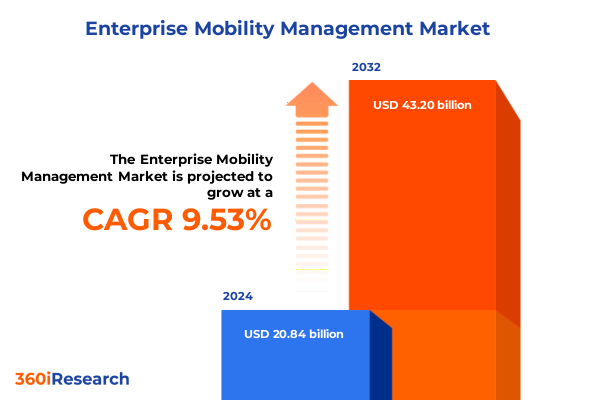

The Enterprise Mobility Management Market size was estimated at USD 22.80 billion in 2025 and expected to reach USD 24.87 billion in 2026, at a CAGR of 9.55% to reach USD 43.20 billion by 2032.

Unlocking the Future of Enterprise Mobility Management with Cutting-Edge Strategies and Market Dynamics Shaping Organizational Digital Transformation

Unlocking the Future of Enterprise Mobility Management with Cutting-Edge Strategies and Market Dynamics Shaping Organizational Digital Transformation

In today’s hyperconnected environment, organizations are navigating an unprecedented wave of digital transformation driven by mobile-first workforce demands, evolving security threats, and an accelerating shift toward hybrid work models. This introduction lays the groundwork for understanding how enterprise mobility management (EMM) has transcended its traditional role of device oversight to become a strategic enabler of productivity, compliance, and innovation. Initially conceived to secure corporate data on mobile endpoints, EMM platforms now incorporate advanced identity management, zero-trust frameworks, and unified endpoint visibility, reflecting a holistic approach to securing the modern digital enterprise.

As businesses strive to balance user experience with robust security, the EMM landscape has become a battleground for differentiation, where seamless integration with cloud services, AI-driven analytics, and contextual access policies serve as key value drivers. Moreover, regulatory pressures-ranging from data residency mandates to privacy regulations-have further elevated the importance of EMM solutions that can orchestrate compliance across diverse geographies and device ecosystems. Through this lens, the introduction provides a concise yet comprehensive orientation to the themes explored in subsequent sections, setting the stage for a deeper examination of transformative shifts, geopolitical impacts, and critical segmentation analyses that define the future of enterprise mobility management.

Navigating the Transformational Shifts Redefining Enterprise Mobility Management Through Technological Innovations and Evolving Security Imperatives

Navigating the Transformational Shifts Redefining Enterprise Mobility Management Through Technological Innovations and Evolving Security Imperatives

Over the past several years, the enterprise mobility management sphere has witnessed a rapid evolution fueled by the convergence of AI, machine learning, and cloud-native architectures. What began as rudimentary mobile device management has given way to intelligent systems capable of predictive threat detection, automated policy orchestration, and adaptive user experiences. For instance, the incorporation of behavioral analytics into identity and access management engines enables organizations to identify anomalous activity in real time, significantly reducing the window of exposure to potential breaches.

Simultaneously, the proliferation of edge computing and 5G connectivity has expanded the attack surface, compelling vendors to develop holistic unified endpoint management solutions that encompass smartphones, tablets, IoT devices, and distributed cloud workloads. As enterprises embrace Bring Your Own Device (BYOD) and choose Your Own Device (CYOD) policies, EMM platforms must strike a delicate balance between employee flexibility and enterprise-grade security. This shift has prompted a move from perimeter-based defenses to zero-trust strategies that verify every connection, user identity, and endpoint posture. Consequently, the role of EMM has broadened to drive cohesive security architectures, embedding itself at the heart of digital resilience and operational continuity initiatives.

Assessing the Far-Reaching Cumulative Impact of United States Tariff Policies on Enterprise Mobility Management Supply Chains and Operational Costs

Assessing the Far-Reaching Cumulative Impact of United States Tariff Policies on Enterprise Mobility Management Supply Chains and Operational Costs

The imposition and recalibration of United States tariffs in 2025 have introduced additional variables into the EMM procurement and deployment calculus. By extending duties on imported hardware components-ranging from mobile chipsets to network interface modules-organizations are encountering incremental cost pressures that cascade through device provisioning, lifecycle management, and support contracts. Beyond direct hardware markups, these tariff measures have prompted vendors to reassess global sourcing strategies, shifting production to alternative markets or renegotiating supply agreements to mitigate price volatility.

Furthermore, the increased cost of devices has spurred renewed interest in software-centric management solutions that extract maximum value from existing fleets via advanced virtualization and containerization techniques. As enterprises explore repair and refurbishment models to offset capital expenditures, EMM platforms are evolving to support reverse logistics workflows and enhanced asset tracking. In parallel, compliance teams are grappling with complex customs classifications and regulatory documentation requirements, heightening the demand for integrated supply chain governance modules within EMM suites. Ultimately, the 2025 tariff environment underscores the necessity for agile, software-led approaches to enterprise mobility that can adapt to shifting trade policies and fiscal headwinds.

Deciphering Key Insights from Component and Service Layers Operating System Choices Deployment Models Industry Vertical Dynamics and Organizational Scale

Deciphering Key Insights from Component and Service Layers Operating System Choices Deployment Models Industry Vertical Dynamics and Organizational Scale

A nuanced understanding of the EMM market necessitates a layered analysis of its core components and service offerings. On one hand, software capabilities encompass identity and access management, mobile application management, mobile content management, mobile device management, and unified endpoint management, with each module serving distinct yet interrelated security and productivity objectives. On the other hand, professional and managed services fortify these capabilities through strategic consulting, deployment planning, and ongoing operational support, ensuring that organizations derive sustained value from their EMM investments.

Equally critical is the operating system landscape, where Android and iOS dominate mobile endpoints, while Windows and macOS continue to anchor desktop experiences in hybrid work models. Linux, though less prevalent on pure client devices, underpins many edge computing deployments and specialized industrial use cases. Decision-makers are increasingly evaluating cross-platform management solutions that deliver consistent policy enforcement and telemetry across diverse OS environments.

In terms of deployment, cloud-hosted EMM offerings-available in both private and public cloud configurations-provide scalability and rapid feature updates, contrasting with on-premises implementations that appeal to entities with stringent data residency or air-gapped security requirements. Within vertical markets, sectors such as banking, financial services, and insurance prioritize stringent compliance and data encryption, whereas healthcare and life sciences demand seamless integration with electronic health record systems. Government and defense agencies underscore secure communications and endpoint resilience, while IT and telecom firms emphasize API-driven extensibility and network integration. Manufacturing and retail organizations, conversely, focus on edge device management, point-of-sale security, and mobile workforce enablement.

Finally, organizational size plays a pivotal role in shaping EMM strategies: large enterprises often adopt modular, multi-tenant architectures that support centralized policy frameworks across thousands of endpoints, while small and medium enterprises favor turnkey solutions that combine ease of use with cost-effective subscription models. This multifaceted segmentation underscores the imperative for vendors and buyers alike to tailor their approaches based on component maturity, service depth, OS compatibility, deployment flexibility, industry-specific requirements, and organizational scale.

This comprehensive research report categorizes the Enterprise Mobility Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Operating System

- Deployment Model

- Industry Vertical

- Organization Size

Unveiling Region-Specific Trajectories and Growth Drivers Across the Americas Europe Middle East Africa and Asia-Pacific in Enterprise Mobility Dynamics

Unveiling Region-Specific Trajectories and Growth Drivers Across the Americas Europe Middle East Africa and Asia-Pacific in Enterprise Mobility Dynamics

In the Americas, North American enterprises continue to lead in mobile-first initiatives, leveraging advanced analytics and AI-driven policy frameworks to optimize user experiences across distributed workforces. Latin America is witnessing a surge in cloud-based deployments, as organizations seek to bypass on-premises infrastructure constraints and capitalize on subscription-based licensing models. The region’s regulatory landscape, marked by data localization debates and privacy law enactments, further shapes the demand for EMM solutions with robust compliance reporting capabilities.

Across Europe, Middle East, and Africa, the diversity of regulatory regimes and economic maturity levels creates a mosaic of requirements. Western European markets emphasize GDPR-aligned data protection, driving investments in encryption, audit trails, and consent management. In contrast, the Middle East and Africa region is characterized by rapid adoption of mobile technologies to bridge infrastructure gaps, with government initiatives in smart cities and digital identity fueling EMM uptake. Moreover, pan-regional collaboration efforts on cybersecurity standards are influencing buyer preferences for unified endpoint management platforms capable of cross-border policy enforcement.

Meanwhile, Asia-Pacific stands out for its dynamic blend of mature and emerging markets. In countries like Japan and Australia, large enterprises are integrating EMM with advanced IoT and 5G applications to enable real-time monitoring and mobile robotics. Southeast Asian economies are accelerating cloud-first strategies, while China’s unique ecosystem-governed by localized operating systems and indigenous platform providers-presents both challenges and opportunities for global EMM vendors. Across the entire Asia-Pacific region, the intersection of mobile commerce, digital payment systems, and government digitalization projects continues to propel demand for comprehensive mobility management frameworks.

This comprehensive research report examines key regions that drive the evolution of the Enterprise Mobility Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Innovation Roadmaps Competitive Tactics and Market Positioning of Leading Enterprise Mobility Management Providers

Highlighting Strategic Innovation Roadmaps Competitive Tactics and Market Positioning of Leading Enterprise Mobility Management Providers

Industry leaders differentiate themselves through a combination of platform breadth, integration depth, and partnership ecosystems. Several vendors emphasize unified endpoint management, consolidating mobile, desktop, and IoT administration into single-pane-of-glass dashboards. Others prioritize identity-first security, embedding zero-trust principles across every layer of the mobility stack. Strategic alliances with cloud hyperscalers and telecom operators enable co-innovation on connectivity and edge compute solutions, extending EMM capabilities into new digital arenas.

Competing approaches also manifest in go-to-market models: some providers offer modular licensing, allowing customers to adopt specific functional blocks such as mobile application management or secure content collaboration, while others bundle comprehensive suites with bundled professional services for rapid time-to-value. Moreover, robust developer platforms and open APIs have become critical differentiators, empowering customers and ISVs to create custom workflows, integrate with IT service management systems, and automate device onboarding at scale.

In the realm of innovation, advanced analytics and machine learning are being embedded to provide predictive maintenance for mobile fleets, automated remediation of misconfigurations, and risk scoring at the individual user level. Vendors are also expanding into adjacent markets-such as mobile threat defense and secure access service edge-to deliver holistic security offerings that address both on-device and network-level threats. This mosaic of strategic roadmaps underscores the competitive imperative for continuous R&D investment, agile delivery models, and customer-centric ecosystem development.

This comprehensive research report delivers an in-depth overview of the principal market players in the Enterprise Mobility Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 42Gears Mobility Systems Pvt. Ltd.

- Addigy, Inc.

- Baramundi Software AG

- BlackBerry Limited

- Cisco Systems, Inc.

- Citrix Systems, Inc.

- Codeproof Technologies Inc.

- Google LLC

- IBM Corporation

- Ivanti, Inc.

- Jamf Holding Corp.

- ManageEngine (Zoho Corporation)

- Matrix42 AG

- Microsoft Corporation

- Miradore Ltd.

- Mitsogo Inc.

- MobileIron, Inc. (part of Ivanti)

- SAP SE

- SOTI Inc.

- VMware, Inc.

Driving Transformation Through Actionable Security Integration Operational Agility and Stakeholder Collaboration for Mobility Excellence

Driving Transformation Through Actionable Security Integration Operational Agility and Stakeholder Collaboration for Mobility Excellence

To thrive in an environment defined by rapid change and elevated threat vectors, enterprise leaders must adopt a security-by-design mindset, embedding zero-trust principles across all mobility initiatives. This entails implementing continuous authentication, device posture checks, and least-privilege access controls while ensuring seamless user experiences through single sign-on and contextual policy enforcement. By aligning security architectures with business processes, organizations can mitigate the risk of data leakage without stifling workforce productivity.

Operational agility hinges on the ability to rapidly scale environments and automate routine tasks. Infrastructure-as-code practices, API-driven orchestration, and policy-as-code frameworks streamline device provisioning, patch management, and incident response workflows. In parallel, fostering cross-functional collaboration between IT, security, and business units is essential; shared governance models and unified dashboards promote transparency, accelerate decision-making, and facilitate continuous improvement cycles.

Finally, embedding analytics-driven feedback loops enables organizations to measure key performance indicators-such as device compliance rates, application usage patterns, and security incident metrics-in real time. By leveraging these insights, stakeholders can prioritize resource allocation, refine access policies, and anticipate emerging trends. Collectively, these actionable strategies empower enterprises to elevate their mobility programs from tactical cost centers to strategic growth enablers within overarching digital transformation agendas.

Explaining Research Design Data Collection Techniques Analytical Frameworks and Validation Processes Underpinning Enterprise Mobility Management Insights

Explaining Research Design Data Collection Techniques Analytical Frameworks and Validation Processes Underpinning Enterprise Mobility Management Insights

This research leverages a multi-faceted approach combining primary data gathered from interviews with technology executives, IT managers, and security architects across diverse industries with secondary research sourced from industry publications, regulatory filings, and vendor documentation. Quantitative surveys were conducted to capture deployment preferences, feature adoption rates, and buyer intent, while qualitative workshops provided deeper understanding of pain points and strategic priorities.

Analytical frameworks such as SWOT assessment, Porter’s Five Forces analysis, and PESTEL evaluation were employed to assess competitive landscapes, market drivers, and macroeconomic influences. Data triangulation techniques ensured the consistency and reliability of findings, with cross-validation against publicly reported financial metrics and independent local market studies. The research methodology also incorporated scenario modeling to simulate the impact of tariff changes, regulatory developments, and technology disruptions on supply chains and operational costs.

Rigorous data governance and ethical research standards were upheld throughout the study, ensuring participant confidentiality and data integrity. The final deliverables underwent multiple rounds of peer review and validation by domain experts to guarantee actionable accuracy and strategic relevance for stakeholders seeking to optimize their enterprise mobility management investments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Enterprise Mobility Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Enterprise Mobility Management Market, by Component

- Enterprise Mobility Management Market, by Operating System

- Enterprise Mobility Management Market, by Deployment Model

- Enterprise Mobility Management Market, by Industry Vertical

- Enterprise Mobility Management Market, by Organization Size

- Enterprise Mobility Management Market, by Region

- Enterprise Mobility Management Market, by Group

- Enterprise Mobility Management Market, by Country

- United States Enterprise Mobility Management Market

- China Enterprise Mobility Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing the Strategic Imperatives and Future Outlook for Enterprise Mobility Management in Shaping Secure and Scalable Digital Work Environments

Summarizing the Strategic Imperatives and Future Outlook for Enterprise Mobility Management in Shaping Secure and Scalable Digital Work Environments

As organizations continue to embrace mobility as a cornerstone of digital transformation, the role of enterprise mobility management has evolved from device-centric administration to an integrated pillar of secure, agile, and user-centric IT ecosystems. Strategic imperatives such as zero-trust adoption, API-driven automation, and cross-platform integration will dictate future success, while emerging innovations in AI, edge computing, and 5G promise to unlock new value streams.

The future outlook suggests that EMM technologies will increasingly converge with broader security fabric initiatives, including secure access service edge and cloud-native firewall services, facilitating unified policy orchestration across network, application, and endpoint layers. Moreover, the rise of remote and distributed workforces will drive demand for adaptive user experiences that seamlessly traverse personal and corporate environments. Ultimately, leaders who embed mobility management at the core of their strategic planning will be best positioned to accelerate time-to-value, strengthen security postures, and support sustainable growth in an ever-changing digital landscape.

Connect Directly with Associate Director of Sales and Marketing to Secure Access to the Latest Enterprise Mobility Management Market Research Report

To explore in-depth market dynamics, uncover emerging opportunities, and leverage strategic insights that drive competitive advantage in the enterprise mobility management space, engage with Ketan Rohom, Associate Director of Sales & Marketing. By reaching out directly, stakeholders can gain privileged access to comprehensive analyses, detailed vendor assessments, and tailored recommendations. This personalized consultation ensures organizations receive clarity on regional trends, technology adoption patterns, and impact assessments tailored to their unique operational needs. Securing the full research report empowers decision-makers with data-driven intelligence and actionable roadmaps essential for navigating ongoing digital transformation journeys.

- How big is the Enterprise Mobility Management Market?

- What is the Enterprise Mobility Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?