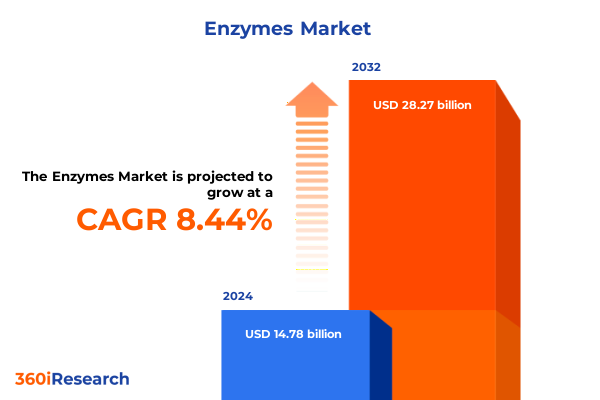

The Enzymes Market size was estimated at USD 15.89 billion in 2025 and expected to reach USD 17.07 billion in 2026, at a CAGR of 8.58% to reach USD 28.27 billion by 2032.

Pioneering the Future of the Enzymes Industry Through Innovative Insights and Strategic Perspectives on Emerging Market Dynamics and Sustainable Growth Drivers

The enzymes sector has emerged as a pivotal force driving innovation across diverse industries, positioning biocatalysts at the heart of technological progress and sustainability commitments. Leveraging decades of biochemical research, contemporary enzyme producers are integrating advanced molecular engineering and high-throughput screening techniques to create tailor-made catalysts capable of delivering optimized performance in applications ranging from food processing to biofuel production. This transition underscores a broader industry imperative: harnessing biological precision to meet complex industrial challenges while simultaneously reducing environmental footprints.

Against this backdrop, decision-makers are seeking a deeper understanding of how enzyme functionalities intersect with evolving regulatory landscapes and rising consumer expectations for green solutions. In response, the market is witnessing intensified collaboration between academic institutions, technology providers, and end-users to accelerate innovation pipelines. These synergistic efforts are fostering the development of next-generation enzymes characterized by enhanced stability, specificity, and operational efficiency under rigorous process conditions.

Consequently, industry stakeholders must equip themselves with a holistic view of the forces reshaping the enzymes market. From the influence of digital platforms in expediting R&D workflows to the integration of sustainability metrics in product roadmaps, the competitive landscape is becoming increasingly dynamic. As a result, organizations that embrace a proactive, data-driven approach to enzyme applications will be best positioned to capitalize on emerging growth vectors and drive long-term value creation.

Unveiling the Transformative Technological and Regulatory Shifts Reshaping the Global Enzymes Ecosystem and Driving Cross-Sector Innovation

Recent years have introduced profound technological breakthroughs and regulatory revisions that are redefining the contours of the enzymes market. Advances in computational enzyme design, powered by machine learning algorithms, are enabling researchers to model active sites and predict catalytic efficiencies with unprecedented speed, thereby slashing development timelines. This digital transformation is complemented by the emergence of robotic automation in laboratory settings, which has amplified throughput and reproducibility during screening campaigns.

Meanwhile, sustainability regulations and voluntary commitments to circular economy principles are prompting manufacturers to rethink enzyme production methods. Consequently, the industry has seen a notable pivot toward microbial fermentation platforms utilizing renewable feedstocks, replacing traditional extraction processes that rely on limited animal or plant sources. As global regulators tighten restrictions on chemical processing aids, the demand for enzyme-based solutions in sectors such as textiles and detergents has surged, reinforcing biocatalysts’ status as clean-label alternatives to harsh chemical reagents.

Further underpinning this transformational landscape are strategic partnerships and joint ventures that bridge expertise across biotechnology, chemical engineering, and materials science. These collaborations are not only expediting the scale-up of novel enzymes but also fostering integrated product offerings tailored to end-user specifications. As a result, market participants are navigating a period of accelerated convergence, where technological innovation and regulatory alignment are jointly reshaping the future of enzyme applications.

Assessing the Multifaceted Impact of 2025 United States Tariffs on Enzymes Supply Chains Regulatory Compliance and Cost Structures

In early 2025, the United States enacted a new wave of tariffs targeting imported enzyme preparations and associated raw materials, prompting a thorough reevaluation of global procurement and supply-chain strategies. Producers that previously relied on cost-effective imports have confronted higher landed costs, driving immediate ripple effects across downstream industries such as biofuel production and pharmaceuticals. This shift has amplified the urgency for localized manufacturing capabilities and strategic inventory management, with several leading enzyme manufacturers announcing expansions of domestic fermentation facilities as a direct countermeasure.

Concurrently, heightened customs inspections and stringent documentation requirements have increased the administrative burden on logistics teams. As a result, organizations are investing in advanced digital platforms to track shipments in real time and automate compliance reporting. These platforms not only reduce potential delays at ports but also enable predictive insights into tariff impacts, allowing companies to adjust order volumes and contract terms proactively.

In response to cost pressures, some enterprises are accelerating the transition toward high-yield microbial strains and continuous processing technologies, which offer lower manufacturing footprints and greater operational agility. Moreover, strategic alliances between enzyme producers and polymer manufacturers have emerged to integrate enzymes directly into polymer matrices, obviating the need for separate shipments and reducing overall import exposure. Through these adaptive measures, industry players are mitigating the immediate financial implications of the new tariff regime while laying the groundwork for more resilient, vertically integrated supply chains.

Deep Dive into Enzymes Market Segmentation Revealing Application Type Source and Form Trends Fueling Targeted Industry Solutions

The enzymes market presents a rich mosaic of applications that intersect with key industrial sectors. In animal nutrition, for example, specialized feed enzymes have been tailored to enhance poultry and ruminant digestion, offering targeted improvements in nutrient bioavailability while reducing environmental nitrogen output. Soon alongside, biofuel producers are deploying custom enzyme blends to streamline biodiesel and bioethanol processes, achieving higher conversion rates of feedstocks such as vegetable oils and lignocellulosic biomass. Within the household and industrial cleaning space, protease and lipase formulations continue to dominate, providing enzyme-based detergents with enhanced stain removal and fabric care performance.

At the same time, the food and beverage sector relies on enzymes in critical subsegments spanning baking, brewing, dairy processing, and juice clarification, where tailored amylase, protease, and pectinase variants deliver process consistency and product quality. Meanwhile, the pharmaceutical and diagnostics segment has embraced enzymes for applications in drug synthesis and biomarker detection, underscoring the biocatalysts’ role in precision healthcare development. Textile manufacturers have also incorporated enzyme treatments to achieve fabric softening and eco-friendly desizing, illustrating the catalysts’ cross-sector versatility.

Beyond application, the market is delineated by enzyme classes that include amylases, cellulases, lipases, and proteases, each engineered for specific substrate interactions. The choice of source-whether animal, microbial, or plant-further influences performance parameters such as pH tolerance and temperature stability. Finally, the form factor, whether liquid or solid, determines ease of integration into industrial workflows and shelf-life considerations. Together, these segmentation layers enable stakeholders to align enzyme characteristics precisely with end-user requirements, driving both technological efficiency and commercial uptake.

This comprehensive research report categorizes the Enzymes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Source

- Form

- Application

Mapping Regional Dynamics in the Enzymes Sector Across Americas Europe Middle East Africa and Asia Pacific Highlighting Distinct Market Drivers

Regional dynamics in the enzymes market are shaped by distinct economic priorities and regulatory frameworks. In the Americas, a robust innovation ecosystem and well-established industrial biotech infrastructure have fuels the rapid adoption of enzyme technologies in biofuels and pharmaceuticals. Localized production facilities in North America have also benefited from government incentives designed to bolster domestic manufacturing, supporting scale-up efforts and strategic partnerships with academic institutions.

Across Europe, the Middle East, and Africa, sustainability mandates and circular economy directives are catalyzing investments in enzyme-enabled processes across multiple end-use sectors. European regulatory bodies have particularly encouraged the replacement of chemical reagents with biocatalysts in textile and detergent manufacturing, reinforcing the region’s reputation as a pioneer in green chemistry. Simultaneously, emerging markets across the Middle East and Africa are exploring enzyme applications in areas such as water treatment and agricultural bioprocessing, aligning enzyme deployment with broader goals of resource conservation.

In the Asia-Pacific region, rapid industrialization and population growth are driving substantial demand for enzymes in food processing, animal nutrition, and biofuels. Key markets like China and India have seen domestic enzyme manufacturers scale production to meet home-market needs as well as export opportunities. Meanwhile, Japan’s advanced fermentation and enzyme-engineering capabilities continue to set benchmarks for product quality and innovation, influencing R&D priorities across the broader Asia-Pacific landscape.

This comprehensive research report examines key regions that drive the evolution of the Enzymes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Initiatives Partnerships and Innovation Portfolios of Leading Companies Shaping the Competitive Enzymes Landscape

Leading companies in the global enzymes arena are distinguishing themselves through targeted investments in R&D, vertical integration, and strategic collaborations. Prominent multinational biocatalyst producers have established dedicated innovation centers to accelerate the discovery of next-generation enzymes, leveraging advanced molecular biology platforms and custom screening libraries. Through selective acquisitions of biotech startups, these corporations have diversified their enzyme portfolios, incorporating novel catalytic functions that address emerging industry challenges.

Partnerships with technology providers and chemical firms have also been instrumental in creating integrated solutions that pair enzymes with complementary additives and process equipment. Such collaborations enable end users to adopt turnkey enzyme-based systems without undertaking complex in-house development, thereby reducing time to market. Additionally, joint ventures between enzyme producers and large agribusiness players have unlocked new pathways for enzyme applications in bio-soil amendment and sustainable crop protection.

Furthermore, many key players are enhancing their market propositions by embedding digital tools and traceability solutions across their value chains. These platforms offer customers real-time visibility into enzyme performance, batch quality, and sustainability metrics, forming the basis for data-driven process optimization. Collectively, these strategic initiatives underscore the competitive imperative to blend scientific excellence with operational agility and customer-centric engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Enzymes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Enzymes GmbH

- Amano Enzyme Inc.

- Angel Yeast Co., Ltd.

- BASF SE

- Bluestar Adisseo Company

- Chr. Hansen Holding A/S

- DSM-Firmenich

- Guangdong VTR Bio-Tech Co., Ltd.

- International Flavors & Fragrances Inc.

- Jiangsu Boli Bioproducts Co., Ltd.

- Kerry Group plc

- Lallemand Inc.

- Meiji Seika Pharma Co., Ltd.

- Novozymes A/S

- Novus International, Inc.

- Qingdao Vland Biotech Group Co., Ltd.

- Rossari Biotech Limited

- Shandong Longda Bio-Products Co., Ltd.

Strategic Recommendations for Industry Leaders to Harness Enzymes Innovation Optimize Supply Chains and Accelerate Sustainable Growth Trajectories

To maintain a competitive edge and capitalize on emerging opportunities, industry leaders should prioritize the integration of advanced enzyme engineering platforms that combine artificial intelligence with high-throughput screening methods. This approach will accelerate the identification of catalytic variants optimized for rigorous industrial conditions, thereby reducing R&D lead times and enhancing product differentiation. Simultaneously, organizations should strengthen collaborative networks with academic institutions and specialized contract research firms to access novel biocatalyst discoveries and foster open innovation models.

From a supply-chain perspective, diversifying manufacturing footprints across multiple geographic locations will be critical to mitigating tariff exposures and logistical disruptions. Companies can further enhance resilience by adopting continuous manufacturing techniques that minimize production costs and environmental impact, as well as by exploring enzyme immobilization strategies to extend catalyst lifetimes. In parallel, embedding digital traceability platforms will empower stakeholders to monitor enzyme batch quality, sustainability indicators, and regulatory compliance metrics in real time.

Lastly, industry leaders must embrace sustainability as a core business driver rather than a peripheral compliance requirement. By developing enzyme formulations derived from renewable feedstocks and implementing closed-loop manufacturing processes, companies will not only meet evolving regulatory standards but also resonate with an increasingly eco-aware customer base. Proactive engagement with policy-makers and standard-setting bodies will further ensure that enzyme-enabled solutions remain central to global decarbonization and circular economy initiatives.

Detailing Robust Research Methodology Emphasizing Data Collection Analytical Techniques and Validation Processes Ensuring Credible Enzymes Market Analysis

This analysis was underpinned by a structured research framework that combined primary and secondary data sources to ensure comprehensive coverage of the enzymes market. Primary insights were obtained through in-depth interviews with senior R&D executives, supply-chain managers, and end-user procurement specialists, providing first-hand perspectives on technology adoption, regulatory challenges, and strategic priorities. These qualitative inputs were supplemented by secondary research encompassing peer-reviewed journals, industry white papers, and government publications, ensuring a robust contextual foundation.

Data triangulation constituted a critical element of the methodology, cross-verifying quantitative inputs with multiple independent sources to minimize bias and enhance reliability. Analytical techniques such as SWOT assessments, Porter’s Five Forces analysis, and value-chain mapping were employed to dissect competitive dynamics and identify structural drivers. Additional validation was achieved through a review panel comprising industry experts, academic researchers, and policy advisors, who corroborated the findings and clarified emerging trends.

By adhering to rigorous data-collection protocols and systematic analytical processes, this study delivers a credible, actionable perspective on the global enzymes landscape. Transparency in methodological assumptions and ongoing engagement with domain specialists further ensures that the insights presented remain relevant and trustworthy for decision-makers navigating an evolving industrial biotech environment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Enzymes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Enzymes Market, by Type

- Enzymes Market, by Source

- Enzymes Market, by Form

- Enzymes Market, by Application

- Enzymes Market, by Region

- Enzymes Market, by Group

- Enzymes Market, by Country

- United States Enzymes Market

- China Enzymes Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Insights and Strategic Imperatives to Illuminate the Path Forward for Enzymes Industry Stakeholders and Inspire Informed Decision Making

Drawing together the core themes of innovation, regulatory evolution, and strategic adaptation, this executive summary reveals an enzymes market at the intersection of scientific ingenuity and commercial pragmatism. Technological advances in enzyme engineering and digitalization are accelerating the pace of discovery, while evolving trade policies underscore the need for resilient supply chains and localized manufacturing capabilities. Segmentation insights highlight the nuanced requirements across applications, classes, sources, and delivery forms, enabling stakeholders to tailor enzyme solutions with precision.

Regional analysis further emphasizes the diverse market drivers in the Americas, Europe, the Middle East, Africa, and Asia-Pacific, from biofuel adoption incentives to sustainability directives and emerging agri-biotech opportunities. The competitive landscape is characterized by strategic alliances, M&A activities, and digital integration initiatives, illustrating how industry leaders are combining scientific excellence with operational agility. Actionable recommendations reinforce the imperative to leverage AI-driven R&D platforms, diversify manufacturing footprints, and embed sustainability at the core of business models.

In synthesizing these insights, it becomes clear that the enzymes sector will continue to expand its influence across traditional and emerging industries. Organizations that proactively align their R&D strategies, supply chains, and sustainability commitments with market dynamics will be best positioned to unlock the full potential of enzyme applications and secure lasting competitive advantage.

Connect with Ketan Rohom to Secure Your Comprehensive Enzymes Market Research Report and Gain Unparalleled Insights to Drive Strategic Business Growth

To explore the cutting-edge analysis and strategic insights contained in this comprehensive enzymes market research report, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy and gain the specialized guidance necessary to navigate evolving market dynamics, optimize innovation pipelines, and achieve sustained competitive advantage in a rapidly advancing industry landscape

- How big is the Enzymes Market?

- What is the Enzymes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?