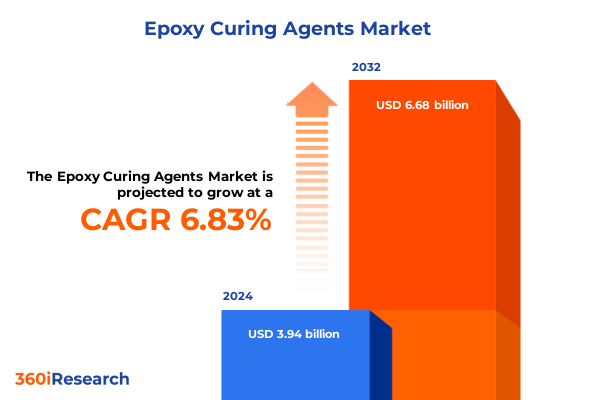

The Epoxy Curing Agents Market size was estimated at USD 4.19 billion in 2025 and expected to reach USD 4.46 billion in 2026, at a CAGR of 6.88% to reach USD 6.68 billion by 2032.

Unveiling the Crucial Role of Epoxy Curing Agents in Modern Industries and Their Pivotal Function in Performance-Driven Applications

Epoxy curing agents serve as the essential catalysts that transform raw epoxy resins into durable, high-performance materials used across diverse industries. These reactive chemicals initiate a cross-linking process that profoundly influences the mechanical strength, thermal stability, chemical resistance, and adhesion properties of final products. As the backbone of adhesives, coatings, and composites, curing agents unlock the remarkable versatility of epoxy systems, enabling engineers and formulators to tailor performance characteristics to exacting specifications.

In recent years, the expanding demand for lightweight composites in aerospace and automotive sectors, coupled with stringent environmental regulations targeting volatile organic compounds, has intensified the focus on advanced curing chemistries. From aliphatic and aromatic amines to novel phenalkamine structures, manufacturers are pursuing innovations that balance reactivity, pot life, and sustainability. Meanwhile, the drive toward electrification and renewable energy infrastructure has elevated the importance of epoxy systems that can withstand elevated temperatures and harsh operating environments.

This executive summary introduces the critical role of curing agents in shaping market dynamics, highlights transformative shifts that are redefining the competitive landscape, and outlines strategic insights designed to guide stakeholders through a period of robust technological advancement and evolving regulatory constraints.

Exploring the Technological Advancements and Sustainability Imperatives Redefining the Epoxy Curing Agent Market and Driving Unprecedented Innovation

The epoxy curing agent market is undergoing a profound transformation driven by intersecting forces of technological innovation and sustainability imperatives. On the technological front, the emergence of bio-derived amine alternatives and low-temperature curing systems is enabling formulators to meet performance requirements while reducing environmental impact. These new chemistries, often based on renewable feedstocks, deliver comparable mechanical properties to traditional petrochemical-derived counterparts, marking a pivotal shift toward greener formulations.

Simultaneously, end-users are demanding faster turnaround times and energy-efficient processing, prompting widespread adoption of rapid-curing and one-component systems. Digitalization of the value chain, from computational formulation development to real-time process monitoring, is further accelerating product innovation cycles. As a result, strategic collaborations between chemical manufacturers, research institutes, and equipment suppliers have proliferated, fostering an ecosystem that can rapidly commercialize breakthroughs in nanoparticle-modified curing agents and UV-activated systems.

Transitioning to these advanced solutions requires careful balancing of pot life, cure schedule, and end-use performance. Nevertheless, the market momentum clearly indicates that sustainability and process efficiency are no longer peripheral concerns-they are now central drivers of product development strategies and competitive differentiation across the entire epoxy curing agent landscape.

Assessing How Recent United States Tariff Policies Have Altered Supply Chains Cost Structures and Strategic Sourcing Decisions in 2025

In 2025, the imposition of new tariff measures by the United States government has introduced significant complexity into the epoxy curing agent supply chain. Raw material costs, particularly for imported specialty amines and anhydrides, have experienced upward pressure as import duties increase landed costs for formulators. These changes have compelled manufacturers to reevaluate sourcing strategies, shifting some procurement toward domestic producers or alternative low-tariff regions to mitigate financial impact.

As a result, supply chain resilience has become a strategic priority. Companies are accelerating investments in local production capacities and forging agreements with regional suppliers in Asia-Pacific and Europe to diversify procurement channels. This trend has led to the renegotiation of long-term contracts, as end-users seek to secure stable pricing and guarantee uninterrupted supply. Meanwhile, the increased cost base is gradually being absorbed through price adjustments and the introduction of value-added formulations that justify premium positioning in end-use markets.

Despite the immediate challenges posed by these policy changes, the market has responded with a wave of operational optimizations. Enhanced logistics planning, consolidated shipping routes, and advanced inventory management systems are helping stakeholders to cushion the effects of tariff-induced cost fluctuations. Over time, these adaptations are expected to bolster the longevity and stability of supply networks, ensuring that the industry remains agile amidst evolving trade policies.

Delving into Product Forms Application Verticals and Industry Uses That Shape Demand Patterns and Performance Requirements for Epoxy Curing Agents

Demand patterns for epoxy curing agents are intricately linked to the underlying chemistry of each product category and the specific performance attributes they confer. Amine-based curing agents remain the predominant choice, spanning aliphatic, aromatic, cycloaliphatic, and polyamide variations that deliver a spectrum of cure speeds and temperature tolerances. Anhydride-based systems continue to find favor in high-temperature applications, whereas mercaptans and emerging phenalkamines are carving out niches where flexibility and rapid reactivity are paramount.

Form factors also play a critical role in shaping procurement and processing decisions. Liquid curing systems dominate when rapid mixing and ease of handling are required, while powder and solid variants are preferred in scenarios demanding extended shelf life and precise dosing. These distinctions underscore the importance of aligning form selection with manufacturing workflows and end-use performance targets.

Application segmentation further illuminates market nuances. Adhesive formulations bifurcate into non-structural and structural products, each tailored to bonding requirements across industries. Industrial, marine, and protective coatings leverage specialized curing agents to achieve corrosion resistance, UV stability, and extended service life. In the composites arena, aerospace and automotive composites rely on curing chemistries that balance lightweight construction with exceptional mechanical robustness.

At the industry level, aerospace and defense procures high-performance agents certified for rigorous standards, automotive and transportation prioritizes fast cure cycles to support just-in-time production, while construction and electrical and electronics segments drive demand for coatings and insulating materials that deliver safety, durability, and reliability.

This comprehensive research report categorizes the Epoxy Curing Agents market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Application

- End Use Industry

Examining Regional Dynamics Across the Americas EMEA and Asia Pacific That Influence Adoption Trends Regulatory Environments and Competitive Landscapes

Regional dynamics exert a powerful influence on the adoption and evolution of epoxy curing agents. In the Americas, advanced manufacturing hubs in North America are driving demand for high-performance systems in aerospace, automotive, and electronics applications, underpinned by regulatory incentives for energy-efficient processes. Latin American markets are witnessing gradual uptake of structural adhesives and protective coatings as infrastructure and automotive production expand.

Europe, the Middle East, and Africa present a diverse tapestry of regulatory frameworks and end-use requirements. Stringent environmental standards in Western Europe have accelerated the transition to low-VOC and bio-based curing solutions, while growth opportunities in the Middle East are fueled by large-scale construction and oil and gas projects. In Africa, emerging manufacturing clusters are gradually incorporating epoxy-based coatings for corrosion protection in infrastructure development.

Across Asia Pacific, robust industrialization in China and India continues to bolster demand for both standard and specialty curing agents. Technological advancement in Japan and South Korea is driving adoption of UV-cure and rapid-cycle systems, while Southeast Asia represents a burgeoning market for cost-effective formulations in the coatings and adhesives sectors. Together, these regional dynamics underscore the critical importance of localized product development, tailored regulatory compliance strategies, and agile supply chain networks.

This comprehensive research report examines key regions that drive the evolution of the Epoxy Curing Agents market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Market Participants Strategies Partnerships and Innovations Driving Competitive Differentiation in the Epoxy Curing Agent Sector

The competitive landscape for epoxy curing agents is characterized by a blend of global chemical conglomerates and specialized niche producers. Leading participants are leveraging integrated supply chain models to secure raw materials and drive economies of scale. At the same time, nimble innovators are focusing on differentiated chemistries-such as renewable feedstock amines and hybrid curing technologies-to carve out premium market positions.

Strategic partnerships between curing agent manufacturers and resin suppliers have become increasingly prevalent, enabling co-development of tailored formulations that optimize adhesion, cure kinetics, and end-use performance. Investment in proprietary catalysts and additive packages further distinguishes top players, allowing them to offer turnkey solutions that accelerate application development cycles.

In addition, capacity expansions in key geographies are shaping market share dynamics. Several firms have announced new production lines in North America and Asia Pacific, strategically located to serve burgeoning demand centers and mitigate logistical constraints. These expansions are often accompanied by technology transfers and joint ventures, reflecting a shared objective of balancing local responsiveness with global expertise.

Ultimately, competitive differentiation hinges on the ability to innovate sustainably, respond rapidly to end-user requirements, and maintain robust quality assurance protocols-all factors that define leadership in the fast-evolving epoxy curing agent sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Epoxy Curing Agents market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A&C Catalysts Inc.

- Adeka Corporation

- Aditya Birla Group

- Air Products and Chemicals, Inc.

- Atul Ltd.

- BASF SE

- Cardolite Corporation

- Cargill, Incorporated

- DIC Corporation

- EMS-Griltech

- Epoxy Base Electronic Material Corporation Ltd.

- Evonik Industries AG

- Hexion Inc.

- Huntsman Corporation

- King Industries, Inc.

- Kukdo Chemical Co., Ltd.

- Kumho P&B Chemicals Inc.

- Mitsubishi Chemical Corporation

- Mitsubishi Gas Chemical Company, Inc.

- Momentive Specialty Chemicals Inc.

- Nippon Shokubai Co., Ltd.

- Olin Corporation

- Polynt Reichhold Group

- Royce International

- Shandong Deyuan Epoxy Resin Co., Ltd.

- Sika Group

- Tetra-Chem Industries Ltd.

- The Dow Chemical Company

Outlining Strategic Initiatives for Industry Executives to Leverage Market Trends Navigate Challenges and Capitalize on Emerging Growth Opportunities

Industry leaders are advised to prioritize innovation pipelines that emphasize both environmental sustainability and process efficiency. Investing in research initiatives focused on bio-based and low-temperature cure chemistries will not only address tightening regulatory requirements but also resonate with customers seeking greener solutions. Collaborative R&D partnerships can accelerate time-to-market for these next-generation agents, leveraging expertise across chemistry, engineering, and application domains.

Strengthening supply chain resilience through diversification is equally imperative. Executives should evaluate opportunities to establish regional production hubs and secure alternative raw material sources to hedge against geopolitical disruptions and tariff fluctuations. Advanced analytics and digital logistics platforms can further optimize inventory management and demand forecasting, reducing the impact of market volatility.

To capture emerging segment opportunities, companies should develop targeted offerings for high-growth applications such as electric vehicle battery encapsulation and wind energy composites. Aligning product portfolios with industry-specific performance standards will enhance competitive positioning and justify premium pricing. Moreover, integrating service-oriented models-such as technical support, on-site formulation assistance, and rapid prototyping capabilities-can foster deeper customer partnerships and drive long-term loyalty.

Detailing the Comprehensive Research Framework Employed to Gather Analyze and Validate Data on Epoxy Curing Agents for Robust Market Intelligence

This research employs a multilayered methodology combining extensive secondary research with rigorous primary data collection. The initial phase involved comprehensive review of scientific literature, patent filings, and regulatory filings to establish a foundational understanding of curing agent technologies and market drivers. This was complemented by analysis of trade data to map global supply chain flows and tariff impacts.

In parallel, confidential interviews were conducted with senior R&D leaders, procurement executives, and technical application specialists across the epoxy resin ecosystem. These one-on-one discussions provided nuanced insights into formulation challenges, performance benchmarks, and evolving customer preferences. Responses were triangulated with quantitative survey data gathered from a broad sample of end-use industry stakeholders, enabling a robust cross-validation of key trends.

Advanced analytical techniques, including regression analysis and scenario modeling, were applied to assess the relationship between macroeconomic variables, raw material price fluctuations, and adoption patterns of specific curing systems. Throughout the process, stringent data quality protocols were enforced, ensuring that findings are both reliable and representative of current market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Epoxy Curing Agents market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Epoxy Curing Agents Market, by Type

- Epoxy Curing Agents Market, by Form

- Epoxy Curing Agents Market, by Application

- Epoxy Curing Agents Market, by End Use Industry

- Epoxy Curing Agents Market, by Region

- Epoxy Curing Agents Market, by Group

- Epoxy Curing Agents Market, by Country

- United States Epoxy Curing Agents Market

- China Epoxy Curing Agents Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Core Findings and Strategic Imperatives That Will Guide Stakeholders Towards Effective Decision-Making and Value Creation in Epoxy Curing Agents

The epoxy curing agent market stands at a crossroads of innovation and regulatory evolution. Recent advancements in sustainable chemistries and rapid-cure technologies have unlocked new application possibilities, while shifting trade policies and raw material constraints have underscored the importance of supply chain agility. Segmentation analysis reveals that targeted product differentiation and regional customization are key to capturing value in specialized end-use segments.

Regional insights highlight the emergence of Asia Pacific as a growth engine, even as North America and Europe redefine performance benchmarks through stringent environmental standards and advanced manufacturing protocols. Competitive positioning will increasingly hinge on the ability to integrate sustainability credentials with high-performance formulations, supported by robust technical service offerings.

As stakeholders navigate this dynamic landscape, strategic alignment of R&D investments, supply chain diversification, and go-to-market approaches will determine success. By synthesizing these insights, decision-makers can chart a course toward resilient growth, leveraging the transformative potential of epoxy curing agents to address evolving industry demands.

Engage with Ketan Rohom Associate Director Sales Marketing to Secure Your Market Insights Report on Epoxy Curing Agents and Drive Informed Investment Decisions

Engaging directly with Associate Director Sales & Marketing Ketan Rohom offers an unparalleled opportunity to obtain a comprehensive and actionable market insights report on epoxy curing agents. This exclusive research delivers in-depth analysis of emerging trends, regional dynamics, segmentation nuances, and strategic imperatives tailored for decision-makers seeking to stay ahead in a rapidly evolving market. By partnering with Ketan Rohom, stakeholders can access tailored briefings and expert guidance to translate complex data into clear business strategies.

Whether you represent a specialty chemicals manufacturer, an end-use industry leader in coatings or composites, or an investment firm evaluating growth opportunities, this report will equip you with the knowledge required to make informed investment, product development, and supply chain decisions. Reach out today to secure your copy and unlock insights that can drive innovation, optimize sourcing strategies, and enhance competitive positioning in the epoxy curing agent sector.

- How big is the Epoxy Curing Agents Market?

- What is the Epoxy Curing Agents Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?