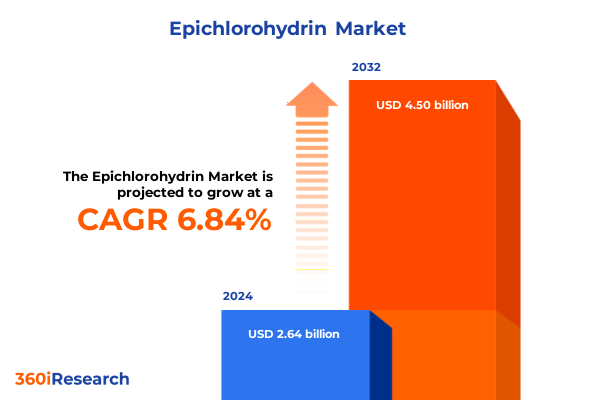

The Epichlorohydrin Market size was estimated at USD 2.83 billion in 2025 and expected to reach USD 3.01 billion in 2026, at a CAGR of 6.82% to reach USD 4.50 billion by 2032.

Framing the Executive Overview of the Diverse Applications, Market Drivers, Regulatory Milestones, and Strategic Imperatives Shaping Epichlorohydrin Usage

Epichlorohydrin has emerged as a cornerstone chemical intermediate, with versatility that spans from advanced polymer production to specialty surfactants. This introduction establishes the critical foundation for understanding how shifting market dynamics, regulatory frameworks, and evolving end-use requirements converge to shape the trajectory of epichlorohydrin applications. By laying out the core landscape of relevance-from performance attributes to compliance mandates-this section sets the stage for a deeper exploration of pivotal industry trends.

As demand patterns continue to evolve in response to global economic recovery and heightened focus on sustainability, the underlying drivers of epichlorohydrin utilization have taken on new dimensions. Technologies aimed at greener synthesis routes and enhanced process efficiency intersect with stringent emission controls, creating both challenges and opportunities. Recognizing these fundamentals is essential for stakeholders seeking to navigate the complex interplay of innovation imperatives and operational constraints that define the modern epichlorohydrin ecosystem.

Unveiling the Transformative Shifts Triggering Innovation in Production Technologies, Sustainability Initiatives, and Supply Chain Resilience for Epichlorohydrin

In recent years, the epichlorohydrin landscape has been reshaped by a wave of transformative shifts that underscore the industry’s commitment to innovation and resilience. Advances in catalytic processes have enabled more efficient feedstock conversions, reducing energy demand and byproduct generation. Concurrently, the rise of bio-based precursors has challenged traditional petroleum-derived pathways, prompting leading producers to pilot alternative synthesis methods that align with corporate sustainability pledges.

Meanwhile, regulatory emphasis on volatile organic compound (VOC) reductions and chlorinated emissions has galvanized investments in closed-loop systems and waste minimization tactics. Supply chain resilience has also become paramount, with companies establishing diversified procurement networks and regional production hubs to mitigate geopolitical uncertainties. Together, these shifts coalesce to drive a new era of agility and value creation, redefining competitive benchmarks across the epichlorohydrin sector.

Analyzing the Complex Web of 2025 United States Tariff Measures and Their Far-Reaching Impact on Epichlorohydrin Trade Dynamics and Cost Structures

The introduction of heightened United States tariff measures in 2025 has profoundly altered the cost and availability of epichlorohydrin imports, particularly from established offshore suppliers. Additional duties imposed under section 301 have elevated landed costs for products sourced from select regions, prompting downstream manufacturers to reassess their procurement strategies. These tariff actions have effectively narrowed the margin between domestic and imported material, driving renewed interest in localized production investments.

As stakeholders contend with escalated import levies, there is a marked shift toward securing domestic capacity and exploring toll-manufacturing partnerships. Refiners and intermediates suppliers are accelerating capacity expansions to capture volumes diverted by tariff incentives, while end users evaluate alternative chemistries to balance performance with price stability. This environment underscores the importance of robust scenario planning, as industry participants navigate a more protected yet complex trade backdrop.

Strategic Insights on How Application Variants, Type Classifications, Functions, End-User Profiles, and Sales Channels Define Epichlorohydrin Market Dynamics

Epichlorohydrin’s multifaceted role across applications such as adhesives, epoxy resin, surfactants, and water treatment unveils a tapestry of user requirements and performance priorities. Within surfactants alone, distinctions between anionic, cationic, and nonionic grades demand precise formulation expertise to optimize functionality. Meanwhile, the dichotomy between high purity and technical grade types continues to shape procurement selection, as purity benchmarks link directly to downstream consistency and product yield.

Functionally, the material serves as both an intermediate in specialty polymer pathways and as a stabilizer in key resin platforms, underscoring its indispensable versatility. Diverse end-use segments-ranging from automotive coatings and construction sealants to electronics encapsulation and oil and gas drilling fluids-reinforce the widespread reliance on tailored epichlorohydrin solutions. Moreover, the dynamic between direct sales agreements and distributor networks influences speed of delivery and service customization, adding another layer to competitive positioning.

This comprehensive research report categorizes the Epichlorohydrin market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Function

- End User

- Sales Channel

- Application

Unraveling Regional Nuances Across the Americas, Europe Middle East Africa, and Asia-Pacific to Illuminate Key Trends in Epichlorohydrin Utilization and Supply

Regional nuances distinctly shape the epichlorohydrin value chain, with the Americas exhibiting robust demand driven by strong adhesives and epoxy resin throughput. Localized manufacturing hubs have enhanced supply security, reinforcing North American producers’ ability to respond swiftly to fluctuating order volumes. In parallel, South American interest in water treatment chemistries has gradually increased, aligned with infrastructure investment programs and water quality regulations.

Across Europe, the Middle East, and Africa, stringent environmental directives have accelerated the adoption of greener production methods, while end users in construction and automotive lean on specialized grades to meet performance certifications. Energy-intensive application hubs in the Middle East further contribute to stable consumption patterns. In Asia-Pacific, rapid expansion in electronics and oil and gas sectors has spurred significant uptake of both intermediate and stabilizer functions, with regional refineries scaling operations to meet localized surges in requirement. Collectively, these regional profiles underscore the importance of granular market understanding and tailored supply frameworks.

This comprehensive research report examines key regions that drive the evolution of the Epichlorohydrin market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

In-Depth Analysis of Leading Industry Players’ Strategic Moves, Partnerships, Innovation Efforts, and Competitive Positioning Shaping the Epichlorohydrin Sector

Leading industry participants have embarked on strategic initiatives encompassing technology alliances, capacity expansions, and portfolio diversification to maintain competitive edge. Some players have integrated upstream raw material sourcing through joint ventures to secure feedstock availability, while others have acquired specialty resin manufacturers to bolster downstream connectivity. Collaboration with research institutes has also been instrumental, enabling the introduction of next-generation epichlorohydrin grades tailored for low-VOC and high-performance applications.

In parallel, strategic partnerships with distributor networks have enhanced global reach, ensuring technical support and inventory optimization for end users. Select firms have piloted green chemistry platforms, positioning their offerings to meet emerging sustainability criteria and differentiate on life-cycle metrics. Such corporate maneuvers illustrate a multifaceted competitive landscape where innovation, integrated value chain control, and strategic alliances converge to redefine market leadership in epichlorohydrin.

This comprehensive research report delivers an in-depth overview of the principal market players in the Epichlorohydrin market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aditya Birla Chemicals

- Daelim Industrial Co., Ltd.

- DAISO Co., Ltd.

- Formosa Plastics Corporation

- Hexion Inc.

- Jiangsu Yangnong Chemical Group Co., Ltd.

- Kashima Chemical Co., Ltd.

- LOTTE Fine Chemical Co., Ltd.

- Momentive Specialty Chemicals Inc.

- Nama Chemicals Company

- Shandong Haili Chemical Industry Co., Ltd.

- Shanghai Huayi Group Corporation

- Solvay SA

- Spolchemie AS

- Sumitomo Chemical Co., Ltd.

- Tamilnadu Petroproducts Limited

- Zaklady Azotowe Kedzierzyn SA

Proactive Leadership Recommendations to Enhance Sustainability, Operational Efficiency, Risk Mitigation, and Growth Across the Epichlorohydrin Value Chain

Industry leaders should proactively evaluate opportunities to diversify feedstock inputs, integrating bio-based or recycled chlorohydrin sources to future-proof supply chains and align with decarbonization goals. Investing in modular process units and advanced catalytic systems can yield both cost efficiencies and reduced environmental footprints. Concurrently, forging collaborative research partnerships with academic institutions will accelerate the development of high-value derivatives, enabling differentiation in competitive end-use markets.

Moreover, establishing transparent risk-monitoring systems that track tariff developments, regulatory shifts, and feedstock pricing volatility will enhance decision-making agility. Strengthening direct customer engagement through digital platforms and custom advisory services can reinforce loyalty and open pathways for value-added service offerings. Together, these measures will empower stakeholders to navigate uncertainty while capitalizing on emergent growth vectors within the epichlorohydrin landscape.

Research Methodology Detailing Data Sources, Analytical Frameworks, Validation Techniques, and Stakeholder Engagement Processes Underpinning the Study

This study synthesizes insights derived from a thorough review of public regulatory filings, technical papers, and peer-reviewed journals, ensuring that data inputs reflect established industry knowledge. Complementary information was obtained through interviews with key stakeholders across the value chain-including producers, distributors, and major end users-to capture real-world operational and strategic perspectives. Industrial trade journals and government databases provided quantitative context regarding production capacities and trade flows.

Analytical frameworks such as SWOT assessment, supply chain mapping, and scenario analysis were employed to evaluate risks and opportunities. Validation techniques included cross-verification of primary interview findings against secondary data sources, followed by peer review with subject matter experts to confirm methodological rigor. These combined approaches ensure that the report’s insights are robust, reliable, and actionable for decision-makers across the epichlorohydrin ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Epichlorohydrin market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Epichlorohydrin Market, by Type

- Epichlorohydrin Market, by Function

- Epichlorohydrin Market, by End User

- Epichlorohydrin Market, by Sales Channel

- Epichlorohydrin Market, by Application

- Epichlorohydrin Market, by Region

- Epichlorohydrin Market, by Group

- Epichlorohydrin Market, by Country

- United States Epichlorohydrin Market

- China Epichlorohydrin Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Critical Findings, Strategic Imperatives, and Industry Reflections to Illuminate the Future Trajectory of Epichlorohydrin Usage and Market Evolution

Through a synthesis of regulatory developments, trade dynamics, and corporate strategies, this executive summary illuminates the core factors influencing epichlorohydrin today. Emerging production technologies and sustainability mandates are reshaping traditional value chains, while tariff measures have underscored the strategic importance of supply security. Segmentation insights reveal how application demands and customer profiles intersect, driving tailored offerings across global markets.

In reflecting on these insights, it becomes clear that the capacity to adapt-whether through innovation, partnership, or strategic investment-will define future success. Stakeholders armed with a nuanced understanding of regional nuances and competitive moves are best positioned to navigate the evolving landscape. Ultimately, this comprehensive perspective serves as the foundation for informed decision making, enabling organizations to harness epichlorohydrin’s versatility for sustained growth.

Engage with Ketan Rohom to Secure Exclusive In-Depth Epichlorohydrin Market Research Insights and Propel Strategic Decision Making for Sustainable Growth

We invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to gain privileged access to the full epichlorohydrin market research report. His expertise and deep engagement with industry decision-makers will ensure you receive tailored insights and actionable intelligence designed to guide your strategic planning. By partnering directly with Ketan, you will unlock in-depth data analysis, competitive assessments, and risk mitigation strategies to support sustainable growth.

Take the next step toward strengthening your competitive advantage and operational resilience. Reach out to Ketan Rohom today to discuss customized research packages that align with your strategic objectives and propel your organization forward in the dynamic epichlorohydrin landscape.

- How big is the Epichlorohydrin Market?

- What is the Epichlorohydrin Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?