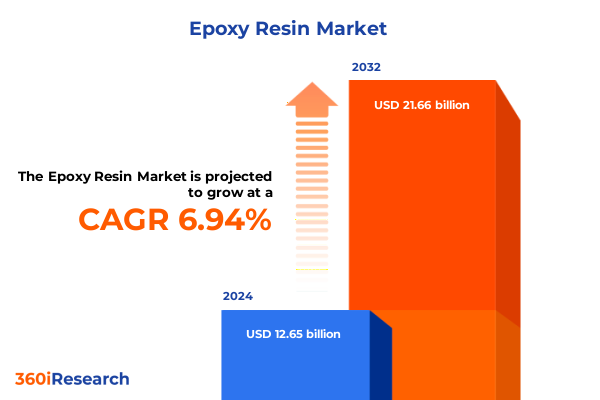

The Epoxy Resin Market size was estimated at USD 13.55 billion in 2025 and expected to reach USD 14.43 billion in 2026, at a CAGR of 6.93% to reach USD 21.66 billion by 2032.

Unveiling the Foundations of Epoxy Resin Dynamics to Illuminate Market Drivers, Core Applications, and Emerging Opportunities in a Rapidly Evolving Industry

Epoxy resins stand at the forefront of advanced polymer materials due to their exceptional mechanical strength, chemical resistance, and electrical insulating properties. As thermosetting polymers, they cure into rigid, durable networks that serve as the backbone for critical applications across aerospace, automotive, and renewable energy sectors. The convergence of burgeoning performance requirements and sustainability imperatives has propelled epoxies into new realms of innovation, fueling investment in research around bio-based precursors and recycling methodologies.

Transitioning from traditional thermosets, modern epoxy formulations increasingly integrate functional additives, nanoparticles, and novel curing agents to tailor properties such as thermal stability, adhesion, and toughness. These advancements have not only broadened the application scope to include fiber-reinforced composites and high-performance coatings but also enhanced competitive differentiation among resin manufacturers. Concurrently, stringent environmental regulations and growing demand for low-VOC coatings have catalyzed the adoption of waterborne and solvent-free epoxy systems, underscoring the market’s evolution toward greener chemistries.

Looking ahead, converging macroeconomic factors and technological breakthroughs herald a dynamic phase for the epoxy resin landscape. Strategic collaborations among chemical producers, end users, and research institutions are shaping a collaborative ecosystem that balances cost efficiency with performance innovation. This introduction lays the groundwork for a comprehensive exploration of supply chain dynamics, tariff impacts, and segmentation nuances that will inform decision makers aiming to capitalize on emerging opportunities.

Charting Transformative Innovations and Disruptive Technological Shifts That Are Redefining Performance, Sustainability, and Competitive Landscapes Across the Epoxy Resin Market

In recent years, the epoxy resin landscape has undergone transformative shifts driven by both technological breakthroughs and evolving end-user expectations. Advanced curing agents, such as latent hardeners and dual-cure systems, have enabled formulators to achieve faster gel times and improved pot life, reducing processing costs and enhancing throughput. At the same time, the rise of functionalized nanoparticles and organo-modified clays has unlocked new performance frontiers, from enhanced thermal conductivity for electronics packaging to self-healing capabilities in high-stress structural composites.

Parallel to these material innovations, digitalization and Industry 4.0 principles have permeated resin manufacturing and application processes. Real-time monitoring of viscosity, cure kinetics, and ambient conditions via sensor arrays allows for precise control over reaction pathways, resulting in consistent product quality and reduced waste. Moreover, predictive analytics and machine learning models are streamlining R&D by accelerating formulation optimization, thereby compressing timeline-to-market and enabling rapid iteration on customized resin solutions.

Collectively, these technological and digital accelerants are redefining competitive landscapes within the epoxy resin market. Manufacturers that integrate smart production platforms, invest in sustainable feedstocks, and forge cross-industry partnerships are achieving distinct advantages in cost structure, product differentiation, and regulatory compliance. As a result, resilience and agility have become the new benchmarks for success in an arena where performance expectations and environmental mandates continue to intensify.

Assessing the Ramifications of United States Tariff Adjustments in 2025 on Supply Chains, Cost Structures, and Competitive Positioning Within the Epoxy Resin Value Chain

The introduction of revised tariffs by the United States in 2025 has exerted profound influence on global epoxy resin supply chains, compelling stakeholders to reassess sourcing strategies and cost structures. With duties imposed on select resin imports, domestic producers gained immediate pricing leverage, yet downstream formulators faced margin pressures as raw material costs surged. This realignment prompted increased nearshoring efforts, as manufacturers sought to mitigate tariff exposure by relocating production closer to key U.S. end markets.

Concurrently, the tariff landscape spurred intensified dialogues around vertical integration, as major chemical companies evaluated the benefits of upstream resin synthesis alongside specialty downstream formulation capabilities. By consolidating supply, these entities aimed to buffer volatility and retain better cost predictability. However, smaller formulators and niche compounders encountered constraints, as restricted access to competitively priced feedstocks hampered innovation cycles and product development timelines.

Overcoming these challenges, market participants diversified their procurement channels, exploring partnerships with producers in non-tariff-impacted regions such as Southeast Asia and Latin America. While this reconfiguration introduced logistical complexities, it also fostered resilience by broadening the supplier base. As the industry adapts, the cumulative tariff impact underscores the criticality of agile supply chain management and proactive policy monitoring to sustain growth and protect profitability in an increasingly protectionist trade environment.

Deep Diving into Diverse Segmentation Perspectives to Uncover Nuanced Insights Across Resin Types, Forms, Applications, End Users, and Distribution Pathways

Analyzing the epoxy resin market through the prism of resin types reveals distinct performance and application paradigms for aliphatic, bisphenol A, bisphenol F, and novolac chemistries. Aliphatic variants deliver superior UV stability, making them ideal for outdoor coatings, while bisphenol A resins provide a balanced profile of mechanical strength and adhesion suited for structural adhesives. Bisphenol F grades, with their lower viscosity and enhanced chemical resistance, find favor in high-temperature applications, and novolac resins excel in protective coatings that demand exceptional heat tolerance.

When considering the physical form, clear delineations emerge between liquid, powder, and solid epoxy offerings. Liquid resins dominate conventional casting and lamination processes, whereas powder formats gain traction for solvent-free coating applications and industrial repair. Solid preforms, such as pellets or granules, offer precise dosing and reduced handling risks, further diversifying processing options for formulators across multiple sectors.

Diving deeper into end-use orientations, adhesive applications bifurcate into non-structural glues used in consumer goods assembly and high-strength structural adhesives that bond load-bearing components in automotive and aerospace industries. Coating solutions split between decorative finishes that enhance aesthetic appeal and protective layers that shield surfaces from corrosion and abrasion. Meanwhile, composite applications differentiate into fiber-reinforced systems that leverage high tensile performance and particle-reinforced blends engineered for cost-efficient impact resistance.

The industrial landscape further stratifies by end-user industry, encompassing aerospace components, automotive and transportation assemblies, infrastructure construction materials, advanced electronics encapsulation, marine coatings, and wind energy composites. Finally, distribution pathways traverse offline direct sales channels and networked distributors and suppliers, as well as digital platforms that facilitate rapid order fulfillment. Understanding these segmentation dimensions equips stakeholders with nuanced clarity to tailor offerings and anticipate shifting demand patterns.

This comprehensive research report categorizes the Epoxy Resin market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Form

- Application

- End-User Industry

- Distribution Channel

Exploring Regional Nuances and Demand Drivers Across the Americas, Europe Middle East & Africa, and Asia Pacific to Decode Epoxy Resin Market Variations

Regional analysis of the epoxy resin market highlights divergent growth trajectories and demand drivers across the Americas, Europe Middle East & Africa, and Asia Pacific. In the Americas, government incentives for renewable energy projects and robust automotive production corridors stimulate uptake of high-performance composites in wind turbines and electric vehicle components. This region’s emphasis on domestic manufacturing underscores the strategic importance of local resin production and integration with advanced fabrication facilities.

Across Europe, Middle East & Africa, stringent environmental regulations and circular economy initiatives drive the adoption of low-VOC epoxy coatings and bio-based resin alternatives, particularly in Western Europe. Meanwhile, the Middle East’s burgeoning infrastructure build-out and Africa’s expanding construction sector create new avenues for protective and decorative epoxy systems. Diverse regulatory and economic conditions within EMEA necessitate tailored market entry and compliance strategies.

Asia Pacific remains a powerhouse of epoxy resin demand, fueled by rapid industrialization in Southeast Asia, electronics manufacturing hubs in East Asia, and large-scale wind energy installations in China and India. The region’s competitive cost structures and strong downstream manufacturing ecosystem position it as both a major consumer and exporter of resin products. However, increasing labor and environmental compliance costs in mature economies are accelerating the shift toward automation and higher-value specialty resin segments.

Understanding these regional distinctions informs strategic investment decisions, from capacity expansions to localized innovation centers, enabling resin producers to align product portfolios with specific market requisites and regulatory frameworks. This geographically nuanced perspective is essential for forging resilient, growth-oriented global strategies.

This comprehensive research report examines key regions that drive the evolution of the Epoxy Resin market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Epoxy Resin Market Players to Highlight Strategic Initiatives, Innovation Pipelines, and Collaborative Partnerships Shaping Industry Growth

Leading epoxy resin manufacturers have demonstrated a keen focus on expanding their product portfolios through strategic partnerships, targeted R&D investments, and capacity augmentations. Global chemical giants have accelerated acquisitions of specialty resin startups to integrate novel curing technologies and proprietary formulations into their mainstream offerings. They have also initiated collaborative ventures with research institutions to co-develop bio-based epoxies that address evolving sustainability mandates without compromising performance.

In parallel, medium-sized and regional players have leveraged niche expertise in high-purity resins and customized compound design to carve out defensible market positions. These companies routinely engage in co-creation with key customers, providing application-specific support from lab-scale trials to full-scale process integration. By harnessing lean innovation frameworks and digital customer engagement platforms, they enhance responsiveness to emerging requirements in automotive electrification, advanced electronics encapsulation, and marine antifouling applications.

Moreover, cross-sector collaborations are becoming increasingly prevalent, as resin producers partner with composite fabricators, curing agent vendors, and additive suppliers to establish integrated solution ecosystems. This trend enables streamlined supply chains, co-marketing synergies, and accelerated time-to-market for end-user prototypes. Investors and strategic acquirers remain vigilant, eyeing firms with robust intellectual property portfolios and established end-user alliances to secure competitive footholds in priority growth segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Epoxy Resin market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Aditya Birla Group

- ALTANA AG

- Chemax Orhanochem Pvt. Ltd.

- China Petrochemical Corporation

- Covestro AG

- Daicel Corporation

- DIC Corporation

- Dow Inc

- DuPont de Nemours, Inc.

- Henkel AG & Co. KGaA

- Huntsman International LLC

- INEOS AG

- K2P Chemicals

- Kolon Industries, Inc.

- Kukdo Chemical Co., Ltd

- Mapei Spa

- Merck KGaA

- Mitsubishi Chemical Group Corporation

- Mitsui Chemicals, Inc.

- Olin Corporation

- Parker-Hannifin Corporation

- Shiv Shakti Group

- Sika AG

- Sumitomo Bakelite Co., Ltd.

Formulating Actionable Strategic Recommendations to Empower Industry Leaders with Proactive Approaches for Maximizing Resilience and Seizing Growth Opportunities

To navigate the evolving epoxy resin landscape, industry leaders should prioritize strategic investments in sustainable feedstock development and circular economy frameworks. Establishing partnerships with biotechnology firms and agricultural cooperatives can secure alternative raw materials and reduce exposure to petrochemical price volatility. Simultaneously, embedding closed-loop recycling processes within manufacturing operations will not only mitigate waste but also align product portfolios with tightening regulatory standards.

Furthermore, companies must harness digitalization across the value chain by deploying advanced analytics to forecast demand, optimize inventory, and predict maintenance needs. Investing in sensor-equipped processing units and cloud-based monitoring solutions will drive operational efficiency and consistent product quality. Equally important is the cultivation of cross-functional innovation teams that bridge R&D, production, and commercial units, ensuring that emerging market insights rapidly translate into tailored resin formulations and service offerings.

Strategic geographic diversification remains another critical lever for resilience. Leaders should evaluate opportunities to expand capacity in high-growth regions while forging supply partnerships in non-tariff-impacted markets. This approach not only reduces exposure to trade disruptions but also enhances proximity to emerging end users in renewable energy, aerospace, and high-tech manufacturing sectors.

By intertwining sustainability, digitalization, and strategic partnerships, industry stakeholders can position themselves at the vanguard of epoxy resin innovation and maintain competitive advantage amid intensifying global challenges.

Illustrating a Robust Multi-Method Research Framework Incorporating Primary Interviews and Secondary Data Triangulation for Unbiased Epoxy Resin Analysis

This research employs a rigorous multi-pronged methodology that integrates primary insights and extensive secondary data triangulation to deliver a robust epoxy resin market analysis. Secondary sources, including regulatory filings, patent databases, industry journals, and trade association publications, established the foundational data on resin chemistries, supply chains, and macroeconomic drivers.

Building upon this, primary research involved in-depth interviews with over 50 stakeholders across the value chain, encompassing resin manufacturers, curing agent suppliers, composite fabricators, coatings formulators, and end-user OEMs. These dialogues provided firsthand perspectives on technology adoption, tariff impacts, and emerging application trends. Interview insights were validated against real-world procurement data and plant-level feedback to ensure consistency and reliability.

Quantitative analyses employed both top-down and bottom-up modeling approaches to cross-validate findings and identify discrepancies between reported capacities and actual consumption patterns. This dual approach enhanced the credibility of segmentation insights and regional breakdowns without relying solely on singular data sources. Furthermore, expert panels convened at multiple stages of the study to review preliminary conclusions and refine assumptions, thereby strengthening the overall analytical framework.

Together, these methodological pillars underpin a comprehensive, unbiased evaluation of the epoxy resin market, equipping decision makers with actionable intelligence and confidence in the report’s strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Epoxy Resin market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Epoxy Resin Market, by Resin Type

- Epoxy Resin Market, by Form

- Epoxy Resin Market, by Application

- Epoxy Resin Market, by End-User Industry

- Epoxy Resin Market, by Distribution Channel

- Epoxy Resin Market, by Region

- Epoxy Resin Market, by Group

- Epoxy Resin Market, by Country

- United States Epoxy Resin Market

- China Epoxy Resin Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Comprehensive Insights to Articulate Strategic Imperatives and Emerging Trends Guiding Stakeholders Through the Epoxy Resin Market’s Evolution

Throughout this executive summary, we have explored the intricate dynamics shaping the epoxy resin industry-from foundational material properties and pioneering technological innovations to the far-reaching implications of new tariff regimes. The segmentation analysis illuminated how specific resin chemistries, physical forms, and application types intersect with end-user demands and distribution pathways, offering a nuanced perspective on market differentiation.

Regional insights underscored the heterogeneity of growth drivers: the Americas’ emphasis on domestic manufacturing and renewable energy, EMEA’s regulatory and circular economy focus, and Asia Pacific’s manufacturing scale and cost competitiveness. Concurrently, leading companies’ strategic maneuvers in mergers, acquisitions, and co-development partnerships highlight the premium placed on innovation pipelines and integrated solution ecosystems.

Looking ahead, the report emphasizes that agility and sustainability will define market leaders. Embracing bio-based feedstocks, digital process optimization, and strategic geographic diversification will serve as vital catalysts for long-term resilience. As the industry grapples with evolving environmental mandates and shifting trade landscapes, stakeholders who proactively align their strategies with these imperatives will unlock new value and maintain competitive positioning.

This executive overview encapsulates the critical insights necessary for informed decision making and strategic planning. The full report delves deeper into quantitative data, proprietary models, and scenario analyses to empower stakeholders with comprehensive market intelligence.

Connect Directly with Associate Director Ketan Rohom to Secure This Definitive Epoxy Resin Market Research Report and Accelerate Strategic Decision Making Today

To obtain unparalleled strategic intelligence and drive decisive actions in the epoxy resin industry, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. His deep expertise in polymer market dynamics, client engagement, and tailored solution delivery ensures you receive comprehensive guidance on the report’s findings and its applications to your organizational priorities. Contact him today to discuss custom data extracts, priority inquiries, and volume-based licensing options designed to align with your specific research needs. Secure your competitive advantage now by partnering with Ketan to unlock full access to the definitive epoxy resin market research report and catalyze your next phase of growth.

- How big is the Epoxy Resin Market?

- What is the Epoxy Resin Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?