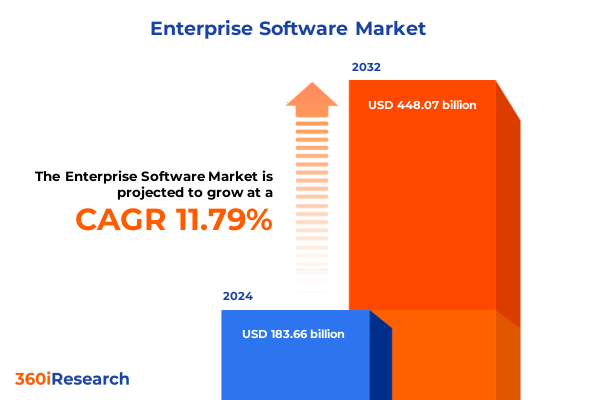

The Enterprise Software Market size was estimated at USD 204.38 billion in 2025 and expected to reach USD 227.66 billion in 2026, at a CAGR of 11.86% to reach USD 448.07 billion by 2032.

Navigating The Evolving Enterprise Software Ecosystem Amid Digital Transformation And Heightened Competitive Pressures

In an era defined by relentless technological progress and competitive disruption, understanding the complex enterprise software ecosystem has become an imperative for decision-makers seeking to harness digital innovation. Organizations today contend with an unprecedented convergence of automated workflows, artificial intelligence, and cloud computing that reshapes traditional IT strategies and operational models. Consequently, business leaders must develop a holistic perspective that encapsulates shifting buyer expectations, evolving regulatory landscapes, and the imperative for resilience against external shocks such as trade policy changes.

This executive overview unpacks the salient trends that characterize the enterprise software market as of mid-2025, providing a strategic lens through which stakeholders can evaluate opportunity spaces and potential challenges. Reflecting on transformative shifts, tariff implications, and critical segmentation dimensions, this introduction sets the groundwork for a nuanced analysis that guides both short-term action items and long-term strategic investments. As digital transformation accelerates, the insights presented herein aim to bridge the gap between technology potential and practical implementation, driving sustainable competitive advantage across industries.

Unprecedented Technological Convergence Accelerating The Enterprise Software Landscape Through AI, Cloud Native Architecture, And Automation Advances

The enterprise software landscape has undergone transformative shifts rooted in the accelerated maturation of cloud native architectures and pervasive artificial intelligence capabilities. Over the past two years, organizations have migrated core applications from on-premises data centers to scalable cloud platforms, opening avenues for rapid deployment and continuous innovation. Simultaneously, low-code and no-code development models are democratizing application creation, enabling citizen developers to address niche business challenges while reducing reliance on central IT teams.

Moreover, integration frameworks and open application programming interfaces have fostered interconnected ecosystems that break down data silos and drive real-time decision-making. As enterprises balance agility with security, cybersecurity solutions embedded directly within software stacks have become critical, ensuring that data protection is not a retrofit but a foundational element. These converging trends underscore a paradigm shift from monolithic suites toward composable applications, empowering organizations to tailor technology stacks to their evolving needs and accelerate time to value.

Assessing The FarReaching Effects Of 2025 United States Trade Tariffs On Supply Chains, Technology Procurement, And Cost Structures In Enterprise Software

The imposition of new tariffs by the United States in early 2025 has reverberated across the global supply chains integral to enterprise software deployment and hardware procurement. Increased duty rates on semiconductors and critical server components have elevated capital expenditure budgets, compelling IT leaders to reassess sourcing strategies and consider alternative manufacturing regions. Consequently, organizations that previously relied on a just-in-time procurement model have pivoted toward inventory buffering and diversified vendor ecosystems to mitigate potential bottlenecks.

Additionally, licensing costs for imported software solutions have seen upward pressure as distributors pass through heightened import duties. This has incentivized enterprises to explore open source alternatives and to negotiate more flexible subscription models. In turn, software vendors are adapting by localizing data center footprints and optimizing licensing structures to remain competitive in a tariff-constrained environment. By understanding these cumulative impacts, stakeholders can navigate cost headwinds while preserving the continuous delivery mechanisms essential for digital transformation.

Holistic Insights Into Enterprise Software Segmentation Revealing Diverse Product Portfolios Platforms And Functional Deployments Across Organizational Profiles

A nuanced view of enterprise software market segmentation reveals how distinct categories influence adoption patterns and growth trajectories. Products spanning business intelligence, business process automation, content management software, customer relationship management and enterprise resource planning, along with supply chain management, demonstrate varied maturity levels across industries. While business intelligence platforms continue to gain traction through embedded analytics and data-driven insights, emerging opportunities in process automation are fueled by robotic process automation tools and workflow orchestration.

Platform delivery modes further modulate customer experiences, with desktop environments remaining critical for complex administrative tasks even as mobile interfaces enable field teams and remote work scenarios. In parallel, business functions such as finance and accounting, human resources, IT and infrastructure management, legal and compliance, operations, project management and sales demonstrate unique feature requirements, reflecting the imperative to tailor solutions to domain-specific workflows. Cloud-based deployments have emerged as the deployment model of choice for organizations prioritizing scalability and lower total cost of ownership, while on-premises suites retain appeal among enterprises with stringent data sovereignty mandates.

Moreover, enterprise size delineates procurement dynamics. Large organizations leverage economies of scale to negotiate enterprise agreements, whereas small and medium businesses favor modular, pay-as-you-grow subscription models. Finally, end-user verticals ranging from banking and financial services to healthcare, manufacturing, retail and transportation exhibit specialized needs that are driving vendor investments in industry-specific extensions and partnerships. Through a composite view of these segmentation layers, decision-makers can align solution roadmaps with targeted customer requirements and market opportunities.

This comprehensive research report categorizes the Enterprise Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Platform

- Business Function

- Deployment Model

- Enterprise Size

- End-user

Comparative Regional Dynamics Shaping Enterprise Software Adoption With Distinct Trends Emerging In Americas EMEA And AsiaPacific Markets

Regional market dynamics continue to shape enterprise software adoption with unique drivers and challenges across the Americas, Europe Middle East and Africa, and AsiaPacific. In the Americas, a mature digital economy fosters rapid uptake of integrated analytics and advanced automation, buoyed by well-established cloud infrastructure and progressive data privacy regulations. However, legacy system continuity and cybersecurity concerns remain focal points for IT leaders seeking to modernize without compromising uptime or compliance.

Transitioning to Europe Middle East and Africa, the landscape is defined by divergent regulatory regimes and a mix of high-growth emerging markets alongside established Western economies. The stringent General Data Protection Regulation environment in Europe underscores investment in compliance and risk management solutions, while digitally ambitious countries in the Middle East pursue state-sponsored smart city initiatives that catalyze infrastructure and technology spending.

In Asia-Pacific, the rapid digitization of small and medium enterprises, alongside large-scale governmental digital projects, is driving widespread cloud adoption. Regional supply chain hubs and burgeoning workforces are also accelerating demand for workforce management and collaboration tools. Collectively, these regional trends inform tailored go-to-market strategies and investment priorities for service providers aiming to capture differentiated regional opportunities.

This comprehensive research report examines key regions that drive the evolution of the Enterprise Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Competitive Intelligence Unveiling Innovation Roadmaps Market Positioning And Collaborative Ecosystems Among Leading Enterprise Software Providers

Leading providers have responded to competitive pressures by pursuing multi-pronged strategies that encompass product innovation, strategic alliances and targeted acquisitions. Major global players have embedded artificial intelligence capabilities directly into their enterprise suites, enabling predictive analytics and self-healing infrastructure features. At the same time, cloud-native pure-play vendors continue to garner interest by delivering specialized solutions optimized for high scalability and rapid integration with third-party tools.

Strategic partnerships between enterprise software vendors and hyperscale cloud providers are becoming increasingly common, facilitating joint go-to-market initiatives and co-innovation in areas such as edge computing and secure data sharing. In addition, established incumbents are expanding their footprints through acquisitions of niche vertical software firms to unlock specialized functionality and cross-sell into existing customer bases. A focus on industry-specific use cases in sectors such as healthcare, manufacturing and retail underscores the growing trend toward modular, microvertical solutions that balance depth of functionality with ease of deployment.

Consequently, the competitive landscape is evolving into a collaborative ecosystem where interoperability, continuous delivery and subscription flexibility are critical differentiators. Organizations evaluating vendors today prioritize roadmaps that emphasize platform extensibility, open standards and customer success engagement models that ensure rapid value realization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Enterprise Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Adobe, Inc.

- Asana, Inc.

- Atlassian

- Autodesk Inc.

- Broadcom Inc.

- Cisco Systems Inc.

- Cloud Software Group, Inc.

- Creative Web Mall India Pvt. Ltd.

- Deltek, Inc.

- Enterprise Software Solutions

- Epicor Software Corporation

- Fingent

- Hewlett Packard Enterprise

- IBM Corporation

- Improsys

- Infor

- Microsoft Corporation

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- ServiceNow, Inc.

- STERP

- SYSPRO

- Workday, Inc.

- Zendesk, Inc.

- Zoho Corporation Pvt. Ltd.

Strategic Imperatives For Leaders To Capitalize On Emerging Technologies Optimize Operational Efficiencies And Drive Sustainable Growth In Enterprise Software

To capitalize on the evolving enterprise software landscape, industry leaders should prioritize investments in artificial intelligence capabilities that drive intelligent automation across key business processes. By strategically integrating AI-driven analytics into core systems, organizations can unlock predictive insights that optimize operations and uncover new revenue streams. At the same time, cultivating partnerships with cloud hyperscalers and niche software specialists will accelerate time to market and foster an ecosystem approach that mitigates vendor lock-in.

Furthermore, operational resilience can be enhanced through a dual-model deployment strategy that leverages cloud infrastructure for innovation and on-premises environments for mission-critical workloads. Leaders should also champion proactive cybersecurity frameworks by embedding security protocols at the application level and conducting continuous vulnerability assessments. For large enterprises, negotiating outcome-based subscription agreements ensures alignment with business objectives and cost predictability, while small and medium businesses benefit from modular, usage-based pricing that scales with demand.

Finally, talent transformation is paramount. Upskilling IT and business teams in cloud operations, data science and agile delivery methodologies will create the organizational agility needed to navigate future disruptions. By executing these recommendations in concert, industry leaders can forge a clear path toward sustainable growth and strategic differentiation.

Rigorous Methodological Framework Integrating Primary Expert Consultations Secondary Data Triangulation And QuantitativeAnalytics For Robust Market Insights

This analysis is underpinned by a rigorous methodological framework that integrates both primary and secondary research to ensure robust and reliable insights. Primary data was gathered through in-depth interviews with technology executives, CIOs and domain experts to capture first-hand perspectives on market dynamics, pain points and investment priorities. Secondary research involved comprehensive reviews of industry publications, regulatory filings and financial statements to validate trends and triangulate quantitative observations.

Data synthesis employed advanced analytical techniques, including trend mapping and cross-segment correlation analysis, to identify interdependencies among technology adoption patterns, tariff impacts and regional growth drivers. To maintain impartiality, multiple data sources were cross-verified and conflicting inputs were reconciled through follow-up consultations and peer review sessions. The research team also applied scenario planning frameworks to assess potential regulatory and economic developments that could influence market trajectories.

Quality assurance protocols included continuous validation checkpoints and expert panel reviews that ensured findings reflect current realities and future projections. By employing this structured approach, the research delivers actionable intelligence that aligns with strategic decision-making needs across enterprise stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Enterprise Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Enterprise Software Market, by Product

- Enterprise Software Market, by Platform

- Enterprise Software Market, by Business Function

- Enterprise Software Market, by Deployment Model

- Enterprise Software Market, by Enterprise Size

- Enterprise Software Market, by End-user

- Enterprise Software Market, by Region

- Enterprise Software Market, by Group

- Enterprise Software Market, by Country

- United States Enterprise Software Market

- China Enterprise Software Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesis Of Critical Insights Illuminating The Future Trajectory Of Enterprise Software Amid Technology Evolution And Market Disruptions

As organizations navigate the intricate enterprise software landscape, it is clear that adaptability and strategic foresight are indispensable. The convergence of artificial intelligence, cloud-native architectures and composable applications is reshaping how businesses operate, while external factors such as trade tariffs introduce fresh complexities that demand agile responses. A deep understanding of segmentation layers-from product categories to end-user verticals-enables more precise targeting and solution alignment.

Regional nuances further emphasize the importance of customized approaches, whether it be leveraging advanced analytics in mature markets, ensuring GDPR compliance in Europe or capitalizing on rapid digitization trends in Asia-Pacific. The competitive environment, characterized by strategic alliances and modular innovation, highlights the value of ecosystem thinking and continuous delivery models that can rapidly adapt to shifting customer needs.

Ultimately, the ability to translate these insights into concrete actions-supported by a rigorous research methodology-will determine which enterprises emerge as market leaders in the years ahead. By synthesizing the transformative shifts, tariff implications and segmentation insights outlined in this report, organizations are better equipped to chart a course toward resilient, growth-oriented software strategies that deliver sustainable competitive advantage.

Connect With Ketan Rohom To Secure Comprehensive Enterprise Software Market Intelligence And Drive Strategic DecisionMaking With Confidence

Ready to elevate your strategic planning with unparalleled market research insights that empower informed investments and transformative growth in the enterprise software arena, you can connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to discuss how our detailed analysis aligns with your organizational imperatives and to secure your copy of this comprehensive report.

- How big is the Enterprise Software Market?

- What is the Enterprise Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?