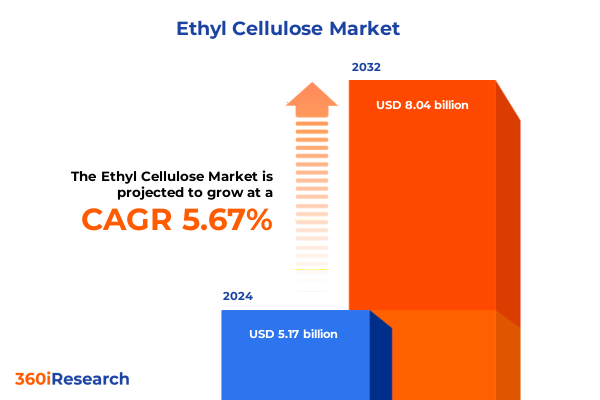

The Ethyl Cellulose Market size was estimated at USD 5.46 billion in 2025 and expected to reach USD 5.77 billion in 2026, at a CAGR of 6.22% to reach USD 8.34 billion by 2032.

Deep Dive into Ethyl Cellulose Extracts Its Unique Properties and Foundational Value across Cutting-Edge Industrial Applications Worldwide

Ethyl cellulose, a versatile cellulose derivative, combines the mechanical strength of natural polymers with enhanced solubility characteristics, positioning it as a critical material across multiple industrial domains. Derived through the etherification of cellulose, this polymer exhibits excellent film-forming properties, making it a preferred binder and thickener in complex formulations. Its thermal stability and compatibility with a wide range of solvents enable formulators to create products that meet exacting performance requirements under diverse environmental conditions.

Across coatings, adhesives, pharmaceuticals, food, and printing inks, ethyl cellulose serves as a foundational ingredient that bridges performance and functionality. In coatings, it contributes to improved rheology control and film integrity, while in adhesives it enhances tack and adhesion strength. In pharmaceutical applications, its controlled-release capabilities are harnessed to optimize drug delivery profiles, and its role as a stabilizer in food encapsulation helps protect sensitive bioactive ingredients. The print media industry relies on its dispersibility to achieve sharp, vibrant images, particularly in flexographic and gravure processes.

Recent advances in polymer science have further refined ethyl cellulose grades, allowing manufacturers to tailor molecular weight distribution and viscosity to precise specifications. Consequently, ethyl cellulose continues to evolve from a niche binder into a multifunctional additive, capable of meeting rigorous sustainability targets and regulatory mandates. This expansion of use cases underscores the material’s adaptability and highlights its strategic importance as industries pursue performance-driven and environmentally responsible solutions.

Analyzing the Major Technological Innovations Policy Reforms and Sustainability Drivers Reshaping the Ethyl Cellulose Landscape Today

In recent years, the ethyl cellulose landscape has been redefined by the convergence of sustainability imperatives, technological breakthroughs, and regulatory reform. A marked shift toward low-VOC and waterborne systems has driven formulators to investigate ethyl cellulose as a key component in eco-conscious coatings and sealants. Concurrently, the advent of digital manufacturing platforms and advanced rheology modifiers has enabled real-time optimization of viscosity profiles, enhancing process consistency and end-product quality.

At the same time, nanotechnology and bio-inspired design are reshaping application frameworks, with researchers exploring micro- and nanoscale ethyl cellulose-based carriers for targeted drug release and controlled food encapsulation. This level of innovation is being supported by stricter global regulations on plasticizers and synthetic polymers, encouraging formulators to pivot toward natural and semi-synthetic materials. In tandem, digital supply chain initiatives have increased transparency in raw material sourcing, fostering trust among end users and enabling traceable compliance certifications.

Moreover, the integration of advanced analytical techniques such as in-line rheometry and spectroscopic monitoring is facilitating accelerated product development cycles. The rise of Industry 4.0 solutions, including predictive maintenance and AI-driven formulation modeling, has reduced trial-and-error workflows, shortening time to market. Taken together, these transformative trends are not only elevating ethyl cellulose’s performance credentials but also creating an ecosystem that prioritizes efficiency, traceability, and environmental stewardship.

Evaluating the Impact of United States Trade Tariffs Introduced in 2025 on Ethyl Cellulose Supply Chains Cost Structures and Procurement Strategies

The introduction of targeted tariffs on imported cellulose ethers by the United States in early 2025 has created significant shifts in the sourcing and cost structures for ethyl cellulose. By imposing an additional duty of up to 25% on key producers, U.S. policymakers aimed to protect domestic manufacturing capacity and encourage local investments in chemical production. However, this policy action has also heightened raw material costs, compelling formulators and end users to reassess procurement strategies and risk management frameworks.

In response, many organizations have accelerated the qualification of alternative suppliers from regions not subject to tariffs, such as Southeast Asia and Latin America. Concurrently, domestic producers have ramped up capacity expansions to capture incremental demand, investing in continuous polymerization and solvent recovery technologies to improve throughput and reduce solvent waste. These adjustments have introduced dual benefits: greater supply stability for U.S. consumers and closer alignment with environmental objectives through lower carbon intensity in shipping.

Nevertheless, the initial impact of elevated tariff burdens was most acutely felt in price-sensitive segments such as adhesives and coatings, where margin pressures forced manufacturers to optimize formulations for lower additive loadings without compromising performance. Over time, collaborative negotiations between buyers and producers have led to more flexible contract terms, including cost-plus and index-linked pricing mechanisms that share the burden of raw material volatility. As a result, stakeholders have begun to view the 2025 tariff measures as a catalyst for long-term supply resilience rather than a transient obstacle.

Revealing Strategic Insights from Ethyl Cellulose Market Segmentation across Applications Forms Distribution Channels Molecular Weights and Viscosity Grades

A nuanced analysis of ethyl cellulose market segmentation reveals distinct performance trajectories based on application, form, distribution channel, molecular weight, and viscosity grade. In its primary market, adhesives and sealants command a robust share, where pressure-sensitive systems leverage the polymer’s tack and flexibility, while structural adhesives exploit its bonding strength and thermal resistance. Coatings represent another pivotal segment, with architectural paints benefiting from superior film formation, automotive finishes demanding high molecular weight variants for durability, and industrial coatings incorporating medium-grade viscosities to balance sprayability and coverage.

Within food applications, ethyl cellulose’s role as an encapsulating agent and stabilizer has expanded alongside the functional foods movement, supporting texture enhancement and controlled release of active compounds. Pharmaceutical applications, particularly in controlled-release tablets and protective film coatings, continue to grow thanks to stringent bioavailability requirements and the polymer’s compatibility with a broad pH range. Meanwhile, printing inks remain a specialized niche, with flexographic processes favoring low-viscosity solutions for rapid drying and gravure systems selecting higher grades to maintain image fidelity.

In terms of physical form, granules offer ease of handling for large-scale industrial mixing, powder delivers cost efficiency for batch processes, and solution grades provide ready-to-use formulations for high-precision coatings. Distribution channels also display varied dynamics: direct sales dominate high-volume industrial accounts, distributors serve regional formulators seeking flexible order sizes, and online platforms are steadily gaining traction among small-scale users. Molecular weight segmentation underscores a balance between mechanical strength, solubility, and processing ease, while viscosity grades from 100 to above 1000 mPa.s are tailored to specific flow and film thickness requirements. Together, these segmentation insights enable practitioners to align grade selection and supply chain strategies with evolving performance and cost objectives.

This comprehensive research report categorizes the Ethyl Cellulose market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Molecular Weight

- Viscosity Grade

- Application

- Distribution Channel

Unveiling Critical Regional Dynamics Influencing Ethyl Cellulose Demand Production and Regulatory Environments in Americas EMEA and Asia Pacific

Regional markets for ethyl cellulose exhibit distinct demand drivers, production capabilities, and regulatory frameworks. In the Americas, robust growth in automotive coatings and pharmaceutical manufacturing has spurred investment in local polymerization facilities, particularly in the Gulf Coast and Southeastern states. Favorable tax incentives and streamlined permitting processes have encouraged US producers to expand continuous production lines, reducing reliance on long-lead imports. Simultaneously, Latin American formulators have increased adoption of ethyl cellulose for food texturizing and oilfield applications, facilitated by trade agreements that lower barriers to North American supplies.

Across Europe, the Middle East, and Africa, regulatory emphasis on low-VOC solvents and circular economy principles has accelerated the substitution of traditional binders with ethyl cellulose. European producers are collaborating on industry consortia to establish certification standards for bio-based content and end-of-life recyclability, ensuring compliance with REACH and upcoming green claims legislation. In the Middle East, petrochemical feedstocks for cellulose derivatives continue to benefit from competitive pricing, while African markets focus on import substitution and local formulation of pharmaceuticals and adhesives, driving demand for medium-viscosity grades.

In Asia-Pacific, rapid expansion of the pharmaceutical sector in India and China has been complemented by surging demand for encapsulation technologies in food and nutraceutical industries across Southeast Asia. Regional manufacturers are investing in solvent recovery and energy-efficient drying systems to meet stringent environmental regulations in Japan and South Korea. As a result, cross-border collaborations have emerged to optimize R&D efforts and share best practices in process intensification, reinforcing Asia-Pacific’s position as both a significant consumer and a growing exporter of specialized ethyl cellulose grades.

This comprehensive research report examines key regions that drive the evolution of the Ethyl Cellulose market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Companies Driving Innovation Investment Partnerships and Competitive Strategies in the Global Ethyl Cellulose Sector

Leading specialty chemical companies are driving the ethyl cellulose market through targeted investments in sustainable production and portfolio diversification. Major global players have pursued strategic acquisitions to complement their cellulose derivative offerings, integrating vertically to secure access to high-purity cellulose feedstocks. Research-driven incumbents have introduced novel high-molecular-weight and ultra-low-viscosity grades, expanding application possibilities in advanced coatings and precision pharmaceuticals.

Several firms have established innovation centers focused on green chemistry, where process chemists collaborate with polymer engineers to optimize solvent recuperation and reduce carbon intensity. These centers serve as testing grounds for continuous manufacturing processes that yield tighter molecular weight distributions and lower batch-to-batch variability. Meanwhile, dynamic partnerships between suppliers and end-users have resulted in co-development platforms, enabling faster scale-up of new formulations and enhancing barrier properties for emerging applications like flexible electronics and battery coatings.

Competitive strategies also involve the establishment of regional production hubs to mitigate trade risks and improve service levels. By situating reactors and downstream processing units closer to key demand centers, companies have been able to reduce inland logistics costs and lead times. Furthermore, alliances with distributors and digital sales platforms are broadening customer access, particularly in emerging markets. Collectively, these initiatives underscore a sector-wide commitment to performance leadership, supply assurance, and sustainability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ethyl Cellulose market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ashland Global Holdings Inc.

- CP Kelco U.S., Inc.

- Daicel Corporation

- Eastman Chemical Company

- J. Rettenmaier & Söhne GmbH + Co KG

- J.M. Huber Corporation

- Lamberti S.p.A.

- Lanxess AG

- Maroon Group LLC

- NIPPON PAPER CHEMICALS Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- The Dow Chemical Company

Providing Pragmatic Action Plans for Industry Stakeholders to Strengthen Supply Resilience Optimize Costs and Foster Sustainable Growth in Ethyl Cellulose

To navigate the evolving dynamics of the ethyl cellulose market, industry leaders should adopt a multifaceted strategy that balances supply resilience, cost optimization, and sustainability. Pursuing diversified sourcing arrangements, including dual-sourcing agreements and regional procurement hubs, can buffer against tariff fluctuations and logistical disruptions while maintaining competitive pricing. Concurrent investments in solvent recovery and energy-efficient polymerization processes will further reduce operational costs and environmental impact.

In parallel, companies should deepen collaborative R&D partnerships with downstream formulators to co-create differentiated products that address specific performance challenges in coatings, adhesives, pharmaceuticals, and food applications. Embracing digital process analytics and AI-driven modeling can accelerate formulation cycles, enabling rapid qualification of new grades and custom solutions. Moreover, obtaining third-party certifications for bio-based content and end-of-life degradability will strengthen sustainability narratives and align with increasingly stringent regulatory requirements.

Finally, stakeholders are encouraged to implement transparent pricing frameworks, such as index-linked and cost-plus models, to foster trust and cost-sharing with customers. A proactive dialogue with policymakers and trade associations can also shape favorable trade policies and regulatory standards, ensuring long-term market stability. By executing these pragmatic action plans, organizations can secure a leadership position in the ethyl cellulose ecosystem and enable sustainable, profitable growth.

Detailing Rigorous Research Methodology Combining Primary Interviews Secondary Data Triangulation and Qualitative Validation for Ethyl Cellulose Market Analysis

The research methodology underpinning this analysis combines structured primary and secondary research techniques to ensure data integrity and depth of insight. Primary research involved in-depth interviews with senior executives at leading ethyl cellulose producers, formulators, and end users across key regions. These qualitative discussions illuminated strategic priorities, product innovation timelines, and supply chain challenges, providing firsthand validation of emerging market trends.

Secondary research comprised a systematic review of publicly accessible technical papers, regulatory filings, patent databases, and academic journals to map evolving application pathways and performance benchmarks. Data triangulation was achieved by cross-referencing multiple sources, including trade publications, financial statements, and import/export databases, to corroborate market dynamics. A rigorous filtering process excluded unsupported claims and ensured alignment with up-to-date regulatory standards, such as low-VOC mandates and international trade regulations.

Quantitative analyses were supplemented by proprietary scorecards that assessed supplier capabilities, innovation pipelines, and sustainability credentials. Continuous validation sessions with industry subject-matter experts provided iterative feedback, refining the study’s thematic focus and ensuring actionable relevance. This comprehensive approach yields a high level of confidence in the findings and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ethyl Cellulose market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ethyl Cellulose Market, by Form

- Ethyl Cellulose Market, by Molecular Weight

- Ethyl Cellulose Market, by Viscosity Grade

- Ethyl Cellulose Market, by Application

- Ethyl Cellulose Market, by Distribution Channel

- Ethyl Cellulose Market, by Region

- Ethyl Cellulose Market, by Group

- Ethyl Cellulose Market, by Country

- United States Ethyl Cellulose Market

- China Ethyl Cellulose Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Summarizing Key Takeaways Strategic Implications and Forward Looking Considerations to Guide Decision Makers in the Evolving Ethyl Cellulose Ecosystem

This executive summary has outlined the key attributes, transformative trends, and regulatory shifts shaping the ethyl cellulose market. From the material’s inherent performance advantages to the disruptive impact of 2025 tariff measures, stakeholders have gained a holistic view of current and emerging dynamics. Segmentation insights offer clarity on where application-driven demand, form factors, distribution channels, molecular weight ranges, and viscosity grades converge to create unique growth pockets.

Regional analyses illuminate how market drivers vary across the Americas, EMEA, and Asia-Pacific, underscoring the need for tailored strategies in production, compliance, and logistics. The competitive landscape is characterized by companies that are investing in sustainable technologies, forging partnerships, and establishing local manufacturing footprints. Based on these observations, industry leaders are advised to adopt actionable recommendations focused on supply chain diversification, collaborative innovation, digital acceleration, and transparent pricing models.

In closing, ethyl cellulose represents more than a traditional binder-it is a dynamic platform for performance customization and sustainability advancement. The insights and recommendations captured here equip decision makers with a clear roadmap to navigate complexity, capitalize on growth opportunities, and reinforce resilience in an increasingly competitive market environment.

Take Action Now to Secure Comprehensive Ethyl Cellulose Market Research Insights and Collaborate Directly with Associate Director of Sales and Marketing

Don’t miss the opportunity to leverage comprehensive and actionable insights into the ethyl cellulose market. By partnering directly with Ketan Rohom, Associate Director of Sales & Marketing, you can tailor your information needs and receive personalized guidance on how to apply the findings to your business strategy. Ketan’s deep expertise in specialty chemicals and strong relationships across key industry segments ensure that your organization will gain a competitive edge. Engage with Ketan today to discuss custom data requirements, explore subscription packages, or secure the full report for immediate access to in-depth analyses, supply chain evaluations, and strategic recommendations. Take the decisive step toward informed decisions and accelerated growth by reaching out to facilitate your purchase and start transforming market intelligence into tangible business value.

- How big is the Ethyl Cellulose Market?

- What is the Ethyl Cellulose Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?