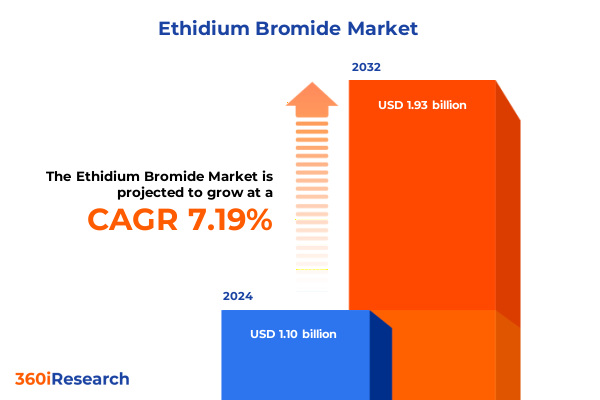

The Ethidium Bromide Market size was estimated at USD 1.17 billion in 2025 and expected to reach USD 1.25 billion in 2026, at a CAGR of 7.30% to reach USD 1.93 billion by 2032.

Unveiling Ethidium Bromide’s Critical Role in Molecular Biology and Its Strategic Implications for Scientific Advancements and Future Research Frontiers

Ethidium bromide has long been recognized for its powerful ability to intercalate with nucleic acids, making it an indispensable tool for visualizing DNA and RNA in molecular biology laboratories. Its high sensitivity and reliable fluorescence under ultraviolet light have cemented its role in gel electrophoresis, where it serves as the gold standard for nucleic acid detection. As researchers continue to pursue advancements in genomics, proteomics, and drug discovery, the demand for robust and reproducible staining agents remains a critical factor in experimental success.

Despite its widespread adoption, ethidium bromide’s classification as a potential mutagen has prompted growing concerns regarding laboratory safety, waste disposal, and regulatory oversight. In response, many institutions have revamped their protocols for handling and disposing of this compound, incorporating specialized waste containers, personal protective equipment, and detailed spill-response procedures. These measures aim to mitigate the risks associated with long-term exposure and environmental contamination, ensuring that laboratories maintain compliance with both federal guidelines and institutional policies.

Concurrently, the scientific community is witnessing the emergence of alternative nucleic acid stains that boast reduced toxicity and enhanced photostability. While these substitutes offer appealing safety profiles, they also present unique trade-offs in terms of staining intensity, cost per assay, and compatibility with existing imaging equipment. As stakeholders evaluate these options, the foundational importance of ethidium bromide in established workflows underscores the need for a nuanced understanding of its operational advantages and intrinsic limitations.

Exploring Pivotal Technological Innovations Regulatory Developments and Market Dynamics Reshaping the Ethidium Bromide Ecosystem in Modern Laboratories

In recent years, ethidium bromide has experienced a paradigm shift driven by technological breakthroughs, evolving regulatory frameworks, and increasing environmental consciousness. Innovations in gel documentation systems have enabled higher-resolution imaging and automated quantification of nucleic acid bands, prompting laboratories to reassess staining protocols and optimize dye concentrations for maximal sensitivity. These advancements have redefined performance benchmarks, spurring manufacturers to refine formulations that enhance fluorescence intensity while reducing background noise.

On the regulatory front, agencies in North America and Europe have implemented more stringent guidelines governing the classification, transportation, and disposal of mutagenic reagents. These regulatory developments have incentivized reagent suppliers to improve their safety data sheets, streamline labeling conventions, and offer comprehensive training modules to end users. As a result, the market is witnessing a concerted effort to harmonize safety practices across multiple jurisdictions, fostering greater transparency and consistency in laboratory operations.

Moreover, the shift toward greener and more sustainable laboratory practices has elevated discussions around recycling protocols, waste minimization, and the adoption of non-toxic alternatives. This transformative movement is not only reshaping procurement strategies but also influencing research budgets, as institutions seek to balance performance requirements with corporate sustainability commitments. Consequently, ethidium bromide is positioned at the nexus of innovation and regulation, where its future role will be defined by both scientific breakthroughs and environmental imperatives.

Analyzing the Comprehensive Impacts of Newly Implemented 2025 United States Tariffs on Ethidium Bromide Supply Chains and Cost Structures

The introduction of new tariff measures by the United States in early 2025 has exerted significant pressure on the supply chain for specialty reagents, including ethidium bromide. Raw materials, notably ammonium bromide and related precursors largely sourced from overseas chemical producers, have become subject to higher import duties, translating into elevated costs for reagent manufacturers. In turn, these increased input expenses place procurement teams in academic, biotech, and pharmaceutical organizations under intensified budgetary constraints.

Confronted with rising prices, many suppliers have reconfigured their sourcing strategies, prioritizing domestic production and establishing buffer inventories to mitigate the impact of fluctuating import duties. Strategic partnerships with North American chemical manufacturers have emerged as a vital means of preserving supply continuity, even as tariff uncertainties persist. However, the logistical complexities associated with scaling up local production-including capital investments, quality control enhancements, and regulatory approvals-continue to pose formidable challenges.

In parallel, some end users have explored alternative nucleic acid stains or sought bulk-purchase agreements to offset cost increases. These adaptive responses illustrate a broader industry trend toward supply chain resilience, where long-term contracts, dual-sourcing arrangements, and just-in-case inventories are employed to safeguard research continuity. As the tariff landscape evolves, stakeholders will need to refine their procurement playbooks, balancing cost containment with uninterrupted access to high-performance reagents.

Deriving Strategic Insights from Application Product Form and End User Segmentation to Illuminate Ethidium Bromide Market Opportunities and Challenges

Deep examination of application-based segmentation reveals that ethidium bromide continues to dominate in gel electrophoresis due to its unparalleled sensitivity, with laboratories relying on sub-categories such as agarose electrophoresis for routine DNA analysis, capillary electrophoresis for high-resolution separations, and polyacrylamide electrophoresis for protein studies. Simultaneously, drug screening platforms leverage its fluorescent properties to assess compound–nucleic acid interactions, while cell imaging workflows occasionally incorporate trace staining protocols to validate nucleic acid localization. This multifaceted application landscape underscores the compound’s versatile functionality across diverse research settings.

When considering product form, the choice between powdered reagent and pre-prepared solution hinges on factors such as storage stability, solubility requirements, and ease of use. Powdered ethidium bromide offers extended shelf life and customizable concentration for high-throughput facilities, whereas liquid formulations appeal to rapid-deployment scenarios where time-to-result is critical. These distinctions inform procurement preferences and influence supply chain planning across research laboratories, contract research organizations, and industrial biotech firms.

End user analysis highlights academia’s continued reliance on ethidium bromide for cost-effective training and fundamental research, contrasted with biotechnology companies that emphasize stringent quality control and traceability in manufacturing assays. Pharmaceutical entities, in turn, integrate ethidium bromide within regulated workflows to support preclinical studies, often subject to rigorous validation protocols. Each end-user segment exhibits unique purchasing drivers, mandating tailored engagement strategies and product support services to address specific laboratory requirements.

This comprehensive research report categorizes the Ethidium Bromide market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Application

- End User

Uncovering Regional Nuances and Growth Drivers Shaping Ethidium Bromide Demand Across the Americas EMEA and Asia Pacific Laboratories and Research Centers

In the Americas, especially within the United States and Canada, robust research funding and large-scale genomics initiatives sustain consistent demand for ethidium bromide, even as laboratories explore safer alternatives. The pharmaceutical hubs in these regions demand high-purity reagents compliant with stringent regulatory standards, fostering a competitive environment among specialized suppliers.

Across Europe, stringent environmental regulations have heightened scrutiny of mutagenic dyes, leading to incremental adoption of non-toxic fluorescent stains. Nonetheless, established academic and industrial research centers continue to utilize ethidium bromide for legacy protocols, supported by advanced waste-treatment infrastructures. In the Middle East, emerging research institutions are expanding their life science capabilities, driving initial uptake of cost-effective established reagents.

In the Asia-Pacific region, rapid expansion in China, India, and Southeast Asia reflects growing investments in biotechnology and contract research services. Here, cost sensitivity and local manufacturing partnerships shape reagent sourcing decisions, with an increasing number of laboratories balancing affordability against performance requirements. Meanwhile, shifting regulatory frameworks in key markets are gradually aligning with global safety conventions, paving the way for harmonized handling practices across the region.

This comprehensive research report examines key regions that drive the evolution of the Ethidium Bromide market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Companies’ Innovations Competitive Strategies and Collaborations Defining the Ethidium Bromide Market’s Competitive Landscape

Within this competitive landscape, leading chemical suppliers have advanced their ethidium bromide portfolios by emphasizing product purity, batch-to-batch consistency, and comprehensive safety documentation. Major global players have leveraged their expansive distribution networks to ensure timely delivery, complemented by technical support services that assist laboratories in optimizing staining protocols and waste management procedures.

Partnerships between reagent manufacturers and instrument providers have further enhanced the value proposition, delivering integrated solutions that pair optimized dye formulations with high-performance imaging systems. Collaborative efforts extend to academic alliances, where co-development initiatives focus on next-generation nucleic acid stains designed to exceed the fluorescence intensity and stability of traditional intercalators while minimizing environmental impact.

Emerging niche suppliers are differentiating through sustainability initiatives, including eco-friendly packaging and take-back programs for chemical wastes. These innovative approaches appeal to research institutions committed to green laboratory certifications, positioning these companies as strategic partners for organizations seeking to align scientific rigor with corporate responsibility. Collectively, these company-level strategies define a dynamic marketplace characterized by continuous product innovation and increasingly sophisticated customer engagement models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ethidium Bromide market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMRESCO, LLC

- Auraiya Laboratory Chemicals Pvt. Ltd.

- Avantor, Inc.

- Bio Basic Inc.

- BioVision, Inc.

- Bio‑Rad Laboratories, Inc.

- Cayman Chemical Company, Inc.

- Discovery Fine Chemicals Ltd.

- Ennore India Chemicals Pvt. Ltd.

- Glentham Life Sciences Ltd.

- LOBA Feinchemie AG

- Merck KGaA

- MP Biomedicals, LLC

- Muby Chemicals

- New England Biolabs, Inc.

- Niche Materials Ltd.

- Orange Chemicals Pvt. Ltd.

- Pharmachem Research & Development Laboratories Pvt. Ltd.

- Promega Corporation

- Sihauli Chemicals Pvt. Ltd.

- Sisco Research Laboratories Pvt. Ltd.

- Suvchem Laboratory Chemicals

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

- Zhangjiagang Xikai Chemical Co., Ltd.

Implementing Action-Oriented Strategies and Best Practices for Industry Leaders to Navigate Regulatory Changes Technological Advances and Market Evolution

Industry leaders should prioritize investment in alternative nucleic acid stains that address safety concerns without compromising performance. By allocating R&D resources toward molecules with reduced mutagenicity and enhanced photostability, manufacturers can meet evolving regulatory demands while preserving analytical sensitivity. Concurrently, establishing flexible manufacturing capabilities both domestically and abroad will strengthen supply chain resilience against tariff fluctuations and raw material bottlenecks.

Alongside product innovation, proactive engagement with regulatory bodies and standard-setting organizations can expedite approvals and foster goodwill with end-user communities. Companies can also benefit from educational initiatives aimed at best practices in handling, disposal, and spill response, thereby reinforcing their role as trusted advisors to research institutions. This consultative approach not only enhances brand loyalty but also elevates the overall safety culture within laboratories.

Moreover, integrating sustainability into every facet of operations-from green chemistry principles to recyclable packaging-will resonate with environmentally conscious stakeholders. By publicizing these efforts through transparent reporting and certification programs, companies can differentiate their offerings and secure preferential procurement status. Such comprehensive strategies will empower industry leaders to navigate market evolution effectively and capture emerging opportunities in life science research.

Outlining Rigorous Research Methodology Data Sources and Analytical Frameworks Ensuring Comprehensive Coverage and Unbiased Ethidium Bromide Market Insights

The research underlying this analysis employed a hybrid methodology integrating both qualitative and quantitative approaches. Primary interviews were conducted with laboratory directors, procurement managers, and regulatory specialists across academic, biotech, and pharmaceutical sectors to capture real-world insights into ethidium bromide usage patterns, safety considerations, and purchasing criteria.

Secondary data was compiled from peer-reviewed journals, regulatory agency publications, and patent databases to validate emerging trends in alternative staining technologies and environmental disposal protocols. Industry conferences and technical symposia provided additional layers of context, offering firsthand perspectives from stakeholders at the forefront of innovation. All data points were triangulated to ensure consistency and reliability.

Analytical frameworks were applied to segment the market according to application area, product form, and end-user type, enabling a granular evaluation of divergent needs and adoption barriers. Regional analyses accounted for geopolitical factors, tariff regimes, and regulatory landscapes, while company profiling incorporated product pipelines, strategic partnerships, and sustainability initiatives. This comprehensive methodology ensures that the insights presented are robust, unbiased, and directly actionable for decision makers seeking to optimize their ethidium bromide strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ethidium Bromide market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ethidium Bromide Market, by Product Form

- Ethidium Bromide Market, by Application

- Ethidium Bromide Market, by End User

- Ethidium Bromide Market, by Region

- Ethidium Bromide Market, by Group

- Ethidium Bromide Market, by Country

- United States Ethidium Bromide Market

- China Ethidium Bromide Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 795 ]

Summarizing Key Findings Strategic Implications and Future Outlook to Empower Decision Makers in the Ethidium Bromide Landscape with Confidence Foresight

This executive summary provides a cohesive overview of ethidium bromide’s enduring significance in molecular biology, illustrating how its unparalleled fluorescence performance continues to support critical DNA and RNA analyses. It also underscores the transformative forces at play, from technological enhancements in imaging systems to heightened environmental and safety regulations that are reshaping laboratory best practices.

The analysis further highlights how the 2025 United States tariff adjustments have compelled stakeholders to reassess supply chain strategies, spurring initiatives to localize production and diversify sourcing. Through detailed segmentation, the report illuminates the distinct needs and preferences of cell imaging, drug screening, and gel electrophoresis applications, as well as the dichotomy between powdered and solution formats and the divergent priorities of academia, biotechnology, and pharmaceutical end users.

Regional perspectives reveal nuanced demand patterns across the Americas, Europe, Middle East, Africa, and Asia-Pacific, while company profiles showcase the competitive landscape of innovation, partnerships, and sustainability commitments. Strategic recommendations emphasize the importance of alternative stain development, resilient supply chain design, regulatory collaboration, and green initiatives. Collectively, these insights equip decision makers with the knowledge needed to navigate market complexities and harness future growth opportunities.

Connect with Ketan Rohom to Secure Your Comprehensive Ethidium Bromide Market Research Report and Drive Informed Strategic Decisions

For tailored guidance on leveraging the latest insights into ethidium bromide market dynamics and to secure your detailed research report, please reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise in translating complex scientific data into strategic business decisions will help your organization harness the full potential of this analysis. To obtain the complete report and gain a competitive edge in reagent procurement, regulatory preparedness, and technology adoption, contact Ketan Rohom today. He will guide you through the subscription options, customization features, and supplementary services designed to meet the specific needs of your laboratory or corporate research division.

- How big is the Ethidium Bromide Market?

- What is the Ethidium Bromide Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?