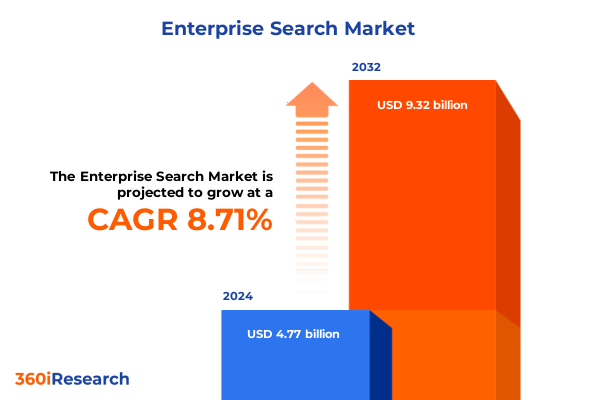

The Enterprise Search Market size was estimated at USD 5.17 billion in 2025 and expected to reach USD 5.62 billion in 2026, at a CAGR of 8.75% to reach USD 9.32 billion by 2032.

Enterprise search accelerates into a RAG-first future where governance, trust, and user-centric design raise the bar for decision velocity

Enterprise search is undergoing a decisive shift from utilities that index documents to strategic systems of intelligence that sit at the center of knowledge work. The convergence of retrieval‑augmented generation, vector indexing, and rigorous governance is transforming how employees discover, synthesize, and act on institutional knowledge. As models improve in reasoning and summarization, leaders no longer evaluate search purely on precision and recall-they now prioritize answerability, provenance, privacy, and measurable business outcomes such as time to resolution and win rates.

At the same time, data sprawl has accelerated. Information now spans chat transcripts, PDFs, ERP records, code repositories, and video, all changing daily. Modern search must bridge structured data from ERP and CRM systems with free‑form, unstructured content, and it must do so in real time, under strict access controls and audit requirements. The operational bar has risen as well: platforms are expected to deliver low‑latency results across hybrid clouds and on‑premises estates while keeping inference costs predictable and aligned to business value.

This executive summary frames the landscape as of November 6, 2025 and distills what executives need to know to navigate product selection, architecture choices, compliance obligations, and organization design. It explains the technology shifts that matter, the policy environment shaping supply chains and deployment strategies, and the segmentation patterns that reveal where value concentrates. Across sections, the emphasis is practical: what to deploy now, what to pilot, and what governance guardrails to institutionalize so search remains trusted and durable as models and regulations evolve.

Shifts redefining enterprise search: hybrid retrieval, vector indexing, and multimodal experiences reshape relevance and operational economics

Three structural shifts define today’s enterprise search. First, retrieval itself has become hybrid. Dense vector retrieval excels at semantic matching while keyword methods such as BM25 capture exactness, field boosts, and lexicon nuance. Mature platforms now fuse these approaches, using techniques like reciprocal rank fusion or pipeline‑based normalization to combine signals, while rankers refine the final list. This blend raises both coverage and precision, and it forms the foundation on which generative answers can be responsibly grounded. Evidence of this convergence is visible in open platforms that formally document hybrid pipelines and neural k‑NN indexing, as well as in cloud services that expose vector and keyword capabilities side by side. These advances are not theoretical; they reflect production‑hardened features and guidance available to engineering teams today.

Second, the user experience has gone multimodal and conversational. Beyond text, search increasingly interprets images, diagrams, and even code snippets, and it must support voice and programmatic interactions through APIs. Leading services position retrieval‑augmented generation as a first‑class pattern, allowing organizations to chain retrieval, summarization, and citations while honoring permissions. Offerings from major clouds explicitly describe RAG support, semantic ranking, and turnkey connectors, signaling a future in which search is the front door to enterprise AI rather than a standalone tool.

Third, governance has become a product requirement, not an afterthought. As search systems answer questions directly, they must attach provenance, enforce document‑level entitlements, and implement safety policies for sensitive data. Buyers therefore evaluate search through the lens of risk: model selection and deployment locality, auditability, data residency, and alignment with security architectures. This has elevated on‑premises and air‑gapped options for regulated workloads, while cloud‑native services compete by pairing strong access controls with well‑documented compliance postures. The resulting market dynamic is healthy for buyers: a broad spectrum of choices from fully managed services to self‑hosted stacks, all increasingly capable of hybrid retrieval and RAG while respecting enterprise guardrails.

United States tariffs through 2025 reshape hardware supply chains and cost structures, pressuring search build-versus-buy and deployment choices

The current U.S. tariff regime-shaped by the four‑year review of Section 301 measures and subsequent actions-continues to ripple through technology supply chains in 2025. While many enterprise search workloads run in the cloud, capital purchases still matter for organizations operating their own data centers or edge estates, and even cloud providers face upstream equipment costs. Tariff increases announced in 2024 target strategic categories including steel and aluminum products, solar cells, and ship‑to‑shore cranes, with higher rates taking effect in 2024 and additional changes scheduled for January 1, 2025 and beyond. Notably, semiconductors imported from China are subject to a rate increase to 50% in 2025, complementing earlier steps on clean‑energy components and critical minerals.

For enterprise search decision‑makers, these measures affect hardware‑adjacent costs such as racks, enclosures, and certain components sourced from China, and they reinforce a multi‑sourcing mindset for servers, storage, and network equipment. Although many high‑end accelerators are fabricated outside China, ongoing U.S. export‑control updates on advanced chips and tools shape availability and design choices, nudging some buyers toward cloud‑based retrieval and inference services or toward architectures that use more CPU‑friendly retrieval paired with selective GPU capacity. The policy environment thus acts both as a cost signal and as a capacity‑planning constraint.

The cumulative picture is one of deliberate redundancy and near‑shoring. Enterprises increasingly distribute procurement across North American suppliers to reduce exposure and to align with public‑sector purchasing norms, while global teams maintain fallback plans to re‑route components ahead of effective dates. The December 2024 notice on additional tariff increases for items such as wafers and polysilicon, effective January 1, 2025, underscores that implementation timelines matter; executives should map major refresh cycles to tariff calendars to avoid avoidable cost spikes. In parallel, new enforcement resources and an exclusion process for manufacturing machinery provide limited relief levers that supply‑chain and tax teams can evaluate case by case.

Finally, the broader geopolitical framing is unavoidable. Tariff adjustments coexist with industrial policy measures such as domestic incentives and ongoing dialogues on critical technology. For technology leaders, the practical implication is to treat procurement and deployment as a portfolio decision: favor architectures that can flex between cloud‑based services and on‑premises deployments, maintain vendor diversity at the component level, and instrument cost observability so that any tariff‑driven variance is quickly visible in unit economics for search workloads.

Segmentation signals reveal adoption patterns across architectures, components, data, and pricing models that dictate successful search outcomes

Architecture choice is the first and most visible signal in this market. Across deployments, a steady shift from siloed implementations to unified and federated models is underway. Unified architectures consolidate indices and permissions to deliver a single, governed view of knowledge, while federated designs preserve data locality by querying multiple systems at runtime and reconciling entitlements just in time. Siloed setups persist in highly regulated pockets or legacy estates, but most buyers now anchor their roadmaps in unified or federated patterns to balance control, latency, and cost.

Component decisions then define where value concentrates. Software spans core search engines that provide indexing and retrieval, middleware and integration layers that orchestrate connectors and pipelines, user‑interface and experience modules that shape how people ask and interpret questions, and analytics and reporting that quantify relevance, gaps, and business impact. Services complement this stack: professional services accelerate migrations, schema design, RAG evaluation, and security hardening, while managed services take on operations such as scaling, patching, and monitoring for teams that prefer to focus on content stewardship and adoption.

Data realities strongly influence outcomes. Unstructured data-policies, tickets, emails, PDFs, transcripts, and media-now dominates the query mix, yet structured data still anchors high‑value workflows. Successful platforms bridge both by indexing ERP and CRM datasets and relational databases alongside documents, enabling cross‑modal queries that respect entity relationships and freshness. This balance is crucial for use cases where answers must incorporate both free‑form context and authoritative records.

Search technology selection reflects a progression from keyword search to semantic search, question answering, and ultimately multimodal retrieval. Keyword methods remain essential for compliance‑sensitive exact matches and fielded queries. Semantic techniques interpret intent and synonyms, while question‑answering layers synthesize passages into direct responses with citations. Multimodal search expands reach by incorporating images and other non‑text signals, a feature increasingly relevant for engineering, healthcare imaging repositories, and media libraries.

User interaction is diversifying as query modality expands. Text remains the default, but voice is rising in field operations and call‑center assist scenarios, visual inputs aid support engineers and designers, and programmatic APIs power automated agents and back‑office workflows. These modalities demand consistent permissions, throttling, and observability across channels.

Indexing strategy has become a lever for both performance and cost. Full‑text indexing provides robust lexical coverage; vector indexing enables semantic similarity search with options for approximate nearest‑neighbor algorithms; metadata indexing supports compliance and tuned relevance; and batch indexing helps control compute budgets and windowed updates. Many leaders now operate hybrid indices that combine sparse and dense representations to optimize for both relevance and efficiency.

Commercial alignment is equally important. Pricing models range from perpetual licenses common in legacy on‑premises environments to subscription and usage‑based approaches that better match cloud elasticity and RAG inference variability. Procurement teams increasingly favor models that expose clear unit metrics-documents, queries, tokens, or compute hours-so business owners can attribute cost to value transparently.

Applications reveal where returns consolidate. Competitive intelligence teams integrate public and internal sources to inform go‑to‑market moves. Customer support and self‑service teams use RAG answers with citations to cut resolution times while preserving accountability. Data discovery and intelligence unlock analytics reuse; knowledge management anchors onboarding and policy compliance; recruitment and talent search improve candidate matching; and risk and compliance management relies on audit trails, entitlements, and retention logic embedded directly into search workflows.

Industry verticals add nuance. Banking, financial services, and insurance emphasize entitlements, lineage, and model risk management. Education focuses on accessibility and multilingual retrieval. Government and the public sector prioritize zero‑trust architectures and data residency. Healthcare and life sciences teams pair retrieval with clinical taxonomies and privacy rules. IT and telecom teams lean on automation and programmatic interfaces. Manufacturing blends textual work instructions with visual inspection content. Media and entertainment emphasize multimodal retrieval and rights management. Retail seeks real‑time product knowledge and policy‑aware recommendations, and healthcare providers focus on care‑team enablement, documentation summarization, and safety guardrails.

Finally, enterprise size and deployment preferences shape operating models. Large enterprises typically adopt platform‑centric approaches with centralized governance and multiple business‑unit tenants, while small and mid‑sized organizations favor opinionated products and managed services to accelerate time to value. Cloud‑based deployments dominate new projects thanks to elasticity and ecosystem integrations, yet on‑premises remains material for air‑gapped and data‑sovereign workloads-especially where latency, residency, or regulatory mandates require local processing.

This comprehensive research report categorizes the Enterprise Search market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Enterprise Search Type

- Component

- Data Type

- Search Technology

- Query Modality

- Indexing Approach

- Pricing Model

- Application

- Industry Vertical

- Enterprise Size

- Deployment Type

Regional dynamics across the Americas, EMEA, and Asia-Pacific reveal distinct regulatory, language, and infrastructure forces shaping enterprise search

Regional differences shape priorities and pace. In the Americas, organizations balance aggressive AI adoption with stringent governance and procurement discipline. U.S. enterprises leverage mature cloud ecosystems and a robust ecosystem of connectors and evaluation tooling, while public‑sector teams emphasize zero‑trust patterns and compliance with federal cloud authorization regimes. Canadian buyers often lead in privacy‑by‑design practices, and Latin American firms, especially in financial services and retail, focus on practical ROI-deploying search where it tangibly improves agent assist, fraud operations, or field service speed. Supply‑chain policies and tariff calendars remain on the radar for hardware buyers, but most teams prioritize platform choices that make RAG measurable and secure.

Across Europe, the Middle East, and Africa, data protection and sovereignty are dominant themes. European buyers frequently require fine‑grained data‑processing agreements, regional hosting, and audit trails that align with evolving AI governance frameworks. This pushes demand for deployment flexibility-being able to run the same search stack in multiple regions or within a customer’s environment where necessary. In the Middle East, rapid cloud region expansion and large digital‑transformation mandates create headroom for greenfield implementations, often paired with Arabic language models and voice interfaces. In Africa, momentum concentrates in sectors such as telecommunications, fintech, and public services, where multilingual retrieval and mobile‑first interfaces are essential.

In Asia‑Pacific, enterprises combine innovation appetite with pragmatic cost control. Japan and South Korea lead in manufacturing and electronics use cases that blend text and visual retrieval. Australia’s public and financial sectors emphasize security certifications and operational resilience. India’s technology and business‑services firms are heavy adopters of API‑driven search to power engineering and support operations at scale. Southeast Asian organizations frequently prioritize low‑code integration and language coverage across English and local languages. Across the region, the rise of managed vector search and hybrid retrieval lowers barrier to entry, letting teams prove value quickly before committing to deeper integration.

This comprehensive research report examines key regions that drive the evolution of the Enterprise Search market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Company strategies highlight converging roadmaps as cloud hyperscalers and specialists vie to power secure, AI-native enterprise search platforms

Vendor strategies are converging around a clear center of gravity: deliver hybrid retrieval, integrate RAG natively, and expose governance‑ready controls. Cloud platform providers have embedded vector search and semantic ranking alongside mature keyword capabilities, reflecting rebrands and feature expansions that make these services the default gateway for AI‑native search. One example is the renaming of Azure Cognitive Search to Azure AI Search in 2023, accompanied by broader vector search and semantic ranker availability; these updates signal a commitment to unified lexical‑and‑vector retrieval with enterprise‑grade controls. Google’s Vertex AI Search likewise positions RAG and semantic features as core, with documentation that ties the product to Discovery Engine APIs and emphasizes domain‑specific tuning.

Open ecosystems continue to mature in parallel. The OpenSearch community documents k‑NN vector fields, hybrid pipelines, and model‑integrated ingest, offering engineering teams the option to self‑host and fine‑tune their stacks while maintaining cloud portability. Elastic highlights hybrid ranking methods and learned sparse encoders under its relevance engine, positioning the platform to support both sparse and dense retrieval at scale. These capabilities give buyers meaningful choice: adopt a managed service for speed and compliance posture, or operate an open stack for maximum control and locality.

Specialists remain crucial in enterprise deployments. Managed search services emphasize connectors, schema intelligence, and security mapping to accelerate time to value. Offerings such as Amazon Kendra and IBM’s discovery tooling underscore unified search across structured and unstructured sources, with features that align to RAG patterns and enterprise entitlements. For buyers, the practical upshot is an ecosystem in which hyperscalers, open platforms, and specialists increasingly interoperate, allowing architectures that combine best‑of‑breed retrieval with the governance and analytics layers required for production.

This comprehensive research report delivers an in-depth overview of the principal market players in the Enterprise Search market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Algolia, Inc.

- AlphaSense Inc.

- Coveo Solutions Inc.

- Dieselpoint Inc.

- eGain Corporation

- Elastic NV

- Glean Technologies, Inc.

- GoLinks Inc.

- Google LLC by Alphabet Inc.

- Guru Technologies, Inc.

- Hyland Software, Inc.

- International Business Machines Corporation

- Lucidworks Inc.

- Luigi’s Box, s.r.o.

- Mango Technologies, Inc.

- MarkLogic Corporation by Progress Software Corporation

- Microsoft Corporation

- MOURI Tech LLC

- Moveworks, Inc.

- OpenText Corporation

- Oracle Corporation

- Salesforce, Inc

- SAP SE

- ServiceNow, Inc.

- Thunderstone Software LLC

- X1 Discovery, Inc.

- ZOOVU GmbH

Action plan for industry leaders: align architecture, governance, and talent to deliver resilient, cost-aware, and measurable enterprise search value

Start by aligning architecture with business objectives. If the goal is faster case resolution in support, prioritize hybrid retrieval with answer generation and citations, and instrument outcome metrics such as deflection rates and handle times. For competitive intelligence, emphasize freshness, source diversity, and permission‑aware summarization. For risk and compliance, bias toward exact matching, audit trails, and retention logic embedded in the retrieval pipeline. Make these priorities explicit and use them to drive product selection, schema design, and evaluation metrics.

Institutionalize governance early. Establish a data catalog and entitlement model that spans both indexing and generation, and ensure that query‑time permissions are enforced consistently across text, voice, visual, and API interactions. Require provenance in every answer and forbid model behavior that fabricates sources. Document residency requirements and validate them against deployment options, including cloud regions and on‑premises or air‑gapped installations.

Engineer for cost and performance. Choose indexing strategies that match your corpus and query mix-lexical fields for exactness, vectors for semantic recall, and metadata fields for filtering and ranking. Use batch windows and incremental updates to control compute spend. In RAG scenarios, decouple retrieval from generation so you can tune model size, temperature, and context windows independently and swap providers without re‑architecting the index.

Raise the bar on evaluation. Move beyond offline benchmarks and incorporate task‑level measures: answer accuracy with citation correctness, time to first relevant result, and task completion rates for agents and analysts. Where possible, implement interleaved experiments to compare rankers in production and combine human judgment with automated checks for safety and PII handling.

Build a durable operating model. Create a cross‑functional team spanning search engineering, knowledge management, security, legal, and operations. Define onboarding playbooks for new sources, establish a schema review board to prevent ungoverned index growth, and maintain runbooks for incident response. Invest in enablement so frontline staff know how to ask questions effectively and how to interpret citations and confidence indicators.

Plan for portability. Avoid hard coupling between your search stack and any single LLM provider. Favor products and frameworks that allow you to bring your own embeddings, switch rankers, and call models through neutral orchestration layers. Maintain clear SLAs for retrieval and for generation, and ensure observability spans both so you can isolate issues and optimize where it matters.

Methodology overview: multi-source validation, practitioner interviews, and scenario analysis anchored in 2025 realities of policy and technology

This analysis synthesizes multiple evidence streams to present an accurate view as of November 6, 2025. The approach combines structured secondary research, primary dialogues with practitioners, and internal analytical modeling to triangulate findings and stress‑test conclusions against real‑world constraints.

Secondary research grounds the policy and technology context in authoritative documents. Government notices and fact sheets inform the section on United States tariffs and effective dates, while official product documentation and release notes validate claims about platform capabilities, rebrands, and feature availability. This ensures that references to hybrid retrieval, vector indexing, semantic ranking, and RAG support reflect what buyers can implement now rather than speculative roadmaps.

Primary inputs come from conversations with enterprise architects, information‑retrieval engineers, compliance leaders, and operations managers across industries and regions. These discussions surface the day‑to‑day realities of indexing strategies, permission models, rollout patterns, and change management. They also highlight the trade‑offs teams confront between speed and rigor, as well as the organizational designs that keep platforms healthy over time.

Analytical methods emphasize scenario thinking and sensitivity analysis. For example, we evaluate the implications of shifting a workload from on‑premises to cloud in the presence of procurement constraints, or of moving from keyword‑only search to hybrid retrieval in content sets with varying noise levels. We map how governance controls-such as provenance requirements or fine‑grained entitlements-affect latency and operational cost. We further assess risks and mitigations associated with policy changes by aligning refresh cycles to published tariff timelines, and by identifying components most exposed to supply‑chain variability.

Finally, we prioritize clarity over speculation. Where the evidence base is still evolving, we indicate likely directions and describe decision frameworks rather than firm predictions. The result is a methodology designed to be repeatable: as new notices or product capabilities are published, the same process can update the implications for architecture, procurement, and governance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Enterprise Search market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Enterprise Search Market, by Enterprise Search Type

- Enterprise Search Market, by Component

- Enterprise Search Market, by Data Type

- Enterprise Search Market, by Search Technology

- Enterprise Search Market, by Query Modality

- Enterprise Search Market, by Indexing Approach

- Enterprise Search Market, by Pricing Model

- Enterprise Search Market, by Application

- Enterprise Search Market, by Industry Vertical

- Enterprise Search Market, by Enterprise Size

- Enterprise Search Market, by Deployment Type

- Enterprise Search Market, by Region

- Enterprise Search Market, by Group

- Enterprise Search Market, by Country

- United States Enterprise Search Market

- China Enterprise Search Market

- Competitive Landscape

- List of Figures [Total: 23]

- List of Tables [Total: 2385 ]

Conclusion: enterprise search becomes a strategic system of intelligence as retrieval, generation, and governance converge to unlock trusted insight

Enterprise search has crossed a threshold. What was once a back‑office utility is now a strategic capability that fuses retrieval, generation, and governance to deliver trusted answers where work happens. Organizations that have embraced hybrid retrieval, rigorous entitlements, and measurable evaluation report faster resolution times, fewer escalations, and more confident decision‑making. Those still running legacy, siloed implementations are seeing rising maintenance costs, inconsistent relevance, and governance gaps that limit where search can be safely used.

The path forward is clear. Treat search as a product with an explicit roadmap and a cross‑functional team. Standardize on schemas and pipelines that balance structured and unstructured data. Make provenance non‑negotiable, and ensure deployment options meet residency and risk requirements. Choose platforms that expose vector and keyword capabilities, support RAG natively, and integrate with your identity and observability stacks. Above all, align investment to the tasks that matter-support cases, bid responses, research workflows, and regulatory obligations-so value is visible and defensible.

With disciplined execution, enterprise search becomes the enterprise’s system of intelligence: a durable foundation that converts institutional knowledge into action while respecting the security, privacy, and compliance standards that modern organizations demand.

Take the next step: speak with Ketan Rohom to tailor this analysis to your context and secure immediate access to the full market research report

Ready to translate these insights into a concrete plan for your organization? Connect with Ketan Rohom, Associate Director, Sales & Marketing, to discuss how this executive summary can be tailored to your priorities and to arrange immediate access to the full market research report. Ketan can guide you to the most relevant chapters, assist with enterprise-wide licensing options, and coordinate a briefing for your leadership team.

To move forward, request a consultation with Ketan and specify your primary use cases, current technology stack, and compliance obligations. He will ensure you receive the version of the report that aligns with your sector, scale, and deployment preferences, along with any add-on analyst time required for a deep dive.

- How big is the Enterprise Search Market?

- What is the Enterprise Search Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?