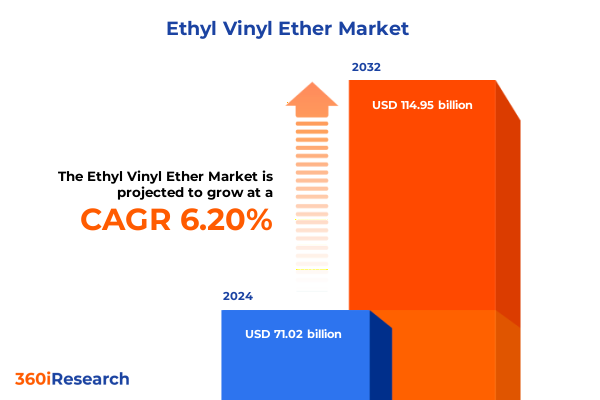

The Ethyl Vinyl Ether Market size was estimated at USD 75.48 billion in 2025 and expected to reach USD 80.22 billion in 2026, at a CAGR of 6.19% to reach USD 114.95 billion by 2032.

Discover the Strategic Potential and Industrial Significance of Ethyl Vinyl Ether in Contemporary and Emerging Chemical Applications

Ethyl Vinyl Ether (EVE) represents a highly reactive monomer that plays a pivotal role in modern polymer chemistry and specialty chemical synthesis. Recognized for its low boiling point and clear, colorless liquid form, EVE serves as a foundational building block in the production of homopolymers and copolymers, offering unparalleled versatility in formulating adhesives, coatings, and sealants. Its unique ability to undergo facile addition reactions under acidic catalysis has positioned it as an essential intermediate in both academic and industrial research laboratories.

In addition to its polymerization capabilities, EVE finds extensive use across multiple industrial sectors. It enhances combustion efficiency when used as a fuel additive in gasoline and diesel engines, directly contributing to reduced emissions and improved performance. In the electronics industry, it is employed in photolithography processes during semiconductor manufacturing, where its volatility and reactivity facilitate precise patterning. Furthermore, the pharmaceutical industry relies on EVE-derived copolymers for drug formulation, including thickening agents and transdermal patch adjuvants, showcasing its importance in medical device and pharmaceutical development.

Recent trends emphasize sustainable sourcing of Ethyl Vinyl Ether, with a growing number of producers deriving the compound from bioethanol feedstocks. This shift toward 100% bio-based solutions not only aligns with corporate environmental goals but also addresses increasing regulatory scrutiny regarding carbon footprint reduction. Manufacturers leveraging bioethanol not only enhance supply chain resilience but also meet stakeholder demands for greener chemical processes, underscoring an industry-wide commitment to sustainable innovation.

Moreover, tightening regulations on volatile organic compounds (VOCs) in major markets have accelerated the adoption of Ethyl Vinyl Ether as a lower-VOC alternative in coatings, adhesives, and solvents. Regulatory frameworks in North America and Europe, in particular, mandate significant VOC reductions, driving formulators to prioritize EVE-based solutions that comply with stringent emissions standards while maintaining high-performance characteristics.

Unveiling the Transformative Mechanisms Driving Ethyl Vinyl Ether Market Evolution Amid Advancing Technologies and Regulatory Environments

The landscape of Ethyl Vinyl Ether applications is undergoing transformative shifts driven by technological breakthroughs, regulatory imperatives, and evolving end-use sector demands. One of the most significant drivers is the rise of bio-based feedstocks, where companies are actively pursuing bioethanol-derived synthesis routes to reduce greenhouse gas emissions and secure stable raw material supplies. This transition not only mitigates environmental impact but also enhances supply chain resiliency amid fluctuating petrochemical prices.

Concurrently, advancements in catalyst design are redefining polymerization processes for Ethyl Vinyl Ether. Novel acid catalysts-ranging from trifluoroacetic acid to p-toluenesulfonic acid-are enabling more efficient protection and deprotection of hydroxyl functionalities, which expands the utility of EVE in complex organic syntheses, such as Claisen rearrangements and cycloadditions. These innovations reduce reaction times, lower energy consumption, and improve overall process yields, thereby bolstering the economic viability of high-purity EVE applications.

Regulatory dynamics also play a crucial role in reshaping demand patterns. Stricter VOC emission limits in North America and Europe are accelerating the reformulation of adhesives, coatings, and sealants around Ethyl Vinyl Ether, which offers both performance and compliance advantages. At the same time, an emphasis on circular economy principles is spurring the development of recyclable and biodegradable polymer systems derived from EVE, opening new market opportunities in sustainable packaging and green materials.

Finally, digitalization and Industry 4.0 initiatives are transforming production and quality control of Ethyl Vinyl Ether. Real-time process monitoring, advanced analytics, and predictive maintenance in manufacturing plants ensure consistent product purity and minimize downtime. These digital tools not only optimize operational efficiency but also reinforce traceability across the supply chain, supporting compliance and risk management in highly regulated environments.

Analyzing the Cumulative Impact of United States Tariff Adjustments on Ethyl Vinyl Ether Supply Chains and Competitive Dynamics in 2025

In 2025, the United States maintained its Most-Favored-Nation tariff rate for ethers under HTS heading 2909 at approximately 5.5 percent, reflecting long-established MFN treatment for chemical intermediates. However, imports of ethers from China have incurred an additional 25 percent Section 301 tariff, effectively raising the total duty on products such as Ethyl Vinyl Ether to around 30.5 percent for Chinese-origin shipments.

Earlier in 2025, the Office of the U.S. Trade Representative concluded its four-year statutory review of Section 301 measures, sustaining higher duties on a diverse range of chemical inputs while confirming targeted exclusions for critical clean energy materials. Although Ethyl Vinyl Ether itself was not specifically listed among the renewed exclusions, the broader environment of heightened tariffs has influenced raw material sourcing strategies. Domestic producers have benefited from this protection, while importers have explored alternative origins or accelerated nearshoring initiatives to mitigate elevated duty burdens.

As a result, many specialty chemical companies have re-evaluated their global logistics networks, investing in North American and European production sites to reduce exposure to Section 301 tariffs. This trend aligns with broader supply chain diversification efforts that prioritize reliability and cost stability over the near-term benefit of lower landed costs from tariff-impacted origins. Consequently, the competitive dynamics of Ethyl Vinyl Ether supply chains have shifted, privileging agile players capable of integrating regional manufacturing and agile distribution models.

Deriving Critical Insights from Segmentation Analysis to Unlock New Growth Frontiers in the Ethyl Vinyl Ether Market Framework

A nuanced segmentation analysis reveals differentiated performance drivers across the Ethyl Vinyl Ether value chain. Within end-use industries, the automotive sector capitalizes on EVE’s role in high-performance adhesives and sealants, especially in the OEM segment where precision bonding of interior components demands reliable adhesion under varied temperature ranges. In the healthcare industry, the medical devices subsegment leverages EVE-based copolymers for transdermal patches, benefiting from optimized viscosity and drug delivery profiles. Construction applications, however, demonstrate a bifurcated pattern: commercial projects increasingly specify EVE-enhanced coatings for corrosion protection, while residential developers focus on sustainable, low-VOC paints formulated from EVE copolymers. Electronics manufacturers are tapping into EVE’s utility in photolithography, particularly within consumer electronics, where industrial-grade purity and reproducible film formation are paramount. Packaging companies depend on food-grade EVE derivatives to ensure safety and performance, balancing regulatory compliance with functional requirements for barrier properties, whereas textile producers employ EVE-modified polymers in industrial fabrics that demand both strength and flexibility.

When examining product grades, laboratory and polymerization grades dominate specialized applications that require stringent purity and controlled reaction kinetics, while solvent-grade EVE finds broader acceptance in large-volume coatings and dispersant roles. In terms of distribution, direct sales channels have become the preferred route for high-value accounts seeking customized technical support, while distributors handle regional inventory management for mid-tier industrial users and online platforms cater to research laboratories requiring small-volume procurement. Purity grade segmentation further highlights industrial-grade EVE for commodity applications, laboratory-grade for research and development, and technical-grade EVE for intermediate-scale production, reflecting escalating demands for traceability and specification compliance across complex supply chains.

This comprehensive research report categorizes the Ethyl Vinyl Ether market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Purity Grade

- End Use Industry

- Distribution Channel

Illuminating Regional Dynamics and Strategic Opportunities for Ethyl Vinyl Ether Across the Americas, Europe Middle East Africa, and Asia Pacific

The Ethyl Vinyl Ether market exhibits marked regional differentiation in both demand and production capabilities. In the Americas, North America stands out as a mature market driven by stringent environmental regulations on VOCs and robust demand from pharmaceutical and automotive industries. The United States, in particular, benefits from established infrastructure for specialty chemicals and ongoing investments in bio-based production facilities that enhance local EVE supply resilience. Latin America, by contrast, is an emerging market where growing automotive production and infrastructure development projects are expanding the use of EVE in adhesives and coatings applications.

Across Europe, Middle East, and Africa, Europe leads with its comprehensive regulatory framework and emphasis on sustainability, incentivizing shifts toward bio-derived EVE and recyclable polymer systems. Germany and France, as leading chemical hubs, host significant R&D centers focusing on advanced polymer applications. The Middle East is augmenting its traditional petrochemical base by integrating specialty chemical segments, leveraging feedstock advantages for Ethyl Vinyl Ether production. Meanwhile, a nascent but growing EME African market is catalyzed by infrastructure investments that increase demand for high-performance adhesives and sealants.

In the Asia-Pacific region, China remains the world’s largest producer of Ethyl Vinyl Ether, supported by expansive petrochemical complexes and favorable manufacturing economics. Japan and South Korea maintain strong capacities in high-purity, technology-intensive segments, such as electronics-grade EVE for photolithography. India’s market growth is propelled by rapid pharmaceutical expansion, driving demand for EVE-based drug intermediates, while Southeast Asian nations are emerging as important hubs for contract manufacturing and specialty polymer formulations. This dynamic interplay shapes regional strategies as companies align production footprints with market-specific requirements and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Ethyl Vinyl Ether market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating the Competitive Landscape, Innovation Trajectories, and Strategic Positioning of Leading Ethyl Vinyl Ether Manufacturers Globally

Leading Ethyl Vinyl Ether manufacturers strategically differentiate themselves through a combination of production scale, specialty grade offerings, and geographic diversity. In ranking studies, SRL emerges as a dominant supplier with approximately 24.9 percent of online engagement, reflecting strong market visibility and established distribution networks across key regions. A. B. Enterprises and National Analytical Corporation follow closely, underscoring the importance of mid-sized innovators in meeting specialized customer requirements. Alfa Chemical Co., Ltd. and Fengchen Group Co., Ltd. round out the top five, demonstrating competitive positioning through portfolio breadth and technical service capabilities.

Beyond these ranked players, multinational corporations such as BASF SE and Merck KGaA maintain significant footprints, leveraging vertically integrated production and extensive R&D investments to supply both commodity and high-purity grades of Ethyl Vinyl Ether. Tokyo Chemical Industry Co., Ltd. and Nippon Carbide Industries Co., Ltd. contribute advanced specialty chemistries, particularly for laboratory-grade and technical-grade EVE. Meanwhile, Gelest (a Mitsubishi Chemical company) and Thermo Fisher Scientific serve niche segments, emphasizing analytical-grade purity for research and photolithography applications.

Regional leaders such as Godavari Biorefineries have distinguished themselves through bio-based production pathways, aligning product portfolios with sustainability mandates. Kanto Chemical Co., Inc., with decades of chemical manufacturing expertise, continues to expand its global supply chain, while other Asia-based producers such as Hubei Xinjing New Material Co., Ltd. and Hubei Shengling Technology Co., Ltd. focus on capacity enhancement to meet rising domestic and export demand. This competitive mosaic underscores the need for agility, specialty grade diversification, and investment in advanced manufacturing technologies to secure leadership in the evolving Ethyl Vinyl Ether market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ethyl Vinyl Ether market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A. B. Enterprises

- Anhui Haihua Chemical Technology Co., Ltd.

- BASF SE

- Boai NKY Pharmaceuticals Ltd.

- Covestro AG

- Dow Inc.

- Evonik Industries AG

- Gelest, Inc.

- GFS Chemicals, Inc.

- Hefei TNJ Chemical Industry Co., Ltd.

- Henan DaKen Chemical Co., Ltd.

- Huntsman Corporation

- Jinan Qinmu Fine Chemical Co., Ltd.

- JSK Chemicals

- Merck KGaA

- Otto Chemie Pvt. Ltd.

- Puyang ShenghuaDe Chemical Co., Ltd.

- Shanghai Macklin Biochemical Co., Ltd.

- Sigma-Aldrich Chemicals Private Limited

- TCI Chemicals (India) Pvt. Ltd.

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry Co., Ltd.

- Wuhan Ruiji Chemical Co., Ltd.

- Yixing Kaixin Chemical Co., Ltd.

- Zhengzhou Alfa Chemical Co., Ltd.

Crafting Actionable Strategic Recommendations to Drive Growth and Resilience in the Ethyl Vinyl Ether Industry Ecosystem

Industry leaders seeking to capitalize on Ethyl Vinyl Ether opportunities should first prioritize supply chain diversification by establishing multi-regional production capabilities, thereby reducing reliance on any single raw material source or tariff-impacted origin. Aligning manufacturing footprints with target markets in North America, Europe, and Asia-Pacific can mitigate exposure to geopolitical risks and regulatory volatility.

Second, investing in sustainable production pathways, including bioethanol-derived EVE and circular polymer recycling initiatives, will not only meet tightening environmental regulations but also resonate with customer demand for greener solutions. Partnering with research institutions to innovate catalyst systems and process intensification techniques can further reduce energy consumption and improve operational margins.

Third, leaders must enhance their digital transformation strategies by deploying advanced analytics, real-time monitoring, and predictive maintenance across production facilities. Such initiatives improve product consistency for high-purity grades, accelerate time-to-market for custom formulations, and reinforce compliance in regulated sectors such as pharmaceuticals and electronics.

Finally, fostering strategic collaborations through joint ventures or targeted acquisitions will accelerate access to new applications and regions. Forming alliances with adhesives, coatings, and pharmaceutical formulators can generate co-development opportunities, while partnerships with distribution networks can optimize market reach and technical support for end-users. Collectively, these recommendations will enable companies to navigate the complex Ethyl Vinyl Ether landscape and secure sustained competitive advantage.

Unveiling Rigorous Methodological Approaches Underpinning Comprehensive Ethyl Vinyl Ether Market Research Deliverables and Insights

This report is grounded in a robust research methodology that integrates both primary and secondary sources to deliver comprehensive market insights. Primary research encompassed interviews with industry executives, technical experts, and supply chain managers from leading Ethyl Vinyl Ether producers and end-use companies. Input from these stakeholders provided firsthand perspectives on product specifications, application trends, and strategic priorities.

Secondary research involved extensive review of government publications, trade association reports, and regulatory databases, including tariff data from the U.S. International Trade Commission and Section 301 notices from the Office of the U.S. Trade Representative. Harmonized Tariff Schedule details were cross-referenced to quantify duty structures affecting Ethyl Vinyl Ether imports. Moreover, peer-reviewed journals and patent filings were analyzed to identify recent innovations in polymerization catalysts and bio-based production methods.

Quantitative data on global trade flows and production capacities were sourced from national customs databases, supplemented by company annual reports and investor presentations. Segmentation analysis leveraged proprietary databases to map applications by end-use industry, product grade, and distribution channel. Regional dynamics were assessed by comparing growth drivers, regulatory frameworks, and capacity expansions across Americas, EMEA, and Asia-Pacific.

Finally, insights were validated through triangulation of multiple data points, ensuring reliability and consistency. The resulting analysis offers actionable intelligence to support strategic decision-making and market entry planning for stakeholders across the Ethyl Vinyl Ether ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ethyl Vinyl Ether market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ethyl Vinyl Ether Market, by Product Type

- Ethyl Vinyl Ether Market, by Purity Grade

- Ethyl Vinyl Ether Market, by End Use Industry

- Ethyl Vinyl Ether Market, by Distribution Channel

- Ethyl Vinyl Ether Market, by Region

- Ethyl Vinyl Ether Market, by Group

- Ethyl Vinyl Ether Market, by Country

- United States Ethyl Vinyl Ether Market

- China Ethyl Vinyl Ether Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Conclusions and Strategic Reflections on Ethyl Vinyl Ether Market Dynamics and Implications to Inform Future Decision-Making Processes

Ethyl Vinyl Ether has emerged as a cornerstone of the specialty chemicals sector, distinguished by its versatile monomeric properties and wide-ranging industrial applications. From high-performance adhesives in the automotive industry to precision reagents for photolithography in semiconductor fabrication, EVE’s unique combination of reactivity and volatility underpins its strategic importance. Regulatory pressures on VOC emissions and sustainability imperatives have further elevated its value proposition, driving bio-based production and circular chemistry initiatives.

The interplay of tariff adjustments, particularly the continued imposition of Section 301 duties on Chinese imports, has catalyzed a reorientation of supply chains toward multi-regional manufacturing and nearshoring strategies. At the same time, segmentation analysis underscores differentiated growth pathways across automotive, healthcare, electronics, packaging, and textile end-use industries, highlighting the need for customized product grades and targeted distribution models.

Key players in the market, ranging from specialized suppliers such as SRL and Godavari to chemical giants like BASF and Merck, are investing in capacity expansions, digital enhancements, and collaborative partnerships to fortify their competitive positions. As the industry navigates dynamic regulatory landscapes and evolving customer demands, strategic recommendations emphasize supply chain diversification, sustainable production, and digital transformation as critical levers for long-term success.

In conclusion, the Ethyl Vinyl Ether market offers robust opportunities for companies that can adeptly integrate technological innovation with strategic foresight. By embracing sustainable practices, optimizing global footprints, and leveraging data-driven insights, stakeholders can secure resilient growth and capitalize on emerging application frontiers in this dynamic chemical segment.

Engage with Ketan Rohom to Unlock In-Depth Insights and Obtain Your Comprehensive Ethyl Vinyl Ether Market Research Report Today

Experts seeking comprehensive insights and strategic guidance on Ethyl Vinyl Ether market trends and dynamics are encouraged to connect with Associate Director of Sales & Marketing, Ketan Rohom. Engaging with Mr. Rohom will unlock tailored perspectives on supply chain strategies, regulatory landscapes, and innovation drivers that are critical for informed decision-making. His deep understanding of specialty chemical markets, combined with an extensive network of industry contacts, ensures that clients receive not only the highest quality research deliverables but also actionable intelligence that drives competitive advantage. Contact Ketan Rohom today to secure your copy of the Ethyl Vinyl Ether market research report and gain access to data-driven analyses, proprietary benchmarks, and expert recommendations designed to catalyze growth and resilience in your organization.

- How big is the Ethyl Vinyl Ether Market?

- What is the Ethyl Vinyl Ether Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?