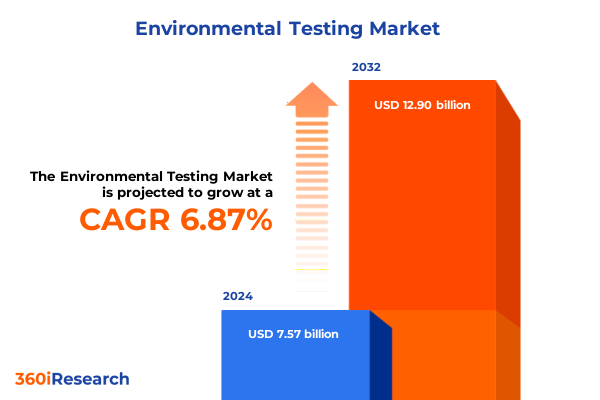

The Environmental Testing Market size was estimated at USD 8.07 billion in 2025 and expected to reach USD 8.61 billion in 2026, at a CAGR of 6.91% to reach USD 12.90 billion by 2032.

Setting the Stage for Informed Environmental Testing Decisions with a Comprehensive Overview of Market Drivers, Challenges, and Emerging Opportunities

Environmental testing has emerged as an indispensable component of corporate responsibility, public health, and regulatory compliance in an era defined by heightened environmental scrutiny. As organizations face mounting pressure to meet stringent environmental standards, the ability to accurately detect and quantify pollutants across air, water, soil, and noise pathways has never been more critical. This report delivers a foundational perspective on the evolving landscape, bridging macro-level regulatory trends with micro-level technological advancements to equip stakeholders with a clear roadmap for navigating an increasingly complex ecosystem.

Within this framework, readers will find a thorough exploration of the forces shaping demand, spanning shifts in regulatory frameworks, the rise of corporate sustainability commitments, and the accelerating pace of innovation in analytical methodologies. By examining both legacy techniques and emerging rapid testing approaches, this section sets the stage for deeper insights into how industry participants can harness new capabilities to drive efficiency, accuracy, and compliance. The introduction further outlines the report’s structure, spotlighting core segments, key regional dynamics, and strategic imperatives that will frame subsequent analyses.

Unveiling the Transformative Shifts Redefining Environmental Testing Paradigms Driven by Technological Innovation, Regulatory Evolution, and Sustainability Imperatives

Over the past decade, environmental testing has undergone profound transformation driven by technological innovation, regulatory evolution, and shifting stakeholder expectations. Legacy methods rooted in batch-based chemical assays and culture-plate analyses have given way to increasingly automated and miniaturized platforms capable of delivering results within hours rather than days. Concurrently, the introduction of remote sensing technologies, driven by unmanned aerial systems and Internet of Things–enabled sensors, has expanded the scope of environmental monitoring far beyond the traditional confines of centralized laboratories.

Equally significant is the regulatory dimension, where updated mandates on contaminant thresholds and reporting requirements have raised the bar for accuracy and traceability. Emerging contaminants of concern, including per- and polyfluoroalkyl substances (PFAS) and microplastics, have prompted agencies to adopt more rigorous testing protocols and enforcement mechanisms. In response, laboratory operators are accelerating investments in advanced spectroscopy, mass spectrometry, and molecular techniques such as polymerase chain reaction (PCR) to meet compliance milestones while managing cost and throughput pressures.

As sustainability imperatives become increasingly intertwined with corporate reputation, organizations are also seeking testing solutions that deliver both environmental insights and operational efficiency. The convergence of digital data management, cloud-based analytics, and artificial intelligence enables sophisticated pattern recognition and predictive modeling, laying the groundwork for proactive environmental stewardship and continuous improvement.

Analyzing the Cumulative Impact of Newly Imposed United States Tariffs on Environmental Testing Supply Chains, Laboratory Expenditures, and Service Accessibility in 2025

The imposition of new United States tariffs in 2025 has prompted industry participants to reassess both procurement strategies and cost structures across the environmental testing value chain. Tariffs applied under Section 301 and Section 232 authorities, targeting key laboratory instruments, specialty reagents, and metal-based equipment, have elevated import duties by up to 25 percent on certain product categories. As a result, lead times have lengthened and landed costs for essential testing assets have risen, squeezing margins for laboratories and service providers alike.

In response, businesses have explored alternative sourcing strategies, including regional suppliers and domestically produced reagents, to mitigate exposure to volatile duty rates and ocean freight surcharges. Some organizations have accelerated capital investments in in-house manufacturing capabilities for standard consumables, while others have engaged in collaborative procurement consortia to leverage bulk purchasing discounts. Meanwhile, service providers are recalibrating contract terms and pricing structures, passing through incremental costs in a phased manner to maintain competitiveness without sacrificing quality or turnaround.

Despite these challenges, the tariffs have also catalyzed innovation within supply chains. Equipment manufacturers are optimizing product designs to reduce reliance on tariffed components, and reagent suppliers are reformulating chemistries to utilize locally sourced materials. Such strategic adaptations underscore the market’s resilience and highlight the critical role of supply chain agility in sustaining uninterrupted environmental testing operations.

Distilling Key Segmentation Insights Revealing How Technology, Sample Type, Contaminant Classification, and End-use Verticals Shape the Environmental Testing Market

A nuanced examination of market segmentation reveals the multifaceted nature of demand within the environmental testing industry. Based on technology, the market encompasses conventional methodologies, which include Biological & Chemical Oxygen Demand assays, Culture Plate Methods, and Dissolved Oxygen Determination protocols, alongside rapid testing techniques such as Acidity/Alkalinity Testing, Chromatography, Immunoassay Testing, Mass Spectrometer Testing, Molecular Spectroscopy Testing, PCR Testing, and Turbidity Testing; this duality reflects a spectrum of needs from thorough baseline assessments to expedited, high-throughput screening. Based on sample matrices, the industry addresses air, noise, soil, and water mediums, each with its own set of analytical challenges and regulatory thresholds that guide method selection and quality control measures. Based on contaminant type, testing solutions span chemical contaminants such as volatile organic compounds, microbiological hazards including bacterial and viral pathogens, physical contaminants like particulate matter, and radiological contaminants necessitating specialized detector protocols. Finally, based on end-use, the landscape is shaped by the distinct requirements of agriculture, energy & utilities, environmental testing laboratories, government entities, and industrial operations, each segment prioritizing different performance attributes, cost sensitivities, and service level agreements.

This comprehensive research report categorizes the Environmental Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Sample

- Contaminant Type

- End-use

Mapping Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Illuminate Divergent Drivers and Challenges in Environmental Testing

Regional dynamics play a pivotal role in defining environmental testing trajectories and investment patterns. In the Americas, robust enforcement of federal and state regulations, coupled with heightened public and private sector investment in infrastructure improvement, drives sustained growth in advanced testing services and instrumentation. Meanwhile, Europe, Middle East & Africa markets are influenced by the evolution of European Union directives on water and air quality, the expansion of environmental, health, and safety regulations in the Middle East, and growing emphasis on sustainable resource management across Africa, resulting in diversified demand for both centralized laboratory services and mobile testing solutions. In the Asia-Pacific region, rapid industrialization, large-scale urbanization projects, and government initiatives to combat pollution have ignited a surge in environmental monitoring activities. Market participants in this region are particularly focused on scalable, cost-effective testing platforms that can be deployed across both densely populated urban centers and remote agricultural zones.

This comprehensive research report examines key regions that drive the evolution of the Environmental Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Providing Strategic Insights into Leading Environmental Testing Providers by Evaluating Their Core Competencies, Innovative Capabilities, and Market Positioning Trends

Industry leaders continue to refine their competitive positioning through targeted investments in research and development, strategic partnerships, and operational scalability. Several global instrument manufacturers have reinforced their market presence by launching modular testing systems that support a broad array of analytical applications, enabling clients to adapt quickly to emerging contaminant threats without extensive capital outlays. Concurrently, specialist service providers have expanded their footprints through strategic acquisitions of regional laboratories, facilitating seamless integration of local compliance expertise with robust quality management systems. At the same time, pure-play analytics firms are differentiating through the development of proprietary data platforms that unify testing results, asset performance metrics, and regulatory reporting into a single digital ecosystem, thereby accelerating decision-making processes for environmental managers. Collectively, these approaches underscore the imperative for cross-functional innovation, where technology, service delivery, and digital capabilities converge to establish sustainable competitive advantage in a crowded marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Environmental Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A & B Environmental Services, Inc.

- ADE Consulting Group Pty Ltd.

- Advanced Environmental, LLC

- Agilent Technologies Inc.

- Alex Stewart International

- ALS Limited

- Analabs Resources Berhad

- AsureQuality Limited

- Bureau Veritas SA

- Clean Water Testing LLC by A. O. Smith Corporation

- Danaher Corporation

- EMSL Analytical, Inc.

- Envirolab Services Pty. Ltd.

- Environmental Systems Research Institute, Inc.

- ESPEC Corp.

- Eureka Analytical Services Pvt. Ltd.

- Eurofins Scientific SE

- Fugro N.V.

- Green Genra Technologies Pvt. Ltd.

- Honeywell International, Inc.

- Intertek Group PLC

- Merck KGaA

- Montrose Environmental Group, Inc.

- Mérieux NutriSciences

- Nemko Group AS

- Pace Analytical Services, LLC

- SGS S.A.

- Shimadzu Corporation

- Summit Environmental Technologies Inc.

- Thermo Fisher Scientific Inc.

- TÜV SÜD AG

- UL LLC

- Veolia Environnement SA

Presenting Actionable Strategic Recommendations to Empower Industry Leaders in Environmental Testing to Navigate Emerging Challenges and Leverage Growth Opportunities

To capitalize on evolving market dynamics, industry leaders must adopt a multifaceted strategy that balances technological advancement, supply chain resilience, and strategic collaboration. It is essential to prioritize investments in rapid testing platforms, leveraging molecular and spectroscopic techniques to reduce turnaround times while maintaining rigorous analytical standards. Equally important is the establishment of diversified sourcing networks for critical reagents and metal components to hedge against tariff-induced cost fluctuations and logistical disruptions. Commercial teams should pursue value-based pricing agreements with key clients, aligning service fees with demonstrable environmental risk reduction outcomes.

Moreover, forging partnerships with academic research institutions and regulatory bodies can accelerate the development of standardized methods for emerging contaminants of concern, thereby enhancing credibility and market leadership. Digital integration should extend beyond internal reporting to encompass client-facing dashboards that provide real-time insights into environmental performance metrics, fostering transparency and trust. Finally, organizations are encouraged to conduct regular scenario planning exercises to anticipate regulatory shifts, tariff adjustments, and technological breakthroughs, ensuring that strategic roadmaps remain adaptive and forward-looking.

Outlining a Rigorous Research Methodology Emphasizing Data Collection Techniques, Robust Analytical Approaches, and Quality Assurance Protocols

This research employs a rigorous, multi-tiered methodology designed to ensure comprehensive coverage and analytical integrity. Primary data collection encompassed in-depth interviews with key opinion leaders, regulatory agency representatives, and senior executives from instrument manufacturers and testing service providers. These insights were complemented by technical workshops and validation sessions to confirm the relevance and applicability of emerging testing methodologies.

Secondary research drew upon industry journals, government publications, and peer-reviewed scientific studies to compile a robust knowledge base of historical trends, regulatory developments, and technological milestones. Quantitative analysis leveraged financial disclosures, patent filings, and trade data to identify patterns in investment, innovation, and supply chain disruptions. A stringent quality assurance protocol, including cross-verification of data sources and iterative peer reviews, was applied at each stage to minimize bias and ensure the reliability of findings. The resulting framework provides stakeholders with a transparent view of underlying assumptions, methodological limitations, and opportunities for further exploration.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Environmental Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Environmental Testing Market, by Technology

- Environmental Testing Market, by Sample

- Environmental Testing Market, by Contaminant Type

- Environmental Testing Market, by End-use

- Environmental Testing Market, by Region

- Environmental Testing Market, by Group

- Environmental Testing Market, by Country

- United States Environmental Testing Market

- China Environmental Testing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Summarizing Critical Takeaways and Future Perspectives to Guide Stakeholders in Environmental Testing Through Evolving Market Dynamics and Technological Advancements

This executive summary has distilled the critical takeaways from a dynamic environmental testing landscape characterized by rapid technological advancement, evolving regulatory imperatives, and a complex web of supply chain challenges. The introduction grounded the discussion in the broader context of environmental stewardship and compliance, while subsequent analysis illuminated key transformative trends-including the shift toward rapid testing paradigms and the rising importance of digital data integration. A detailed assessment of new United States tariffs underscored the need for supply chain agility and strategic procurement to manage cost pressures.

Segmentation insights shed light on the varied demands across technology types, sample matrices, contaminant classes, and end-use verticals, reinforcing the importance of tailored solutions. Regional explorations revealed distinct drivers in the Americas, Europe Middle East & Africa, and Asia-Pacific, each presenting unique regulatory, economic, and infrastructural landscapes. Company profiles highlighted how leading players are forging competitive advantage through modularity, strategic M&A, and digital ecosystems. Finally, actionable recommendations outlined a path forward that emphasizes rapid innovation, strategic partnerships, and proactive scenario planning. As stakeholders prepare for the next wave of environmental testing challenges, these insights will serve as a guiding framework for achieving sustainable growth and operational excellence.

Driving Engagement with Key Stakeholders Through a Persuasive Invitation to Connect with the Associate Director, Sales & Marketing, for Exclusive Access to Comprehensive Market Insights

To gain a comprehensive understanding of the trends, challenges, and opportunities shaping the environmental testing landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing, for exclusive access to the full market research report. Engage directly with an industry expert who can guide you through tailored insights, strategic analyses, and actionable recommendations that will empower your organization to make informed decisions. By partnering with Ketan, you unlock personalized support, priority briefings, and in-depth data tailored to your specific needs. Take the next step toward optimizing your environmental testing strategies by contacting Ketan Rohom today and ensure your team benefits from the most current and thorough intelligence available in the marketplace

- How big is the Environmental Testing Market?

- What is the Environmental Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?