticals, financial services and healthcare organizations prioritize data security and compliance, government entities focus on public safety enhancements, manufacturing and transportation sectors demand robust asset visibility, and retail, media, telecom, energy, and utilities seek customer engagement and operational efficiency gains.

This comprehensive research report categorizes the Enterprise LBS market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Organization Size

- Application

- Industry Vertical

Exploring Regional Nuances and Strategic Drivers across the Americas Europe Middle East Africa and Asia-Pacific Markets for LBS

Regional market dynamics are shaped by unique regulatory environments, infrastructure maturity levels, and industry priorities. In the Americas, the presence of established logistics hubs and advanced telecommunications networks has driven rapid adoption of fleet management and last-mile delivery optimization solutions. Enterprise buyers in North America exhibit a strong preference for integrated analytics suites coupled with edge computing capabilities, while Latin American markets are increasingly exploring public cloud services to accelerate pilot deployments with minimal initial investment.

Across Europe, Middle East, and Africa, the regulatory mosaic varies significantly. Stringent data sovereignty regulations in European Union member states compel enterprises to maintain on-premise or private cloud instances for sensitive location data, whereas emerging markets in the Middle East and Africa demonstrate a willingness to adopt public cloud services offered by global hyperscalers. Meanwhile, Asia-Pacific is characterized by dual-speed markets: advanced economies such as Japan and South Korea are pioneering 5G-powered indoor positioning and smart factory use cases, while Southeast Asian and South Asian nations prioritize asset tracking and geofencing to support rapidly growing supply chains. These regional insights illuminate the localized drivers and challenges that enterprises must navigate when scaling location-based services across different parts of the world.

This comprehensive research report examines key regions that drive the evolution of the Enterprise LBS market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Established Enterprises Shaping the Future of Location-Based Services through Strategic Initiatives Collaborations and Offerings

The competitive landscape is defined by a mix of established technology providers and agile niche players, each driving differentiation through platform innovation, specialized services, and strategic alliances. Leading software vendors continue to enrich core geospatial offerings with advanced analytics modules, while infrastructure giants partner with telecommunications carriers to deliver unified connectivity and location services. Niche consultancies and system integrators are carving out value by tailoring implementations for specific industry use cases, such as precision agriculture, smart mining, and critical infrastructure monitoring.

Forward-thinking start-ups are also making significant inroads, leveraging open-source mapping frameworks and lightweight sensor technologies to lower entry barriers. Some firms focus on proprietary positioning algorithms that improve indoor accuracy, whereas others emphasize modular hardware kits enabling rapid prototyping. Together, these players contribute to a vibrant ecosystem in which partnerships between global corporations and regional specialists foster co-innovation and accelerate time to market. As solutions mature, the lines between hardware, platform, and service providers continue to blur, creating new opportunities for collaboration and bundled offerings tailored to diverse enterprise requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Enterprise LBS market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Info Service Public Company Limited

- Apple Inc.

- Ascom Holding AG

- Baidu, Inc.

- Cisco Systems, Inc.

- Ericsson AB

- Esri Inc.

- Foursquare Labs, Inc.

- Google LLC by Alphabet Inc.

- HERE Global B.V.

- Hewlett Packard Enterprise Development LP

- Hexagon AB

- Intel Corporation

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- Pitney Bowes Inc.

- Qualcomm Technologies, Inc.

- Ruckus Wireless, Inc.

- Spireon, Inc.

- Telenav, Inc.

- TomTom N.V.

- Trimble Inc.

- Ubisense Group Plc

- Zebra Technologies Corporation

Delivering Practical Strategic Roadmaps for Industry Leaders to Capitalize on Emerging Trends Optimize Operations and Drive Sustainable Growth in LBS

To capitalize on the evolving landscape, industry leaders must adopt a strategic roadmap that balances innovation with operational pragmatism. First, organizations should establish cross-functional governance frameworks to oversee deployment decisions, ensuring alignment between IT, operations, and business units. This governance should define clear performance metrics and risk thresholds, enabling rapid evaluation of new geospatial technologies and tariff mitigation strategies.

Second, enterprises ought to prioritize modular architectures that decouple hardware dependencies from analytics components. By investing in open standards and API-driven platforms, firms can integrate next-generation sensors and connectivity options without extensive retooling. Third, cultivating strategic partnerships with network providers and cloud hyperscalers will be critical to optimize coverage, data throughput, and cost efficiencies across regions. Finally, embedding continuous learning programs and innovation labs will empower internal teams to prototype emerging use cases-such as AI-driven demand forecasting and real-time safety monitoring-while maintaining compliance with evolving data governance requirements. These recommendations will enable leaders to navigate complexity with agility and build resilient, future-proof location-based services portfolios.

Outlining Rigorous Research Approaches Data Collection Techniques and Analytical Frameworks Underpinning the Robust Insights into the Enterprise LBS Market

This research leverages a comprehensive, multi-tiered methodology designed to ensure robustness and credibility of insights. The approach commenced with extensive desk research, encompassing regulatory filings, technology white papers, and industry publications to establish foundational knowledge of market drivers and barriers. In parallel, structured interviews with key stakeholders-including CIOs, operations managers, and solution architects-provided nuanced perspectives on deployment challenges, strategic priorities, and technology adoption timelines.

Data triangulation was employed to reconcile quantitative findings from secondary sources with qualitative feedback from primary interviews, resulting in a cohesive view of market dynamics. In addition, use-case validation workshops were conducted with representative end users to stress-test assumptions around performance requirements, integration complexities, and total cost of ownership considerations. Finally, an iterative review process with subject matter experts ensured alignment with the latest advances in network infrastructure, sensor technologies, and AI-driven analytics. This rigorous methodology underpins the reliability of the strategic insights presented throughout this research.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Enterprise LBS market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Enterprise LBS Market, by Component

- Enterprise LBS Market, by Deployment Mode

- Enterprise LBS Market, by Organization Size

- Enterprise LBS Market, by Application

- Enterprise LBS Market, by Industry Vertical

- Enterprise LBS Market, by Region

- Enterprise LBS Market, by Group

- Enterprise LBS Market, by Country

- United States Enterprise LBS Market

- China Enterprise LBS Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Bringing Together Critical Insights and Forward-Looking Perspectives to Illuminate the Strategic Imperatives and Opportunities within the Enterprise LBS Ecosystem

The confluence of technological innovation, regulatory change, and geopolitical factors is reshaping the enterprise location-based services arena at an unprecedented pace. Organizations that successfully integrate edge computing, AI-driven analytics, and hybrid deployment architectures will unlock new efficiencies in asset utilization, fleet optimization, and field workforce management. At the same time, evolving tariff regimes and data sovereignty mandates require businesses to adopt agile supply chain and compliance strategies to mitigate cost and operational risk.

Looking ahead, the capacity to harmonize hardware agility with software-driven intelligence will serve as a key differentiator. By embracing open architectures and fostering cross-industry collaborations, enterprises can tap into specialized expertise and accelerate time to value for advanced use cases such as indoor navigation, context-aware marketing, and real-time safety monitoring. These strategic imperatives underscore the need for a holistic approach-one that aligns technological vision with regulatory foresight and operational execution-to capture the full potential of location-based services in the digital enterprise ecosystem.

Empowering Your Strategic Decisions Engage with Ketan Rohom to Unlock Comprehensive Insights and Acquire the Definitive Enterprise LBS Market Research Report

Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to gain unparalleled insights and strategic guidance for optimizing your enterprise’s location-based services initiatives. By connecting with Ketan, organizations can secure a tailored briefing that delves into the nuances of deployment models, component strategies, and regional considerations uniquely relevant to their operational context. This engagement offers a collaborative opportunity to align research findings with your business objectives, ensuring that the recommendations translate into measurable operational enhancements and competitive differentiation.

Take the next step toward informed decision making and accelerated implementation by partnering with Ketan Rohom. His expertise in navigating complex market dynamics and translating robust research into actionable plans will empower your leadership teams to deploy enterprise location-based services with confidence and precision.

- How big is the Enterprise LBS Market?

- What is the Enterprise LBS Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?