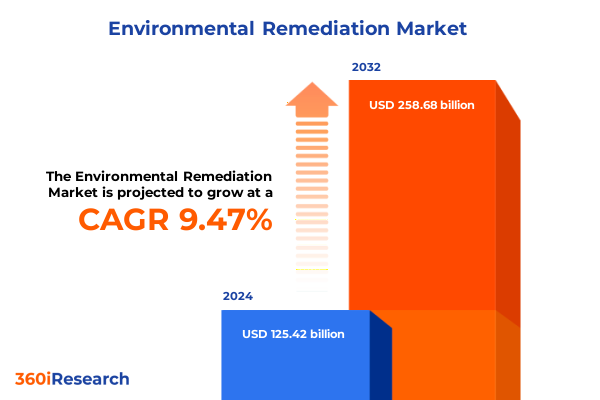

The Environmental Remediation Market size was estimated at USD 136.91 billion in 2025 and expected to reach USD 149.49 billion in 2026, at a CAGR of 9.51% to reach USD 258.68 billion by 2032.

How Accelerating Environmental Pressures and Technological Innovations Are Redefining Remediation Strategies and Market Priorities for Sustainable Growth

In the wake of intensifying environmental challenges and heightened stakeholder scrutiny, the realm of contamination cleanup has evolved into a strategic battleground for innovation and sustainable practice. The convergence of stricter regulations, public demand for corporate responsibility, and rapid technological advancements is redefining traditional remediation approaches. Today’s decision-makers are no longer content with merely restoring contaminated sites; they are seeking solutions that deliver long-term ecosystem resilience while optimizing cost and performance metrics.

Consequently, the environmental remediation sector has witnessed a paradigm shift from reactive cleanup models to proactive, integrated frameworks that anticipate emerging contaminants and leverage data-driven insights. This evolution is underpinned by breakthroughs in sensor technology, digital analytics, and eco-efficient treatment modalities, which collectively enable more precise contaminant detection, targeted intervention, and real-time performance monitoring. As a result, remediation strategies now emphasize not only pollutant removal but also ecological restoration and adaptive management.

Furthermore, the industry’s strategic landscape is being reshaped by a broader recognition of the social and economic implications of contamination events. Soil, groundwater, and ambient air quality are increasingly tied to public health outcomes and community well-being, driving municipalities and private enterprises to adopt more transparent and participatory remediation planning processes. This shift has catalyzed greater collaboration among technology providers, regulatory bodies, and local stakeholders, fostering cross-sector partnerships that elevate innovation pipelines and refine best practices.

Against this backdrop, a comprehensive understanding of market drivers, segment-level nuances, and emerging policy frameworks is essential for organizations aiming to maintain a competitive edge. This executive summary synthesizes the latest trends, tariff impacts, segmentation insights, and regional dynamics shaping the environmental remediation market, culminating in strategic recommendations to guide industry leaders toward sustainable, future-ready solutions.

Unveiling the Regulatory, Technological, and Stakeholder-Driven Disruptions Reshaping Environmental Remediation Practices and Competitive Dynamics Globally

The environmental remediation sector is undergoing transformative shifts fueled by converging forces on multiple fronts. First, the tightening of international and domestic environmental regulations has imposed more stringent cleanup standards, compelling companies to explore advanced treatment options that deliver faster, more reliable outcomes. At the same time, an expanding agenda for sustainable development has introduced life-cycle considerations into remediation planning, whereby the ecological footprint of cleanup technologies is evaluated alongside their efficacy in pollutant removal.

Moreover, digitalization is rapidly permeating the sector, propelling the adoption of remote sensing, geospatial analytics, and machine learning algorithms that enhance site characterization and risk assessment processes. These tools facilitate predictive modeling of contaminant behavior, enabling practitioners to design interventions that are both cost-effective and scalable. As a result, decision-makers are increasingly leveraging integrated data platforms to orchestrate multi-phase remediation campaigns, reducing uncertainty and accelerating project timelines.

In parallel, stakeholder expectations are evolving, with investors and community groups demanding greater transparency and accountability in remediation projects. The emergence of environmental, social, and governance (ESG) frameworks has amplified the spotlight on remediation outcomes, transforming site cleanup into a visible indicator of corporate sustainability performance. This has spurred a wave of strategic partnerships between technology developers, engineering firms, and financial institutions to co-create financing models that align remediation goals with broader ESG targets.

Additionally, the proliferation of novel contaminants-such as emerging chemical compounds and microplastics-has introduced new challenges that traditional remediation methods are ill-equipped to address. This has triggered intensified research efforts into specialized treatment processes capable of targeting these complex pollutants, from in-situ vitrification techniques that immobilize hazardous elements in soil matrices to bioremediation strategies that harness specialized microbial consortia.

Collectively, these shifts are elevating the environmental remediation market into a multifaceted ecosystem where regulatory compliance, technological innovation, and stakeholder engagement converge to shape strategic imperatives. Understanding these transformative dynamics is critical for organizations seeking to captivate new growth opportunities while navigating a landscape marked by increasing complexity.

Assessing the Complex Interplay of New United States Tariffs in 2025 and Their Ripple Effects on Environmental Remediation Supply Chains and Investment Flows

In 2025, a suite of new tariffs introduced by the United States government is exerting significant influence on the environmental remediation market’s cost structures and supply chains. These tariffs, imposed on key equipment imports such as advanced filtration units, reactive barrier components, and specialized sensors, have elevated procurement costs for remediation technology providers and service contractors. Consequently, organizations are reassessing sourcing strategies, turning to domestic manufacturers or exploring alternative suppliers in tariff-exempt jurisdictions to mitigate the financial burden.

Furthermore, the heightened import costs are cascading down to project budgets, compelling stakeholders to reexamine capital allocation and bidding strategies. Public sector agencies are facing budgetary pressures as they adjust to elevated unit costs for critical remediation assets, leading to more stringent evaluation criteria and extended procurement timelines. In response, some contractors are innovating modular deployment models that enable phased capital outlays and reduce upfront expenditure, thereby preserving project feasibility despite tariff-induced cost increases.

The tariff landscape is also impacting investment flows, as private equity firms and infrastructure funds recalibrate risk-return profiles for remediation ventures. Rising equipment prices have introduced greater uncertainty to project economic models, prompting investors to demand higher internal rates of return or to prioritize projects in jurisdictions unaffected by U.S. tariffs. This has, in turn, created pockets of opportunity for domestic technology developers capable of offering competitive solutions at scale.

In addition, the tariffs have spurred a renewed focus on circular economy principles within the sector. Service providers are intensifying efforts to refurbish and repurpose existing equipment, extending lifecycle value and reducing dependency on imported capital goods. Simultaneously, research institutions and industry consortia are accelerating the development of open-source designs for remediation hardware, seeking to democratize access to cost-effective technologies and insulate the market from geopolitical disruptions.

Overall, the cumulative impact of the 2025 tariffs underscores the importance of supply chain resilience and strategic agility. Organizations that proactively adapt procurement practices, leverage domestic innovation ecosystems, and embrace circular strategies are better positioned to sustain operations and capture market share in this evolving tariff environment.

Deep-Dive into Environmental Mediums, Advanced Remediation Technologies, Contaminant Classifications, and Sector Applications Revealing Tailored Market Strategies

A nuanced understanding of market segmentation is vital for tailoring remediation strategies to specific environmental challenges and stakeholder expectations. Across the environmental medium axis, treatment needs diverge significantly: air interventions prioritize rapid pollutant capture and filtration, soil remediation demands intensive in-situ or ex-situ processes to immobilize or extract contaminants, while water systems require specialized technologies to address dissolved-phase pollutants and maintain hydrological integrity.

From a technological perspective, the marketplace features a broad array of treatment modalities that cater to diverse site conditions and contaminant profiles. Air Sparging techniques facilitate volatilization and capture of volatile organic compounds, whereas Bioremediation harnesses microbial consortia to enzymatically degrade organic pollutants. Chemical Treatment approaches involve reagent injection for contaminant neutralization, while Electrokinetic Remediation deploys electric fields to mobilize charged species. In-situ Vitrification transforms contaminated soil into a stable glass-like matrix, and Permeable Reactive Barriers incorporate sorbent materials to intercept pollutant plumes. Additionally, Pump & Treat systems extract groundwater for above-ground processing, Soil Washing techniques separate contaminants through physical and chemical means, and Thermal Treatment applies heat to volatilize or destroy pollutants.

The contaminant type segmentation further refines strategic focus areas. Inorganic Pollutants, such as heavy metals and metalloids, present challenges due to their persistence and potential toxicity, necessitating immobilization or extraction tactics. Organic Pollutants, including petrochemicals and industrial solvents, are often addressed through biological or chemical degradation pathways. Radioactive Pollutants, though less common, require stringent safety protocols and specialized containment measures to mitigate radiological risks.

Finally, application-based segmentation reveals sector-specific dynamics influencing remediation demand. Agricultural settings grapple with pesticide and fertilizer residues impacting soil and groundwater health, while the automotive industry contends with solvent and oil-based contamination. Mining and forestry operations generate acid mine drainage and heavy metal leachate, and oil & gas activities are linked to hydrocarbon spills and produced water management. Each application context imposes distinct technical, regulatory, and stakeholder requirements that drive bespoke remediation approaches.

By appreciating these segmentation layers-covering environmental medium, technology, contaminant type, and application-organizations can align their service offerings and R&D priorities with market needs, optimizing both technical outcomes and commercial viability.

This comprehensive research report categorizes the Environmental Remediation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Environmental Medium

- Technology

- Contaminant Type

- Application

Comprehensive Geographic Analysis Highlighting Americas, Europe Middle East & Africa, and Asia-Pacific Dynamics Influencing Regional Remediation Priorities

Regional dynamics play a pivotal role in shaping environmental remediation strategies, driven by localized regulatory regimes, economic priorities, and contamination profiles. In the Americas, the combination of stringent federal guidelines under the Environmental Protection Agency and rising community activism is fueling demand for advanced in-situ and ex-situ remediation services. Countries such as Canada are spearheading green remediation initiatives, integrating carbon offset considerations into cleanup plans, while Latin American markets are experiencing growing foreign direct investment in mining remediation projects.

Across Europe, the Middle East & Africa, regulatory frameworks encompass a broad spectrum of environmental standards. European nations, under the aegis of the European Union, have harmonized directives that emphasize soil and groundwater protection, promoting technologies that minimize additional ecological disturbance. Meanwhile, the Middle East is balancing rapid infrastructure development with emerging environmental oversight, creating niches for desalination brine management and arid-zone soil stabilization. In Africa, remediation efforts are often intertwined with capacity-building programs, leveraging public-private partnerships to address legacy contamination from extractive industries.

The Asia-Pacific region exhibits diverse market maturity levels, with several developed economies like Japan, South Korea, and Australia leading in technology innovation and stringent site cleanup mandates. These markets place strong emphasis on continuous monitoring and digital integration within remediation workflows. Conversely, rapidly industrializing nations are prioritizing baseline environmental assessments and pilot-scale remediation demonstrations to address heavy metal contamination and groundwater degradation. In addition, transboundary concerns, such as river basin pollution, are prompting regional cooperation on water remediation frameworks.

Moreover, economic drivers such as infrastructure investment, urbanization rates, and trade policies are influencing regional service demand. The Americas benefit from well-established private sector contracting models, whereas EMEA markets are characterized by a mixture of centralized procurement through governmental agencies and localized execution by specialized firms. In Asia-Pacific, investment incentives and technology transfer agreements are accelerating the deployment of cutting-edge remediation solutions.

Understanding these region-specific insights-from the Americas’ blend of regulatory rigor and activism to EMEA’s harmonized standards and Asia-Pacific’s dual-track development-is crucial for organizations aiming to tailor go-to-market strategies and foster strategic alliances that align with local market imperatives.

This comprehensive research report examines key regions that drive the evolution of the Environmental Remediation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Environmental Remediation Enterprises and Their Strategic Focus Areas in Innovation, Collaboration, and Market Expansion Across Critical Verticals

A number of industry protagonists have emerged as bellwethers in driving innovation and market leadership within the environmental remediation sector. Leading engineering and technology firms have invested heavily in R&D collaborations with academic institutions to accelerate the commercialization of novel treatment processes. These companies are strategically forging partnerships with mid-tier service providers to expand geographic reach while maintaining a robust pipeline of proprietary technologies that address site-specific challenges.

Beyond technology development, several key players are differentiating themselves through integrated service models that combine end-to-end project management, financing solutions, and long-term performance guarantees. By bundling remediation services with sustainability certification frameworks, these firms are appealing to corporate clients seeking to bolster their ESG credentials. At the same time, pure-play remediation specialists are carving out niche positions in high-growth verticals, such as petrochemical facility decommissioning and legacy mine tailings rehabilitation, leveraging deep technical expertise and specialized equipment fleets.

In addition, the competitive landscape is being reshaped by private equity participation, which is driving consolidation through acquisitions of regional service providers and asset-intensive operators. This trend is resulting in a bifurcated market structure, where global incumbents coexist with agile local champions. The convergence of scale and agility is fostering healthy competition, prompting organizations to differentiate through service excellence, digital integration, and enhanced client advisory capabilities.

Moreover, a select group of innovative start-ups is gaining traction by offering modular, plug-and-play remediation systems that reduce deployment time and capital intensity. These emerging entrants are backed by venture capital and impact investors who are attracted by the potential for high scalability and environmental returns. Their market success is spurring incumbents to accelerate in-house incubators and technology scouting initiatives.

Collectively, these industry players exemplify varied strategic approaches-from full-spectrum, integrated service delivery to focused technological differentiation-all contributing to a dynamic competitive environment. Their activities underscore the importance of aligning strategic investments with evolving customer demands and technological possibilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Environmental Remediation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AECOM

- Amentum Services, Inc.

- Apex Companies, LLC

- Aptim Environmental & Infrastructure, Inc

- Arcadis N.V.

- Bechtel Corporation

- Beijing High Energy Era Environmental Technology Co., Ltd.

- Brisea Group Inc.

- Cascade Environmental

- Clean Harbors, Inc.

- DEME NV

- EnSafe Inc.

- ENTACT, LLC

- Enviri Corporation by Harsco Corporation

- GEO Group

- Haley & Aldrich, Inc.

- HDR, Inc.

- Jacobs Solutions Inc.

- Lamor Corporation PLC

- North Wind Group by CIRI Development Corporation

- Parsons Corporation

- Ramboll Group A/S

- Sevenson Environmental Services, Inc.

- SUEZ Group

- Terracon Consultants, Inc.

- Tetra Tech, Inc.

- Veolia Environnement SA

- Versar, Inc.

- WSP Global Inc.

Strategic Imperatives and Targeted Actions for Industry Stakeholders to Capitalize on Emerging Opportunities and Navigate Environmental Remediation Challenges

To navigate the evolving environmental remediation landscape, industry leaders should prioritize the integration of advanced digital tools for end-to-end project management. By adopting cloud-native monitoring platforms that combine real-time sensor data with predictive analytics, organizations can enhance decision-making agility, optimize resource allocation, and demonstrate compliance more transparently to regulators and stakeholders.

Furthermore, establishing flexible procurement strategies that balance domestic manufacturing partnerships with selective international sourcing will mitigate tariff-related cost pressures. Cultivating relationships with local equipment fabricators and modular system integrators can ensure supply chain resilience while preserving access to specialized technologies that remain subject to import restrictions.

In addition, firms should expand their service portfolios by embedding circular economy principles into remediation business models. Initiatives such as equipment leasing, refurbishment programs, and materials repurposing not only reduce environmental impact but also unlock new revenue streams and strengthen client relationships through value-added offerings.

Collaboration remains a critical enabler of innovation. Leaders are advised to engage in multi-stakeholder consortiums encompassing technology developers, regulatory agencies, and community representatives to co-develop standardized remediation protocols. Such partnerships can streamline permitting processes, foster knowledge sharing, and accelerate the uptake of best practices across the sector.

Lastly, aligning remediation project delivery with broader ESG reporting frameworks will elevate the strategic positioning of remediation services. By quantifying social and ecological outcomes-such as ecosystem restoration indices and community health metrics-organizations can demonstrate tangible value creation beyond traditional cleanup milestones, thereby strengthening stakeholder trust and unlocking new financing opportunities.

Robust Research Framework Combining Qualitative and Quantitative Approaches to Deliver Validated Insights on Environmental Remediation Market Dynamics

The foundation of this research rests on a multi-pronged methodology designed to ensure rigor, validity, and actionable relevance. Initially, an extensive secondary research phase involved the systematic review of peer-reviewed journals, government publications, and reputable industry reports to map out the regulatory environment, technology advancements, and stakeholder priorities.

Subsequently, a curated panel of subject-matter experts-including environmental engineers, policy analysts, and technology innovators-was convened to validate preliminary findings. In-depth interviews and roundtable discussions provided nuanced perspectives on emerging contaminants, regional regulatory shifts, and the practical challenges of field implementation, adding qualitative depth to the research.

Quantitative analysis incorporated the aggregation of project-level data sourced from public procurement records, sustainability disclosures, and corporate project announcements. These data points were normalized and triangulated with financial metrics and patent filings to identify leading technology trajectories and investment hotspots across different market segments.

Furthermore, the research employed scenario-based modeling to assess the impact of macroeconomic variables-such as the 2025 tariff changes and evolving ESG investment trends-on supply chain resilience and capital expenditure planning. Sensitivity analyses were conducted to stress-test key assumptions and ensure that strategic recommendations remain robust under alternative market conditions.

Finally, iterative validation sessions were held with industry stakeholders to refine the research outputs, ensuring that the insights resonate with on-the-ground realities and strategic imperatives. This rigorous approach underpins the credibility of the findings and equips decision-makers with data-driven guidance for charting future pathways.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Environmental Remediation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Environmental Remediation Market, by Environmental Medium

- Environmental Remediation Market, by Technology

- Environmental Remediation Market, by Contaminant Type

- Environmental Remediation Market, by Application

- Environmental Remediation Market, by Region

- Environmental Remediation Market, by Group

- Environmental Remediation Market, by Country

- United States Environmental Remediation Market

- China Environmental Remediation Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesis of Critical Trends, Competitive Forces, and Strategic Imperatives Framing the Future Roadmap for Sustainable Environmental Remediation Solutions

The environmental remediation sector stands at a pivotal juncture where technological prowess, regulatory rigor, and stakeholder expectations converge to shape its trajectory. The transition toward proactive, digitally enabled cleanup models underscores the imperative for organizations to adapt their strategies in response to emerging contaminants and evolving policy landscapes. Concurrently, the 2025 tariff environment has illuminated the criticality of supply chain agility and the strategic value of circular economy principles.

Segmentation insights reveal that tailoring solutions across environmental mediums-from air and soil to water-demands a versatile technology portfolio encompassing bioremediation, thermal processes, electrokinetic methods, and more. Regional dynamics further accentuate the need for localized execution strategies, as regulatory stringency and economic drivers vary across the Americas, EMEA, and Asia-Pacific.

Looking ahead, collaboration among technology developers, service providers, investors, and regulators will be instrumental in fostering standardized protocols and shared innovation pathways. Organizations that embrace data-driven decision frameworks and embed ESG outcomes into their value propositions are poised to lead the next wave of sustainable remediation solutions.

In essence, success in the environmental remediation market hinges on a balanced synthesis of technical expertise, strategic agility, and stakeholder engagement. By aligning organizational priorities with these multidimensional imperatives, industry leaders can unlock new growth opportunities while safeguarding environmental and community health.

Connect with Associate Director Ketan Rohom to Unlock Comprehensive Environmental Remediation Insights and Equip Your Organization with Actionable Market Intelligence

Engaging with tailored market intelligence can be the catalyst your organization needs to navigate the intricate landscape of environmental remediation. By reaching out directly to Ketan Rohom, Associate Director of Sales & Marketing, decision-makers can secure an in-depth analysis that unpacks emerging technologies, regulatory nuances, and competitive dynamics shaping the industry today. This report goes beyond surface-level observations, providing a granular view of the drivers and inhibitors across various segments that inform strategic investments and operational pivots.

Securing this research will empower your team with actionable insights, from understanding the cumulative impact of new 2025 tariffs to identifying region-specific growth opportunities in the Americas, EMEA, and Asia-Pacific. The report’s comprehensive coverage and rigorous methodology ensure you have the most accurate and timely data at your fingertips, enabling proactive decision-making in an ever-evolving sector. Rather than relying on fragmented public data, this executive summary offers clarity and context backed by expert validation.

Contact Ketan Rohom today to customize a purchase plan that aligns with your budget and strategic objectives. Whether you need targeted deep dives on contaminant-specific remediation technologies or a broad strategic overview for board-level discussions, Ketan can facilitate a tailored engagement. Take the next step toward gaining a competitive edge by acquiring a report designed to translate complex market dynamics into clear action pathways for sustainable growth.

- How big is the Environmental Remediation Market?

- What is the Environmental Remediation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?