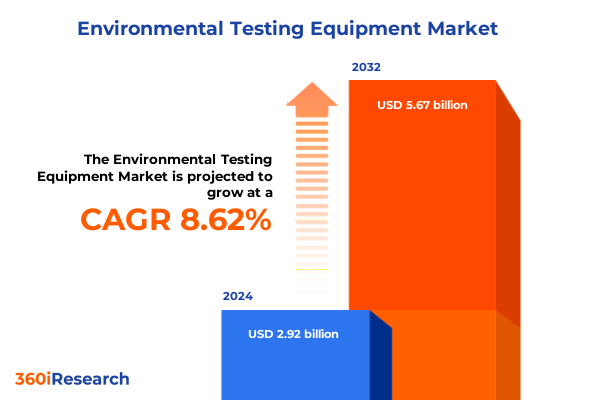

The Environmental Testing Equipment Market size was estimated at USD 3.18 billion in 2025 and expected to reach USD 3.45 billion in 2026, at a CAGR of 8.62% to reach USD 5.67 billion by 2032.

Setting the Stage for a New Era in Environmental Testing Equipment: Key Drivers, Market Dynamics, and Emerging Opportunities

Environmental testing equipment is undergoing a remarkable transformation, driven by heightened regulatory scrutiny, rapid technological advancements, and an escalating global focus on sustainability. In response to tightened emissions standards and expanding environmental mandates, decision-makers are seeking robust analytical solutions that combine precision, portability, and data connectivity. The convergence of advanced sensor technologies with cloud-based analytics platforms enables real-time monitoring of critical environmental parameters, facilitating proactive interventions and continuous compliance.

This dynamic landscape is further shaped by the growing emphasis on corporate social responsibility and ESG reporting. Organizations across industries are investing heavily in next-generation instrumentation to quantify their environmental footprint, mitigate risks, and demonstrate transparency to stakeholders. Simultaneously, the rise of decentralized testing models, powered by compact and user-friendly analyzers, is democratizing access to diagnostic capabilities. Through these shifts, the environmental testing equipment sector is poised for sustained evolution, with innovation at its core and regulatory alignment as its compass.

Revolutionary Advances and Strategic Realignments Reshaping the Environmental Testing Equipment Landscape Across Industries

The environmental testing equipment domain is witnessing transformative shifts that are redefining traditional workflows and unlocking new avenues for value creation. Foremost among these developments is the integration of artificial intelligence and machine learning into data analysis pipelines, which enhances pattern recognition and predictive maintenance. By coupling advanced algorithms with high-resolution mass spectrometry and spectroscopy systems, laboratories can detect emerging contaminants at trace levels, anticipate equipment downtime, and optimize resource allocation.

Concurrently, modular instrument architectures are taking center stage, allowing users to customize analytical configurations across the spectrum of chromatographs or thermal analyzers. This flexible approach reduces capital expenditure barriers and accelerates deployment, as research teams can expand their capabilities incrementally. Cloud-native platforms further amplify this adaptability by delivering centralized dashboards for cross-site performance tracking and regulatory reporting. Together, these breakthroughs are not only accelerating time-to-result but also fostering collaborative research ecosystems that span academia, government agencies, and private enterprises.

Analyzing the Comprehensive Ripple Effects of 2025 Tariff Changes on the United States Environmental Testing Equipment Ecosystem

In 2025, sweeping tariff adjustments enacted by the United States government have exerted multifaceted effects on the environmental testing equipment market. Higher duties on imported components for chromatographs and mass spectrometry instruments have driven upstream cost pressures, compelling manufacturers to reassess their supply chains. These surcharges have also incentivized the nearshoring of critical component production, as domestic suppliers seek to capture demand for gas analyzers and particulate counters that once relied on overseas sourcing.

End users have experienced moderate price escalations, particularly in high-precision spectrometers and UHPLC systems, which depend on specialized column materials. Some laboratories have deferred noncritical upgrades in anticipation of potential tariff relief in subsequent policy cycles, while forward-thinking organizations have negotiated value-added service contracts to hedge against cost volatility. Regulatory bodies have responded by offering targeted incentives and grants to offset capital investment challenges, fostering a more resilient procurement environment. As a result, the 2025 tariff landscape has catalyzed a broader strategic reorientation toward supply chain diversification and cost management within the industry.

Decoding Critical Market Segmentation Variables to Illuminate Diverse Equipment Types, Testing Parameters, Technologies, Applications, and End Use Scenarios

Understanding market dynamics requires a granular examination of five core segmentation dimensions that influence purchasing and deployment strategies. When evaluating equipment type, the landscape spans classes from gas chromatographs to liquid chromatographs, with the latter further differentiated into HPLC and UHPLC platforms, alongside gas analyzers, particle counters, spectrometers, and thermal analyzers. Each category presents unique performance and cost trade-offs for analytical laboratories.

Testing parameters introduce another layer of complexity, encompassing gas analyses, heavy metal detection, microbial testing, organic compound identification, and particulate measurement. Laboratories specializing in air quality monitoring may prioritize particle counters and gas analyzers, whereas water quality analysis teams often rely on spectrometry and chromatography modules optimized for organics and heavy metals. Technology selection is similarly nuanced, with chromatography, electrochemical sensors, filtration methods, mass spectrometry, spectroscopy, and thermal analysis each offering distinct sensitivity profiles and maintenance requirements.

Applications further influence procurement decisions, spanning air quality monitoring, emissions compliance, industrial hygiene, soil testing, and water quality analysis. Each application domain imposes specific performance criteria, sample throughput needs, and calibration protocols. Finally, end-use segments-from academic research institutions to chemical producers, environmental agencies, food and beverage companies, oil and gas operators, and pharmaceutical manufacturers-drive feature prioritization, service model preferences, and integration pathways with enterprise systems.

This comprehensive research report categorizes the Environmental Testing Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Testing Parameter

- Technology

- Application

- End Use

Uncovering Regional Dynamics Shaping Environmental Testing Equipment Demand Across the Americas, Europe Middle East and Africa, and Asia Pacific

A regional lens reveals distinct demand drivers and competitive landscapes across the Americas, Europe Middle East & Africa, and Asia-Pacific markets. In the Americas, stringent EPA regulations and proactive state-level air quality mandates underpin robust investment in portable gas analyzers and particle counters. North American laboratories emphasize high-throughput chromatography systems to support pharmaceutical and food safety testing, while Latin American markets are witnessing gradual uptake of turnkey spectroscopy solutions.

Across Europe, the Middle East, and Africa, the push toward carbon neutrality and circular economy initiatives is elevating the importance of real-time emissions monitoring and advanced mass spectrometry for pollutant tracking. Regulatory harmonization across the European Union is streamlining cross-border procurement, encouraging vendors to offer standardized service agreements. Meanwhile, in the Middle East, rapid industrial expansion is fueling demand for water quality testing infrastructure, and in Africa, mobile testing units are increasingly adopted to bridge analytical capacity gaps.

In the Asia-Pacific region, accelerating urbanization and pronounced air quality challenges are driving capital investments in integrated analytical platforms. Government subsidies in China and India for environmental infrastructure upgrades are catalyzing widespread deployment of HPLC and UHPLC systems. Japan and South Korea continue to lead in high-end spectrometer development, while Southeast Asian nations are emerging markets for cost-effective electrochemical and filtration-based analyzers.

This comprehensive research report examines key regions that drive the evolution of the Environmental Testing Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Technology Innovators and Strategic Partnerships Driving Growth and Innovation in the Environmental Testing Equipment Industry

Leading participants in the environmental testing equipment arena are distinguished by their commitment to innovation, strategic partnerships, and lifecycle service excellence. Global firms have expanded their portfolios through the integration of AI-powered analytics suites with core instrumentation, thereby delivering end-to-end solutions that drive laboratory productivity. Others have forged alliances with software providers to create interoperable ecosystems that facilitate remote diagnostics and predictive maintenance across multivendor fleets.

Investment in R&D remains a top priority, as companies race to develop ultra-low detection technologies and energy-efficient instrument designs. Collaborative research initiatives between academia and industry are accelerating the commercialization of novel sensor materials and miniaturized analytical modules. Aftermarket support models have evolved from reactive maintenance to outcome-based service contracts, aligning vendor incentives with uptime performance guarantees. This shift underscores a broader trend toward value-added offerings that encompass training, calibration, and digital workflow integration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Environmental Testing Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- AMETEK, Inc.

- Analytik Jena AG

- Angelantoni Industrie S.r.l.

- Binder GmbH

- Cincinnati Sub-Zero (CSZ) Products, Inc.

- Danaher Corporation

- ESPEC Corp.

- HORIBA, Ltd.

- JEOL Ltd.

- Merck KGaA

- PerkinElmer, Inc.

- Shimadzu Corporation

- Tenney Environmental, LLC

- TestEquity LLC

- Thermo Fisher Scientific Inc.

- Waters Corporation

- Weiss Technik GmbH & Co. KG

Implementing Tactical Strategies and Collaborative Frameworks to Empower Industry Leaders in Navigating the Future Environmental Testing Equipment Landscape

To maintain competitive advantage amid rapid technological convergence and regulatory complexity, industry leaders should adopt a series of actionable strategies. First, diversifying supply chains to include both established domestic suppliers and emerging regional partners can mitigate the impact of tariff fluctuations and logistical disruptions. Simultaneously, investing in modular instrument platforms that support incremental upgrades will enable cost-effective scaling of analytical capabilities.

Embracing digital transformation initiatives is essential; integrating IoT-enabled sensors with cloud-based analytics not only enhances data transparency but also streamlines compliance reporting. Collaboration with academic institutions and regulatory agencies can accelerate the validation of new testing methodologies and foster early adoption. Finally, cultivating outcome-oriented service offerings-such as performance-based maintenance agreements-aligns vendor and customer objectives, driving mutual long-term value and reinforcing customer loyalty.

Detailing a Rigorous Multi-Stage Research Methodology Combining Qualitative and Quantitative Approaches for Comprehensive Market Insights

This study employs a rigorous, multi-tiered research methodology combining both qualitative and quantitative approaches to ensure comprehensive and reliable insights. Primary research was conducted through in-depth interviews with key opinion leaders across laboratory operations, regulatory bodies, and procurement teams, providing firsthand perspectives on evolving testing needs and purchasing criteria. Secondary research incorporated an extensive review of public filings, technical white papers, industry standards, and government regulations to contextualize market dynamics.

Data triangulation techniques were applied to reconcile information from diverse sources, while scenario analysis was used to explore the potential implications of tariff policy changes and technological disruptions. Statistical validation, including cross-verification of supplier shipment data and patent activity trends, reinforced the credibility of findings. Finally, an expert review panel comprising seasoned analysts and domain specialists validated the final insights, ensuring that the conclusions and recommendations align with real-world industry conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Environmental Testing Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Environmental Testing Equipment Market, by Equipment Type

- Environmental Testing Equipment Market, by Testing Parameter

- Environmental Testing Equipment Market, by Technology

- Environmental Testing Equipment Market, by Application

- Environmental Testing Equipment Market, by End Use

- Environmental Testing Equipment Market, by Region

- Environmental Testing Equipment Market, by Group

- Environmental Testing Equipment Market, by Country

- United States Environmental Testing Equipment Market

- China Environmental Testing Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Critical Findings and Strategic Imperatives to Chart a Sustainable and Resilient Path Forward in Environmental Testing Equipment

The synthesis of regulatory developments, technological breakthroughs, and evolving end-user requirements underscores a pivotal moment for the environmental testing equipment sector. Companies that proactively embrace modular architectures, digital integration, and diversified supply chains will be best positioned to thrive. As 2025 unfolds, the interplay of tariffs, sustainability mandates, and data-driven analytics will shape competitive dynamics and define market leaders.

Strategic imperatives include fostering collaborative innovation, optimizing lifecycle service models, and leveraging advanced data platforms to drive operational efficiency. By aligning product roadmaps with the trajectory of environmental regulations and customer demand, stakeholders can unlock growth opportunities and reinforce resilience. Ultimately, a holistic approach that balances precision instrumentation with agile business models will chart a sustainable and resilient path forward.

Connect with Ketan Rohom to Unlock In-Depth Environmental Testing Equipment Insights That Drive Informed Decisions and Accelerate Business Growth

Taking the next step toward achieving superior environmental compliance and strategic advantage has never been more straightforward. Contact Ketan Rohom, Associate Director of Sales & Marketing, to discover how this comprehensive analysis can empower your organization. By engaging directly with Ketan, you will gain access to tailored insights, exclusive executive briefings, and specialized support to translate data into actionable strategies. Whether you seek to refine your product roadmap, optimize procurement processes, or forge new partnerships, Ketan’s expertise and commitment will ensure you maximize ROI from your market research investment. Don’t miss the opportunity to transform raw intelligence into a catalyst for growth and innovation-reach out now to secure your copy of the full Environmental Testing Equipment market research report and set your business on a path to sustained success.

- How big is the Environmental Testing Equipment Market?

- What is the Environmental Testing Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?