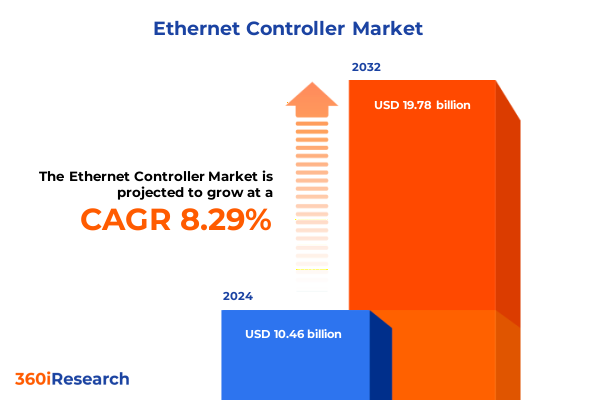

The Ethernet Controller Market size was estimated at USD 11.29 billion in 2025 and expected to reach USD 12.20 billion in 2026, at a CAGR of 8.33% to reach USD 19.78 billion by 2032.

Setting the Stage for Unprecedented Connectivity Demands through Emerging Ethernet Controller Technologies and Market Dynamics

The Ethernet controller market is at the heart of today’s network-driven digital economy, enabling seamless connectivity across myriad applications ranging from data center interlinks to automotive infotainment systems. Accelerated data generation propelled by cloud computing, IoT proliferation, and the rise of artificial intelligence has elevated the role of Ethernet controllers from simple packet movers to critical accelerators of traffic management and security functions. As organizations pivot toward hyper-converged infrastructures and software-defined networking models, the demand for controllers that balance low latency with high throughput has never been more pronounced.

Against this backdrop of intensifying connectivity demands, a new generation of Ethernet controller technologies is emerging. Innovations in integrated offload engines, advanced congestion control algorithms, and hardware-based security modules are redefining performance expectations. This convergence of hardware and software capabilities is steering market dynamics, compelling vendors to innovate rapidly while ensuring interoperability within increasingly heterogeneous network ecosystems. Consequently, stakeholders at every level-from chip designers to network architects-are recalibrating priorities to align with this transformative moment in networking history.

Charting the Evolution of Ethernet Controllers Amidst Rising Data Volumes AI Accelerators and Edge Computing Convergence Driving Market Disruption

In recent years, the Ethernet controller landscape has experienced profound transformation driven by exponential growth in data volumes and the advent of new computing paradigms. The migration to multi-cloud architectures and edge computing frameworks has placed a premium on controllers capable of handling distributed traffic flows with minimal overhead. Simultaneously, the integration of hardware accelerators for AI inference tasks has introduced fresh performance benchmarks, requiring controllers to offload compute-intensive packet processing without compromising on energy efficiency.

Moreover, as bandwidth requirements surge toward 400 Gigabit Ethernet and beyond, standardization bodies have moved swiftly to define next-generation interface protocols. The interplay between evolving server CPU topologies and network fabrics has compelled controller vendors to optimize for tighter integration, ushering in an era of system-on-chip architectures that consolidate networking logic with compute and memory resources. These shifts underscore a market in flux, where legacy solutions are rapidly giving way to agile, scalable, and programmable controllers designed for tomorrow’s dynamic networking challenges.

Analyzing the Ripple Effects of 2025 United States Tariff Measures on Ethernet Controller Supply Chains Costs and Competitive Positioning

In 2025, a series of adjustments to United States tariff structures has introduced a new layer of complexity to the Ethernet controller supply chain. Tariffs targeting semiconductor components and related electronic assemblies have led to recalibrated sourcing strategies, as vendors seek to mitigate cost escalations through strategic relocation of manufacturing footprints and renegotiation of supplier agreements. The cumulative burden of these measures has been felt most acutely by players with significant reliance on cross-border inventory flows, prompting a reevaluation of global operational models.

Beyond immediate cost impacts, the elevated tariff environment has accelerated efforts to localize critical production steps, with several stakeholders announcing investments in domestic packaging, testing, and assembly capabilities. While these initiatives promise long-term resilience against trade disruptions, they also entail ramp-up timelines and capital commitments that must be balanced against near-term margin pressures. Ultimately, the tariff-driven recalibration is reshaping competitive positioning and encouraging a renewed focus on supply chain transparency and agility.

Unveiling Critical Segmentation Insights Spanning Technology Types Interface Standards and End User Industry Applications Driving Strategic Decisions

A granular segmentation of the Ethernet controller market reveals diverse performance tiers and application demands. Based on Type, the spectrum spans from legacy 2.5 Gigabit and 5 Gigabit solutions for cost-conscious network segments up through high-throughput 25 Gigabit and 40 Gigabit variants favored in enterprise backbones, and culminating in 100 Gigabit and 10 Gigabit offerings that dominate hyperscale data center deployments. Each type category is characterized by unique trade-offs between power consumption, integration density, and price per port, guiding procurement decisions across use cases.

Examining the market through the lens of Interface Type exposes an intricate ecosystem of transfer protocols and form factors. Traditional host interfaces such as PCIe and M.2 remain widespread, even as emerging Future Interface Standards like CXL and PCIe Gen6 promise to break bandwidth ceilings. Parallel developments in peripheral connectivity-embodied by Thunderbolt 5 and USB4-are opening new avenues for network-adjacent devices, while the OCP form factor continues to gain traction in open-hardware server projects. In this multi-dimensional matrix, selection criteria hinge on interoperability, upgrade paths, and ecosystem maturity.

When viewed by End User Industry, it becomes clear that application drivers vary significantly. Automotive networks demand deterministic performance for in-vehicle systems, whereas data centers prioritize port density and power efficiency to support AI inference clusters. Government and healthcare environments place a premium on embedded security modules integrated at the controller level, while IT & Telecom firms seek modularity and rapid programmability. Manufacturing facilities increasingly rely on ruggedized controllers for industrial Ethernet, and retail deployments balance cost-effectiveness with robust VLAN segmentation for point-of-sale networks.

This comprehensive research report categorizes the Ethernet Controller market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Host Interface

- Bandwidth Type

- Application

- End-Use Industry

Illuminating Regional Dynamics Revealing Unique Opportunities in the Americas EMEA and Asia Pacific Ethernet Controller Markets

Regional analysis of the Ethernet controller market underscores distinctive growth trajectories and investment patterns. In the Americas, robust data center expansion in North America is fueling demand for ultra-high-speed controllers, while Latin American enterprises are gradually adopting advanced network infrastructures to support digital transformation initiatives. Shifts in regulatory frameworks around data sovereignty and local manufacturing incentives are influencing vendor strategies and joint ventures across the region.

In the Europe, Middle East & Africa corridor, heterogeneous economic conditions translate into varied adoption timelines. Western European markets lead in implementing advanced interface standards, bolstered by stringent GDPR-driven security requirements. The Middle East is witnessing accelerated infrastructure programs aimed at establishing regional technology hubs, while African markets prioritize cost-effective, energy-efficient Ethernet solutions to extend connectivity in resource-constrained settings.

Across Asia-Pacific, the interplay of massive hyperscale data center investments in China, Japan’s focus on next-generation networking for Industry 4.0, and India’s scaling telecom infrastructure projects is creating one of the most dynamic environments globally. Local government incentives aimed at domestic semiconductor ecosystems and a strong push for indigenous technology development are key factors driving region-specific controller features and partnerships.

This comprehensive research report examines key regions that drive the evolution of the Ethernet Controller market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Market Leaders and Innovators Shaping Ethernet Controller Technology with Their Distinctive Strategies and Product Portfolios

Several market leaders have distinguished themselves through targeted investments in IP cores, flexible architectures, and strategic alliances with hyperscale operators. One prominent innovator continues to refine its silicon photonics integration, enabling controllers to support optical interfaces at speeds previously unattainable on PCIe form factors. Another key player has focused on modular firmware stacks that allow network administrators to customize packet processing pipelines on the fly, underscoring a trend toward software-defined control.

A number of established semiconductor firms are leveraging their broader system portfolios to offer bundled networking solutions that integrate Ethernet controllers with switching silicon, creating value propositions that simplify procurement and accelerate time to market. At the same time, emerging startups are carving out niches by specializing in ultra-low-power controllers for edge computing use cases and by pioneering chiplet-based designs that facilitate heterogeneous integration. Together, these diverse strategies illustrate a competitive landscape where innovation velocity and ecosystem partnerships are paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ethernet Controller market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Micro Devices, Inc.

- Analog Devices, Inc.

- ASIX Electronics Corporation

- Broadcom Inc.

- C*Core Technology. Co., Ltd.

- Cadence Design Systems, Inc.

- Cirrus Logic, Inc.

- Infineon Technologies AG

- Intel Corporation

- Kyland Technology Co., Ltd.

- Linkreal Co., Ltd.

- Marvell Technology Group Ltd.

- MaxLinear, Inc.

- MediaTek Inc.

- Microchip Technology Inc.

- NVIDIA Corporation

- NXP Semiconductors N.V.

- ODOT Automation

- Realtek Semiconductor Corp.

- Renesas Electronics Corporation

- Rohm Co., Ltd.

- Semiconductor Components Industries, LLC

- Semtech Corporation

- Silicon Laboratories Inc.

- STMicroelectronics N.V.

- Synopsys, Inc.

- Texas Instruments Incorporated

Presenting Actionable Strategic Recommendations for Industry Stakeholders to Capitalize on Emerging Technologies and Mitigate Evolving Market Challenges

To navigate the evolving Ethernet controller ecosystem, industry stakeholders should prioritize strategic collaboration with standards bodies and hyperscale platform developers to ensure early access to emerging interface protocols. Building cross-functional teams that align hardware architects with software developers will accelerate the integration of smart offload engines and enhance interoperability across complex network stacks. Moreover, diversifying the supplier base and investing in multi-region manufacturing capabilities can safeguard against geopolitical and tariff-induced supply disruptions while maintaining cost competitiveness.

In parallel, organizations must deepen their focus on security at the controller level by adopting solutions with integrated encryption, authentication, and anomaly detection modules. Engaging in comprehensive interoperability testing and certification programs will de-risk deployment in mission-critical environments. Finally, cultivating direct partnerships with academic institutions and consortia can fuel forward-looking research into photonic interconnects and chiplet ecosystems, positioning stakeholders to ride the next wave of Ethernet controller innovation.

Detailing Rigorous Research Methodology Employing Primary and Secondary Data Collection as Well as Robust Analytical Techniques for Credible Insights

This research synthesizes insights from a dual-pronged methodology that combines primary data collection through in-depth interviews with senior engineering and procurement executives alongside extensive secondary research across industry white papers and technical journals. Primary engagements provided nuanced perspectives on current design priorities, supply chain constraints, and emerging customer requirements, while secondary sources validated statistical trends and technology roadmaps.

Quantitative data was triangulated using a blend of top-down analysis based on end market indicators and bottom-up synthesis of company announcements, product datasheets, and conference proceedings. Rigorous validation processes included cross-referencing vendor press releases with independent test reports and academic publications. Analytical techniques such as scenario analysis and sensitivity testing were applied to uncover critical inflection points, ensuring that the insights presented are robust, reproducible, and aligned with evolving industry benchmarks.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ethernet Controller market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ethernet Controller Market, by Product Type

- Ethernet Controller Market, by Host Interface

- Ethernet Controller Market, by Bandwidth Type

- Ethernet Controller Market, by Application

- Ethernet Controller Market, by End-Use Industry

- Ethernet Controller Market, by Region

- Ethernet Controller Market, by Group

- Ethernet Controller Market, by Country

- United States Ethernet Controller Market

- China Ethernet Controller Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Drawing Comprehensive Conclusions on Key Market Trends Impactful Variables and Strategic Imperatives for the Future of Ethernet Controller Ecosystems

The collective analysis presented underscores that Ethernet controllers are transitioning from commoditized components to strategic assets in high-performance networking architectures. Key trends such as the push toward 400 Gigabit and beyond, deeper offload integration for AI workloads, and the maturation of future interface standards are set to define competitive differentiation. Navigating trade policy shifts will require supply chain agility and investment in localized production, while security and interoperability remain non-negotiable priorities for enterprise and government deployments.

As the market continues to fragment into specialized performance tiers and form factors, stakeholders who align R&D roadmaps with end user imperatives-whether ultra-low-power edge devices or hyperscale data centers-will be best positioned to capture emerging opportunities. The convergence of standardization efforts, strategic alliances, and technology convergence will shape the next chapter of Ethernet controller evolution, making this an opportune moment for organizations to recalibrate their networking strategies and capitalize on the momentum of an industry undergoing its most transformative shift.

Encouraging Immediate Engagement with Ketan Rohom to Secure Your Comprehensive Ethernet Controller Market Intelligence Report for Strategic Advantage

For organizations aiming to outpace competitors in networking infrastructure intelligence, engaging with Ketan Rohom will unlock unparalleled access to in-depth analysis, strategic insights, and technical clarity. This comprehensive market intelligence report equips decision-makers with a nuanced understanding of emerging Ethernet controller innovations, cost considerations influenced by tariffs, and regional nuances shaping demand. By partnering directly with the Associate Director of Sales & Marketing, stakeholders can customize their research deliverable to address specific strategic questions and operational priorities. Reach out to secure your copy today and ensure your planning and procurement processes are grounded in the latest, most reliable intelligence to gain a sustainable competitive edge.

- How big is the Ethernet Controller Market?

- What is the Ethernet Controller Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?