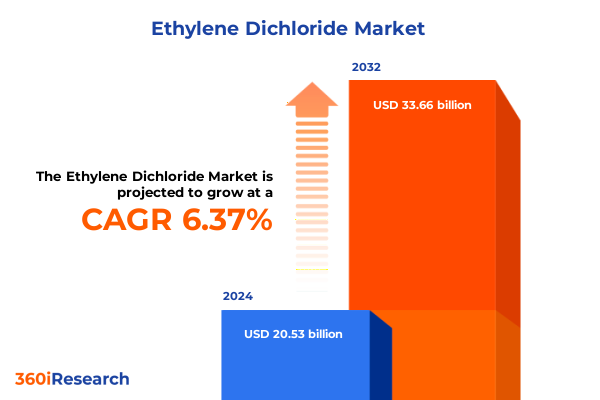

The Ethylene Dichloride Market size was estimated at USD 21.72 billion in 2025 and expected to reach USD 22.97 billion in 2026, at a CAGR of 6.46% to reach USD 33.66 billion by 2032.

Unveiling Ethylene Dichloride’s Central Importance Amid Shifting Global Petrochemical Supply Chains and Emerging Regulatory Landscapes

Ethylene dichloride, commonly known as 1,2-dichloroethane, serves as the indispensable feedstock for vinyl chloride monomer production and underpins a wide range of industrial applications. Its pivotal role in generating polyvinyl chloride resins situates it at the heart of numerous downstream supply chains, from piping and construction materials to consumer goods. As global demand for plastics and specialty solvents evolves, ethylene dichloride remains a barometer of petrochemical sector health, with feedstock availability, transportation logistics, and energy price volatility all exerting significant influence on market dynamics.

Despite its maturity as an industrial chemical, ethylene dichloride faces mounting pressures that reshape its market contours. Environmental regulations targeting chlorinated hydrocarbons and intensifying scrutiny of manufacturing emissions have prompted producers to invest in cleaner technologies and enhanced process controls. Concurrently, digital transformation initiatives are accelerating process optimization and predictive maintenance, unlocking new efficiencies across production facilities. In this context, stakeholders must understand how these intersecting drivers inform strategic decision-making and competitive positioning in an increasingly complex landscape.

Exploring the Technological, Environmental, and Economic Transformations Reshaping Ethylene Dichloride’s Global Future Trajectory

Recent years have witnessed profound shifts that are redefining the ethylene dichloride ecosystem. Technological innovation, particularly the adoption of advanced separation and catalyst systems, is improving energy efficiency while reducing environmental footprints, paving the way for more sustainable operations. In parallel, stringent regulatory frameworks aimed at minimizing chlorinated emissions are compelling manufacturers to pursue best-in-class environmental performance, influencing site selection and capital expenditure priorities.

Economic headwinds and geopolitical realignments are also transforming traditional trade flows. The reconfiguration of global supply chains in response to trade policy uncertainties has led to a resurgence of regional integration strategies, as companies seek to mitigate tariff risks and logistical bottlenecks. At the same time, growing customer expectations around product traceability and lifecycle impact are driving greater transparency and collaboration across the value chain. As these transformative forces converge, industry participants must proactively adapt their operating models to harness new opportunities and build resilience.

Assessing the Cumulative Consequences of the 2025 United States Tariff Regime on Ethylene Dichloride’s Competitiveness and Cost Structures

The United States’ 2025 tariff measures have exerted a pronounced influence on ethylene dichloride import costs and downstream competitiveness. Effective April 9, 2025, imports from European Union member states now incur a 20 percent duty, while Japanese shipments face a 24 percent levy, elevating landed costs for domestic processors and end-use manufacturers. Consequently, these heightened duties have contributed to cost escalations across the vinyl chloride monomer production chain, compressing margins for converters who rely on imported feedstock.

Moreover, industry analysts project that combined impacts of tariff pass-through and ancillary logistical expenses could increase intermediate chemical costs by as much as 8 to 15 percent, exacerbating margin pressures in contract manufacturing and tolling operations. Export competitiveness has also been affected, as retaliatory measures in key Asia-Pacific markets have dampened demand for U.S.-made vinyl intermediates, prompting suppliers to explore alternative sourcing and regional rerouting strategies.

Adding complexity to this environment, legal challenges to the tariff framework remain unresolved. In mid-June 2025, a federal appeals court granted a stay allowing the continuation of chemical and plastic duties under the International Emergency Economic Powers Act, underscoring ongoing uncertainty around the permanence of these levies. As a result, companies are balancing short-term inventory adjustments with longer-term investment decisions, navigating fluctuating policy signals while safeguarding operational agility.

Uncovering Critical Segmentation Dynamics in Ethylene Dichloride Supply Chains Based on Application, Purity, Process, and End Use Industries

Diving into market segmentation reveals nuanced dynamics that shape ethylene dichloride demand and product strategies. When examined through the lens of application, the chemical’s utilization spans intermediate processing for vinyl chloride monomer production, direct use as a solvent in industrial cleaning and extraction processes, and feedstock supply for specialized polymer synthesis, each exhibiting distinct supply chain characteristics and margin profiles. Evaluating purity grades uncovers variations in manufacturing complexity, with standard grade offerings meeting general industrial requirements, high purity grades catering to stringent electronic and pharmaceutical sectors, and ultra-high purity materials commanding a premium in specialty applications. The production process dimension highlights competitive advantages tied to direct chlorination versus oxychlorination methods: direct chlorination enjoys operational simplicity but faces feedstock constraints, whereas oxychlorination offers greater feedstock flexibility at the cost of more complex reaction control and byproduct management. Finally, end-use industries drive differentiated growth trajectories, as rising automotive lightweighting initiatives spur demand for vinyl materials, construction sector expansion fuels piping and siding requirements, the dynamic electronics industry intensifies demand for high-performance insulators, and the packaging sector’s sustainability focus accelerates interest in recyclable polymer formulations.

This comprehensive research report categorizes the Ethylene Dichloride market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Purity Grade

- Production Process

- Application

- End Use Industry

Revealing Regional Nuances and Growth Drivers for Ethylene Dichloride Demand Across the Americas, EMEA, and Asia-Pacific Markets

Regional analysis underscores divergent trends and strategic imperatives within the ethylene dichloride market. In the Americas, producers leverage integrated petrochemical complexes that capitalize on abundant natural gas liquids feedstocks, fostering competitive cost structures and enabling export growth to Latin American neighbors. Infrastructure enhancements and digitalization investments are further bolstering operational efficiency, while environmental permitting and community engagement remain focal points for site expansions.

Across Europe, the Middle East, and Africa, regulatory rigor around chlorinated compounds and circular economy mandates are reshaping production footprints. European refiners are retrofitting facilities to meet stringent emission thresholds, whereas Middle Eastern complexes are pursuing scale-driven cost advantages and downstream integration projects. In Africa, nascent opportunities are emerging as petrochemical joint ventures seek to localize supply chains, albeit constrained by logistics and financing challenges.

The Asia-Pacific region continues to be the fastest-growing market, with China and India driving capacity additions through both state-backed and private investments. Technological partnerships and licensing agreements are facilitating the adoption of advanced process technologies, and regional trade frameworks are gradually reducing tariff barriers. However, feedstock security and currency fluctuations remain key considerations for multinational participants seeking to optimize their Asia-Pacific operations.

This comprehensive research report examines key regions that drive the evolution of the Ethylene Dichloride market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Moves, Portfolio Optimizations, and Competitive Positioning of Leading Ethylene Dichloride Producers in 2025

Leading ethylene dichloride producers are navigating a complex environment through strategic portfolios, operational excellence, and collaborative ventures. Major integrated energy and chemical companies have prioritized capacity expansions in low-cost, feedstock-advantaged locations, while also divesting non-core assets to reallocate capital toward higher-margin specialty segments. Joint ventures between petrochemical incumbents and technology licensers are fast-tracking the implementation of energy-efficient production units and emission mitigation systems, reinforcing competitive differentiation.

Furthermore, the pursuit of digitalization and data-driven analytics is becoming a cornerstone for tactical decision-making. Producers are deploying advanced process controls and predictive maintenance platforms to reduce downtime and optimize yields. At the same time, strategic collaborations with logistics partners are enhancing supply chain visibility, enabling just-in-time provisioning and more resilient inventory management. In parallel, firms with strong sustainability credentials are positioning themselves to capture the growing share of customers prioritizing low-carbon and responsibly sourced chemical inputs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ethylene Dichloride market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Inc.

- Akzo Nobel N.V.

- Arihant Chemicals

- BASF SE

- Bayer AG

- Chemex Organochem Pvt. Ltd.

- DuPont de Nemours, Inc.

- EASTMAN CHEMICAL COMPANY

- Evonik Industries AG

- Gujarat Alkalies and Chemicals Limited

- Huntsman International LLC

- INEOS AG

- JSR Corporation

- KEM ONE SAS

- Merck KGaA

- Ningbo Juhua Chemical & Science Co., Ltd.

- Occidental Petroleum Corporation

- Research Solutions Group, Inc.

- Solvay S.A.

- Spectrum Chemical Mfg. Corp.

- SUMITOMO SEIKA CHEMICALS CO.,LTD.

- The Dow Chemical Company

- Tokuyama Corporation

- Vizag Chemical

Driving Strategic Resilience: Actionable Recommendations for Industry Leaders to Navigate Ethylene Dichloride Market Volatility and Regulation

To thrive amid ongoing volatility and regulatory flux, industry leaders should adopt a multipronged strategic blueprint. First, diversifying feedstock supply sources through a balance of local and global procurement can mitigate the impacts of tariff escalations and geopolitical disruptions. Second, accelerating investments in cleaner production technologies and abatement systems will not only ensure compliance with tightening environmental standards but also enhance brand reputation and stakeholder trust. Third, leveraging digital twins and real-time analytics to refine operational efficiency can unlock cost savings and drive continuous process improvements.

Moreover, forging strategic alliances across the value chain-spanning feedstock suppliers, technology providers, and end-use customers-will facilitate more agile responses to demand shifts and co-create value-add solutions. Bolstering downstream integration opportunities, such as collaborating on recyclable polymer formulations, can unlock new revenue streams while aligning with sustainability imperatives. Finally, engaging proactively with trade associations and regulatory bodies to advocate for transparent, predictable policy frameworks will help shape a more stable operating environment and reduce future compliance burdens.

Illuminating Rigorous Research Methodology and Best Practices Behind the Ethylene Dichloride Market Analysis Framework

This analysis combines rigorous primary research with comprehensive secondary data to ensure robust findings. Primary insights were obtained through in-depth interviews with supply chain executives, technical specialists, and policy experts, providing firsthand perspectives on operational challenges, investment priorities, and regulatory developments. Concurrently, secondary sources-including industry publications, government reports, and trade association white papers-were synthesized to validate trends and benchmark best practices.

Quantitative data collection involved mapping production capacities, feedstock flows, and trade volumes, enabling comparative analysis across regions and production technologies. Qualitative assessments incorporated competitive profiling and value chain mapping to identify strategic strengths and potential disruptors. The research approach was underpinned by a structured framework that balanced top-down industry overviews with bottom-up company case studies, ensuring both macro-level context and granular operational insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ethylene Dichloride market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ethylene Dichloride Market, by Purity Grade

- Ethylene Dichloride Market, by Production Process

- Ethylene Dichloride Market, by Application

- Ethylene Dichloride Market, by End Use Industry

- Ethylene Dichloride Market, by Region

- Ethylene Dichloride Market, by Group

- Ethylene Dichloride Market, by Country

- United States Ethylene Dichloride Market

- China Ethylene Dichloride Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Key Findings and Strategic Implications for Stakeholders in the Global Ethylene Dichloride Ecosystem

In summary, ethylene dichloride’s market dynamics are being reshaped by an intricate blend of regulatory pressures, tariff regimes, and evolving production technologies. Segmentation analysis reveals that applications, purity requirements, process choices, and end-use sectors each present unique opportunities and challenges. Regionally, the Americas capitalize on feedstock advantages, EMEA navigates stringent environmental mandates, and Asia-Pacific drives capacity growth amid economic development.

Competitive positioning hinges on the ability to adapt through technological innovation, strategic partnerships, and proactive policy engagement. While the 2025 United States tariff environment has introduced cost headwinds and supply chain recalibrations, forward-looking companies can leverage diversification strategies and digitalization to sustain profitability. Ultimately, stakeholders equipped with a holistic understanding of these trends will be best positioned to convert market complexities into strategic advantages.

Secure Your Comprehensive Ethylene Dichloride Market Insights Today by Connecting with Ketan Rohom to Elevate Your Strategic Decisions

Elevate your strategic decision-making by securing a deep dive into the comprehensive Ethylene Dichloride market research report. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to tailor insights that address your organization’s unique needs and challenges. By partnering with Ketan, you’ll gain prioritized access to exclusive analysis, expert interpretations, and customizable data deliverables that can inform supply chain optimization, competitive benchmarking, and regulatory compliance strategies.

Don’t miss the opportunity to strengthen your market positioning and capitalize on emerging trends. Connect with Ketan Rohom today to explore flexible procurement options, discuss bespoke research scopes, and ensure your team is equipped with the actionable intelligence required to navigate the evolving Ethylene Dichloride landscape.

- How big is the Ethylene Dichloride Market?

- What is the Ethylene Dichloride Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?