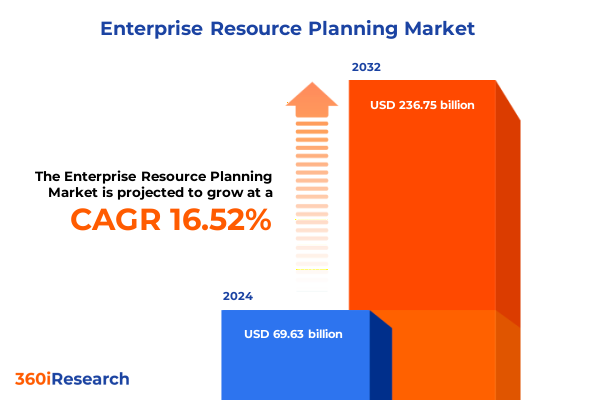

The Enterprise Resource Planning Market size was estimated at USD 81.28 billion in 2025 and expected to reach USD 93.34 billion in 2026, at a CAGR of 16.50% to reach USD 236.75 billion by 2032.

Understanding the Central Role of Enterprise Resource Planning in Driving Operational Efficiency and Strategic Agility Across Global Enterprises

Enterprise resource planning has emerged as the backbone of modern organizational operations, seamlessly integrating finance, supply chain, human resources, and customer relationship processes within a unified technology framework. As enterprises navigate increasing complexity, from digital transformation imperatives to dynamic market pressures, the ability to leverage a cohesive ERP platform is no longer a luxury-it is essential for maintaining agility, transparency, and cross-functional collaboration. Through streamlined workflows and centralized data repositories, ERP solutions facilitate faster decision cycles and foster an environment where real-time insights drive continuous improvement.

In recent years, expectations have shifted towards systems that not only automate routine tasks but also proactively recommend optimized actions based on predictive analytics and artificial intelligence. Consequently, ERP adoption strategies have evolved from one-time implementations to ongoing, iterative deployments that adapt to changing business objectives. This evolution underscores the necessity of viewing ERP as a strategic asset capable of enabling enterprise-wide innovation.

Against this backdrop, this executive summary serves as a concise yet rich overview of how ERP landscapes are transforming in response to technological advancements, regulatory shifts, and evolving organizational needs. By examining the most influential trends, segmentation nuances, regional dynamics, leading provider profiles, and actionable recommendations, decision makers will be equipped with the insights needed to craft forward-looking ERP strategies that deliver measurable value.

Identifying Pivotal Transformative Shifts Reshaping the Enterprise Resource Planning Landscape Amid Technological Evolution and Market Demands

Over the past decade, several transformative shifts have fundamentally reshaped the ERP landscape, compelling organizations to rethink their digital transformation roadmaps. First, the proliferation of cloud-native architectures has driven a departure from monolithic on-premise systems, with enterprises increasingly embracing scalable, subscription-based models that minimize upfront investments and accelerate time to value. This shift has also fueled new vendor ecosystems, where collaboration and interoperability have become cornerstones of effective deployment.

Simultaneously, the integration of artificial intelligence and machine learning capabilities into ERP suites has enhanced process automation and predictive intelligence. These embedded technologies enable advanced demand forecasting, anomaly detection in financial transactions, and dynamic resource allocation, thus reducing manual intervention and unlocking new productivity gains. Furthermore, the rise of low-code development platforms within ERP environments has democratized customization, empowering citizen developers to tailor workflows and reports without extensive coding expertise.

As enterprises face mounting cybersecurity threats and increasingly stringent data privacy regulations, the emphasis on robust governance, risk management, and compliance modules has never been greater. ERP providers have responded by embedding advanced encryption, access controls, and audit trails directly into core platforms. Consequently, these transformative forces are setting new benchmarks for ERP capabilities and investment priorities, compelling organizations to align their IT architectures with evolving digital imperatives.

Evaluating the Cumulative Impact of 2025 United States Tariffs on Enterprise Software Procurement Supply Chain Resilience and Operational Costs

The imposition and continuation of United States tariffs throughout 2025 have had a cascading effect on enterprise software procurement, supply chain resilience, and overall operational costs. Heightened duties on imported components, hardware, and even certain software categories have led organizations to reassess sourcing strategies and supplier relationships, spurring a renewed focus on near-shoring and regional ecosystem partnerships. By diversifying vendor portfolios, many enterprises aim to absorb tariff impacts while maintaining continuity in critical ERP implementations.

These trade measures have also influenced total cost of ownership considerations for both on-premise and hybrid deployments. Companies operating multi-site manufacturing and distribution networks have reported increased financial scrutiny on infrastructure upgrades, given that tariff-driven price fluctuations in server hardware and networking equipment can erode budget forecasts. In response, several organizations have prioritized cloud-based ERP alternatives, leveraging vendor-managed data centers to mitigate exposure to import duties and capitalize on operational scalability.

Moreover, the broader macroeconomic implications of shifting trade policies have underscored the importance of advanced scenario planning within ERP analytics modules. Firms are incorporating real-time tariff monitoring and cost-impact simulations to anticipate fiscal outcomes under varying policy scenarios. This heightened agility in financial planning not only helps organizations buffer against sudden duty increases but also empowers strategic decision makers to optimize global supply chain configurations in an ever-evolving trade environment.

Unveiling Key Segmentation Insights Revealing Distinct Enterprise Resource Planning Adoption Patterns Based on Deployment Mode Organizational Size Industry Vertical and Component

Dissecting ERP adoption through the lens of deployment mode reveals distinct organizational priorities. Cloud offerings continue to capture interest for their elastic scalability and pay-as-you-go models, making them particularly attractive for organizations seeking rapid implementation cycles and minimal infrastructure overhead. Conversely, on-premise solutions remain prevalent in highly regulated industries where data sovereignty and stringent compliance requirements demand local control. Hybrid architectures, marrying the benefits of cloud agility with on-site governance, have emerged as a pragmatic compromise for enterprises balancing innovation imperatives with risk management.

From the perspective of organization size, large enterprises leverage their capital strength to negotiate comprehensive licensing agreements and invest in advanced customization across sprawling operations. These organizations often require robust integration capabilities to unify legacy systems and modern platforms seamlessly. In contrast, small and medium enterprises prioritize out-of-the-box functionality, favoring solutions that deliver rapid deployment and built-in best practices without extensive professional services overhead.

Industry vertical segmentation further illuminates unique ERP priorities. Banking, financial services, and insurance firms emphasize advanced compliance, risk management, and real-time transaction monitoring. Healthcare and life sciences organizations focus on patient data security, regulatory reporting, and integrated research and development workflows. Information technology and telecom companies prioritize scalability and multi-tenant support to accommodate rapid user growth, while manufacturing and retail sectors demand end-to-end supply chain orchestration, inventory optimization, and omnichannel fulfillment capabilities.

Considering component segmentation, software suites are evaluated based on modularity and ease of upgrades, whereas services such as consulting, implementation, support and maintenance, and training play an essential role in ensuring sustained ROI and user adoption. Deep expertise from service providers becomes a differentiator, particularly for organizations undertaking complex digital transformation journeys.

This comprehensive research report categorizes the Enterprise Resource Planning market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Mode

- Component

- Organization Size

- Industry Vertical

Exploring Critical Regional Dynamics Influencing Enterprise Resource Planning Implementation Trends Across Americas Europe Middle East Africa and Asia Pacific

Regional market dynamics underscore the importance of contextualized ERP strategies. In the Americas, maturity in cloud adoption is matched by a growing emphasis on AI-enabled analytics and digital supply chain visibility. North American enterprises, in particular, are driving demand for integrated customer experience modules that extend core ERP functionality into front-office operations. Latin America, by contrast, is experiencing accelerated ERP interest among mid-market players, driven by modernization initiatives and the pursuit of export competitiveness.

Across Europe, the Middle East, and Africa, regulatory heterogeneity shapes ERP selection criteria. European firms prioritize stringent GDPR compliance and data localization requirements, prompting deeper investments in governance and security features. In the Middle East, public sector digitalization programs have catalyzed large-scale ERP rollouts, often supported by government incentives and strategic partnerships. African markets are witnessing a surge in cloud-based ERP trials, as organizations seek cost-effective platforms to drive modernization despite variable infrastructure readiness.

In the Asia-Pacific region, diversified economic landscapes yield a broad spectrum of ERP maturities. Developed markets such as Japan and Australia favor established vendors offering deep industry vertical expertise, whereas emerging economies in Southeast Asia and India demonstrate strong appetite for modular, SaaS-based ERP models that facilitate rapid scaling. Cross-regional initiatives, such as regional free trade agreements and digital corridors, are further influencing ERP investment patterns, as enterprises align system architectures with cross-border supply chain frameworks and omnichannel distribution networks.

This comprehensive research report examines key regions that drive the evolution of the Enterprise Resource Planning market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Prominent Enterprise Resource Planning Providers Driving Market Innovation Partnerships and Competitive Differentiation Through Strategic Offerings

Leading ERP providers are differentiating themselves through a combination of strategic partnerships, platform ecosystem expansions, and vertical-specific innovations. Certain providers have forged alliances with cloud hyperscalers to deliver native integrations that enhance system performance and reliability, while others have focused on embedding advanced analytics and industry-tailored process templates to accelerate time to value.

Innovation roadmaps highlight a collective shift towards mobile-first interfaces, conversational user experiences driven by natural language processing, and robust API frameworks that facilitate seamless connectivity with specialized third-party applications. In parallel, provider strategies increasingly emphasize outcome-based service models, aligning vendor compensation with the achievement of key performance indicators such as process efficiency gains and user adoption rates. These differentiated engagement approaches underscore the shifting expectations enterprises have of their ERP providers.

Beyond technology capabilities, competitive differentiation is also being shaped by go-to-market agility and customer success practices. Providers investing in co-innovation labs and customer advisory forums are successfully cultivating long-term relationships that drive continuous improvement. Moreover, a focus on environmental sustainability and ethical supply chain management is emerging within provider value propositions, reflecting broader corporate responsibility trends that influence ERP procurement decisions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Enterprise Resource Planning market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- abas Software AG

- Acumatica, Inc.

- Deltek, Inc.

- Epicor Software Corporation

- Exact Holding N.V.

- IFS AB

- Infor, Inc.

- Microsoft Corporation

- Oracle Corporation

- Oracle NetSuite, Inc.

- Plex Systems, Inc.

- Priority Software Ltd.

- QAD Inc.

- Ramco Systems Limited

- SAP SE

- SYSPRO (Pty) Ltd.

- The Sage Group plc

- TOTVS S.A.

- Unit4 N.V.

- Workday, Inc.

Formulating Actionable Recommendations for Industry Leaders to Optimize Enterprise Resource Planning Investments Enhance ROI and Foster Sustainable Growth

To maximize the value of ERP investments, industry leaders should first establish clear, measurable objectives aligned with overarching business goals. By articulating specific outcomes-whether improving order fulfillment efficiency, enhancing financial close accuracy, or accelerating new product introductions-organizations can better prioritize features and allocate resources effectively. This clarity of purpose also serves as a guiding north star throughout the implementation lifecycle, ensuring alignment between IT teams, business stakeholders, and external partners.

Next, adopting a phased implementation approach can mitigate risk and deliver incremental wins. Beginning with high-impact modules and expanding scope iteratively allows organizations to refine governance processes, scale user training programs, and validate technical integrations. Alongside this, embedding a center of excellence model fosters cross-functional collaboration, driving consistency in best practices and accelerating organizational learning curves.

Leaders should also invest in data governance frameworks that address data quality, security, and compliance from day one. By instituting policies for data stewardship and leveraging automated cleansing tools, enterprises can safeguard the integrity of analytics outputs and decision support systems. Finally, maintaining a continuous improvement mindset-driven by ongoing performance monitoring and user feedback loops-enables organizations to adapt ERP configurations in response to evolving market conditions, technological advances, and internal performance insights.

Outlining a Rigorous Research Methodology Combining Qualitative and Quantitative Analyses for Comprehensive Enterprise Resource Planning Market Insights

This analysis integrates a multi-method research framework, beginning with primary qualitative interviews conducted with ERP decision makers across multiple industries to capture first-hand insights into adoption drivers and implementation challenges. In parallel, in-depth case studies of representative deployments were examined to identify best practices and common pitfalls encountered during project lifecycles.

Secondary research involved systematic reviews of vendor documentation, white papers, regulatory filings, and publicly available financial reports to triangulate provider strategies and market developments. Quantitative data collection leveraged aggregated industry surveys and proprietary databases to validate observed trends and assess the distribution of deployment modes, organization sizes, and vertical use cases. Collected data underwent rigorous statistical analysis, including correlation and regression techniques, to uncover meaningful relationships between strategic initiatives and operational outcomes.

Throughout the research process, methodological rigor was maintained via expert peer reviews and cross-validation exercises, ensuring that findings are both reliable and actionable. Ethical considerations, including confidentiality agreements with participating organizations and anonymization of sensitive details, were strictly observed to protect proprietary information.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Enterprise Resource Planning market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Enterprise Resource Planning Market, by Deployment Mode

- Enterprise Resource Planning Market, by Component

- Enterprise Resource Planning Market, by Organization Size

- Enterprise Resource Planning Market, by Industry Vertical

- Enterprise Resource Planning Market, by Region

- Enterprise Resource Planning Market, by Group

- Enterprise Resource Planning Market, by Country

- United States Enterprise Resource Planning Market

- China Enterprise Resource Planning Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Drawing Conclusive Perspectives on Enterprise Resource Planning Evolution to Empower Decision Makers and Guide Strategic Technology Adoption

Enterprise resource planning has evolved from a tactical tool for back-office automation into a strategic enabler of enterprise-wide innovation. The convergence of cloud scalability, intelligent automation, and advanced analytics has redefined the criteria by which ERP solutions are evaluated and deployed. As organizations confront complex trade dynamics, shifting regulatory landscapes, and rising customer expectations, the adaptability of ERP architectures will remain a critical determinant of competitive advantage.

By examining segmentation patterns, regional variances, and provider differentiators, this report underscores that successful ERP initiatives are characterized not only by technology selection but also by disciplined governance, data integrity, and stakeholder alignment. Forward-looking organizations will embrace iterative deployment approaches, continuous learning frameworks, and vendor partnerships that prioritize outcome-based models.

Ultimately, mastery of ERP strategies will hinge on an organization’s commitment to embedding agility into its operational core, leveraging real-time insights to respond to market disruptions, and fostering a culture of continuous process optimization. Armed with the insights presented herein, decision makers are positioned to architect ERP strategies that balance immediate operational improvements with long-term transformational potential.

Seizing Opportunities Today Reach Out to Ketan Rohom Associate Director Sales Marketing to Secure Your Comprehensive Enterprise Resource Planning Research Brief

To explore this comprehensive enterprise resource planning research brief and gain tailored insights, please connect with Ketan Rohom, the Associate Director of Sales & Marketing, who can guide you through the customization options and support a seamless acquisition process. With an in-depth understanding of ERP dynamics and strategic alignment, he stands ready to help you secure the intelligence necessary to enhance operational decision making, drive technology investments, and achieve a competitive advantage in a rapidly evolving marketplace. Engage today to ensure your organization capitalizes on the latest findings and actionable recommendations, and position your ERP initiatives for sustained success.

- How big is the Enterprise Resource Planning Market?

- What is the Enterprise Resource Planning Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?