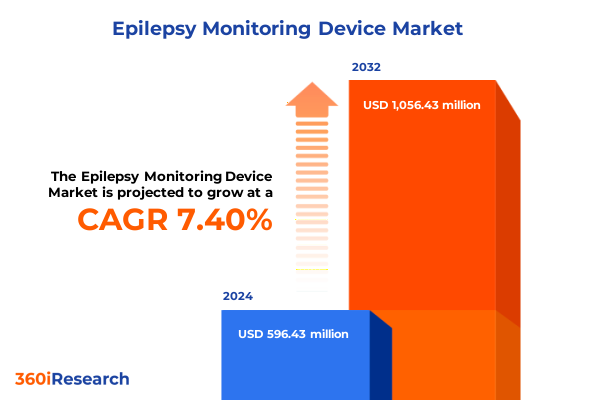

The Epilepsy Monitoring Device Market size was estimated at USD 632.43 million in 2025 and expected to reach USD 671.25 million in 2026, at a CAGR of 7.60% to reach USD 1,056.43 million by 2032.

Unveiling the Evolutionary Trajectory and Emerging Potentials of Epilepsy Monitoring Devices in Today's Healthcare Environment

Epilepsy monitoring has undergone a profound transformation as novel technological modalities converge to enhance diagnostic accuracy and patient quality of life. Historically reliant on inpatient electroencephalogram monitoring within specialized centers, the field now benefits from sophisticated wearable and implantable solutions that enable continuous data collection in everyday settings. This evolution reflects both the maturation of sensor technology and the growing imperative to reduce clinical bottlenecks while expanding access to neurological care.

At the heart of this shift lies an increasing emphasis on minimally invasive and patient-friendly formats that facilitate long-term monitoring without impeding daily activities. Innovations such as headband devices, wrist-worn wearables, and non-invasive EEG caps harness miniaturized electronics and advanced signal-processing algorithms to detect seizure activity in real time. Concurrently, implantable systems leveraging subdural electrodes and vagus nerve stimulation offer adjunctive therapeutic capabilities that integrate monitoring with intervention.

These developments intersect with broader digital health trends, including remote patient management, cloud-based analytics, and machine learning–driven insights. As healthcare providers and device manufacturers navigate regulatory pathways and reimbursement frameworks, the stage is set for a new era of personalized epilepsy care. This introduction establishes the foundational context for understanding the multifaceted landscape of epilepsy monitoring devices and underscores the strategic importance of informed decision-making in this rapidly evolving domain.

Navigating the Pivotal Technological Breakthroughs and Paradigm Shifts Redefining Epilepsy Monitoring Device Capabilities and Clinical Integration

Over the past decade, epilepsy monitoring has been propelled forward by a cascade of technological breakthroughs that extend beyond incremental improvements. Sensor miniaturization has given rise to devices that are both discreet and powerful, enabling continuous electroencephalographic data capture without constraining user mobility. Moreover, integration of wireless communication protocols and edge computing capabilities ensures that high-fidelity neural signals can be transmitted and analyzed in near real time, mitigating the latency challenges inherent in traditional on-site monitoring.

In parallel, advances in artificial intelligence and machine learning have unlocked new possibilities in predictive analytics. Pattern recognition algorithms trained on vast data sets can now differentiate between seizure subtypes with remarkable precision, supporting clinicians in tailoring therapeutic regimens. Furthermore, hybrid monitoring–treatment platforms, such as those integrating vagus nerve stimulation thresholds with adaptive feedback loops, exemplify the convergence of monitoring and intervention into unified systems. Regulatory agencies have increasingly embraced these disruptive solutions, fostering expedited pathways for devices that demonstrate robust safety and efficacy profiles.

Equally transformative is the shift toward patient-centric care models that leverage telehealth platforms to bridge geographical barriers. Remote monitoring not only reduces the burden on epilepsy centers but also empowers patients to engage proactively in their treatment regimens. As interoperability standards mature and cybersecurity measures strengthen, the clinical integration of these advanced monitoring devices gains momentum, heralding a paradigm shift in how epilepsy is managed across care settings.

Assessing the Ripple Effects of 2025 United States Tariff Adjustments on Supply Chains Production Costs and Accessibility of Epilepsy Monitoring Devices

The implementation of revised United States tariffs in early 2025 has introduced a layer of complexity to the global supply chain dynamics underpinning epilepsy monitoring device production. Components such as specialized semiconductors, high-precision sensors, and biocompatible materials often originate from key manufacturing hubs in Asia-Pacific regions. With increased duties applied to these imports, device producers have encountered elevated procurement expenses that reverberate through cost structures and pricing models.

Simultaneously, strategic procurement teams have begun to diversify supplier networks, exploring nearshoring options and domestic partnerships to buffer against tariff volatility. This shift has generated new collaborations with North American suppliers capable of meeting stringent quality standards, albeit with longer development lead times. In response to escalating import costs, manufacturers are also optimizing internal supply chain logistics by consolidating shipments and negotiating volume discounts, thereby seeking to offset the impact of added duties.

Beyond production considerations, the tariff adjustments have influenced downstream distribution and patient accessibility. Stakeholders have engaged with policy advocacy groups to articulate the clinical benefits of maintaining affordable device pricing, citing potential adverse effects on patient adherence and long-term health outcomes. Moreover, several industry leaders are exploring cost-sharing arrangements through value-based agreements, ensuring that end users face minimal economic barriers. Collectively, these adaptive strategies illustrate a resilient ecosystem that continues to prioritize innovation and patient engagement despite evolving trade landscapes.

Deciphering Market Segmentation Dynamics Spanning Technology Monitoring Methods End User Environments Distribution Strategies and Clinical Applications

A nuanced understanding of epilepsy monitoring device segmentation unveils critical drivers of both technological evolution and adoption patterns. Within technology categories, implantable devices offer deep neural interfacing through subdural electrodes and programmable vagus nerve stimulators, catering to patients requiring continuous intracranial assessment and therapeutic modulation. Conversely, non-invasive devices employ EEG caps and scalp electrodes that enable periodic or continuous neural waveform capture with minimal procedural risk. Wearable devices, exemplified by ergonomic headband systems and discreet wrist-worn sensors, bridge the gap between clinical precision and everyday usability, reflecting patient preferences for non-obtrusive monitoring.

Monitoring type further delineates device utilization, with continuous monitoring solutions emerging as essential for high-risk patients to detect subclinical seizures and inform therapy adjustments. Intermittent monitoring, on the other hand, remains valuable for diagnostic clarification during episodic events or routine follow-up assessments. End user segmentation reveals that ambulatory centers favor advanced implantable and continuous monitoring systems supported by clinical infrastructure, while homecare settings increasingly adopt wearable and non-invasive tools that empower self-managed care. Hospitals and clinics continue to integrate a spectrum of device modalities, leveraging robust support services and multidisciplinary teams.

Distribution channel analysis indicates that direct sales relationships facilitate customized device configurations and comprehensive training, whereas online sales platforms expand reach to underserved regions and streamline procurement. In clinical applications, diagnostic monitoring instruments specialize in epilepsy disorder diagnosis and pre-surgical evaluation, providing definitive insights for treatment planning. Therapeutic monitoring platforms emphasize seizure management protocols and compliance tracking, enabling clinicians to refine stimulation parameters and evaluate patient adherence. By synthesizing these segmentation layers, stakeholders can identify synergistic opportunities and tailor strategies to emerging clinical and operational requirements.

This comprehensive research report categorizes the Epilepsy Monitoring Device market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Monitoring Type

- End User

- Distribution Channel

- Application

Comparative Outlook on Regional Demand Patterns Regulatory Environments and Adoption Trajectories Across Major Global Markets

Regional dynamics significantly shape the development and uptake of epilepsy monitoring devices, reflecting the interplay of regulatory frameworks, healthcare infrastructure maturity, and patient access initiatives. In the Americas, robust reimbursement policies, coupled with a concentrated network of leading research institutions, have accelerated clinical trials and post-market surveillance of advanced monitoring technologies. This environment has fostered early adoption of integrated platforms that combine diagnostic and therapeutic functionalities, while patient support programs mitigate cost barriers.

In Europe, Middle East, and Africa, regulatory harmonization efforts under the European CE marking system have streamlined approvals for non-invasive and implantable devices, prompting manufacturers to prioritize these markets. Select EMEA countries have established center-of-excellence networks that champion remote monitoring pilots, leveraging telemedicine to connect urban and rural populations. Meanwhile, Middle Eastern investment in digital health infrastructure has spurred pilot projects that integrate wearable sensors with national health records, offering scalable models for broader deployment. In Africa, partnerships between global device providers and local healthcare NGOs have begun to address infrastructural gaps, introducing portable EEG solutions in resource-constrained areas.

Asia-Pacific exhibits pronounced growth driven by expanding neurology clinics, rising digital health adoption, and supportive government health initiatives. Japan and South Korea lead in domestic R&D and regulatory approvals for next-generation implantable systems, while China’s manufacturing capabilities and large patient population underpin extensive real-world data collection. Emerging markets such as India and Southeast Asia are embracing low-cost wearable devices and telehealth services to overcome specialist shortages and geographical barriers. Across these regions, localized partnerships and tailored reimbursement schemes underscore the importance of region-specific strategies in advancing patient care and device accessibility.

This comprehensive research report examines key regions that drive the evolution of the Epilepsy Monitoring Device market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Alliances Product Innovations and Competitive Posturing of Prominent Stakeholders in the Epilepsy Monitoring Device Sector

Inspection of key industry participants reveals a landscape marked by strategic alliances, targeted acquisitions, and robust product pipelines. Leading medical device firms continue to invest significantly in research alliances with academic centers, driving innovations in sensor fidelity and neuromodulation algorithms. Meanwhile, specialized technology start-ups leverage their agility to introduce disruptive wearable platforms that rapidly attract venture funding and strategic partnerships with established corporations. These collaborative models facilitate accelerated time to market and broadened geographical coverage.

Product innovation remains central to competitive differentiation. High-profile launches of next-generation subdural electrode arrays and adaptive vagus nerve stimulators underscore the commitment to improving both therapeutic efficacy and safety profiles. Equally, companies specializing in non-invasive monitoring have expanded their offerings with enhanced EEG caps featuring dry electrodes and advanced noise-reduction filters, addressing key usability challenges. Wearable device manufacturers continue to refine form factors, embedding respiration and heart rate monitoring alongside seizure detection to deliver comprehensive physiological insights.

Beyond technology, market leaders differentiate through service models that integrate remote patient monitoring platforms, data analytics dashboards, and clinician training modules. Some enterprises have established dedicated hubs for customer support and technical education, reinforcing loyalty and ensuring optimal device utilization. Additionally, regulatory expertise and quality management systems have emerged as critical assets, enabling swift market entry across diverse jurisdictions. Through these concerted efforts, prominent stakeholders reinforce their competitive positioning while shaping the broader ecosystem of epilepsy monitoring solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Epilepsy Monitoring Device market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ambu A/S

- Cadwell Industries, Inc.

- Ceribell Inc.

- Compumedics Limited

- Koninklijke Philips N.V.

- Micromed S.r.l.

- Natus Medical Incorporated

- NeuroPace, Inc.

- NeuroWave Systems Inc.

- Nihon Kohden Corporation

- The Magstim Co. Ltd.

Strategic Roadmap for Industry Leaders Emphasizing Collaborative Innovation Regulatory Engagement Patient-Centric Deployment and Supply Chain Resilience

To capitalize on the evolving landscape of epilepsy monitoring, industry leaders must adopt a multi-pronged strategic approach that aligns technological innovation with regulatory foresight and patient needs. Initially, companies should invest in collaborative research initiatives that bring together neuroscience experts, data scientists, and user experience designers to co-create devices that balance clinical precision with ease of use. Moreover, proactive engagement with regulatory bodies can expedite approval pathways, particularly for novel combinations of monitoring and therapeutic functions.

In tandem, forging partnerships with telehealth providers and digital health platforms will enable seamless integration of remote monitoring data into electronic health record systems, thereby enhancing care coordination. Companies are advised to prioritize patient-centric deployment strategies by establishing training programs, patient education modules, and adherence support services that foster long-term engagement. Such initiatives not only improve clinical outcomes but also generate valuable real-world evidence to inform subsequent iterations of device design.

Supply chain resilience must also feature prominently in strategic planning. Diversifying component sourcing and exploring localized manufacturing options can mitigate risks associated with tariff fluctuations and global disruptions. Furthermore, embracing value-based contracting models with healthcare payers can facilitate shared-risk frameworks, aligning device performance incentives with patient health outcomes. Collectively, these recommendations offer a coherent roadmap for stakeholders aiming to deliver cutting-edge epilepsy monitoring solutions while navigating regulatory complexities and market uncertainties.

Transparent Overview of the Comprehensive Research Framework Underpinning Data Collection Validation and Analytical Integrity

The research methodology underpinning this executive summary encompasses a rigorous blend of qualitative and quantitative techniques designed to ensure comprehensive coverage and analytical robustness. Secondary research involved systematic reviews of peer-reviewed journals, regulatory filings, and clinical trial registries to establish a foundational understanding of technological advancements and therapeutic impact. In parallel, primary research included structured interviews with neurologists, device engineers, regulatory specialists, and procurement professionals to capture firsthand insights into market dynamics and adoption barriers.

Data triangulation was employed to validate findings against multiple sources, reconciling discrepancies through iterative cross-referencing and expert consultations. Detailed mapping of supply chain nodes and tariff schedules provided context for assessing the implications of policy changes on device availability. Segmentation analyses were grounded in predefined criteria-technology type, monitoring modality, end user environment, distribution channel, and application focus-ensuring consistency in categorization and interpretation. Geographic intelligence was enhanced via region-specific case studies and stakeholder feedback panels, offering granularity in understanding local regulatory nuances and healthcare infrastructure constraints.

Analytical integrity was maintained through adherence to established validation protocols, including outlier detection, consistency checks, and scenario testing. Confidential stakeholder contributions were anonymized and aggregated, preserving the integrity of proprietary information while enriching the overall insight quality. This transparent framework provides a robust foundation for the conclusions and recommendations presented herein, enabling stakeholders to navigate the complexities of the epilepsy monitoring device ecosystem with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Epilepsy Monitoring Device market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Epilepsy Monitoring Device Market, by Technology

- Epilepsy Monitoring Device Market, by Monitoring Type

- Epilepsy Monitoring Device Market, by End User

- Epilepsy Monitoring Device Market, by Distribution Channel

- Epilepsy Monitoring Device Market, by Application

- Epilepsy Monitoring Device Market, by Region

- Epilepsy Monitoring Device Market, by Group

- Epilepsy Monitoring Device Market, by Country

- United States Epilepsy Monitoring Device Market

- China Epilepsy Monitoring Device Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesis of Core Findings and Strategic Imperatives Shaping the Future Evolution of Epilepsy Monitoring Solutions

This analysis synthesizes critical insights across technological innovations, regulatory developments, tariff impacts, segmentation dynamics, regional trends, and competitive strategies, revealing a field that is both dynamic and resilient. Transformative shifts in sensor design, data analytics, and telehealth integration are redefining clinical workflows and patient experiences. At the same time, emerging trade policy adjustments underscore the necessity for supply chain agility and diversified procurement approaches.

Segmentation insights highlight the distinct value propositions of implantable, non-invasive, and wearable devices across continuous and intermittent monitoring contexts, accommodated by a range of end users from ambulatory centers to homecare settings. Distribution strategies and clinical applications further nuance these dynamics, pointing to targeted opportunities for customizable solutions. Regional considerations emphasize the importance of tailored market entry strategies, regulatory alignment, and local partnerships to drive adoption in the Americas, EMEA, and Asia-Pacific.

Competitive positioning analysis underscores the role of strategic alliances, product differentiation, and service-oriented models in maintaining market leadership. Drawing on these findings, stakeholders are equipped with actionable recommendations that balance innovation imperatives with patient-centric care and regulatory compliance. Ultimately, the evolving ecosystem of epilepsy monitoring devices offers significant potential to improve clinical outcomes, foster patient empowerment, and reshape the management of neurological disorders on a global scale.

Empower Your Strategic Planning with Personalized Insights – Connect with Ketan Rohom to Secure Comprehensive Epilepsy Monitoring Device Market Research

For industry leaders seeking to deepen their understanding of the epilepsy monitoring device landscape and leverage actionable intelligence, tailored support is available. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive market research report can inform your strategic initiatives. By partnering early, you can access detailed analyses, proprietary case studies, and expert perspectives designed to accelerate product development, optimize market entry, and enhance stakeholder engagement. Reach out today to obtain a full copy of the executive summary, gain exclusive insights into emerging trends, and chart a course toward sustainable growth in the epilepsy monitoring domain.

- How big is the Epilepsy Monitoring Device Market?

- What is the Epilepsy Monitoring Device Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?