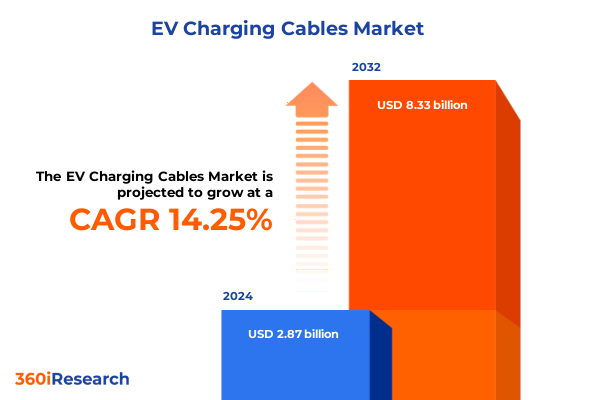

The EV Charging Cables Market size was estimated at USD 3.26 billion in 2025 and expected to reach USD 3.72 billion in 2026, at a CAGR of 14.32% to reach USD 8.33 billion by 2032.

Understanding the Crucial Role and Evolutionary Importance of High-Performance EV Charging Cables in Modern Electric Mobility

The accelerating shift toward electric mobility has placed charging infrastructure at the epicenter of global energy transformation. Among the critical components that ensure reliable power delivery, EV charging cables serve as the vital link between charging stations and vehicles, facilitating energy transfer with safety and efficiency. As governments worldwide enact policies to curb carbon emissions and automakers ramp up EV production, the demand for robust, technologically advanced cable solutions has surged.

Investors, policymakers, and infrastructure developers are increasingly focused on the design, materials, and capabilities of charging cables to support faster, higher-capacity charging sessions. Beyond basic interoperability, the industry now demands cables that balance mechanical resilience, thermal management, and compatibility with diverse connector standards. In this evolving environment, stakeholders must understand the nuances of cable technologies to optimize infrastructure planning, drive consumer confidence, and maintain grid stability during peak charging periods.

How Rapid Innovations in Connectivity, Regulatory Alignment, and Consumer Demands Are Redefining the EV Charging Cables Ecosystem

Over the past two years, the EV charging cables landscape has undergone a series of transformative shifts driven by technological innovation, regulatory acceleration, and emerging user expectations. Initially, cable development prioritized fundamental safety features and basic conductivity, but recent advances have introduced integrated sensors for temperature monitoring, dynamic current modulation, and adaptive cooling mechanisms. As a result, next-generation cables now deliver higher power densities with enhanced real-time diagnostics.

Concurrently, regulatory bodies in key markets have tightened standards to harmonize charging infrastructure across regions. This regulatory convergence encourages manufacturers to adopt uniform protocols, reducing fragmentation and simplifying cross-border interoperability. Moreover, consumer expectations have evolved: drivers now anticipate shorter charge times, consistent performance in extreme weather conditions, and seamless integration with digital charging networks. Taken together, these shifts have propelled cable design from a purely functional element into a strategic differentiator for charging network operators and equipment suppliers.

Examining the 2025 United States Tariff Measures on Cable Materials and Their Far-Reaching Effects on Supply Chain Resilience and Cost Structures

In early 2025, new tariffs on cable materials and finished components imposed by the United States government triggered ripple effects throughout the supply chain. These measures, intended to protect domestic manufacturing, raised the import duties on copper conductors and certain aluminum alloys, increasing landed costs for many cable producers. As a direct consequence, suppliers have been compelled to reassess procurement strategies, secure alternative sources of raw materials, and, in some cases, pass incremental cost pressures onto end users.

Despite these headwinds, the imposition of tariffs has spurred innovation in material engineering and localized production. Several manufacturers have accelerated investments in composite conductors that blend multiple metals to achieve comparable electrical performance at lower tariff brackets. Additionally, the shift toward onshore fabrication facilities in the United States has shortened lead times and bolstered supply chain resilience. While short-term cost implications remain a challenge, these strategic adjustments are laying the groundwork for a more diversified and robust domestic cable industry over the long term.

Unveiling In-Depth Segmentation Dynamics That Reveal Tailored Pathways for Material, Phase, and Mode Optimizations Across Diverse EV Charging Applications

A granular understanding of segmentation reveals critical pathways for tailoring cable offerings to specific consumer and infrastructure needs. Material composition shapes performance and cost dynamics, with copper conductors delivering superior conductivity, aluminum alternatives offering lightweight economies, and composite blends emerging as optimized hybrids. Similarly, phase configuration delineates application contexts, where single phase systems predominantly serve residential settings and three phase arrangements underpin high-powered commercial and public charging stations.

Charging mode segmentation further refines the landscape: alternating current cables remain ubiquitous for lower-power home and workplace installations, while direct current solutions, equipped with air cooling or advanced liquid cooling, address rapid-refill demands at highway corridors and urban destination hubs. Vehicle classification also influences cable specifications, as fully battery electric vehicles exert different charging profiles compared to plug-in hybrids, necessitating nuanced cable designs. End user segments span residential installations, dedicating cable lengths and current ratings to personal garaging setups, to commercial deployments at retail and workplace venues, and public networks featuring destination and roadside stations that demand robust durability.

Connector type insights underscore the importance of global interoperability, with CCS interfaces, divided into Combo 1 and Combo 2 formats, gaining prominence in North America and Europe, respectively, even as CHAdeMO, Type 1, and Type 2 connectors maintain footholds in specific markets. Current rating classification, ranging from up to 32 amps for standard home charging, through 32 to 63 amps for intensified residential and light commercial use, to above 63 amps for high-powered DC charging, dictates conductor sizing and cooling requirements. Finally, cable length considerations, spanning up to five meters for constrained home setups, five to ten meters for flexible station design, and lengths above ten meters for wide-area public infrastructure, influence handling, storage, and installation logistics.

This comprehensive research report categorizes the EV Charging Cables market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Phase

- Charging Mode

- Vehicle Type

- Connector Type

- Current Rating

- End User

Analyzing Regional Impulses Driving Localized Innovation and Policy-Driven Growth in the Americas, EMEA, and Asia-Pacific EV Charging Cable Markets

Regional perspectives illuminate the geographic forces shaping cable development and deployment. In the Americas, policy incentives and accelerating EV registrations have driven rapid expansion of both residential and commercial charging networks. Domestic manufacturing incentives, combined with tariff influences, have catalyzed local production of conductors and assembly of finished cables, positioning the United States as an increasingly self-reliant supplier.

Europe, the Middle East, and Africa collectively showcase a mosaic of regulatory frameworks and infrastructure maturity levels. The European Union’s harmonized charging standards and sustainability mandates have propelled investments in standardized CCS Combo 2 cables and liquid-cooled systems along transnational highways. Meanwhile, emerging markets in the Middle East and North Africa exhibit pilot programs that integrate solar-powered charging and modular cable stations. Across sub-Saharan Africa, nascent EV ecosystems leverage locally adaptable cable designs to accommodate evolving grid capacities.

In the Asia-Pacific region, strategic leadership from China, Japan, and South Korea shapes the sector’s trajectory. China’s expansive rollout of DC fast-charging corridors, underpinned by large state-backed OEM initiatives, has created substantial demand for high-current, liquid-cooled cable solutions. Japan’s stringent safety regulations encourage advanced sensor integration, while South Korea’s focus on compact urban charging fosters innovations in flexible cable formulations and retractable length mechanisms.

This comprehensive research report examines key regions that drive the evolution of the EV Charging Cables market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Decoding Strategic Partnerships, Product Innovations, and Vertical Integration Moves That Define the Competitive Landscape in EV Charging Cable Solutions

Industry leaders are deploying differentiated strategies to capture emerging opportunities and address evolving infrastructure demands. Flagship automakers and charging network operators are forging partnerships with specialized cable manufacturers to ensure seamless end-to-end integration, from onboard sockets to station-side connectors. At the same time, traditional electrical equipment suppliers are expanding R&D footprints to introduce proprietary cooling systems, smart monitoring modules, and advanced insulation materials that enhance safety and performance.

Strategic collaborations between technology startups and established conglomerates are yielding modular cable platforms, enabling rapid customization for diverse end user scenarios. Meanwhile, several market incumbents are accelerating vertical integration, acquiring component suppliers, and establishing controlled manufacturing networks to mitigate tariff-induced cost pressures. As the competitive landscape intensifies, leading players are increasingly emphasizing lifecycle management services, offering cable maintenance, remote diagnostics, and end-of-service recycling programs to differentiate their value propositions.

This comprehensive research report delivers an in-depth overview of the principal market players in the EV Charging Cables market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- ADS-TEC Energy plc

- Allego N.V.

- Aptiv PLC

- Blink Charging Co.

- ChargePoint, Inc.

- Compleo Charging Solutions AG

- Eaton Corporation plc

- Electrify America, LLC

- EVBox Group

- EVgo, Inc.

- Fortum Corporation

- Leoni AG

- NaaS Technology Inc.

- Schneider Electric SE

- Shell plc

- Siemens AG

- TE Connectivity Ltd.

- Tesla, Inc.

- Wallbox N.V.

Implementing Tactical Material Diversification, Advanced Cooling Integrations, and After-Sales Ecosystems to Drive Differentiation and Growth

Leaders in the cable segment should consider several actionable paths to strengthen market positioning. First, diversifying material portfolios by validating composite conductor designs can mitigate raw-material tariffs and enhance performance-to-cost ratios. At the same time, investing in localized assembly capacities and forging partnerships with regional grid operators will bolster supply security and reduce logistical complexities.

Second, embedding advanced thermal management systems, whether through air-cooled fins or next-generation liquid cooling, can unlock higher power thresholds for rapid charging corridors. In parallel, integrating real-time sensor networks and digital twins within cable assemblies will deliver predictive maintenance capabilities, minimizing operational downtime. Collaboration with connector standard bodies and EV OEMs to co-develop universal interfaces will further streamline the charging experience for end users.

Finally, establishing comprehensive after-sales support frameworks-encompassing field service networks, remote diagnostics, and eco-friendly recycling pathways-will foster customer loyalty and sustainability credentials. Through these targeted initiatives, industry leaders can navigate regulatory shifts, capture new use cases, and secure long-term growth in the accelerating electric mobility landscape.

Detailing a Robust Dual-Layered Research Process Combining Extensive Secondary Analysis and In-Depth Primary Interviews with Industry Stakeholders

Our research methodology combined extensive secondary analysis of regulatory filings, industry white papers, and patent disclosures with primary interviewed insights from infrastructure developers, cable manufacturers, EV OEMs, and energy regulators. This dual approach ensured both breadth and depth in capturing technological advances, policy impacts, and end user requirements.

To validate segmentation frameworks, data points were cross-referenced against trade association reports and publicly accessible quality standards documentation. Key informant interviews provided firsthand perspectives on emerging materials, cooling architectures, and interoperability challenges. Throughout the process, iterative feedback loops with industry advisors refined the thematic focus areas, ensuring the final insights align with the real-world priorities of charging infrastructure stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our EV Charging Cables market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- EV Charging Cables Market, by Material

- EV Charging Cables Market, by Phase

- EV Charging Cables Market, by Charging Mode

- EV Charging Cables Market, by Vehicle Type

- EV Charging Cables Market, by Connector Type

- EV Charging Cables Market, by Current Rating

- EV Charging Cables Market, by End User

- EV Charging Cables Market, by Region

- EV Charging Cables Market, by Group

- EV Charging Cables Market, by Country

- United States EV Charging Cables Market

- China EV Charging Cables Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Summarizing the Critical Convergence of Technological Innovation, Policy Dynamics, and Strategic Segmentation in Shaping the Future of EV Charging Cables

In sum, the EV charging cable domain stands at the intersection of material science, power electronics, and policy-driven infrastructure development. As transformative innovations reshape cable architectures-introducing smarter cooling, integrated diagnostics, and modular interfaces-stakeholders must pivot quickly to harness these advancements. Simultaneously, evolving tariffs and regional policy incentives underscore the need for supply chain agility and localized production strategies.

By thoroughly understanding segmentation nuances and regional market forces, companies can tailor product portfolios and partnerships to meet diverse charging requirements. Moving forward, the integration of advanced sensor-based monitoring, predictive maintenance frameworks, and sustainable end-of-life practices will define competitive differentiation. Ultimately, strategic leaders who embrace these dynamics will be best positioned to capitalize on the continued electrification of mobility and the expanding charging infrastructure ecosystem.

Secure Strategic Market Intelligence for EV Charging Cables by Partnering Directly with Ketan Rohom for Customized Research Support

To explore comprehensive insights into the dynamic EV charging cables market and secure your competitive advantage, connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise will guide you through the detailed findings, advanced analyses, and strategic recommendations that can inform your next steps.

- How big is the EV Charging Cables Market?

- What is the EV Charging Cables Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?