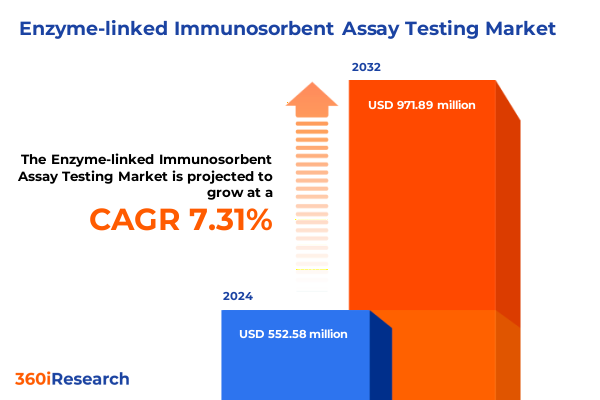

The Enzyme-linked Immunosorbent Assay Testing Market size was estimated at USD 592.09 million in 2025 and expected to reach USD 636.82 million in 2026, at a CAGR of 7.33% to reach USD 971.88 million by 2032.

Establishing the Strategic Importance and Evolutionary Trajectory of ELISA Testing in Advancing Diagnostics and Biopharmaceutical Innovation Worldwide

The enzyme-linked immunosorbent assay has emerged as a cornerstone technology for diagnostics, drug discovery, and quality control, transforming the way biological interactions are quantified and monitored. Its high specificity and sensitivity have led to widespread adoption in academic research, pharmaceutical development, clinical laboratories, and environmental analysis, creating a dynamic market that is continually evolving to meet complex analytical challenges. The ability to detect minute concentrations of proteins, antibodies, and other biomolecules using colorimetric, fluorometric, or chemiluminescent readouts has positioned ELISA testing as an indispensable tool for understanding disease mechanisms, validating biomarkers, and ensuring product safety across industries.

As the market has matured, advances in assay automation, miniaturization, and multiplexing have accelerated throughput while reducing per-sample costs, broadening ELISA’s appeal beyond traditional laboratory settings. Simultaneously, the integration of digital data analysis platforms has streamlined result interpretation, enhanced reproducibility, and enabled real-time monitoring of assay performance. Today’s ELISA solutions encompass a spectrum of instruments, reagents, assay formats, and software services, reflecting a diverse ecosystem designed to address the needs of end users ranging from contract research organizations to hospital diagnostics. This introduction sets the stage for a detailed examination of the transformative shifts, regulatory pressures, segmentation dynamics, and strategic imperatives shaping the ELISA market in the current landscape and beyond.

Unveiling the Transformative Technological and Operational Shifts Defining the Next Generation Evolution of ELISA Platforms and Practices

Over recent years, the ELISA market has undergone profound transformations driven by technological breakthroughs, shifting workflows, and evolving end-user demands. Automation has moved beyond standalone plate readers and washers to fully integrated systems capable of handling large sample volumes with minimal human intervention, thereby reducing variability and freeing up skilled personnel for higher-value tasks. In parallel, microfluidic and lab-on-a-chip platforms have made it possible to perform immunoassays using microliter volumes, enabling rapid point-of-care diagnostics and resource-efficient research applications. Moreover, multiplex ELISA kits now allow simultaneous detection of multiple analytes from a single sample, significantly enhancing data richness and sample utilization efficiency.

Additionally, the rise of digital immunoassay readers equipped with advanced image analysis algorithms has revolutionized sensitivity and dynamic range, while cloud-based software platforms offer real-time data aggregation, collaborative analysis, and remote monitoring of assay performance. These digital capabilities have not only improved throughput but have also facilitated seamless integration with laboratory information management systems, fostering end-to-end workflow optimization. As a result, researchers and clinicians can now obtain high-resolution insights into biomolecular interactions more quickly than ever before, thereby accelerating therapeutic development, disease surveillance, and quality assurance processes.

Analyzing the Layered Effects of U.S. Section 301 Tariffs on ELISA Supply Chains Production Costs and Market Dynamics Through 2025 and Beyond

U.S. trade policy continues to exert significant pressure on the ELISA supply chain through the maintenance and expansion of Section 301 tariffs on imports from China. Originally imposed in 2018 and 2019 in response to adjudicated unfair technology transfer and intellectual property practices, these tariffs have persisted under successive administrations, reflecting strategic concerns over domestic manufacturing capacity and national security. While the U.S. Trade Representative extended exclusions on certain medical equipment categories through May 31, 2025 to mitigate supply constraints, many laboratory instruments and reagents remain subject to additional duties of up to 25 percent, heightening cost pressures for importers and end users.

Following a comprehensive four-year review, the USTR finalized further increases to Section 301 duties effective September 27, 2024, affecting key medical products essential to ELISA workflows. Tariffs on certain personal protective equipment rose to 25 percent, with rates on surgical gloves slated to climb to 50 percent in 2025 and 100 percent in 2026, while syringes and needles faced duty hikes to 100 percent beginning in late 2024. These measures have driven reagent suppliers and instrument manufacturers to explore nearshoring, expand domestic production lines, and secure advance purchase agreements to hedge against volatility. Consequently, organizations are recalibrating sourcing strategies, investing in alternative regional partners, and reassessing inventory models to maintain operational continuity and manage total cost of ownership.

Insightful Breakdown of ELISA Market Segmentation Revealing Strategic Opportunities Across Products Assay Types End Users and Applications

A nuanced understanding of market segmentation reveals distinct demands and growth trajectories across multiple dimensions. Within the product domain, end users deploy a blend of sophisticated instruments such as microplate readers and washers, coupled with both automated and manual assay kits tailored for high-volume and customizable workflows. Reagent portfolios span antibodies, enzymes, and substrates, each critical for assay specificity and signal development, while data analysis software and maintenance services deliver comprehensive support for laboratory operations.

Assessing assay types underscores the varied immunoassay approaches in practice, with sandwich ELISA favored for quantifying antigens of interest, indirect formats leveraged for antibody screening, competitive assays applied in small molecule detection, and direct methods used in rapid diagnostic contexts. This methodological diversity aligns closely with the profiles of academic and research institutions conducting fundamental investigations, contract research organizations delivering outsourced services, hospitals and diagnostic laboratories performing clinical testing, and pharmaceutical and biotechnology firms driving drug discovery pipelines.

Finally, application segments illustrate ELISA’s versatility, spanning disease testing for biomarkers and infectious agents, drug discovery programs requiring robust quantitation of therapeutic targets, environmental testing for pollutants and allergens, and food safety and quality control ensuring compliance with regulatory standards. The intersection of these segmentation axes highlights opportunities for solution providers to tailor offerings, differentiate through specialized capabilities, and capture value across discrete yet interrelated market niches.

This comprehensive research report categorizes the Enzyme-linked Immunosorbent Assay Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Assay Type

- Application

- End Users

Examining Key Diverse Regional Dynamics Shaping ELISA Adoption and Growth Patterns Across the Americas EMEA and Asia Pacific Markets

Regional landscapes for ELISA adoption are shaped by distinct economic, regulatory, and infrastructural factors. In the Americas, advanced healthcare and research infrastructure, supportive reimbursement frameworks, and established distribution networks have fostered robust demand for state-of-the-art immunoassay solutions. Moreover, significant public and private investment in biotechnology ventures has spurred growth in contract research services and in-house diagnostic capabilities, projecting a stable uptake of both modular and fully integrated ELISA platforms.

Conversely, the Europe, Middle East, and Africa region presents a heterogeneous market: Western Europe benefits from stringent regulatory harmonization and clinical laboratory accreditation standards, driving demand for premium, validated products, while emerging markets within Eastern Europe, the Middle East, and Africa exhibit price sensitivity and variable regulatory environments but offer significant upside potential through expanding research budgets and public health initiatives. Suppliers that navigate the diverse reimbursement landscapes and tailor service models to local needs stand to gain competitive advantage.

Asia-Pacific continues to register some of the fastest growth rates, underpinned by burgeoning research activities in life sciences, government programs to bolster domestic manufacturing of diagnostic reagents and equipment, and rapid expansion of hospital networks. Countries such as China, India, Japan, and South Korea have prioritized biotechnology R&D, leading to increased procurement of high-throughput ELISA systems, while Southeast Asian markets are emerging as key nodes in global supply chains due to favorable production costs and trade incentives.

This comprehensive research report examines key regions that drive the evolution of the Enzyme-linked Immunosorbent Assay Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading ELISA Market Players Showcasing Strategic Innovations Partnerships and Competitive Strategies Driving Market Leadership

Competition among ELISA providers is intense, with global leaders deploying robust innovation pipelines, strategic partnerships, and service differentiators to consolidate their positions. Thermo Fisher Scientific has extended its portfolio through targeted acquisitions and in-house development of high-sensitivity assay kits and automated workstations, coupled with cloud-based data management solutions that cater to evolving laboratory digitization requirements. Danaher Corporation, through its Beckman Coulter and SCIEX divisions, emphasizes microplate reader performance and multiplex capabilities, reflecting a commitment to throughput and precision.

Bio-Rad Laboratories continues to bolster its core strengths in antibody development and quality-control reagents, while Merck KGaA (MilliporeSigma) leverages extensive chemical synthesis capabilities to enhance substrate and enzyme formulations for enhanced signal resolution. Agilent Technologies and PerkinElmer have pursued collaborations with academic institutions and biotech startups to enrich assay libraries and integrate AI-driven analytics into their software suites. Emerging regional players in Asia-Pacific and Latin America differentiate through localized manufacturing, competitive pricing, and tailored service offerings, challenging incumbents to adapt distribution and support models to maintain market share.

This comprehensive research report delivers an in-depth overview of the principal market players in the Enzyme-linked Immunosorbent Assay Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abcam plc

- Abnova Corporation

- Bio-Rad Laboratories, Inc.

- Biolegend, Inc.

- BioVendor-Laboratorní Systémy s.r.o.

- Boster Biological Technology Co., Ltd.

- Calbiotech, Inc.

- Cusabio Technology Co., Ltd.

- DiaSorin S.p.A.

- DRG International, Inc.

- Elabscience Biotechnology Co., Ltd.

- Enzo Life Sciences, Inc.

- Merck KGaA

- MyBioSource, Inc.

- PerkinElmer, Inc.

- R&D Systems, a brand of Bio-Techne Corporation

- RayBiotech, Inc.

- Sino Biological, Inc.

- Thermo Fisher Scientific, Inc.

Strategic Imperatives for ELISA Industry Leaders to Enhance Resilience Drive Sustainable Innovation and Capitalize on Emerging Opportunities

To thrive amid evolving technological, regulatory, and geopolitical pressures, industry leaders should adopt a multi-pronged strategic approach. First, diversifying supply chains by cultivating relationships with manufacturers across multiple regions can mitigate tariff exposure and logistical bottlenecks, ensuring continuity of reagents and instrument availability. Additionally, investing in automation and digital transformation initiatives will enhance throughput while improving data integrity and enabling remote monitoring, positioning organizations for both operational efficiency and scalability.

Furthermore, expanding local manufacturing or contract production capabilities can reduce dependency on high-tariff import channels and foster closer alignment with regional regulatory requirements. Collaboration with academic and clinical research centers on co-development projects can accelerate innovation cycles and drive market acceptance of novel assay formats. Finally, maintaining proactive engagement with trade and regulatory authorities to anticipate policy shifts and secure exclusion or exemption pathways will empower organizations to manage cost volatility and adapt pricing strategies dynamically.

Outlining Comprehensive Primary and Secondary Research Methodology Employed to Deliver Rigorous ELISA Market Intelligence and Validation

The insights presented in this report are based on a rigorous, two-track research methodology combining primary and secondary data sources. Primary research involved in-depth interviews with senior executives, R&D directors, procurement managers, and end-user stakeholders across academic, clinical, and industrial settings. These interviews were complemented by a structured online survey of laboratory directors to quantify demand drivers, technology adoption patterns, and spend priorities.

Secondary research encompassed a comprehensive review of peer-reviewed scientific literature, patent filings, regulatory documentation, and customs data to map technology trends, IP landscapes, and trade flows. Company annual reports, financial statements, and press releases were analyzed to profile competitive strategies and partnership activities. Data triangulation techniques and validation checkpoints with industry experts ensured accuracy, while geographical and segment-specific analyses were performed to uncover nuanced growth prospects and risk factors.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Enzyme-linked Immunosorbent Assay Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Enzyme-linked Immunosorbent Assay Testing Market, by Product

- Enzyme-linked Immunosorbent Assay Testing Market, by Assay Type

- Enzyme-linked Immunosorbent Assay Testing Market, by Application

- Enzyme-linked Immunosorbent Assay Testing Market, by End Users

- Enzyme-linked Immunosorbent Assay Testing Market, by Region

- Enzyme-linked Immunosorbent Assay Testing Market, by Group

- Enzyme-linked Immunosorbent Assay Testing Market, by Country

- United States Enzyme-linked Immunosorbent Assay Testing Market

- China Enzyme-linked Immunosorbent Assay Testing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing ELISA Market Findings to Illuminate Strategic Pathways and Future Trajectories for Diagnostic and Biopharmaceutical Stakeholders

The enzyme-linked immunosorbent assay market stands at a pivotal juncture, shaped by accelerating technological innovation, shifting trade policies, and evolving end-user requirements. The convergence of high-throughput automation, digital analytics, and advanced assay chemistries is redefining performance benchmarks, while ongoing tariff pressures and regional dynamics are driving strategic realignments across supply chains. Market participants that proactively embrace segmentation insights, invest in resilience-enhancing capabilities, and cultivate collaborative partnerships will be best positioned to capitalize on emerging opportunities in disease diagnostics, drug development, environmental monitoring, and food safety.

As stakeholders navigate this complex landscape, the ability to anticipate regulatory changes, leverage data-driven decision making, and tailor offerings to discrete market niches will be critical for sustaining competitive advantage. By synthesizing the report’s findings, organizations can chart a clear course for innovation, operational excellence, and long-term growth in the dynamic ELISA testing arena.

Connect with Ketan Rohom Associate Director Sales and Marketing to Unlock In-Depth ELISA Market Insights and Secure Your Customized Research Report Today

To explore the detailed findings and gain a comprehensive understanding of the enzyme-linked immunosorbent assay landscape, please reach out to Ketan Rohom, Associate Director, Sales and Marketing, to secure your tailored copy of the research report. Ketan can guide you through the report’s insights, discuss bespoke data requirements, and ensure your organization obtains the actionable intelligence needed to make informed strategic decisions. Connect today with Ketan Rohom to unlock exclusive access to in-depth analysis, customizable data sets, and expert support for driving growth and innovation in the ELISA testing market

- How big is the Enzyme-linked Immunosorbent Assay Testing Market?

- What is the Enzyme-linked Immunosorbent Assay Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?