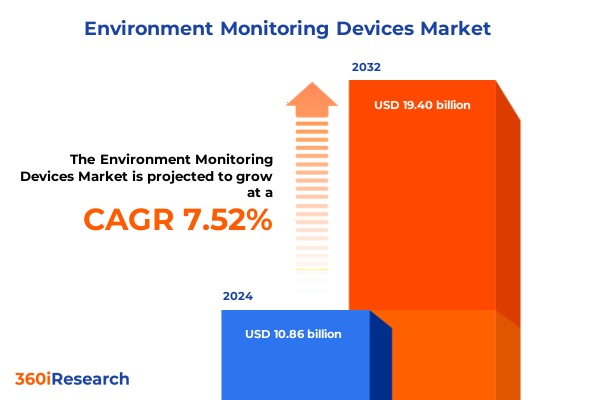

The Environment Monitoring Devices Market size was estimated at USD 11.69 billion in 2025 and expected to reach USD 12.49 billion in 2026, at a CAGR of 7.49% to reach USD 19.40 billion by 2032.

Unveiling the Progressive Evolution of Environment Monitoring Devices and Their Pivotal Role in Enabling Data-Driven Sustainability Across Industries

The rising urgency to monitor environmental parameters has placed specialized devices at the forefront of sustainable operations across industries. As regulatory frameworks tighten and corporate responsibility agendas broaden, air quality monitors, noise monitoring systems, radiation detectors, soil moisture sensors, and water quality instruments have become indispensable. Organizations are no longer content with periodic snapshots; they demand real-time, high-fidelity data streams to guide decisions that impact public health, regulatory compliance, and operational efficiency.

In parallel, digital transformation initiatives are driving the convergence of advanced sensors with analytics platforms. Edge computing architectures and cloud ecosystems now empower organizations to transform raw measurements into actionable intelligence. Such integration enhances the granularity and timeliness of insights, enabling predictive maintenance, anomalous event detection, and resource optimization. This report examines how these converging trends have shaped the current landscape of environment monitoring devices, elucidating both the technological innovations and strategic imperatives that define this critical sector.

By weaving together market dynamics, policy influences, and emerging use cases, this narrative sets the stage for a nuanced exploration of transformative shifts, tariff impacts, segmentation insights, regional variations, competitive profiles, and forward-looking recommendations. It serves as a compass for executives, engineers, and sustainability officers seeking to navigate an ever-evolving domain with precision and foresight.

Revolutionary Advancements and Emerging Paradigms Redefining the Trajectory of Environmental Monitoring Technology, Data Integration Processes, and Industry Adoption Patterns

The landscape of environmental monitoring is being reshaped by rapid digitally driven advancements that marry sensor miniaturization with sophisticated data platforms. Breakthroughs in semiconductor fabrication have yielded compact, battery-efficient air quality monitors and noise monitoring devices that can be deployed ubiquitously. Concurrently, the emergence of anomaly detection algorithms has propelled AI-driven analytics from pilot projects into mainstream adoption, transforming raw environmental readings into early warnings and actionable forecasts.

Moreover, the proliferation of IoT-enabled architectures has revolutionized connectivity paradigms across wired and wireless technologies. Edge computing nodes now process critical datasets locally, reducing latency and enhancing system resilience, while cloud-based frameworks accumulate and harmonize disparate streams for enterprise-grade reporting. These innovations are fostering a shift from siloed point solutions toward integrated platforms that support cross-domain insights, such as correlating noise compliance data with air pollution metrics in urban environments.

Finally, collaborative ecosystems involving sensor manufacturers, software providers, and regulatory bodies are driving standardization efforts and interoperability protocols. Industry alliances are accelerating the adoption of LoRa, NB-IoT, and other low-power networks to enable pervasive coverage at scale, while open data initiatives encourage shared repositories of environmental intelligence. Taken together, these transformative shifts underpin a new era of connected, intelligent monitoring solutions that promise to unlock both operational efficiencies and environmental stewardship.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on Supply Chains Innovation Dynamics and Cost Structures in Environmental Monitoring

Recent escalations in United States tariffs on imported environment monitoring components have exerted a multifaceted influence on supply chain configurations and cost structures. As levies on sensor modules, circuit boards, and specialized materials took effect in 2025, manufacturers faced elevated input costs that necessitated strategic recalibrations. Procurement teams began diversifying supplier portfolios, seeking tariff-exempt sources or negotiating volume-based rebates to alleviate margin pressures.

In response, device developers accelerated localization efforts, establishing new assembly lines and forging partnerships with domestic electronics foundries. This shift not only mitigated tariff exposure but also enhanced logistics resilience in an era of global supply disruptions. Simultaneously, tier-one original equipment manufacturers reprioritized product roadmaps, deferring lower-margin offerings in favor of high-value, AI-enabled systems that justify premium pricing tiers and support ongoing R&D investments despite elevated duties.

While the immediate effect included modest end-user price adjustments, the mid-term implications have proven more profound. Organizations reliant on environmental monitoring devices have increasingly embraced modular architectures and software subscriptions, decoupling hardware refresh cycles from analytical service delivery. Furthermore, the tariff environment has catalyzed innovation in material science-driving research into alternative semiconductors and printed electronics that offer lower trade risk. Collectively, these developments highlight the cumulative impact of 2025 tariffs, illustrating both the challenges and adaptive strategies that characterize the industry’s resilience.

Illuminating Market Segmentation Perspectives Spanning Product Types Technologies Applications and End User Verticals to Reveal Opportunity Landscapes

Dissecting the product landscape reveals that air quality monitors, available in both fixed and portable forms, command robust interest across commercial facilities and remote field operations. Fixed systems, whether rack-mounted or wall-mounted, integrate seamlessly with building management platforms, while portable battery-powered and solar-powered variants enable intermittent measurements in agriculture and disaster response scenarios. Noise monitoring devices exhibit similar versatility, with indoor handheld and wall-mounted instruments balancing ease of use with continuous compliance tracking, and outdoor standalone and vehicle-mounted units suited to infrastructure projects and transportation corridors.

In the radiation detector segment, ionizing technologies detect beta and gamma emissions, making them vital for nuclear facilities and security checkpoints, whereas non-ionizing microwave and UV detectors serve specialized industrial processes and environmental research. Soil moisture sensors, from capacitance probes to time domain reflectometry and tensiometers, support precision irrigation and academic studies, while water quality monitors span in situ fixed and portable options as well as laboratory offline and online analyzers, catering to both field testing and centralized water treatment facilities.

Technological segmentation underscores the growing prominence of AI-driven devices, where anomaly detection and predictive analytics elevate traditional thresholds. IoT-enabled instruments leverage cloud-based and edge-based deployments to address latency and bandwidth considerations. Wired connectivity via Ethernet, RS-485, and USB continues to undergird mission-critical installations, while wireless protocols such as Bluetooth, LoRa, NB-IoT, and Wi-Fi extend reach into smart city and remote site applications.

Application-oriented breakdowns demonstrate the pivotal role of environmental monitoring in agricultural management through irrigation scheduling and precision farming, in air pollution control across indoor and outdoor settings, and in industrial emission monitoring encompassing fugitive and stack measurement. Noise compliance is addressed through construction and transportation focus areas, while water treatment spans both potable and wastewater contexts. Meanwhile, end users range from commercial offices and retail spaces to government environmental agencies and municipalities, from manufacturing, oil and gas, and power generation entities to academic and private research labs, and from multi-family residential complexes to single-family homes, illustrating the breadth of demand drivers.

This comprehensive research report categorizes the Environment Monitoring Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

Examining Regional Dynamics Across Americas Europe Middle East Africa and Asia Pacific for Environmental Monitoring Device Adoption and Infrastructure Variances

Across the Americas, environmental awareness initiatives and stringent regulatory frameworks have propelled early adoption of advanced monitoring solutions. North American industries leverage comprehensive deployments of air quality and noise monitoring platforms to support sustainability commitments and community relations, while South American agricultural sectors increasingly adopt soil moisture sensors to optimize water usage amid climate variability. Trade agreements and regional standards bodies further harmonize certification processes, enabling more seamless cross-border equipment deployments.

In Europe, Middle East and Africa, environmental agencies and municipalities enforce rigorous compliance requirements, driving demand for high-precision fixed and portable instruments. The European Union’s emerging Green Deal directives have spurred public-private collaborations on networked sensor arrays, whereas Middle East oil and gas operators utilize radiation detectors and water quality monitors to uphold environmental safeguards in extractive operations. Meanwhile, African research institutions are beginning to integrate wireless IoT protocols for cost-effective, scalable monitoring in rapidly urbanizing regions.

Asia-Pacific’s trajectory is marked by aggressive infrastructure expansion and urban air quality crises, prompting city administrators in China and India to deploy dense networks of both indoor and outdoor air pollution control devices. Japan and South Korea are pioneering edge-based analytics to facilitate real-time emission reporting in industrial parks. At the same time, Southeast Asian agricultural communities are embracing predictive soil moisture sensing to mitigate water scarcity, illustrating how regional imperatives shape both the pace and nature of technology adoption within the environmental monitoring domain.

This comprehensive research report examines key regions that drive the evolution of the Environment Monitoring Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Moves Competitive Positioning and Collaborative Ventures Shaping Leading Players in the Environmental Monitoring Device Ecosystem

Leading conglomerates and specialized manufacturers are actively refining their portfolios through strategic acquisitions and organic innovation. Multinational industrial automation firms have integrated environmental sensing modules within broader controls suites, targeting sectors such as oil and gas, power generation, and manufacturing, while agile sensor startups focus on AI-enabled edge devices tailored for smart city deployments. Collaborative ventures between electronic component producers and software integrators are accelerating time to market for end-to-end solutions that encompass hardware, connectivity, and analytics layers.

In parallel, partnerships between research laboratories and commercial entities are driving advances in novel sensing principles, from printed electronics to bio-sensing applications that extend monitoring capabilities into new environmental domains. Several early movers in wireless protocol development are now enhancing network security features and energy management algorithms to meet the demands of long-duration field installations. Simultaneously, service-oriented players are differentiating through managed analytics offerings, packaging subscription-based insights with hardware leasing to deliver predictable total cost of ownership models.

Furthermore, procurement groups and integrators are consolidating vendor relationships to streamline support and certification processes. This has prompted key players to emphasize interoperability and open API frameworks, ensuring that diverse systems-from laboratory-grade water quality analyzers to rack-mounted air sampling units-can cohesively feed unified dashboards. The resulting competitive landscape underscores a shift toward collaborative ecosystems where the combined value of hardware, software, and services drives sustainable growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Environment Monitoring Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ABB Ltd.

- Aeroqual Limited

- Agilent Technologies, Inc

- Danaher Corp.

- Ecotech Pty Ltd

- Emerson Electric Co.

- Entech Instruments, Inc.

- Fondriest Environmental, Inc.

- General Electric Company

- Honeywell International Inc.

- Horiba, Ltd.

- Opengear, Inc. by Digi International

- Opsis AB

- PerkinElmer Inc.

- RKI Instruments, Inc.

- Rockwell Automation, Inc.

- ROTRONIC AG by Process Sensing Technologies

- Siemens AG

- Specto Technology LLC

- Teledyne Technologies Incorporated

- Testo SE & Co. KGaA

- Thermo Fisher Scientific Inc.

- Vaisala Oyj

- Yokogawa Electric Corporation

Strategic Imperatives for Industry Leaders to Drive Innovation Scale Operations and Enhance Value Through Environmental Monitoring Solutions

Industry leaders must prioritize the integration of AI-driven analytics within modular sensor architectures to support both real-time alerting and long-term predictive capabilities. Investing in edge computing infrastructure will reduce latency and enable mission-critical applications, while a complementary focus on cloud-native platforms will facilitate centralized data orchestration and scalability. Additionally, forging partnerships with domestic component suppliers and local foundries can mitigate exposure to fluctuating tariff regimes and strengthen supply chain resilience.

Organizations should adopt a customer-centric approach by offering flexible deployment models, bundling hardware and software under subscription frameworks to provide transparent total cost of ownership. Engaging with regulatory stakeholders early in the product development cycle can expedite approvals and enhance compliance features, turning regulatory requirements into competitive differentiators. Furthermore, active participation in industry consortia and standards bodies will ensure interoperability across diverse connectivity protocols, fostering seamless integration with enterprise and smart city infrastructures.

Finally, allocating resources toward sustainability-focused R&D-exploring low-power wireless technologies, alternative materials, and biodegradable packaging-will resonate with end users and investors alike. By implementing continuous feedback loops through digital twins and pilot programs, companies can rapidly iterate on product designs and service offerings, maintaining agility in a market defined by evolving environmental priorities.

Detailing Rigorous Multi Stage Research Methods Combining Primary Expert Interviews Secondary Data Analysis and Validation Protocols

This report synthesizes insights derived from a robust multi-stage research methodology designed to balance depth with rigor. The primary phase involved structured interviews with senior executives, technical experts, and procurement specialists across device manufacturers, software providers, and end-user organizations to capture frontline perspectives on emerging technologies and strategic priorities. These qualitative inputs were complemented by extensive secondary research, encompassing governmental publications, industry whitepapers, patent filings, and peer-reviewed journals to validate emerging trends and technological trajectories.

Quantitative data was triangulated through an exhaustive review of public filings, trade association statistics, and custom-compiled databases of environmental monitoring deployments. To ensure consistency and objectivity, all data points underwent cross-validation, with discrepancies addressed through follow-up consultations and expert panel reviews. A structured framework segmented the market by product type, technology, application, and end user, enabling granular analysis of adoption patterns and investment drivers without reliance on any single proprietary source.

Finally, a rigorous validation protocol was employed, incorporating peer reviews from independent thought leaders and iterative feedback loops with select advisory board members. This process ensured that the final narrative reflects a balanced perspective, free from undue bias and anchored in verifiable evidence, thereby offering stakeholders a trustworthy foundation for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Environment Monitoring Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Environment Monitoring Devices Market, by Product Type

- Environment Monitoring Devices Market, by Technology

- Environment Monitoring Devices Market, by Application

- Environment Monitoring Devices Market, by End User

- Environment Monitoring Devices Market, by Region

- Environment Monitoring Devices Market, by Group

- Environment Monitoring Devices Market, by Country

- United States Environment Monitoring Devices Market

- China Environment Monitoring Devices Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 5088 ]

Synthesizing Critical Insights into Environmental Monitoring Device Trends Challenges and Strategic Pathways for Sustained Competitive Advantage

The convergence of advanced sensors, AI-driven analytics, and robust connectivity protocols is redefining how organizations monitor and manage environmental parameters. Regulatory imperatives, coupled with heightened stakeholder expectations for transparency and sustainability, have transformed environmental monitoring devices from ancillary tools into core components of operational and strategic decision making. Through segmentation by product type, technology, application, and end user, it becomes evident that demand is increasingly driven by integrative solutions that deliver end-to-end visibility.

Regional dynamics underscore the importance of regulatory alignment and infrastructure readiness, with the Americas leading in agricultural and commercial applications, EMEA emphasizing precision compliance and public health, and Asia-Pacific demonstrating rapid urban rollout and crisis-driven innovation. The cumulative impact of recent tariff adjustments has catalyzed supply chain diversification and localized manufacturing, while collaborative industry models highlight the centrality of interoperability and service-oriented value propositions.

Looking forward, industry players that embrace modular, AI-enabled platforms and cultivate strategic partnerships will be best positioned to address evolving environmental challenges. With the insights provided here, decision makers can navigate regulatory complexities, optimize deployment strategies, and foster sustainable growth, ultimately advancing both organizational objectives and global environmental stewardship.

Engage Directly with Ketan Rohom to Secure Tailored Environmental Monitoring Device Insights and Propel Strategic Growth

To delve deeper into the comprehensive insights and strategic evaluations presented within this report, interested stakeholders are encouraged to reach out to Ketan Rohom, Associate Director, Sales & Marketing. Ketan Rohom can guide decision makers through the report’s detailed analyses, bespoke segmentation narratives, and region-specific implications, ensuring that the intelligence aligns precisely with organizational objectives. By engaging directly with Ketan Rohom, executives and procurement teams will gain clarity on how the findings translate into actionable strategies, cost-effective implementation pathways, and partnership opportunities. Secure direct access to this critical research and empower your organization to capitalize on emerging trends within the environmental monitoring device landscape by contacting Ketan Rohom today.

- How big is the Environment Monitoring Devices Market?

- What is the Environment Monitoring Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?