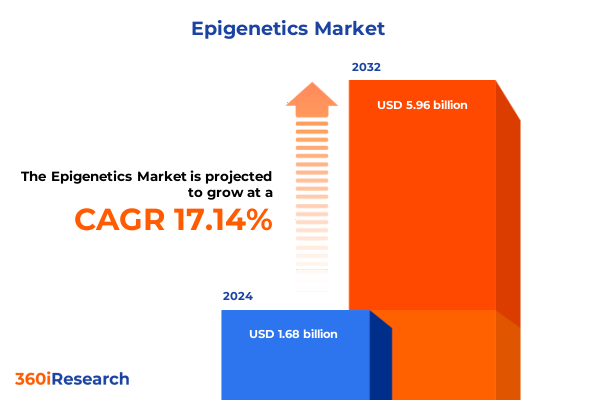

The Epigenetics Market size was estimated at USD 1.94 billion in 2025 and expected to reach USD 2.25 billion in 2026, at a CAGR of 17.33% to reach USD 5.96 billion by 2032.

Unlocking the Pivotal Role of Epigenetic Insights in Shaping the Future of Life Sciences Research and Therapeutic Innovation

Epigenetics has emerged as a transformative field that extends beyond DNA sequence variation to encompass the dynamic regulation of gene expression through chemical modifications. In recent years, breakthroughs in chromatin profiling, high-throughput sequencing, and single-cell analytics have propelled epigenetic research to the forefront of life sciences. Stakeholders across academia, biotechnology, and pharmaceutical companies are increasingly leveraging epigenetic insights to develop novel diagnostics, personalized therapies, and precision agriculture solutions.

As the industry matures, the intersection of innovative methodologies and cross-disciplinary collaboration has become paramount. Advances such as CRISPR-based epigenome editing, non-coding RNA modulation, and artificial intelligence–driven pattern recognition in methylation datasets are reshaping research agendas and investment priorities. Moreover, regulatory agencies are establishing clearer pathways for the clinical translation of epigenetic biomarkers, underscoring the pathway from basic research to marketable products.

This executive summary distills critical developments, market dynamics, and strategic opportunities shaping the global epigenetics ecosystem. By synthesizing transformative shifts, tariff impacts, granular segment analyses, and regional nuances, this document equips decision makers with a concise yet comprehensive overview. It serves as both an entry point for newcomers and a roadmap for established organizations seeking to refine their strategies and capture emerging avenues of growth.

Revolutionizing Epigenetic Research Through Cutting-Edge Technologies and Collaborative Platforms That Propel Scientific Discoveries Beyond Conventional Boundaries

The epigenetics landscape is undergoing a profound metamorphosis as cutting-edge tools and collaborative platforms redefine the boundaries of discovery. Innovations in epigenome editing technologies, particularly CRISPR-based systems capable of locus-specific methylation or histone modification, have opened new horizons for functional genomics. These techniques enable researchers to interrogate gene regulation with unprecedented precision, accelerating target validation across therapeutic areas.

Concurrently, the integration of single-cell resolution assays and spatial epigenomics is furnishing a more nuanced understanding of cellular heterogeneity within complex tissues. This granular perspective is fueling breakthroughs in oncology and neurobiology by revealing epigenetic signatures that were previously undetectable in bulk analyses. The synergy between high-content imaging for chromatin accessibility and next-generation sequencing pipelines is facilitating holistic maps of regulatory landscapes.

Artificial intelligence and machine learning have emerged as critical enablers, automating pattern recognition in large epigenomic datasets and predicting regulatory networks. Cloud-based data management solutions and collaborative portals are streamlining data sharing and reproducibility, while public-private partnerships are bridging gaps between academic insights and commercial development. Together, these transformative shifts are establishing a new paradigm in which epigenetic research is both more comprehensive and more translational.

Evaluating the Far-Reaching Consequences of the 2025 United States Tariff Measures on Epigenetic Supply Chains and Research Ecosystems

In early 2025, the United States introduced a series of targeted tariffs on imported laboratory instruments, reagents, and consumables central to epigenetic research. These measures have reverberated throughout global supply chains, resulting in increased procurement costs for critical enzymes, sequencing instruments, and assay kits. As a consequence, research budgets within academic institutions and small biotechnology firms have faced heightened pressure, prompting many to reevaluate sourcing strategies and timelines for project milestones.

Major instrumentation providers have responded by diversifying manufacturing footprints, investing in domestic production sites, and negotiating preferential terms to mitigate cost escalation. At the same time, reagent suppliers have explored alternative raw-material sourcing, optimized packaging efficiencies, and leveraged local distribution partnerships to stabilize pricing. These adjustments have alleviated some short-term disruptions but underscore the need for long-term strategic resilience against geopolitical fluctuations.

Importers and end users are increasingly collaborating with contract research organizations that possess established local infrastructure to hedge against tariff-induced delays. Such partnerships have catalyzed a rise in shared facilities and consortia models, where cost-sharing and pooled resources enable continuity of high-priority epigenetic projects. Looking ahead, proactive scenario planning and supply-chain risk assessments are becoming indispensable components of R&D programs, ensuring robustness in the face of evolving trade policies.

Decoded Perspectives on Market Segmentation Revealing How Product, Technology, Application, and End Users Influence Epigenetics Industry Dynamics

A nuanced examination of market segmentation reveals how product innovations, technological breakthroughs, varied applications, and diverse end users collectively sculpt the trajectory of epigenetics. Within the spectrum of Consumables & Reagents, enzymes and modification reagents dominate demand for routine epigenetic assays, while kits and assays provide streamlined workflows that cater to researchers seeking faster time-to-result. Instruments, encompassing mass spectrometers, microarray scanners, PCR platforms, and sequencing systems, remain vital for generating high-resolution data, though sequencing systems increasingly command premium investment due to their versatility across multiple epigenomic assays. On the services front, contract research organizations are capitalizing on demand for specialized expertise, and software tools are gaining prominence for advanced data analysis and integration of multi-omics datasets.

From a technological perspective, DNA methylation assays continue to serve as a cornerstone for biomarker discovery, particularly in oncology research and diagnostics. Chromatin accessibility assays are on an upward trajectory, unveiling regulatory elements linked to cellular differentiation and disease progression. Epigenome editing techniques are transitioning from proof of concept to early-phase applications, while histone modification analyses remain essential for elucidating complex regulatory networks. Non-coding RNA profiling has emerged as a complementary approach, unraveling additional layers of epigenetic modulation.

The breadth of applications spans agricultural biotechnology, autoimmune disease research, cardiovascular disease exploration, and infectious disease modeling, with particular emphasis on drug discovery and toxicology studies where epigenetic endpoints are integrated into lead optimization. Within oncology, biomarker discovery, diagnostic development, and therapeutic research form a triad of priorities, each driving distinct demand for tailored epigenetic solutions. End users range from academic and research institutes leveraging foundational science to pharmaceutical and biotechnology companies pursuing translational pipelines, augmented by diagnostic laboratories and contract research organizations that bridge the gap between discovery and clinical implementation.

This comprehensive research report categorizes the Epigenetics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

Navigating Regional Variances in Epigenetic Research Adoption Highlighting Strategic Opportunities Across Americas, EMEA, and Asia-Pacific Markets

Regional disparities in epigenetic research adoption underscore strategic opportunities for stakeholders. In the Americas, a mature ecosystem fortified by substantial government and private research funding underpins robust activity across all epigenetic domains. The presence of leading instrument manufacturers and reagent suppliers further cements North America’s position as an innovation hub, with clinical translation pipelines for epigenetic diagnostics advancing steadily through regulatory pathways.

Across Europe, the Middle East, and Africa, heterogeneous regulatory frameworks coexist with emerging centers of excellence in the United Kingdom, Germany, and select Middle Eastern research initiatives. These regions are characterized by collaborative consortia that leverage pan-regional expertise to tackle complex diseases endemic to local populations. Investment in public health genomics and epigenetics is on the rise, spurring demand for regionally adapted assays and supporting infrastructure.

In the Asia-Pacific region, dynamic growth is driven by government initiatives aimed at bolstering biotechnology capabilities and by a burgeoning network of academic institutions. Countries such as China, India, Japan, and Australia have accelerated investment in epigenetic research, often in collaboration with multinational corporations establishing regional research centers. As these markets scale, local manufacturing and distribution networks are increasingly critical to meet demand and to ensure the sustainability of long-term research initiatives.

This comprehensive research report examines key regions that drive the evolution of the Epigenetics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborations That Are Driving Competitive Advantage and Market Leadership in the Epigenetics Sector

The competitive landscape of the epigenetics sector is defined by established leaders and agile challengers forging strategic collaborations. Instrumentation giants continue to enhance their portfolios with next-generation sequencing platforms optimized for epigenomic assays, while consumable manufacturers refine reagent specificity and throughput. Software providers are advancing user interfaces and analytics pipelines that integrate machine learning to interpret complex epigenomic patterns, offering modular solutions that appeal to both research and clinical customers.

Contract services companies have emerged as vital enablers of end-to-end epigenetic studies, combining laboratory expertise with bioinformatics capabilities. These firms often partner with instrument and reagent suppliers to deliver turnkey solutions that accelerate project timelines. In parallel, biotechnology enterprises focused exclusively on epigenome editing technologies and novel assay formats are attracting venture capital, signaling confidence in next-wave applications of gene regulation tools.

Strategic alliances between stakeholders are becoming increasingly prevalent, with co-development and licensing agreements enabling shared risk and accelerated go-to-market strategies. Collaborative efforts with academic consortia enrich innovation pipelines and facilitate access to diverse sample cohorts. As market complexity intensifies, companies that cultivate flexible business models and nimble product roadmaps will secure competitive advantage in this evolving ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Epigenetics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 10X Genomics, Inc.

- Abcam PLC

- Active Motif, Inc.

- Agilent Technologies, Inc.

- Bio‑Rad Laboratories, Inc.

- CellCentric Ltd.

- Danaher Corporation

- Diagenode s.a.

- Domainex Ltd.

- Element Biosciences, Inc.

- EpiGentek Group Inc.

- Exact Sciences

- F. Hoffmann-La Roche AG

- GeneTex, Inc.

- Illumina, Inc.

- Ipsen Biopharmaceuticals, Inc.

- Merck KGaA

- MorphoSys

- New England Biolabs, Inc.

- Pacific Biosciences

- PerkinElmer, Inc.

- Promega Corporation

- QIAGEN N.V.

- Thermo Fisher Scientific Inc.

- Zymo Research Corp.

Actionable Strategies for Industry Leaders to Harness Epigenetic Innovations, Strengthen Market Position, and Capitalize on Emerging Growth Avenues

To thrive in the dynamic epigenetics landscape, industry leaders must adopt a multifaceted strategic approach. Building resilience against supply chain disruptions requires diversification of sourcing and the establishment of regional manufacturing or distribution hubs. Embracing automation in sample preparation and incorporating digital platforms for real-time monitoring can streamline operations and reduce time-to-result.

Forging alliances with computational and artificial intelligence firms enables the development of integrated solutions that couple advanced analytics with experimental workflows. Joint ventures with contract research organizations can extend service offerings and enhance capacity for complex study designs. Engaging proactively with regulatory bodies to shape guidelines around epigenetic biomarkers and diagnostic assays will facilitate faster approvals and bolster market credibility.

Moreover, targeting high-value segments such as epigenome editing and single-cell applications offers potential for premium pricing and differentiation. Strategic investments in talent development, including training programs in advanced epigenetic methodologies, will sustain innovation pipelines. Finally, maintaining a customer-centric focus by delivering customizable solutions and robust post-sales support will deepen client relationships and foster long-term partnerships.

Comprehensive Research Framework Detailing Methodologies and Analytical Approaches Underpinning Robust Epigenetic Market Insights and Validation Processes

The research underpinning these insights employed a rigorous, multi-tiered methodology combining both secondary and primary data sources. A comprehensive review of peer-reviewed literature, patent filings, industry white papers, and regulatory documentation provided foundational context on emerging technologies, product launches, and policy developments. Trade directories and financial disclosures informed the competitive mapping of manufacturers, reagent suppliers, and service providers.

Primary research included structured interviews with key opinion leaders across academia, pharmaceutical R&D, and contract research organizations. These dialogues yielded qualitative perspectives on market drivers, adoption barriers, and anticipated technological inflection points. Surveys of laboratory managers and principal investigators further quantified preferences in instrumentation, assay selection, and data analysis requirements.

Data triangulation was employed to reconcile disparate inputs, ensuring consistency between reported adoption rates, investment trends, and product pipelines. Validation workshops with senior industry executives were conducted to refine assumptions and stress-test scenarios related to tariff impacts and regional market dynamics. The resulting framework offers a transparent view of analytical underpinnings, enabling stakeholders to understand the basis for conclusions and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Epigenetics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Epigenetics Market, by Product Type

- Epigenetics Market, by Technology

- Epigenetics Market, by Application

- Epigenetics Market, by End User

- Epigenetics Market, by Region

- Epigenetics Market, by Group

- Epigenetics Market, by Country

- United States Epigenetics Market

- China Epigenetics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Consolidated Insights on the Evolution of Epigenetics Research Landscape Emphasizing Core Findings and Strategic Imperatives for Decision Makers

This executive summary has illuminated the dynamic interplay of technological innovation, market segmentation, and geopolitical factors shaping the epigenetics sector. Cutting-edge tools such as epigenome editing and single-cell assays are redefining research capabilities, while trade policies are prompting strategic realignments in global supply chains. Detailed segmentation analysis highlights the varying demands across product categories, technologies, applications, and end users, and regional insights underscore the importance of tailored strategies for mature, emerging, and fast-growth markets.

Competitive pressure is intensified by collaborative models and rapid advancements in analytics, positioning companies that excel in integration and customer engagement for sustained success. The recommended actions emphasize supply chain diversification, strategic partnerships, and regulatory engagement as key levers for growth. This confluence of insights and strategic imperatives provides a holistic view of the epigenetics landscape, equipping decision makers with the tools necessary to navigate complexity and capitalize on emerging opportunities.

Empowering Your Next Strategic Move in Epigenetics Research by Securing Exclusive Market Intelligence with Our Specialized Insights Package

We invite you to secure a competitive edge in the rapidly evolving epigenetics landscape by accessing our comprehensive market intelligence report. This resource offers in-depth analyses, actionable insights, and strategic frameworks designed to guide your decision-making and investment planning. To explore how this research can support your organizational goals and unlock new opportunities, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in translating complex data into clear, targeted strategies ensures that you will derive maximum value from these findings. Reach out today to engage in a tailored discussion about your needs and to gain immediate access to the full report.

- How big is the Epigenetics Market?

- What is the Epigenetics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?