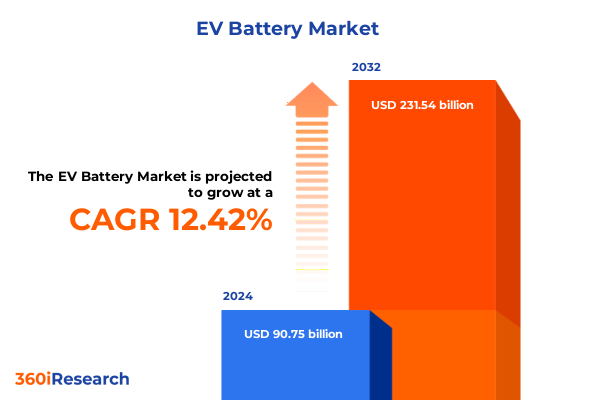

The EV Battery Market size was estimated at USD 101.47 billion in 2025 and expected to reach USD 113.46 billion in 2026, at a CAGR of 12.50% to reach USD 231.54 billion by 2032.

Setting the Stage for the Electric Vehicle Battery Revolution: Drivers, Challenges, and Global Momentum Shaping Tomorrow’s Mobility

The global transition to electric mobility has driven unprecedented focus on the batteries powering these vehicles, positioning them as the critical enabler for broader decarbonization and energy resilience. Over the past decade, battery technologies have advanced rapidly, spurred by strides in materials science, manufacturing scale, and supportive policy frameworks. As a result, cost reductions exceeding 80 percent per kilowatt-hour have been achieved, making electric vehicles increasingly competitive with internal combustion platforms. Governments across North America, Europe, and Asia have enacted incentive schemes and regulatory mandates to accelerate EV adoption, reinforcing the strategic importance of robust, diversified battery supply chains. Together, these trends underscore the pivotal role of battery innovation and deployment in shaping the future of transportation and energy storage.

Transformative Shifts in EV Battery Technology and Supply Chains Redefining How Automakers and Suppliers Compete Globally

Recent years have witnessed transformative shifts across the EV battery landscape, driven by both technological breakthroughs and evolving competitive imperatives. Lithium iron phosphate chemistry has surged from niche application to comprise nearly half of global battery production in 2024 due to its cost advantage and rapid maturation of performance, as detailed in the IEA’s Global EV Outlook. This trend is complemented by cell-to-pack and cell-to-chassis architectures, which eliminate module overhead and enable higher volumetric efficiency, further compressing pack costs and accelerating charging capabilities. At the same time, advanced chemistries such as sodium-ion and lithium-sulphur are moving toward commercial readiness, promising alternatives that reduce reliance on critical minerals amid potential supply constraints. Several automakers have announced pilot deployments of semi-solid or gel-electrolyte batteries, signifying strides toward solid-state paradigms that could offer dramatic improvements in energy density and safety once scale production hurdles are overcome. These parallel developments illustrate a rapidly diversifying battery technology ecosystem poised to redefine product roadmaps across the automotive value chain. Furthermore, the competitive balance is shifting as non-Chinese stakeholders, including Korean and Japanese manufacturers, expand overseas capacity to secure tariff-free access to key markets. In 2024, U.S. cell manufacturing capacity grew by nearly 50 percent, outpacing the European Union’s 10 percent expansion and contributing to the United States overtaking the EU in gigawatt-hour capacity, according to the IEA’s capacity assessment. These moves reflect an urgent drive to localize production, reduce geopolitical risk, and capture emerging policy incentives for domestic sourcing.

Assessing the Cumulative Impact of 2025 United States Tariffs on EV Battery Supply Chains and North American Market Dynamics

The cumulative impact of new U.S. tariffs implemented in early 2025 has introduced significant cost pressures across the North American EV battery ecosystem. Section 301 duties on battery cells imported from China climbed from 7.5 percent to 25 percent in April, supplemented by a universal 10 percent levy that, combined with reciprocal surcharges, drives some rates above 60 percent. Analysts estimate these measures could add over $8 billion in annual costs for automakers and energy-storage firms by 2025. As key component costs increase, higher prices may filter through to consumer vehicles, potentially slowing EV adoption curves and challenging automaker profitability targets. LG Energy Solution has already warned of a potential demand slowdown into early 2026 due to tariff-induced price inflation and the scheduled end of U.S. federal EV purchase incentives, with the company reevaluating production investments and exploring repurposing lines for stationary storage modules to offset lower EV volumes. These dynamics underscore a fundamental tension between protecting domestic manufacturing and preserving the affordability that electric mobility relies upon, forcing stakeholders to reassess sourcing strategies, invest in local capacity, and explore alternative chemistries to mitigate tariff exposure.

Key Segmentation Insights Explaining How Battery Types, Charging Capacities, Cell Forms, Propulsion Modes, Vehicle Classes, and Channels Shape Market Opportunities

Based on battery type, the market is evolving from a landscape once dominated by lead acid and nickel-metal hydride offerings to one where lithium-ion chemistries command the lion’s share, with rapid shifts toward lithium iron phosphate as cost optimization becomes paramount. Concurrently, solid-state batteries have transitioned from research labs to pilot-scale production, prompting both incumbents and startups to pursue partnerships that can bridge innovation with manufacturing scale. Charging capacity segmentation reveals a bifurcated trend: packs in the 40-90 kilowatt-hour range continue to serve mass-market passenger vehicles, while above-90-kilowatt-hour architectures have become almost indispensable for long-range models and premium SUVs, even as sub-40-kWh packs power urban micro-mobility and emerging markets. The form factor of cells further stratifies competitive positioning, as cylindrical formats retain their appeal for high-rate performance and automotive-grade robustness, pouch cells gain traction for flexible packaging in space-constrained designs, and prismatic cells drive the highest volumetric efficiency in high-volume mainstream models. Propulsion type segmentation underscores that battery electric vehicles lead growth in zero-emission mandates, fuel cell electric vehicles advance in targeted commercial and heavy-duty applications, hybrid electric vehicles remain significant for transitional markets, and plug-in hybrids capture consumers seeking extended range without full EV charging infrastructure. Vehicle type segmentation highlights that passenger vehicles-especially SUVs-remain the marquee battleground, even as light and heavy commercial platforms adopt electrification for last-mile delivery and fleet decarbonization. Finally, distribution channel segmentation shows that while offline dealerships still dominate initial sales, digital direct-to-consumer channels are rapidly scaling, driven by OEMs seeking data-rich, vertically integrated customer relationships.

This comprehensive research report categorizes the EV Battery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Battery Type

- Charging Capacity

- Battery Form

- Propulsion Type

- Vehicle Type

- Distribution Channel

Key Regional Insights Examining Americas, Europe, Middle East & Africa, and Asia-Pacific Trends That Are Steering EV Battery Adoption and Production

In the Americas, the confluence of policy incentives under the Inflation Reduction Act and regional content requirements has galvanized new cell and pack production investments, pushing U.S. capacity ahead of the European Union in 2024. North American facilities led by Korean and Japanese firms attracted more than 70 percent of foreign direct investment into cell manufacturing, enabled by tax credits and streamlined permitting. Mexico’s emergence as an assembly hub benefits from USMCA provisions that allow manufacturers to circumvent some tariffs, fostering a North American supply corridor. Conversely, Europe, Middle East & Africa present a mosaic of opportunities: the European Union’s Net Zero Industry Act sets ambitious local manufacturing targets matched by joint ventures such as the Stellantis–CATL LFP gigafactory in Spain, while Eastern European corridors offer cost-competitive labor and proximity to legacy automotive clusters. In the Middle East, sovereign wealth-backed projects are integrating renewable energy with battery megafactories to export to Europe, and Africa is pursuing gigafactory initiatives in Morocco and South Africa, leveraging critical mineral deposits and trade agreements. Asia-Pacific remains the global powerhouse, where China’s 85 percent share of global cell capacity endures, even as government measures seek to limit export of key technologies. Meanwhile, Japan and Korea are ramping local expansions in Southeast Asia, and India’s nascent gigafactory ecosystem targets domestic electrification ambitions alongside export potential.

This comprehensive research report examines key regions that drive the evolution of the EV Battery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Company Insights Highlighting Strategic Moves, Innovations, and Competitive Dynamics Among Leading EV Battery Manufacturers

Leading companies across the value chain have adopted divergent yet complementary strategies to secure competitive advantage in this rapidly evolving market. CATL maintains its global leadership by integrating cell, pack, and raw material operations, while expanding LFP production outside China to mitigate tariff hurdles. LG Energy Solution leverages U.S. tax credits to optimize battery cost structures but is also pivoting toward energy storage systems to utilize excess capacity. Panasonic aligns closely with Tesla’s evolving cell roadmap, including the proprietary 4680 cylindrical format, while forging alliances with regional automakers to diversify customer portfolios. BYD’s vertical integration-from cathode and anode materials to cell assembly-has underpinned aggressive global electrification, as evidenced by its rising market share in Europe and Asia. Samsung SDI and SK On emphasize solid-state and high-nickel chemistries for premium segments, reflecting their investment in differentiation. Tesla’s in-house cell development and gigafactory network continue to set performance benchmarks, compelling legacy OEMs to form joint ventures or acquisitions to bridge technology gaps. Across all fronts, startups specializing in next-generation chemistries, cell-to-pack architectures, and recycling technologies are securing venture capital backing, signaling heightened M&A activity as incumbents seek to bolster their innovation pipelines.

This comprehensive research report delivers an in-depth overview of the principal market players in the EV Battery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AESC Group Ltd.

- Amara Raja Batteries Limited

- BYD Co. Ltd

- Clarios LLC

- Contemporary Amperex Technology Co. Limited

- Exicom Tele-Systems Limited

- Exide Industries Ltd.

- Farasis Energy Europe GmbH

- GS Yuasa Corporation

- Hero MotoCorp Ltd

- Hitachi Ltd.

- Johnson Controls Inc.

- LG Energy Solution, Ltd.

- Mitsubishi Corporation

- Northvolt AB

- Okaya Power Pvt. Ltd.

- Panasonic Corporation

- SAMSUNG SDI Co., Ltd.

- Tata Motors Limited

- Tesla, Inc.

- Tianjin Lishen Battery Joint-Stock Co., Ltd.

- Tianneng Power International Limited

- Toshiba Corporation

Actionable Recommendations Empowering Industry Leaders to Navigate Tariff Pressures, Supply Chain Complexities, and Technological Disruption in EV Batteries

To navigate the complexity of tariff-induced cost pressures and rapidly advancing technologies, industry leaders should prioritize diversification of sourcing by establishing multi-regional production footprints and forging strategic joint ventures that ensure access to critical chemistries. Investment in advanced analytics and digital twins can accelerate process optimization and yield improvements, effectively lowering per-kilowatt-hour production costs. OEMs are advised to integrate battery management expertise early in vehicle development, capturing system-level efficiencies from cell-to-pack to chassis integration. Partnerships with material innovators and recycling specialists will be crucial to secure circular supply chains, reduce dependency on volatile commodity markets, and comply with emerging sustainability regulations. Additionally, companies should tailor offerings by segment, matching energy density and cost targets to vehicle classes-leveraging pouch cells for premium, space-constrained designs and cylindrical modules for high-volume, performance-oriented platforms. Finally, a dual-channel sales approach that balances traditional dealership networks with direct online channels will enable richer customer data capture, faster feedback loops, and enhanced brand loyalty in an increasingly digital marketplace.

Research Methodology Detailing Multi-Source Data Collection, Expert Interviews, and Triangulation Approaches Underpinning This Comprehensive EV Battery Study

This research synthesizes insights from a multi-tiered methodology that integrates primary and secondary sources, ensuring comprehensive coverage and robust validation. Detailed interviews with senior executives at OEMs, battery producers, and raw material suppliers provided firsthand perspectives on strategy and operational priorities. Concurrently, quantitative data from public filings, trade associations, and international agencies were triangulated to capture production capacities, technology adoption rates, and policy impacts at global and regional levels. A proprietary database tracks over 100 active gigafactory projects, enabling dynamic scenario modeling and sensitivity analysis around tariff changes and supply constraints. Secondary research encompassed peer-reviewed journals, technical white papers, and patent filings to map technology roadmaps and identify emerging chemistries. The final analysis underwent rigorous validation through expert panel reviews, ensuring alignment with real-world developments and cross-sectoral consistency. Methodological transparency and ongoing updates enable this report to offer timely, data-driven insights for decision-makers aiming to navigate the fluid EV battery landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our EV Battery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- EV Battery Market, by Battery Type

- EV Battery Market, by Charging Capacity

- EV Battery Market, by Battery Form

- EV Battery Market, by Propulsion Type

- EV Battery Market, by Vehicle Type

- EV Battery Market, by Distribution Channel

- EV Battery Market, by Region

- EV Battery Market, by Group

- EV Battery Market, by Country

- United States EV Battery Market

- China EV Battery Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Conclusion Synthesizing Insights to Illuminate the Path Forward for Stakeholders in the Rapidly Evolving Electric Vehicle Battery Ecosystem

The electric vehicle battery landscape is at an inflection point, characterized by rapid technological innovation, recalibrated supply chains, and evolving policy frameworks. Stakeholders who can balance cost, performance, and sustainability considerations will gain decisive advantages as market dynamics shift. Whether optimizing for emerging chemistries, localizing production to navigate trade barriers, or orchestrating circular material flows, the ability to translate detailed market intelligence into strategic action will define leadership in the years ahead. As the race for battery excellence intensifies, informed decision-making underpinned by rigorous research will be the bedrock of resilient, future-ready business models.

Take the Next Step by Engaging with Ketan Rohom to Access In-Depth EV Battery Market Research and Strategic Guidance for Your Business Growth

Are you ready to transform your strategic vision with unparalleled market intelligence on the electric vehicle battery industry? Reach out today to engage with Ketan Rohom, Associate Director of Sales & Marketing, whose expertise can guide you in leveraging critical insights to accelerate growth. Whether you seek tailored analysis on tariff impacts, segmentation strategies, or competitive benchmarking, Ketan will partner with you to deliver the precise research solutions your organization requires. Contact him directly to secure your copy of this comprehensive market report and position your company at the forefront of the EV battery revolution.

- How big is the EV Battery Market?

- What is the EV Battery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?