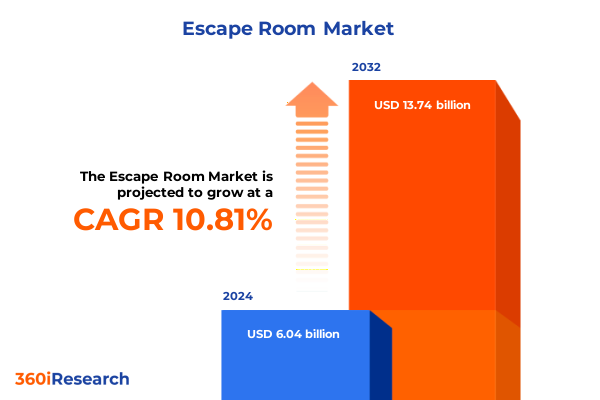

The Escape Room Market size was estimated at USD 6.66 billion in 2025 and expected to reach USD 7.37 billion in 2026, at a CAGR of 10.88% to reach USD 13.74 billion by 2032.

Discover How Immersive Puzzle Adventures Are Redefining Consumer Entertainment Preferences and Shaping the Escape Room Market Landscape

Immersive puzzle adventures have emerged as a leading force in modern experiential entertainment, captivating consumers seeking interactive, story-driven encounters that transcend traditional leisure offerings. These experiences blend narrative depth with hands-on problem solving, encouraging collaboration and fostering memorable emotional connections. As demand for engaging activities intensifies, escape room operators are continually innovating with thematic design, cutting-edge technology, and adaptive challenges to maintain consumer interest and differentiate their offerings.

In response to shifting consumer preferences toward experiential spending over material goods, immersive escape experiences are increasingly valued as social currency, driving repeat visitation and word-of-mouth growth. Operators are leveraging insights from behavioral analytics to refine challenge pacing, narrative immersion, and difficulty calibration across diverse demographic segments. Simultaneously, the convergence of digital and physical realms through augmented reality, interactive sensors, and integrated mobile applications has unlocked new avenues for personalization and scalability.

As this market matures, stakeholders must recognize the interplay between consumer expectations for heightened authenticity and the operational demands of streamlining bookings, maintaining thematic quality, and ensuring safety. By aligning innovation pipelines with audience feedback loops and strategic partnerships, industry participants can continue elevating the consumer journey while reinforcing brand loyalty and expanding market reach.

Explore How Technological Integration and Hybrid Formats Are Redefining Operational Models and Consumer Access in the Escape Room Industry

The escape room landscape has undergone a profound transformation as technology integration and hybrid formats reshape operational models. Traditional brick-and-mortar locations are incorporating augmented reality overlays and virtual reality portals to augment physical set pieces with dynamic digital content, enhancing narrative complexity and replay value. Simultaneously, turnkey at-home escape kits and virtual puzzle sessions have expanded audience access, enabling operators to extend their brand beyond physical venues and engage remote participants in real time.

In parallel, health and safety protocols introduced during global public health challenges have prompted sustained adoption of contactless entry, digital briefing materials, and modular set designs that facilitate rapid sanitization. This heightened focus on hygiene and convenience has bred consumer confidence and operational resilience against future disruptions. Moreover, partnerships between escape room operators and corporate clients have matured beyond team-building retreats into customized training modules that leverage immersive scenarios for leadership development, conflict resolution, and crisis management simulations.

Looking ahead, industry leaders are exploring subscription-based and membership models to cultivate loyal communities and secure recurring revenue streams. At the same time, data-driven content personalization engines are being piloted to adapt puzzle difficulty on the fly, tailoring experiences to group profiles and enhancing satisfaction metrics. These transformative shifts signal a market in evolution, where agility and innovation serve as the cornerstones of long-term competitive advantage.

Analyze the Multifaceted Effects of 2025 Trade Tariffs on Cost Structures Supply Chain Resilience and Pricing Strategies in Escape Room Operations

The implementation of United States tariffs in 2025 has exerted notable pressure on sourcing strategies for escape room operators, particularly those reliant on imported props, electronics, and specialized materials. The elevated duties on composite plastics and electronic components have increased replacement costs for interactive devices, motion sensors, and high-fidelity sound systems essential to immersive storytelling. As a result, many operators are recalibrating supply chains to incorporate domestic manufacturers and bulk procurement agreements that mitigate the impact of variable trade policies.

In response, procurement teams have intensified collaboration with local artisans and fabrication workshops, fostering co-development arrangements that align design specifications with cost-effective production. This shift has yielded the dual benefit of reducing lead times and supporting regional economic ecosystems. To balance increased input costs, operators are reevaluating pricing structures and optimizing facility utilization through dynamic scheduling and tiered experience offerings, ensuring that ticket revenues reflect the enhanced value proposition without compromising consumer affordability.

Moreover, tariff-driven cost pressures have catalyzed investment in modular set designs that maximize component reuse and minimize material waste. By adopting standardized interface modules and interchangeable asset libraries, operators can streamline refurbishment cycles and pivot thematic content more rapidly. This cumulative impact of tariffs has accelerated the industry’s emphasis on supply chain resilience, cost management discipline, and strategic local partnerships.

Uncover Comprehensive Segmentation Strategies Informing Thematic Appeal Demographic Preferences and Operational Design Across the Escape Room Market

Insightful segmentation analysis reveals distinct behavioral profiles across themed adventures, age demographics, group configurations, temporal preferences, reservation channels, and end-use applications. Adventure themes such as Fantasy and Mystery consistently draw enthusiasts seeking narrative richness, while Horror and Heist scenarios appeal to thrill-seekers and collaborative problem solvers craving higher adrenaline engagement. Historical and Sci-Fi experiences attract niche audiences that value educational depth and technological immersion respectively, guiding operators to refine creative development pipelines to maximize thematic resonance.

Age group segmentation underscores divergent expectations: Teens gravitate toward visually dynamic and socially driven formats that integrate mobile interactivity, Adults favor complex narratives with layered puzzles demanding critical thinking, and Seniors appreciate accessible experiences emphasizing safety, clear instructions, and moderate physical exertion. Group size dynamics further inform operational design; individual bookings highlight single-player puzzle pods and remote game formats, medium and large groups necessitate scalable puzzles that maintain cohesion across participants, and small groups often seek intimate scenarios that blend personalization with challenge balance.

Duration preferences also shape booking patterns, with short 30-minute experiences catering to impulse visits and quick entertainment sequences, standard one-hour sessions forming the market cornerstone, and extended formats exceeding 90 minutes reserved for premium or bespoke storylines. Booking behavior reveals a growing shift toward online reservation platforms equipped with integrated payment gateways and automated reminders, while offline bookings remain relevant in tourist-driven locales and community centers. Finally, end-use segmentation delineates Education programs focused on curriculum-aligned logic exercises, purely Entertainment-driven leisure outings, and Team Building engagements tailored to corporate clients seeking experiential learning, each prompting operators to customize marketing collateral and facility configurations accordingly.

This comprehensive research report categorizes the Escape Room market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Format

- Adventure Themes

- Capacity

- Age Group

- Booking Channel

- Ownership

- Use Case

Delve into Dynamic Regional Variations Shaped by Cultural Drivers Regulatory Frameworks and Economic Incentives Across Global Escape Room Markets

Regional dynamics exhibit pronounced heterogeneity shaped by cultural trends, regulatory frameworks, and economic development trajectories. The Americas market demonstrates robust consumer enthusiasm for high-octane themes and experiential innovations, with urban hubs spearheading collaborations between entertainment venues and hospitality partners. Tax incentives in certain states have encouraged creative reinvestment into facility enhancements and franchise expansion, though operators must navigate varying licensing requirements and municipal zoning codes that influence location strategy.

In Europe Middle East & Africa, legacy cultural sites and historical landmarks inspire themed narratives that resonate with regionally specific storylines, driving localized content development and cross-border tourism packages. Regulatory emphasis on heritage conservation and safety certifications necessitates meticulous compliance protocols, elevating operational standards and customer trust. Meanwhile, emerging markets in the Middle East are rapidly adopting luxury escape concepts within integrated resort complexes, signaling escalating investment appetite.

Asia-Pacific presents a dynamic growth frontier characterized by tech-savvy audiences, high digital engagement rates, and government-backed creative incubators. Major metropolitan centers are fertile grounds for VR-integrated escape rooms and gamified social hubs, while second-tier cities are witnessing pop-up and mobile escape experiences capitalizing on low-capex deployment. This region’s appetite for mobile-first booking and social media-driven marketing underscores the importance of streamlined digital channels and localized language support to optimize market penetration and consumer retention.

This comprehensive research report examines key regions that drive the evolution of the Escape Room market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Explore How Industry Leaders Are Leveraging Partnerships Diversification and Sustainability to Cement Competitive Dominance in the Escape Room Sector

Leading operators are forging strategic alliances and pursuing vertical integration to reinforce market positioning. Signature experiential design studios are partnering with immersive technology developers to co-create proprietary game engines, thereby insulating content pipelines from external licensing risks. Concurrently, franchise networks are embracing hybrid ownership models that blend corporate-run flagship locations with franchised satellite venues, enabling rapid geographic scaling while maintaining creative oversight through standardized training academies.

Innovative companies are also leveraging data analytics to refine customer segmentation and personalize marketing outreach. Loyalty programs integrated with mobile applications track play history, incentive redemptions, and social shares, generating rich behavioral datasets that inform adaptive promotions and retargeting strategies. Meanwhile, mergers and acquisitions within the space are consolidating specialized prop fabrication firms, digital content providers, and location-based entertainment chains to foster end-to-end service delivery and cost synergies.

Sustainability has emerged as a competitive differentiator, prompting top-tier companies to source eco-friendly materials and adopt energy-efficient facility operations. By showcasing green credentials and community engagement initiatives, these industry leaders are enhancing brand reputation and attracting environmentally conscious audiences, setting new benchmarks for responsible entertainment experiences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Escape Room market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 13th Gate Escape

- All In Adventures, LLC

- Blacklight Attractions, Inc.

- Breakout Games

- Claustrophobia Online LLC

- ClueQuest

- Enigma Escape

- Epic Escape Game, LLC

- Escape Game, LLC

- Escape Hunt Franchises Ltd

- Escape My Room by DeLaporte Ventures, LLC

- Escape Reality Ltd

- Escape Room Doctor

- Escape Room International

- Escape the Room

- Escape Ventures Orlando LLC

- Escapology LLC

- Exit Strategy Escape Room

- Immersive Group Gaming Ltd

- Key Quest, LLC

- Locked In A Room Ltd

- Locurio

- Maze Rooms Corp.

- Mystery Rooms

- Mystery Soup Escape Rooms

- Palace Games

- PanIQ Franchising Inc

- Pro Escape Rooms

- PuzzleWorks Escape Co

- ResQRoom by Setoo.

- Ruby Escape Rooms

- Ruby Escape Rooms

- Sherlocked BV

- The Great Escape Room, LLC

- Trapdoor Escape Room Inc.

Implement Scalable Immersive Technologies Strategic Partnerships and Advanced Data Governance to Propel Sustainable Growth and Differentiation

Industry leaders should capitalize on the integration of immersive technology by investing in modular AR and VR components that seamlessly augment physical sets, ensuring future-proof scalability while minimizing redevelopment cycles. Embracing dynamic pricing algorithms can optimize revenue management across peak and off-peak hours, balancing consumer demand with operational capacity. To broaden market appeal, operators can develop tiered membership programs offering exclusive access to early-stage concepts, behind-the-scenes workshops, and community forums that foster brand advocacy.

Cultivating strategic alliances with local tourism boards, educational institutions, and corporate training firms will unlock new distribution channels and reinforce experiential relevance across varied end uses. Strengthening direct-to-consumer digital platforms with AI-driven recommendation engines and social proof integrations will streamline the booking journey and amplify conversion rates. Moreover, embedding sustainability principles into set design and facility operations-such as repurposing modular assets and adopting low-energy technologies-will resonate with eco-aware demographics and reinforce corporate responsibility narratives.

Finally, establishing a centralized data governance framework to aggregate insights from customer feedback, operational metrics, and competitive intelligence will empower leadership teams to make informed decisions, rapidly iterate on concept portfolios, and sustain a culture of continuous improvement across the organization.

Understand the Robust Mixed Methods Research Framework Employed to Capture Behavioral Trends Competitive Intelligence and Operational Best Practices

This research integrates a mixed-methods approach combining extensive primary and secondary investigations to ensure rigor and accuracy. Primary insights derive from in-depth interviews with industry veterans-including founders, creative directors, and supply chain specialists-complemented by targeted surveys of consumer segments to capture experiential preferences and willingness to pay. Mystery shopping exercises and site visits across diverse geographies provided hands-on assessment of operational standards and thematic execution.

Secondary research encompassed systematic reviews of industry publications, market white papers, and publicly available financial disclosures, supporting competitive benchmarking and trend validation. Data triangulation was employed by reconciling findings from differing sources-such as interview transcripts, survey results, and desk research-to mitigate bias and reinforce conclusion reliability. Quality control processes included peer reviews by subject matter experts and iterative feedback loops with strategic advisors to refine analytical frameworks.

The methodology balances depth and breadth, leveraging qualitative narratives to illuminate evolving consumer motivations and quantitative insights to underpin strategic recommendations. This robust foundation ensures that the presented analysis is both actionable and reflective of real-world dynamics within the escape room ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Escape Room market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Escape Room Market, by Format

- Escape Room Market, by Adventure Themes

- Escape Room Market, by Capacity

- Escape Room Market, by Age Group

- Escape Room Market, by Booking Channel

- Escape Room Market, by Ownership

- Escape Room Market, by Use Case

- Escape Room Market, by Region

- Escape Room Market, by Group

- Escape Room Market, by Country

- United States Escape Room Market

- China Escape Room Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1431 ]

Synthesize Key Market Dynamics Technological Innovations and Strategic Pathways to Navigate the Competitive Escape Room Landscape Effectively

This executive summary synthesizes critical insights imperative for stakeholders navigating the evolving landscape of immersive puzzle entertainment. The confluence of consumer demand for narrative-driven experiences, technological convergence, and regulatory developments underscores the necessity for adaptive strategies that prioritize innovation, operational efficiency, and collaboration. Tariff-induced cost pressures have accelerated the shift toward local supplier networks and modular set architectures, reinforcing the importance of supply chain resilience.

Segmentation and regional analyses reveal nuanced patterns in thematic preferences, demographic behaviors, and booking modalities, offering a roadmap for tailored market entry and expansion initiatives. Company-level insights demonstrate the strategic value of partnerships, data-driven personalization, and sustainability commitments in forging competitive advantage. Actionable recommendations highlight pathways for leveraging modular immersive technologies, cultivating strategic alliances, and implementing advanced data governance frameworks to sustain growth and differentiation.

As the escape room ecosystem continues to mature, decision-makers who effectively integrate these insights into strategic planning processes will be best positioned to capitalize on emerging opportunities, strengthen customer loyalty, and achieve long-term profitability in this dynamic experiential entertainment sector.

Elevate Strategic Advantage by Connecting with Our Associate Director to Unlock Exclusive Escape Room Market Intelligence

Engage with Ketan Rohom, Associate Director of Sales & Marketing, to secure exclusive access to this in-depth competitive analysis and intelligence resource crafted specifically for decision-makers seeking a strategic edge in the fast-paced realm of immersive puzzle entertainment. Partnering with this industry authority will provide your organization with unparalleled guidance on capitalizing upon emerging trends, optimizing operational excellence, and outpacing rivals through data-driven insights tailored to your unique strategic objectives. Reach out today to transform your next growth initiative into a landmark success.

- How big is the Escape Room Market?

- What is the Escape Room Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?