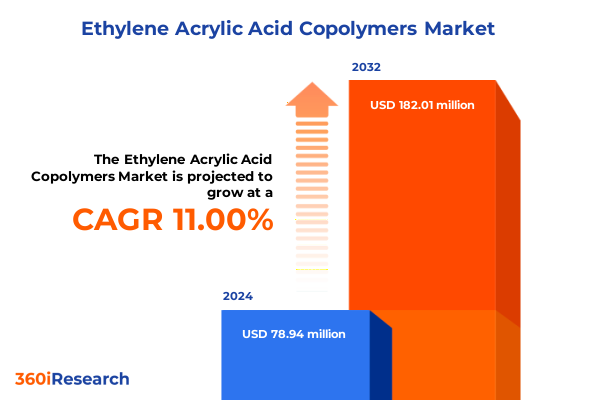

The Ethylene Acrylic Acid Copolymers Market size was estimated at USD 87.48 million in 2025 and expected to reach USD 97.40 million in 2026, at a CAGR of 11.03% to reach USD 182.01 million by 2032.

Introducing Ethylene Acrylic Acid Copolymers as Catalysts for Versatile Performance Enhanced Durability and Innovation Across Key Industrial Applications Worldwide

Ethylene Acrylic Acid Copolymers represent a pivotal class of functionalized polyolefins synthesized through the copolymerization of ethylene and acrylic acid monomers, offering a unique combination of properties that have cemented their place across diverse industrial applications. By varying the ratio of hydrophobic ethylene and polar acrylic acid units, manufacturers can fine-tune performance characteristics such as crystallinity, glass transition, and melt temperatures, unlocking tailored solutions for adhesion, barrier, and flexibility requirements. This compositional flexibility enables these copolymers to deliver superior hot-tack strength, chemical resistance, and substrate compatibility, positioning them as the material of choice for applications that demand both durability and process efficiency.

From a processing standpoint, Ethylene Acrylic Acid Copolymers exhibit excellent extrusion and lamination behavior, allowing the production of films, coatings, and adhesives with consistent quality. The inherent polarity introduced by acrylic acid units enhances interlayer adhesion and barrier performance without necessitating extensive priming or surface treatments, streamlining manufacturing workflows. Consequently, these copolymers have become integral to flexible packaging, where heat sealability at lower temperatures can increase line speeds and reduce energy consumption, while providing robust seals for food, pharmaceutical, and industrial products. Moreover, their tunable mechanical profile supports applications in wire and cable insulation, as well as in aqueous dispersions for protective coatings and adhesives, showcasing the material’s versatility across sectors.

Evolving Landscape of Ethylene Acrylic Acid Copolymers Driven by Bio-Based Feedstocks Digitalization and Stringent Environmental Regulations Reshaping Industry Growth

The landscape for Ethylene Acrylic Acid Copolymers is undergoing transformative shifts driven by heightened environmental mandates, advances in sustainable feedstocks, and the integration of digital technologies in materials development. Leading chemical producers have announced transitions toward bio-based monomers, leveraging biomass-derived ethanol to synthesize acrylic acid and ethyl acrylate precursors. In August 2024, a major producer unveiled a bio-based ethyl acrylate with a certified 40% renewable carbon content and achieved a 30% product carbon footprint reduction relative to its fossil-based counterpart, underscoring the potential to decouple polymer performance from petrochemical inputs. This move represents a strategic pivot in industrial sustainability, providing drop-in replacements that meet existing technical specifications while aligning with corporate decarbonization goals.

Concurrently, breakthroughs in microbial fermentation have advanced the commercial viability of renewable acrylic acid synthesis. A global specialty chemical company announced plans to initiate commercial production of bio-based acrylic acid by mid-2025, employing proprietary fermentation strains to convert plant-derived feedstocks into high-purity monomers. This technology promises to deliver low-carbon acid comonomers without compromising the reactivity or thermal properties essential for copolymer production. Alongside these feedstock innovations, digitalization is reshaping polymer design and scale-up, with machine learning algorithms accelerating formulation screening and predictive modeling of structure-property relationships. Materials informatics platforms are enabling chemists to explore a wider compositional space and optimize process parameters in silico, significantly reducing development timelines.

Furthermore, regulatory bodies are intensifying focus on chemical safety and end-of-life stewardship, prompting manufacturers to embed recyclability and circularity principles early in copolymer design. Industry consortia are collaborating to define standardized testing protocols for mechanical recycling streams, while stakeholders across supply chains are evaluating take-back schemes and chemical recycling technologies. These concerted efforts are recalibrating market expectations and will shape the next generation of Ethylene Acrylic Acid Copolymers that adhere to rigorous environmental performance and compliance benchmarks.

Assessing the Cumulative Impact of 2025 United States Tariffs on Ethylene Acrylic Acid Copolymer Supply Chains Costs and Market Dynamics

The cumulative impact of United States tariff actions in 2025 has introduced profound complexities for supply chain management, cost structures, and sourcing strategies for Ethylene Acrylic Acid Copolymers. At the outset of the year, Section 301 measures on select chemical imports, underpinned by national security and industrial policy objectives, imposed duties that elevated the average applied tariff rate on imports from 2.5% at the end of 2024 to nearly 27% by April 2025, marking the most aggressive tariff posture in over a century for chemicals. Although subsequent policy adjustments trimmed the average rate to 15.8% by June 2025, these fluctuating duty levels generated market uncertainty and triggered supply chain realignments as buyers sought tariff-exempt sourcing and explored insourcing of critical intermediates.

Concurrently, a universal 10% baseline tariff was implemented on all imported goods starting April 5, 2025, pursuant to reciprocal tariff authorities, affecting both finished copolymers and essential monomer feedstocks. Specialized tariffs targeting key trading partners created additional layers of complexity: cargoes from Canada and Mexico initially faced a 25% levy under IEEPA, while shipments from major European nations experienced temporary spikes before reverting to baseline levels in short windows due to moratoriums on reciprocity adjustments. In parallel, products originating in China endured duties that escalated from 10% to 20% in early March, before being subject to bespoke measures exceeding 50% in certain monomer categories.

These cumulative tariff actions have materially inflamed input costs, with import bills for acrylic acid and ethyl acrylate monomers rising by 30–35%, according to industry estimates, thereby compressing margins for downstream copolymer producers who rely on competitively priced feedstocks. The heightened duty environment has also compelled many polymer manufacturers to accelerate capital investments in domestic production capacity, leveraging onshore monomer synthesis and value-add polymerization to mitigate exposure to import duties. Additionally, long-term supply agreements and bonded warehouse strategies have gained prominence as firms seek to hedge against volatile duty regimes and safeguard uninterrupted raw material flows. Collectively, the 2025 tariff landscape underscores the strategic imperative for end users to diversify procurement footprints and fortify resilience across North American and alternative low-tariff markets.

Deconstructing Ethylene Acrylic Acid Copolymer Market Segmentation Insights Revealing Applications Grades Forms Technologies and Sales Channel Dynamics

Disaggregating the Ethylene Acrylic Acid Copolymers market by application reveals that adhesives and sealants have emerged as a dominant end-use, driven by the need for pressure-sensitive formulations in packaging, demanding both hot-tack performance and structural strength. Within this segment, pressure-sensitive adhesives are capitalizing on enhanced adhesion to diverse substrates, while sealants and structural adhesives leverage the copolymer’s polarity to achieve robust bonding in construction and industrial assembly. In automotive components, exterior body molding, interior trim, and under-the-hood parts increasingly rely on these copolymers for paint primer adhesion, flexible gaskets, and heat-resistant liners, underscoring their role in vehicle weight reduction and multi-material integration. Consumer goods applications span household appliances and electronic devices, where EAA copolymers contribute to gasket seals, transparent coatings, and flexible film laminates that balance aesthetics with functional durability.

Packaging continues to represent a cornerstone market, with flexible pouches and rigid containers benefiting from the copolymer’s low-temperature heat sealability and moisture barrier properties. Laminated tubes for condiments and aseptic packaging for dairy products consistently deploy EAA copolymers to ensure seal integrity under varied processing conditions. In wire and cable, both power distribution and telecommunications segments exploit the material’s chemical resistance and mechanical flexibility, protecting conductors against environmental stress and electrical interference.

Evaluation by grade indicates that high-performance variants, characterized by elevated acrylic acid content and enhanced mechanical properties, are favored for specialty applications, whereas standard grades serve high-volume, cost-sensitive uses. The specialty grade niche, with tailored melt flow indices and functional additives, captures demand in demanding segments such as medical packaging and oil-resistant gaskets. Form analysis shows that pelletized copolymers dominate extrusion and molding operations, while powder forms are leveraged in powder coating formulations and aqueous dispersions for industrial coatings. In terms of technology, bulk polymerization remains prevalent for high-throughput production, with emulsion and solution processes supporting specialized dispersion and hot-melt adhesive products. Finally, direct sales continue to undergird long-term supply contracts with large end users, while distributor channels provide agility for smaller customers and rapid-response restocking.

This comprehensive research report categorizes the Ethylene Acrylic Acid Copolymers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Grade

- Technology

- Application

- Sales Channel

Exploring Regional Dynamics of Ethylene Acrylic Acid Copolymers Uncovering Growth Drivers and Challenges Across the Americas Europe Middle East Africa and Asia Pacific

Geographic trends in Ethylene Acrylic Acid Copolymers reveal contrasting growth trajectories across the Americas, Middle East and Africa (EMEA), and Asia-Pacific regions, underscored by local demand drivers and supply chain architectures. North America maintains a leading position in copolymer consumption, driven by robust packaging, automotive, and construction industries and buttressed by domestic petrochemical feedstock advantages. In 2025, U.S. output volumes of basic and specialty chemicals are projected to grow by 1.9%, with the Gulf Coast and Midwest regions poised for the most significant expansion owing to new polymerization investments and tie-ins with existing refining complexes. Canada and Mexico further contribute to regional copolymer supply, leveraging integrated ethylene and acrylic acid production to supply North American converters.

Within EMEA, the European Union’s stringent environmental regulations and energy price volatility have both challenged and catalyzed copolymer producers. While higher energy costs have weighed on operating margins, major chemical hubs in Germany, the Netherlands, and Belgium have intensified investments in bio-based acrylic acid routes and advanced recycling infrastructure, aiming to decarbonize their value chains. Despite these headwinds, Europe captured nearly 15% of global chemical sales in 2024, with specialty grades of EAA copolymers witnessing particular uptake in high-tech packaging and metal coating applications. The Middle East has also emerged as an export-oriented platform, with low-cost ethylene production and petrochemical investments enabling the region to serve Africa and South Asia.

Asia-Pacific stands out as the fastest-growing market, propelled by rapid industrialization, expanding automotive manufacturing in China and India, and rising demand for consumer electronics in Southeast Asia. Chemical output in Asia-Pacific expanded by 3.5% in 2024, with gains outpacing other regions and driving incremental copolymer capacity additions in China, Korea, and India. Regional government initiatives supporting self-sufficiency and downstream value addition have further incentivized local EAA production, reducing reliance on imports and fostering competitive export platforms for Asia-Pacific producers.

This comprehensive research report examines key regions that drive the evolution of the Ethylene Acrylic Acid Copolymers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Players Shaping the Ethylene Acrylic Acid Copolymers Sector Highlighting Competitive Strategies Innovation Partnerships and Sustainable Growth Initiatives

The competitive landscape of Ethylene Acrylic Acid Copolymers is defined by both global chemical giants and specialized materials firms, each deploying strategic initiatives to fortify market positions and meet evolving customer requirements. The Dow Chemical Company, marketing copolymers under its PRIMACOR™ brand, continues to leverage its integrated ethylene and acrylic acid production chain, while offering differentiated grades optimized for extrusion coating and laminating applications. ExxonMobil Chemical competes with its ESCOR™ line, emphasizing ionomer variants for high-transparency films and metal adhesion, and benefits from its global distribution network to serve demanding packaging and industrial sealant customers. SK Global Chemical, under the LOTRYL™ trademark, capitalizes on a recent acquisition of a leading copolymer business, expanding its resin portfolio and R&D footprint in Asia to capture regional growth opportunities.

Arkema has distinguished itself by integrating sustainability into its product roadmap, initiating bio-based ethyl acrylate production at its Carling facility in France, delivering copolymers with a 40% bio-carbon content and a 30% carbon footprint reduction. This move not only supports end-user decarbonization targets but also signals the potential for bio-resins to gain mainstream acceptance. LyondellBasell addresses demand for high-performance adhesion resins with its Lucalen™ portfolio, introducing novel copolymerization techniques to enhance barrier and mechanical properties in flexible packaging applications. In the specialty segment, companies such as BYK Chemie GmbH and Michelman Inc. focus on formulation additives and crosslinking solutions that extend copolymer performance in coatings and adhesives, demonstrating the importance of value-added services and technical support in complex end-use environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ethylene Acrylic Acid Copolymers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Arkema S.A.

- BASF SE

- Chemate Group Co., Ltd.

- Chevron Phillips Chemical Company LLC

- Dow Inc.

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Entec Polymers

- ExxonMobil Chemical

- Honeywell International Inc.

- INEOS Group

- LyondellBasell Industries N.V.

- Merck KGaA

- Merck Performance Polymers

- Reliance Industries Limited

- Repsol S.A.

- SABIC

- Sinopec

- SK Functional Polymer

- SK Global Chemical

- SNP, Inc.

- Tianshi New Material Technology Co., Ltd.

- Toagosei Co., Ltd.

Actionable Roadmap for Industry Leaders to Enhance Competitiveness and Resilience in the Ethylene Acrylic Acid Copolymers Market Through Strategic Investments and Innovation

To navigate the evolving Ethylene Acrylic Acid Copolymers market successfully, industry leaders should adopt a multipronged strategy that balances innovation, supply chain resilience, and sustainability. First, diversifying feedstock portfolios through investments in bio-based monomer production and partnerships with biomass suppliers can mitigate exposure to tariff-related cost volatility and align product offerings with emerging decarbonization mandates. Co-investment in bio-refinery technologies and collaborative research with biotechnology firms will accelerate the scaling of renewable acrylic acid and ethyl acrylate production.

Second, companies should enhance supply chain agility by establishing regional polymerization assets near key demand centers and leveraging bonded warehouse structures to reduce inventory tariffs. Embracing a multi-sourcing approach for critical intermediates will create redundancy against trade policy shifts and logistical disruptions. Additionally, implementing advanced analytics for demand forecasting and tariff impact modeling will support proactive procurement and pricing strategies, preserving margin integrity.

Third, advancing product differentiation through specialized grades-such as ionomers, high-acrylic content variants, and custom dispersion systems-will enable copolymer producers to capture higher-value niches in medical packaging, automotive electronics, and sustainable coatings. Engaging in co-development partnerships with leading end users will facilitate the rapid deployment of tailored formulations and co-marketing opportunities. Finally, committing to circular economy initiatives-through design for recyclability, chemical recycling trials, and take-back programs-will meet regulatory expectations and contribute to brand reputation. By integrating these strategic imperatives, industry leaders can fortify their competitive stance and capitalize on growth prospects in the dynamic Ethylene Acrylic Acid Copolymers landscape.

Comprehensive Research Methodology Integrating Primary Insights Secondary Data and Rigorous Analysis to Ensure Accuracy Depth and Reliability of Market Perspectives

This analysis draws upon a comprehensive research methodology that integrates primary qualitative interactions and robust secondary data triangulation. Primary insights were obtained through in-depth interviews with senior executives, R&D directors, and supply chain managers across leading copolymer producers, converters, and end users. These discussions provided direct perspectives on market challenges, technology adoption, sustainability priorities, and tariff management approaches.

Secondary research encompassed a detailed review of industry reports, trade publications, corporate press releases, and regulatory filings, including trade and customs data that informed tariff impact assessments. Company financial reports and investor presentations supplied quantitative context for capital investment trends and feedstock integration strategies. Publicly available production and consumption statistics from trade associations, such as the American Chemistry Council and equivalent bodies in Europe and Asia, were used to validate regional output and demand projections.

Data points from third-party sources underwent cross-validation to ensure consistency and accuracy. Emerging technology evaluations were supported by patent landscape analyses and materials informatics studies. Finally, a rigorous quality assurance process, including editorial reviews and expert peer feedback, was employed to confirm the integrity and relevance of the findings, ensuring that the resulting insights reliably inform strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ethylene Acrylic Acid Copolymers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ethylene Acrylic Acid Copolymers Market, by Form

- Ethylene Acrylic Acid Copolymers Market, by Grade

- Ethylene Acrylic Acid Copolymers Market, by Technology

- Ethylene Acrylic Acid Copolymers Market, by Application

- Ethylene Acrylic Acid Copolymers Market, by Sales Channel

- Ethylene Acrylic Acid Copolymers Market, by Region

- Ethylene Acrylic Acid Copolymers Market, by Group

- Ethylene Acrylic Acid Copolymers Market, by Country

- United States Ethylene Acrylic Acid Copolymers Market

- China Ethylene Acrylic Acid Copolymers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Conclusion Summarizing Strategic Imperatives and Future Outlook for Ethylene Acrylic Acid Copolymers Amidst Evolving Market Trends Regulatory Shifts and Technological Advances

Ethylene Acrylic Acid Copolymers have solidified their position as indispensable materials across adhesives, packaging, automotive, and specialty applications, with performance tunability and adhesion prowess driving sustained adoption. The industry is at an inflection point, shaped by tariff fluctuations, feedstock sustainability imperatives, and technological innovation through digital materials design. Regional dynamics reflect a balancing act between domestic production advantages in the Americas, regulatory-driven transitions in EMEA, and rapid capacity expansions in the Asia-Pacific. Leading producers are differentiating through bio-based offerings, supply chain localization, and partnerships that enhance value-added technical support.

Looking ahead, the ability to align product portfolios with circular economy principles, diversify sourcing footprints to mitigate geopolitical risks, and harness advanced analytics for market agility will determine competitive leadership. Strategic investments in renewable feedstocks and co-development initiatives with key end users will unlock new growth pathways and reinforce market resilience. As the copolymer landscape becomes increasingly sophisticated, stakeholders who proactively integrate these imperatives will secure advantage in a market characterized by evolving performance demands and regulatory expectations. Ethylene Acrylic Acid Copolymers are poised to continue driving innovation in industrial materials, offering tailored solutions that underpin efficiency, sustainability, and product integrity.

Connect Directly with Ketan Rohom to Access the Definitive Ethylene Acrylic Acid Copolymer Market Research Report and Unlock Critical Industry Intelligence

To acquire the full strategic business report on Ethylene Acrylic Acid Copolymers and leverage unparalleled insights tailored to your organization’s objectives, please contact Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan will guide you through the report’s scope, customization options, and enterprise licensing models, ensuring you receive timely support in aligning the research with your business needs. The report encompasses comprehensive analyses, from market segmentation and regional dynamics to tariff impacts and competitive benchmarking, empowering your team to make informed, high-impact decisions. Connect with Ketan today to secure your copy and gain the competitive intelligence necessary for sustained success in the evolving Ethylene Acrylic Acid Copolymers market.

- How big is the Ethylene Acrylic Acid Copolymers Market?

- What is the Ethylene Acrylic Acid Copolymers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?