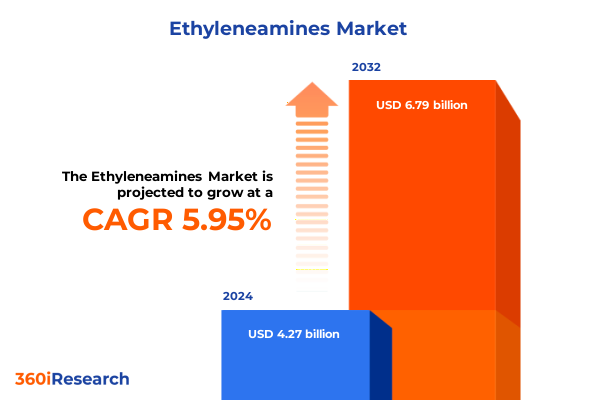

The Ethyleneamines Market size was estimated at USD 4.53 billion in 2025 and expected to reach USD 4.80 billion in 2026, at a CAGR of 5.94% to reach USD 6.79 billion by 2032.

Exploring the Strategic Importance of Ethyleneamine Chemistry in Driving Performance and Innovation across Contemporary Industrial Applications

Ethyleneamines stand at the confluence of versatility and performance in the chemical industry, driving advancements across multiple sectors. Their unique molecular structures enable a broad spectrum of applications, from enhancing polymer strength to improving water treatment efficacy, making them indispensable to manufacturers seeking both quality and efficiency. As global demand evolves, stakeholders must appreciate how these compounds contribute to end-use innovations and operational excellence across value chains.

In recent years, ethylenediamine, diethylenetriamine, triethylenetetramine, and pentaethylenehexamine have each demonstrated distinct property advantages, catalyzing the development of new formulations and technologies. This introduction lays the groundwork for understanding the foundational significance of these amines, as well as the market forces shaping their adoption. By framing the strategic importance of ethyleneamines within a broader industrial context, decision-makers can more effectively align supply chain strategies with emerging trends and performance requirements.

Analyzing Recent Paradigm Shifts in Production Technologies Regulatory Frameworks and Sustainability Practices Shaping Ethyleneamine Market Dynamics

The ethyleneamine landscape has undergone profound transformations driven by technological breakthroughs, regulatory evolution, and a relentless push toward sustainability. Novel catalytic processes and continuous-flow reactors now enable manufacturers to streamline production, reducing energy consumption and waste generation. Concurrently, recent regulatory updates have tightened restrictions on emissions and effluents, prompting producers to adopt advanced recovery systems and greener reaction pathways.

Meanwhile, the industry is witnessing a decisive shift toward bio-based feedstocks and circular chemistry principles. Companies are increasingly investing in renewable precursors and closed-loop recovery mechanisms, aiming to lower carbon footprints and meet stringent environmental performance standards. These shifts have elevated ethyleneamine manufacturers from commodity suppliers to strategic innovators, fostering deeper collaborations with downstream formulators on eco-efficient products. As a result, the competitive landscape is defined not only by price and volume, but also by each player’s ability to demonstrate robust sustainability credentials and technical expertise.

Evaluating the Aggregate Effects of Recent United States Tariff Policies on Ethyleneamine Supply Chains Cost Structures and Competitive Positioning

United States tariff measures enacted in early 2025 have significantly altered the cost and availability of imported ethyleneamines, reshaping supply chain strategies for domestic and global players. Heightened duties on key amine imports have driven downstream formulators to seek local sourcing alternatives and to renegotiate long-term contracts. This policy environment has also encouraged some producers to accelerate investments in North American capacities, aiming to buffer against tariff volatility.

The cumulative effect of these duties extends beyond immediate price inflation. For downstream industrial users, higher input costs have led to more stringent cost-control initiatives and an increased focus on process efficiencies. Import restrictions have prompted a realignment of trade flows, with certain exporters redirecting volumes to more favorable regions. In parallel, domestic producers have gained negotiation leverage, using tariff-induced scarcity to optimize margin structures and reinforce strategic partnerships with key end users. Overall, the 2025 tariff framework has catalyzed a realignment of ethyleneamine sourcing paradigms and underscored the importance of supply chain resilience.

Gaining Deep Insights into Ethyleneamine Market Segmentation by Type Application and End Use Industry Revealing Strategic Opportunities

The ethyleneamine market can be dissected through multiple segmentation lenses, each offering critical insights into demand drivers and growth vectors. From a type perspective, diethylenetriamine commands attention for its multifunctional reactivity in curing and crosslinking applications, while ethylenediamine remains a staple for water treatment and surfactant synthesis. Pentaethylenehexamine and triethylenetetramine, by contrast, find niche prominence in specialty corrosion inhibitors and high-performance polymer formulations, underlining the strategic importance of product differentiation based on molecular complexity.

Application segmentation reveals further nuances; adhesives and sealants leverage ethyleneamines for improved adhesion and curing kinetics, whereas agrochemical formulators depend on these amines to enhance active ingredient stability and bioavailability. In corrosion inhibition, ethyleneamine-based inhibitors deliver tailored protection in harsh environments, and oilfield chemical companies exploit their chelating properties for fluid treatment. Meanwhile, polymerization processes, surfactant blends, and water treatment solutions each extract distinct value from ethyleneamines, reflecting the compounds’ versatility across process chemistries.

End use industries paint a broader picture of market interplay. Within agriculture, crop protection and fertilizer additive producers harness ethyleneamines to stabilize formulations and boost efficacy. Automotive manufacturers, spanning aftermarket parts and original equipment, rely on these amines to enhance coating durability and thermal stability. The construction sector, from commercial to infrastructure and residential projects, benefits from ethyleneamine-enabled concrete admixtures and sealants. Oil and gas firms, operating upstream through downstream, apply these compounds for corrosion control and drilling fluid optimization. Finally, industrial and municipal water treatment operations utilize ethyleneamines to remove contaminants and ensure regulatory compliance. Together, these segmentation insights illuminate where targeted strategies can yield the greatest impact.

This comprehensive research report categorizes the Ethyleneamines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Manufacturing Process

- Application

- End Use Industry

Uncovering Regional Variations in Ethyleneamine Demand and Growth Patterns across Americas Europe Middle East Africa and Asia Pacific Territories

Regional dynamics profoundly influence ethyleneamine demand patterns and supply chain configurations. In the Americas, established petrochemical hubs and robust downstream manufacturing sectors drive consistent consumption, with an increasing focus on localized production to mitigate policy risk. Contemporary expansions in greenfield ethylene cracking and amine synthesis capacities further reinforce North America’s strategic role in meeting domestic and export demands, while shifting trade alignments with Latin American markets open new collaborative avenues.

Europe, Middle East and Africa exhibit a mosaic of regulatory frameworks and resource endowments that shape competitive positioning. Stringent EU environmental directives accelerate the adoption of greener production practices and feedstock diversification, whereas Middle Eastern producers leverage low-cost energy to maintain cost advantages. In Africa, nascent downstream sectors and infrastructure investments signal untapped potential for ethyleneamine applications in water treatment and agriculture, against a backdrop of evolving industrialization and policy reforms.

Across the Asia-Pacific region, the rapid growth of end-use industries propels ethyleneamine uptake. Key manufacturing centers in East and Southeast Asia continue to expand production lines for coatings, adhesives, and specialty chemicals, while India’s agricultural sector intensifies demand for advanced crop protection chemistries. The region’s dynamic supply chains and increasing investments in technology transfer reinforce Asia-Pacific’s pivotal status in global ethyleneamine markets.

This comprehensive research report examines key regions that drive the evolution of the Ethyleneamines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Moves Product Portfolios and Collaborative Initiatives of Leading Players in the Ethyleneamine Industry

Leading chemical companies have sharpened their strategic focus on ethyleneamine portfolios, leveraging M&A, joint ventures, and R&D alliances to fortify their market positions. One global specialty chemical producer has recently completed a capacity expansion project, deploying next-generation continuous reactors to enhance throughput and reduce environmental impact. Another diversified conglomerate has entered into a technology partnership with an innovative catalyst provider, aiming to commercialize bio-based ethylenediamine pathways.

Mid-sized producers are also making notable strides, differentiating through customer-centric solutions and flexible toll manufacturing offerings. By integrating advanced analytics and digital process controls, these companies deliver tailored batch sizes and rapid innovation cycles, appealing to niche formulators. At the same time, several regional champions in Asia and the Middle East are forging strategic alliances to co-develop performance additives, underscoring the importance of collaboration in navigating complex regulatory landscapes and volatile feedstock markets.

Collectively, these strategic moves highlight an industry in which scale, technological sophistication, and partnership ecosystems are paramount. Firms that excel at integrating end-to-end supply chain capabilities and at aligning product development with end-user performance criteria are best positioned to capture emerging growth opportunities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ethyleneamines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Alkyl Amines Chemicals Limited

- Arabian Amines Company

- BASF SE

- Cole-Parmer Instrument Company, LLC

- Delamine B.V.

- Diamines and Chemicals Ltd.

- Dow Chemical Company

- DuPont de Nemours, Inc.

- Gem Chemicals

- Huntsman International LL

- Kelvion Holding GmbH

- LANXESS AG

- Lumitos AG

- Nouryon Chemicals Holding B.V.

- Oriental Union Chemical Corporation

- Paari Chem Resources Pvt. Ltd.

- Prasol Chemicals Limited

- Saanvi Corp.

- Sadara Chemical Company

- Saiper Chemicals Pvt. Ltd.

- Saudi Basic Industries Corporation

- Thermo Fisher Scientific Inc.

- Tosoh USA, Inc.

- UTS Group

Presenting Strategic and Operational Recommendations for Industry Leaders to Capitalize on Emerging Ethyleneamine Market Opportunities and Mitigate Risks

To navigate the evolving ethyleneamine landscape, industry leaders should prioritize investments in process intensification and digital transformation to drive cost efficiencies and sustainability gains. Implementing advanced catalytic systems and continuous processing platforms will not only reduce operational waste, but also enhance production flexibility to respond to fluctuating tariff and feedstock dynamics.

Strategic partnerships with upstream feedstock suppliers and downstream formulators can secure stable supply channels and facilitate co-innovation of value-added products. By embedding themselves in collaborative ecosystems, companies can accelerate time-to-market for specialized amine derivatives and jointly develop solutions that address stringent environmental and performance requirements. Additionally, diversifying production footprints across tariff-sensitive markets will mitigate the risk of policy volatility and bolster supply chain resilience.

A customer-centric approach to R&D prioritization is essential. Engaging end users through pilot programs and application trials will yield crucial data for formulating high-margin products tailored to agriculture, coatings, water treatment, and oilfield applications. Concurrently, firms should continue to explore bio-based feedstocks and circular recycling processes, thereby pre-empting regulatory pressures and tapping into growing demand for sustainable chemistries.

Outlining the Comprehensive Research Approach Data Collection Techniques and Analytical Frameworks Employed to Derive Ethyleneamine Market Insights

Our research methodology combined a rigorous blend of primary and secondary data collection techniques to generate comprehensive insights into the ethyleneamine market. Initial secondary research encompassed an exhaustive review of peer-reviewed journals, patent filings, regulatory databases, and industry publications, establishing a robust baseline for market dynamics, technology trends, and policy developments.

Primary research efforts included in-depth interviews with senior executives, R&D managers, and supply chain directors across leading chemical manufacturers, specialty formulators, and end-use companies. These conversations provided qualitative context on strategic priorities, investment plans, and operational challenges. In parallel, surveys were distributed to a broad cohort of end users to capture quantitative data on application-specific performance requirements, purchasing criteria, and future demand projections.

Analytical frameworks incorporated scenario analysis to assess the impact of variable tariff structures, feedstock price fluctuations, and regulatory shifts. Competitive benchmarking evaluated key players based on capacity footprints, product portfolios, innovation pipelines, and sustainability credentials. The synthesis of these methodologies ensured a balanced and actionable view, enabling stakeholders to make informed decisions grounded in real-world intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ethyleneamines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ethyleneamines Market, by Type

- Ethyleneamines Market, by Manufacturing Process

- Ethyleneamines Market, by Application

- Ethyleneamines Market, by End Use Industry

- Ethyleneamines Market, by Region

- Ethyleneamines Market, by Group

- Ethyleneamines Market, by Country

- United States Ethyleneamines Market

- China Ethyleneamines Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Drawing Conclusive Observations on Ethyleneamine Market Trends Strategic Imperatives and the Path Forward for Stakeholders and Investors

In conclusion, ethyleneamines will continue to underpin critical industrial processes, with their multifaceted applications driving demand across diverse end-use sectors. The interplay of technological innovation, regulatory requirements, and global trade policies has reshaped supply chains and created both challenges and opportunities for market participants. Companies that proactively adapt through process innovations, strategic collaborations, and regional diversification are best positioned to thrive.

As the industry moves toward greener chemistries and more integrated value chains, stakeholders must emphasize transparency, agility, and customer engagement to maintain competitive advantage. The insights presented here offer a strategic compass for navigating the complexities of the ethyleneamine market, guiding decision-makers toward informed actions that align with evolving market dynamics and sustainability imperatives.

Engage and Collaborate Directly with Ketan Rohom to Secure In-Depth Ethyleneamine Market Intelligence and Customized Support

To access the full comprehensive report, reach out to Ketan Rohom, Associate Director of Sales & Marketing, who can guide you through tailored insights and facilitate purchasing options. Whether you require deeper data on specific chemistries, personalized market entry strategies, or bespoke competitive benchmarking, Ketan stands ready to support your objectives and ensure you leverage these findings for maximum impact.

- How big is the Ethyleneamines Market?

- What is the Ethyleneamines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?