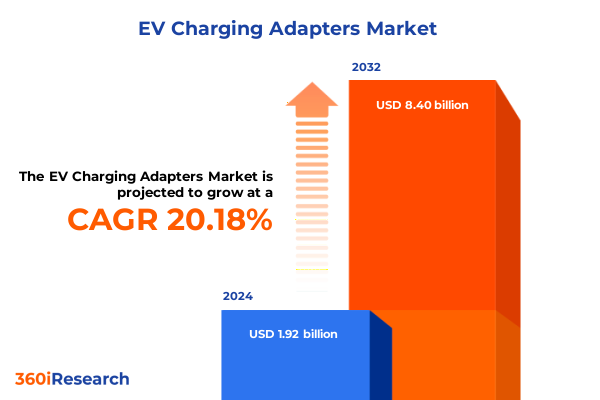

The EV Charging Adapters Market size was estimated at USD 2.31 billion in 2025 and expected to reach USD 2.78 billion in 2026, at a CAGR of 20.20% to reach USD 8.40 billion by 2032.

Exploring the Unprecedented Growth of EV Charging Adapters and Their Pivotal Influence on Enabling Mass-Scale Electric Mobility Adoption

The global shift towards electrified transportation has placed EV charging adapters at the forefront of infrastructure development, no longer regarded as mere connectors but as critical enablers of seamless vehicle-to-grid integration. As consumer adoption of electric vehicles accelerates, the demand for reliable, interoperable adapters has surged, compelling stakeholders to prioritize compatibility across diverse models and standards. This heightened focus on adaptor technologies reflects the industry’s push towards reducing charging friction and enhancing user experience, which in turn accelerates mass-market acceptance of zero-emission mobility solutions.

In parallel, regulatory initiatives worldwide are mandating standardized charging protocols, incentivizing automakers and infrastructure providers to adopt open architectures. This confluence of policy support and consumer expectations has catalyzed investment in advanced materials, modular designs, and smart connectivity features. Consequently, EV charging adapters are evolving beyond passive components into intelligent nodes capable of load balancing, firmware updates, and remote diagnostics. Such advances underscore the adapter’s role as a linchpin in achieving grid resilience and enabling bidirectional charging scenarios.

Moreover, the adapter segment’s rapid maturation reflects a broader shift in value chains, where OEMs, charging network operators, and aftermarket specialists are forging strategic alliances. These collaborations are designed to streamline supply networks, foster economies of scale, and accelerate time-to-market for new charging solutions. In this context, the introduction of wireless and standardized high-power charging adapters marks the latest frontier, promising to redefine the parameters of consumer convenience and infrastructure scalability.

Examining the Transformative Technological, Regulatory, and Market Shifts Redefining the EV Charging Adapter Landscape Worldwide

The EV charging adapter ecosystem is undergoing transformative shifts that extend from technological breakthroughs to evolving regulatory frameworks. High-rate power delivery has rapidly transitioned from a niche offering to a central prerequisite for commercial and fleet applications. This has spurred the deployment of DC fast charging adapters capable of handling ratings above 22 kilowatts, reshaping user expectations around charging speed and convenience. Simultaneously, the proliferation of smart charging modes is enabling dynamic load management and vehicle-to-grid functionalities, thereby rendering adapters integral to grid optimization strategies.

Furthermore, the standardization of connectors worldwide is recalibrating market dynamics, with CCS2 emerging as the dominant interface in Europe while CCS1 continues to lead in North America. Legacy interfaces such as CHAdeMO and GB/T retain significant market presence in Asia-Pacific, reflecting region-specific adoption curves and vehicle portfolios. Meanwhile, proprietary connectors like Tesla’s North American design are gradually aligning with open standards to foster interoperability, signaling a convergence toward unified technical specifications.

In addition, end-user requirements have diversified, prompting manufacturers to offer tailored solutions for residential, commercial, and public charging scenarios. Residential adapters tend to prioritize ease of installation and compatibility with wall-mounted units, whereas commercial deployments demand robust pedestal or floor-mounted designs to endure higher duty cycles. Public charging installations at highway service stations and municipal locations emphasize durability and user-friendly interfaces. This segmentation underscores the adapter market’s complexity and the imperative for manufacturers to deliver versatile product portfolios.

Analyzing the Compound Effects of U.S. Trade Tariffs Through 2025 on the Cost Structures and Supply Chains of EV Charging Adapters

Since the introduction of trade measures in previous years, the United States has progressively imposed tariffs affecting steel and aluminum imports as well as electronic components sourced from Asia. In 2025, new duties of 25 percent on structural materials and a ten percent levy on connectors and power electronics have compounded these measures, elevating upstream costs for adapter manufacturers. These accumulated duties have reshaped sourcing strategies, compelling industry players to reassess reliance on imports and accelerate localization of fabrication for critical components.

Moreover, the tariff environment has introduced a dynamic tension between cost containment and compliance with Buy America provisions embedded in federal and state incentive programs. Manufacturers increasingly face decisions about accepting margin compression or investing in domestic capacity expansions. While the tariffs have temporarily inflated sticker prices for EV charging adapters, they have also stimulated capital commitments toward U.S.-based tooling, assembly lines, and supplier partnerships designed to circumvent punitive import levies.

Furthermore, the cumulative tariff landscape has driven ergonomic innovation, as companies seek to redesign adapters to use composite housings and alternative alloys less susceptible to trade actions. This material optimization effort not only mitigates tariff impact but also offers ancillary benefits in weight reduction and thermal performance. In parallel, contingency planning has become a centerpiece of supply chain management, with players establishing multi-regional component hubs to buffer against geopolitical volatility. This recalibration of manufacturing footprints and design philosophies underscores the enduring influence of U.S. trade policy on adapter cost structures and competitive positioning.

Uncovering Nuanced Segmentation Trends Shaping Connector Types, Charging Modes, Power Ratings, End Users, and Installation Preferences Across EV Charging Markets

The adapter market’s segmentation reveals critical insights into how product variants meet evolving application requirements. A diverse connector landscape encompasses North American CCS1 and European CCS2 standards alongside established options such as CHAdeMO and GB/T interfaces in select Asian markets, complemented by Tesla’s unique interface and legacy Type 1 and Type 2 connectors that remain in wide circulation. This multiplicity of standards demands that manufacturers maintain flexible production lines and invest in cross-compatible designs to serve global deployments.

Charging mode distinctions further delineate the market, with Mode 1 and Mode 2 adapters catering to basic residential use cases, transitioning to Mode 3 devices that support both single-phase and three-phase installations for semi-public and fleet applications. The rapid adoption of Mode 4 solutions underscores the criticality of high-power DC charging in public fast-charging networks. Each mode’s technical requirements drive component selection, safety certifications, and cost structures, compelling suppliers to adopt modular architectures.

Power rating stratification offers another lens through which to view product differentiation. Below 3.7 kilowatts, adapters typically align with standard home charging requirements, while the 3.7 to 22 kilowatt bracket-which subdivides into 3.7 to 7.4 kilowatt and 7.4 to 22 kilowatt segments-caters to both residential and light commercial needs. Above 22 kilowatts, ultra-fast adapters meet the performance demands of highway, fleet, and high-throughput stations. Concurrently, end-user categorization spans residential, commercial and public domains. Commercial environments, including fleet depots, hospitality venues, and retail parking facilities, require robust, scalable adapters, contrasting with municipal and highway service station deployments in the public sector. Installation preferences vary among wall-mounted solutions in urban residential sites, floor-mounted units for corporate campuses, and pedestal-mounted designs for mixed-use retail settings.

This comprehensive research report categorizes the EV Charging Adapters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Connector Type

- Charging Mode

- Power Rating

- Installation Type

- End User

Mapping Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East Africa, and Asia-Pacific EV Charging Adapter Markets

Examining regional market dynamics illuminates the differential growth engines within the EV charging adapter sector. Across the Americas, robust federal incentives and aggressive state-level mandates have incentivized network operators to deploy high-speed adapters along interstate corridors, with an emphasis on modular, high-power interfaces capable of supporting heavy-duty fleet electrification initiatives. In parallel, North American OEMs are forging alliances to standardize CCS1 implementations, enhancing interchangeability across brand portfolios and reducing reliance on proprietary connectors.

Conversely, the Europe, Middle East, and Africa region is characterized by a mosaic of regulatory regimes that converge around the CCS2 standard as the de facto interface, with legacy Type 2 plugs still prevalent in residential contexts. Governments across the European bloc have instituted stringent CO₂ targets for automakers, driving rapid expansion of public charging infrastructures and accelerating the uptake of ultra-fast adapters in urban centers. In the Middle East, pilot projects in smart cities are testing bidirectional charging adapters, while African markets are gradually embracing GB/T standards imported from Asia.

In Asia-Pacific, adaptation to local protocols such as GB/T in China and CHAdeMO in Japan underscores the region’s influence on global connector evolution. Significant investments in high-power DC charging corridors have sparked demand for adapters above 22 kilowatts, often integrated with advanced thermal management systems to ensure reliability under extreme climatic conditions. Furthermore, regional trade agreements are facilitating localized manufacturing clusters, enabling economies of scale and mitigating tariff-related disruptions. This tri-regional perspective highlights how localized policy frameworks, consumer behaviors, and manufacturing capabilities coalesce to shape the adapter market’s global trajectory.

This comprehensive research report examines key regions that drive the evolution of the EV Charging Adapters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Strategic Moves and Competitive Profiles of Leading Global Players Driving Innovation and Market Penetration in EV Charging Adapters

Leading providers in the charging adapter domain are differentiating through vertical integration, proprietary protocols, and strategic partnerships. One major OEM has leveraged its vehicle manufacturing heritage to introduce adapters with seamless plug-and-play interfaces, capitalizing on deep distribution networks and strong brand loyalty. Another global electronics conglomerate has focused on modular power electronics platforms, enabling rapid customization of adapters for different regional standards without significant retooling.

Further, established industrial automation firms have entered the market by bundling adapter offerings with comprehensive charging station portfolios, emphasizing robust hardware certifications and lifecycle service agreements. These players are leveraging existing relationships in the electrical infrastructure space to accelerate adoption of advanced adapters, particularly in the commercial and industrial segments. Meanwhile, nimble startups are carving niches by offering subscription-based adapter-as-a-service models, reducing upfront investment barriers for fleet operators and ride-sharing providers.

In addition, emerging entrants from the semiconductor sector are integrating power management ICs and smart communication chips into next-generation adapters, enabling real-time data analytics and predictive maintenance. This inflection towards digital intelligence underscores the competitive imperative to offer value-added services alongside hardware shipments. As the market matures, alliances between automakers, charger network operators, and independent technology suppliers will continue to redefine competitive boundaries, with interoperability and software ecosystems becoming key battlegrounds.

This comprehensive research report delivers an in-depth overview of the principal market players in the EV Charging Adapters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Amphenol Corporation

- Delta Electronics, Inc.

- Eaton Corporation plc

- Legrand SA

- Leviton Manufacturing Co., Inc.

- Phoenix Contact GmbH & Co. KG

- Prysmian S.p.A.

- Qualcomm Technologies, Inc.

- Robert Bosch GmbH

- Schneider Electric SE

- Siemens AG

- TE Connectivity Ltd

Actionable Strategic Recommendations to Navigate Tariff Challenges, Technological Advancements, and Evolving Customer Segments in the EV Charging Adapter Industry

To thrive amid tariff headwinds and shifting customer demands, industry leaders should prioritize the diversification of sourcing strategies. Building strategic relationships with domestic suppliers for critical materials such as composite housings and power electronics can mitigate exposure to import levies while reinforcing compliance with local content requirements. At the same time, investing in modular adapter architectures that can be calibrated for different connector standards and power ratings will streamline production workflows and enable rapid response to emerging regulatory mandates.

Furthermore, companies should intensify participation in global standards bodies to shape technical specifications that align with their proprietary strengths and ensure future compatibility. Engaging proactively in these forums not only influences market direction but also signals commitment to interoperability-a key factor for fleet operators and charging network investors. Parallel to this, embedding smart connectivity features that enable firmware updating, remote diagnostics, and integration with energy management platforms will differentiate adapter offerings and foster long-term service revenue streams.

Finally, brands should deploy targeted marketing initiatives that articulate the total cost of ownership advantages of advanced adapters, particularly in fleet and commercial applications. Demonstrating how high-power, intelligent adapters can reduce operational downtime and extend battery life will resonate with cost-conscious decision-makers. By coupling these tactics with continuous R&D on novel materials and power semiconductors, industry leaders can secure resilient market positions and deliver sustainable growth in a rapidly evolving landscape.

Detailing Rigorous Research Methodologies Employed to Derive Insights on Market Segmentation, Regional Variations, and Tariff Impact Analysis

The analysis underpinning this report integrates both primary and secondary research methodologies to ensure robust, multi-faceted insights. Primary research initiatives included in-depth interviews with senior executives at leading automakers, charging network operators, and technology suppliers. These discussions provided firsthand perspectives on strategic priorities, regional market nuances, and cross-industry collaboration models. Complementing these engagements, the research team conducted site visits to major manufacturing facilities, enabling observational data on production processes, quality control protocols, and supplier ecosystems.

Secondary research encompassed a comprehensive review of government policy documents, industry white papers, and published technical standards across key markets. This phase involved meticulous analysis of tariff schedules, incentive frameworks, and regulatory filings to quantify the cumulative impact of trade measures. Additionally, data triangulation was achieved by cross-referencing commercial databases, press releases, and financial disclosures to validate company profiles and product portfolios.

Analytical frameworks employed include scenario-based tariff modeling, segmentation mapping, and SWOT analyses at both regional and global levels. The segmentation approach synthesized connector type, charging mode, power rating, end-user, and installation data to uncover cross-cutting trends. Regional market sizing and growth trajectory estimations were derived using macroeconomic indicators, EV adoption curves, and infrastructure rollout projections. This rigorous, layered methodology ensures that the findings reflect current realities and anticipate future market inflections.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our EV Charging Adapters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- EV Charging Adapters Market, by Connector Type

- EV Charging Adapters Market, by Charging Mode

- EV Charging Adapters Market, by Power Rating

- EV Charging Adapters Market, by Installation Type

- EV Charging Adapters Market, by End User

- EV Charging Adapters Market, by Region

- EV Charging Adapters Market, by Group

- EV Charging Adapters Market, by Country

- United States EV Charging Adapters Market

- China EV Charging Adapters Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Critical Findings and Forward-Looking Perspectives on Market Evolution and Strategic Imperatives for EV Charging Adapters

The convergence of rising EV adoption, regulatory mandates, and tariff-induced cost pressures has reshaped the EV charging adapter market into a dynamic landscape defined by technical innovation and supply chain recalibration. Key findings reveal that connector standardization efforts are streamlining interoperability while diversifying power rating options cater to increasingly segmented end-user needs. Regional variations underscore the importance of aligning product portfolios with localized protocols and infrastructure development strategies.

Trade policies through 2025 have introduced complexity into cost structures, yet they have also accelerated domestic manufacturing initiatives and material innovation. Leading firms that leverage modular design principles and smart connectivity features are well-positioned to capitalize on these shifts, particularly as public and private fleets transition to high-power charging dependencies. Growth in the Americas, EMEA, and Asia-Pacific regions highlights distinct demand drivers-from interstate fast-charging corridors to urban multi-dwelling residential deployments and climate-adaptive solutions in emerging markets.

Looking forward, the ability to navigate evolving tariff frameworks, participate in global standardization efforts, and deliver adaptive product innovations will serve as the primary differentiators among competitors. As the EV ecosystem continues to mature, charging adapters will evolve beyond passive conduits into intelligent infrastructure nodes, playing a pivotal role in realizing the vision of a resilient, decarbonized transportation network.

Engage with Ketan Rohom to Secure the Comprehensive EV Charging Adapter Market Research Report and Propel Your Strategic Decision-Making

We invite readers seeking a comprehensive understanding of the EV charging adapter landscape to connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore the full market research report. Through this collaboration, decision-makers can gain exclusive access to in-depth analyses, proprietary data, and detailed scenario planning that will inform strategic investments and operational roadmaps. Engaging with Ketan ensures that your organization benefits from tailored insights on tariff implications, segmentation nuances, and regional growth trajectories. Don’t miss this opportunity to secure the intelligence you need to stay ahead of market shifts and technological disruptions in the rapidly evolving EV charging domain.

- How big is the EV Charging Adapters Market?

- What is the EV Charging Adapters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?