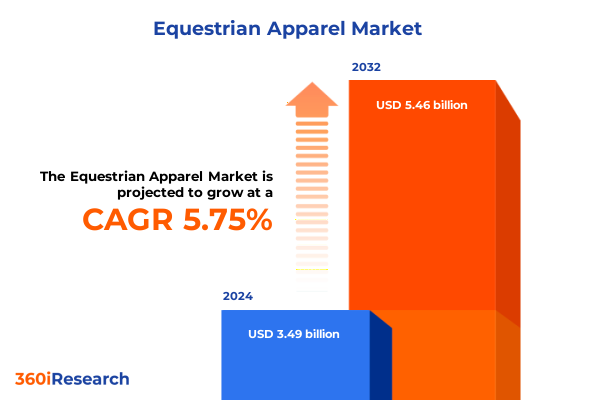

The Equestrian Apparel Market size was estimated at USD 1.34 billion in 2025 and expected to reach USD 1.47 billion in 2026, at a CAGR of 8.98% to reach USD 2.45 billion by 2032.

Discover the Dynamic World of Equestrian Apparel Through an Informative and Engaging Overview of Industry Fundamentals and Emerging Trends

The equestrian apparel sector stands at the intersection of tradition and innovation, drawing on centuries-old riding disciplines while continuously adapting to modern performance demands and aesthetic expectations. Driven by riders’ pursuit of style, safety, and comfort, the market has diversified far beyond classic breeches and tailored jackets into a dynamic array of high-performance garments engineered for endurance, aeration, and moisture management. In recent years, expanding participation rates in equestrian sports-spanning professional competition circuits, amateur shows, and recreational trail riding-have catalyzed new product lines and design philosophies, inviting brands to blend heritage-inspired silhouettes with cutting-edge technical fabrics.

As equestrian communities embrace digital platforms, social media, and online retail channels, the fashion sensibilities of younger riders are reshaping the palette of colorways, pattern applications, and customization options. Simultaneously, the demand for sustainable practices in fiber sourcing and manufacturing has elevated natural materials such as cotton, wool, and leather alongside advanced synthetic alternatives like nylon, polyester, and spandex. This confluence of factors underscores the need for a comprehensive overview that not only chronicles the evolution of equestrian apparel but also elucidates the market forces propelling it toward new frontiers of performance enhancement, brand differentiation, and consumer engagement.

Uncover the Transformative Shifts Reshaping the Equestrian Apparel Landscape From Technological Innovations to Consumer Behavior and Sustainability

The equestrian apparel landscape is undergoing transformative shifts propelled by a convergence of technological advancements, shifting consumer priorities, and evolving retail paradigms. Rapid innovation in smart textiles-ranging from moisture-wicking base layers and temperature-regulating fabrics to impact-dissipating protective gear-has elevated functional performance standards, compelling brands to invest in research partnerships and proprietary material development. Concurrently, rising consumer awareness of ethical production has ushered in a wave of sustainable practices, including the utilization of responsibly sourced leather, organic cotton, and recycled synthetic fibers, as well as transparent supply chain traceability.

In parallel, the digital commerce revolution has redefined the customer journey, with immersive virtual fitting rooms, AI-driven personalized styling recommendations, and seamless omnichannel experiences emerging as vital differentiators. Riders today expect instant access to product information, peer reviews, and tailored sizing guidance, placing a premium on agility and data-driven engagement strategies. Furthermore, the rise of direct-to-consumer models and strategic collaborations with equestrian influencers are reshaping marketing playbooks, enabling smaller innovators to compete alongside established names. These cumulative shifts signify a market in flux, where technological prowess, sustainability credentials, and customer-centric retail models coalesce to establish the new benchmarks for success.

Examine the Comprehensive Impact of Recent United States Tariff Measures on Equestrian Apparel Imports Costs Supply Chains and Market Competitiveness

The implementation of United States tariff measures in 2025 has introduced a notable inflection point for equestrian apparel manufacturers, importers, and retailers. Elevated duties on select textile and apparel categories-including synthetic blends commonly used in high-performance base layers and protective gear-have imposed additional cost considerations across global supply chains. Consequently, companies are reevaluating sourcing strategies, with many seeking to diversify manufacturing footprints by nearshoring operations to regions with more favorable trade agreements, thereby mitigating exposure to fluctuating tariff schedules and currency volatility.

Moreover, the ripple effects of these tariff adjustments have stimulated increased domestic production investments and strategic alliances with local fabric mills, bolstering resilience in material sourcing while supporting regional economic development. Simultaneously, price-sensitive segments of the equestrian market have experienced margin compression, prompting brands to refine product portfolios and optimize cost structures. Amidst these dynamics, organizations that proactively implement tariff engineering-such as modifying fabric compositions or leveraging tariff classification differentials-are better positioned to preserve profitability and maintain competitive pricing. Collectively, these tariff-driven developments are redefining cost frameworks, supply chain configurations, and market strategies within the U.S. equestrian apparel industry.

Gain Deep Insights into Key Market Segmentation Highlighting Variations by Product Type Material Gender Distribution Channel and End Use Preferences

A nuanced understanding of equestrian apparel market segmentation illuminates the varied demand drivers across product types, material preferences, gender demographics, distribution channels, and end-use categories. Within the realm of product type, the market encompasses bottomwear, footwear, protective gear, and topwear, where bottomwear segments manifest as breeches, jodhpurs, riding tights, and shorts, while topwear extends through base layers, jackets, polo shirts, shirts, sweaters, and vests. Material type segmentation further discriminates between natural and synthetic fibers, with the former anchored by cotton, leather, and wool, and the latter driven by nylon, polyester, and spandex. Gender-based segmentation bifurcates the market into men’s and women’s lines, each reflecting distinct fit profiles, style preferences, and color palettes.

Distribution channels wield a critical influence on consumer access and purchasing behavior, separating offline retailers into department stores and specialty stores, and online retailers into e-commerce channels and manufacturer websites. Finally, end-use segmentation differentiates competition-grade offerings-engineered to meet stringent performance requirements-from recreational products that prioritize comfort, style, and accessibility. By integrating these segmentation facets, stakeholders can pinpoint growth pockets, tailor marketing strategies, and deploy product development resources with greater precision.

This comprehensive research report categorizes the Equestrian Apparel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Types

- Gender

- Distribution Channel

- End-Use

Explore Essential Regional Insights Revealing How the Americas Europe Middle East Africa and Asia Pacific Regions Are Shaping the Equestrian Apparel Market

Regional market dynamics exert a profound influence on the trajectory of the equestrian apparel industry, revealing distinct opportunities and challenges across the Americas, Europe, Middle East & Africa (EMEA), and Asia-Pacific. In the Americas, high participation rates in the United States, combined with growing equestrian communities in Canada and Latin America, drive robust demand for both performance-focused and lifestyle-oriented apparel. Consumer emphasis on domestic sourcing and sustainable production underpins product development and brand positioning strategies, while e-commerce proliferation enhances reach across geographically dispersed populations.

Within EMEA, Europe’s mature equestrian markets-anchored by the United Kingdom, Germany, and France-exhibit strong consumption of premium, technically advanced garments, complemented by emerging demand in Middle Eastern nations where equestrian heritage enjoys renewed investment. African markets, though nascent, display significant potential as rising disposable incomes support recreational riding and competitive equestrian events. Conversely, Asia-Pacific stands out as the fastest-growing region, propelled by China’s expanding equestrian infrastructure, Japan’s blend of tradition and modernity, Australia’s competitive riding culture, and India’s burgeoning interest in both recreational and competitive riding disciplines. This regional mosaic underscores the imperative for tailored market entry plans, localized product assortments, and region-specific marketing narratives to capture diverse consumer cohorts effectively.

This comprehensive research report examines key regions that drive the evolution of the Equestrian Apparel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Review Critical Company Intelligence Spotlighting Leading Players Strategies Collaborations and Innovation Drivers Within the Global Equestrian Apparel Sector

Leading organizations within the equestrian apparel sphere leverage a blend of innovation, strategic partnerships, and brand heritage to solidify market presence. High-performance specialists differentiate themselves through advanced material technologies, ergonomic design features, and athlete-driven product validation, ensuring that competition-grade offerings meet the exacting standards of professional riders. Simultaneously, established fashion-centric entities emphasize premium craftsmanship, heritage-inspired aesthetics, and collaborations with renowned equestrian ambassadors to resonate with affluent consumer segments seeking exclusivity.

Value-oriented brands, meanwhile, capitalize on channel partnerships and in-house manufacturing efficiencies to deliver cost-competitive assortments without compromising essential performance attributes. Across the board, omnichannel distribution models-spanning flagship retail locations, specialty boutiques, digital platforms, and direct-to-consumer portals-facilitate seamless customer journeys and reinforce brand engagement. Furthermore, sustainability initiatives have emerged as a vital differentiator, with leading players integrating eco-friendly production processes, circular economy principles, and transparent supply chain disclosures to meet escalating consumer expectations. Collectively, these strategic imperatives delineate the competitive landscape and underscore pathways to long-term differentiation and resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Equestrian Apparel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ariat International, Inc.

- Back on Track BOT LLC

- Cavallo GmbH & Co. KG

- Dover Saddlery, Inc

- English Riding Supply Inc.

- Equiline S.R.L

- FITS Riding, LLC

- Horseware Products Limited

- HUGO BOSS AG

- Kerrits Equestrian Apparel

- LeMieux Ltd.

- Muck Boot Company, LLC

- Ovation Riding Apparel

- PIKEUR Reitmoden & Arendicom GmbH

- Pikeur Reitsport GmbH

- Roeckl Sporthandschuhe GmbH & Co. KG

- Romfh Equestrian Apparel

- Schockemöhle Sports GmbH.

- SmartPak Equine LLC

- Tredstep Ireland

- Weatherbeeta USA Inc.

Implement Actionable Recommendations to Strengthen Market Position Leverage Emerging Opportunities and Drive Growth for Equestrian Apparel Industry Leaders

Industry leaders seeking to capitalize on the evolving equestrian apparel environment should prioritize strategic investments in advanced material research, including smart textiles that offer enhanced moisture management, thermal regulation, and impact protection. Concurrently, forging partnerships with reputable fabric suppliers and exploring nearshoring opportunities can mitigate exposure to tariff fluctuations and supply chain disruptions. Equally important is the cultivation of compelling omnichannel retail experiences, integrating virtual fitting tools, AI-driven personalization engines, and seamless cross-channel fulfillment options to strengthen customer loyalty and streamline purchase journeys.

To address shifting consumer values, brands should embed sustainability throughout product lifecycles, from sourcing responsibly certified natural fibers to incorporating recycled synthetics and minimizing waste through modular design concepts. Engagement with the equestrian community via athlete endorsements, digital content collaborations, and experiential marketing activations can also amplify brand visibility and foster trust. Moreover, tapping into underpenetrated segments-such as entry-level recreational riders and emerging economies-will unlock incremental growth, provided that localized product assortments and culturally resonant messaging are deployed. By executing a balanced strategy that marries innovation, operational agility, and consumer-centricity, industry leaders can position themselves for sustained success.

Understand the Robust Research Methodology Underpinning Analysis Through Detailed Primary Secondary Data Collection and Rigorous Analytical Techniques

This analysis was underpinned by a rigorous mixed-methods research framework, incorporating both primary and secondary data sources to ensure comprehensive coverage and methodological integrity. Primary research encompassed in-depth interviews with industry executives, equestrian athletes, and retail channel managers, supplemented by voice-of-the-customer surveys that captured nuanced preferences across product types, materials, and price tiers. Secondary research drew on publicly accessible trade publications, import-export databases, patent filings, and regulatory records to contextualize market dynamics and validate emerging trends.

Quantitative data modeling techniques, including data triangulation and cross-sectional analysis, were employed to reconcile disparate data inputs and enhance the reliability of segmentation insights. Qualitative thematic analysis facilitated the identification of strategic imperatives and innovation trajectories, while scenario-based assessments evaluated the potential impact of tariff policy shifts and sustainability regulations. Rigorous data validation protocols, peer reviews, and stakeholder consultations further reinforced the credibility and actionable nature of the findings, ensuring that the report serves as an authoritative guide for decision-makers within the equestrian apparel ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Equestrian Apparel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Equestrian Apparel Market, by Product Type

- Equestrian Apparel Market, by Material Types

- Equestrian Apparel Market, by Gender

- Equestrian Apparel Market, by Distribution Channel

- Equestrian Apparel Market, by End-Use

- Equestrian Apparel Market, by Region

- Equestrian Apparel Market, by Group

- Equestrian Apparel Market, by Country

- United States Equestrian Apparel Market

- China Equestrian Apparel Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesize Key Findings and Strategic Implications to Conclude a Comprehensive Understanding of Equestrian Apparel Trends Challenges and Growth Opportunities

In synthesizing the foregoing insights, it is evident that the equestrian apparel market is undergoing a period of accelerated transformation driven by technological innovation, shifting consumer values, and evolving trade policies. Segmentation analysis highlights the diverse requirements of bottomwear, topwear, footwear, and protective gear categories, alongside material preferences that span natural fibers such as cotton, leather, and wool, and synthetic alternatives like nylon, polyester, and spandex. Gender dynamics, distribution channel nuances, and end-use distinctions further underscore the imperative for precision in product development and go-to-market strategies.

Regional disparities underscore the importance of localized approaches, as the mature Americas and EMEA markets coexist alongside the high-growth Asia-Pacific region, each demanding tailored assortments and marketing narratives. Compelling competitive intelligence reveals that leading players succeed by marrying advanced material science, omnichannel retail capabilities, and sustainability credentials. As the industry navigates the implications of U.S. tariffs and broader macroeconomic shifts, the ability to remain agile, data-driven, and customer-focused will determine which organizations secure lasting market leadership. Ultimately, this executive summary lays the groundwork for informed strategic decisions and illuminates the pathways to future growth and profitability within the equestrian apparel arena.

Engage with Associate Director of Sales Marketing to Access In-Depth Equestrian Apparel Intelligence and Secure Your Comprehensive Market Research Report Today

Elevate your strategic decision-making with unparalleled Equestrian Apparel market intelligence by partnering with Ketan Rohom, the Associate Director of Sales & Marketing. Engage with Ketan to secure access to a meticulously crafted market research report that unveils comprehensive insights spanning product innovation, consumer behavior dynamics, regulatory impacts, and regional opportunities. Whether you seek tailored data on segment performance across bottomwear, topwear, footwear, protective gear, material preferences, gender trends, distribution channels, or end-use patterns, this report delivers actionable intelligence designed to empower your next strategic move. Reach out to Ketan Rohom today to explore customized solutions, schedule a personalized consultation, and obtain immediate delivery of the definitive Equestrian Apparel market analysis that will drive growth and outpace competitors.

- How big is the Equestrian Apparel Market?

- What is the Equestrian Apparel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?