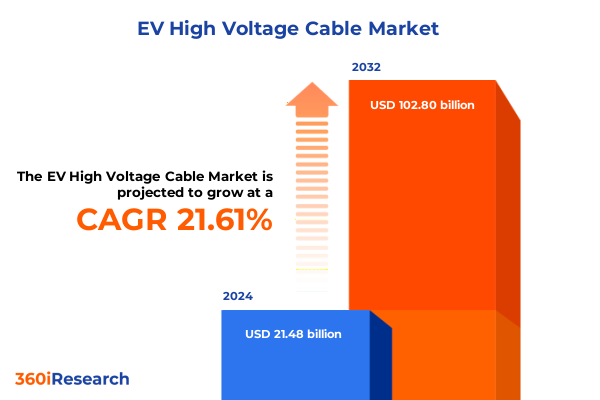

The EV High Voltage Cable Market size was estimated at USD 26.05 billion in 2025 and expected to reach USD 31.05 billion in 2026, at a CAGR of 21.66% to reach USD 102.80 billion by 2032.

Exploring the Critical Role of High-Voltage Cabling in Accelerating Electric Vehicle Performance and Safety Across the Global Automotive Ecosystem

The rapid proliferation of electric vehicles worldwide has elevated the role of high-voltage cabling as a foundational technology underpinning power transmission, safety protocols, and vehicle performance. In 2025, global electric car sales are projected to exceed 20 million units and represent more than one-quarter of all new cars sold, reflecting a 25% year-on-year increase driven by policy support in China, Europe, and emerging economies. As OEMs push for higher voltage architectures and faster charging capabilities, cabling systems capable of handling currents in excess of 800 volts while maintaining minimal weight and exceptional reliability have become indispensable components in modern EV platforms.

High-voltage cables not only serve as the arteries delivering energy from battery packs to traction inverters and onboard chargers but also integrate critical safety and diagnostic features. Innovations in conductor metallurgy such as aluminum-based alloys doped with micronized additives rivaling copper conductivity, and advanced polymer insulations delivering enhanced environmental resistance, underscore the transformative potential of cabling materials in next-generation EVs. As vehicles transition toward 800V architectures, the synergy between material science and cable design will remain pivotal to achieving compact harness layouts that satisfy performance requirements without compromising on vehicle range or occupant safety.

Unveiling the Latest Material Innovations and Technological Breakthroughs Revolutionizing Electric Vehicle High-Voltage Cable Design and Manufacturing

Material science breakthroughs and innovative manufacturing techniques are reshaping electric vehicle high-voltage cable systems, engendering a wave of transformative shifts in performance, weight reduction, and integration. Miniaturization and high-density cable solutions are at the forefront of this revolution, enabling package designs that free up valuable chassis space while reducing thermal accumulation and material usage. The adoption of high-dielectric polymers allows insulation layers to be thinner yet achieve equivalent voltage ratings, and flattened cable profiles optimize routing through complex vehicle architectures. Concurrently, integrated thermal management approaches-ranging from thermally conductive jackets to liquid-cooled harnesses-ensure stable operation under ultra-fast charging scenarios, mitigating hotspots and extending cable longevity.

Further driving advancement is the infusion of nanomaterial enhancements into both conductors and insulation matrices. Graphene and carbon nanotube additives in conductor strands promise substantial weight savings and improved flexibility, while nano-silica and clay-based composite fillers in insulation deliver elevated dielectric strength and resistance to partial discharge. These developments are complemented by materials engineered for automated assembly processes, featuring low-friction jacketing and form-stable sheaths that facilitate robotic placement and bending without compromising harness integrity. Together, these technological breakthroughs forge a new paradigm in EV cable manufacturing, poised to support the next wave of high-power vehicle architectures and novel application segments.

Assessing How Recent United States Tariff Measures Have Reshaped Costs, Supply Chains, and Innovation in the High-Voltage Cable Sector for EV Infrastructure

The introduction of new U.S. tariffs in 2025 has precipitated a pronounced recalibration of cost structures and supply chain strategies within the high-voltage cable sector for electric vehicles. Major battery producers such as LG Energy Solution have flagged a deceleration in North American EV battery demand, citing increased tariff burdens alongside the impending expiration of federal purchase subsidies as material headwinds for the industry. Automotive giants are also feeling the strain: General Motors disclosed a $1.1 billion operating income impact in Q2 2025 directly linked to tariffs on imported vehicles and auto components, adversely affecting margins and prompting accelerated efforts to repatriate production.

Beyond vehicle assembly, the EV charging infrastructure and cable manufacturing ecosystems are contending with tariff-induced cost escalations for copper wiring, steel enclosures, and associated switchgear. According to IDTechEx, tariffs on copper and aluminum imports could inflate cable production costs and extend lead times for critical components, potentially driving a strategic pivot toward domestic sourcing or alternative material compositions. This cumulative tariff effect has compelled suppliers to refine contingency budgets, reengineer cable designs to minimize tariff-exposed content, and collaborate with downstream stakeholders to preserve project economics in a more challenging trade environment.

Delving into Comprehensive Segmentation Criteria That Reveal Application, Material, Construction, and End-User Dynamics Driving High-Voltage Cable Market Complexity

The electric vehicle high-voltage cable market exhibits remarkable complexity across multiple segmentation dimensions that inform both product strategy and competitive positioning. Application segmentation encompasses critical functions such as battery charging-further delineated into offboard charging cables and onboard charger cables-as well as battery management, power distribution subdivided into auxiliary power and main power cables, sensor connections, and traction inverter circuits. Conductor material choices between aluminum and copper continue to shape cost-performance tradeoffs, just as insulation materials ranging from cross-linked polyethylene to ethylene propylene rubber and polyvinyl chloride define thermal and electrical resilience characteristics. Voltage range segmentation spans up to 1500 volts, between 1500 and 3000 volts, and above 3000 volts, each tier presenting unique engineering challenges and safety requirements.

Cable type diversity further accentuates market dynamics: bi-axial and coaxial constructions serve specialized signal and high-current applications, while multi-core options configured as three-core, four-core, or five-core assemblies support consolidated power delivery. Single-core alternatives, differentiated into flexible and rigid variants, offer design flexibility for tightly packaged harness architectures. Construction types-shielded or unshielded-introduce considerations for electromagnetic compatibility versus weight optimization, and end-user segmentation across commercial vehicles, off-highway equipment, and passenger vehicles-subdivided into electric and hybrid cars-drives nuanced demand patterns based on duty cycle, durability expectations, and certification standards.

This comprehensive research report categorizes the EV High Voltage Cable market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Conductor Material

- Insulation Material

- Voltage Range

- Cable Type

- Construction Type

- Application

- End User

Analyzing Regional Variations in High-Voltage Cable Demand and Innovation Patterns Across the Americas, Europe Middle East Africa, and Asia-Pacific Regions

Regional disparities in high-voltage cable demand are closely aligned with distinct policy frameworks, infrastructure maturity, and automaker localization strategies. In the Americas, robust investment in charging networks and reshoring initiatives catalyzed by tariff pressures are driving a surge in domestic cable sourcing for passenger and commercial vehicle applications. North American OEMs and suppliers are strategically expanding capacity to mitigate import exposure and leverage competitive incentives that support U.S.-based manufacturing.

In Europe, Middle East, and Africa, regulatory mandates for emissions reductions and safety certifications are elevating cable specifications, compelling manufacturers to develop standardized solutions that comply with evolving directives while maintaining agility to address regional grid variances. The emphasis on recycling and circular economy principles has also spurred demand for recyclable polymer insulations and eco-friendly conductor processing.

Asia-Pacific continues to anchor global high-voltage cable innovation, led by China’s expansive EV ecosystem and industrial policy support for local material and component production. Southeast Asia is emerging as a secondary growth frontier, benefitting from rising EV adoption and targeted incentives, while markets in Japan and South Korea remain at the vanguard of advanced cable fabrication and quality assurance practices.

This comprehensive research report examines key regions that drive the evolution of the EV High Voltage Cable market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading High-Voltage Cable Suppliers and Their Strategic Moves to Capture Market Opportunities Amidst Evolving Electric Vehicle Requirements

Leading suppliers in the EV high-voltage cable domain are forging competitive advantage through targeted R&D investments, strategic partnerships, and product portfolio enhancements. Companies such as Aptiv and Champlain Cable Corporation are collaborating on modular cable harness systems optimized for high-power EV architectures, focusing on improved thermal management and simplified assembly workflows. Simultaneously, firms like Volex Group and Pfisterer are introducing advanced charging cables equipped with dual thermistor safety mechanisms and compatibility features that streamline home and commercial charging deployments.

Innovation hubs are also proliferating, with Coroplast Group advancing nanocomposite insulation materials that offer superior dielectric strength, and HUBER+SUHNER AG scaling production of lightweight, high-conductivity aluminum-based conductors for next-generation 800V systems. These strategic moves underscore the imperative for cable manufacturers to balance technological differentiation with supply chain resilience, ensuring that rapid shifts in vehicle architectures and tariff environments do not compromise delivery timelines or product reliability.

This comprehensive research report delivers an in-depth overview of the principal market players in the EV High Voltage Cable market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACOME S.A.

- AG Electrical Technology Co., Ltd.

- Aptiv Global Operations Limited

- Champlain Cable Corporation

- COFICAB Group

- Coroplast Fritz Müller GmbH & Co. KG

- EG Electronics AB

- Eland Cables Limited

- HEW-KABEL GmbH

- HUBER+SUHNER AG

- Hypermotive Ltd.

- JYFT

- KEI Industries Limited

- Kromberg & Schubert GmbH Cable & Wire

- LEONI AG

- Nexans

- OMG EV Cable

- ProEV

- Prysmian S.p.A.

- Southwire Company, LLC

- Sumitomo Electric Industries, Ltd.

- SUNKEAN CABLE Co,.Ltd.

- Suzhou Keli Technology Development Co., Ltd.

- Zhengzhou Guchen Industry Co., Ltd.

- Zhengzhou Saichuan Electronic Technology Co., Ltd.

Strategic Recommendations for Industry Leaders to Enhance R&D, Supply Chain Resilience, and Collaboration for Sustained Growth in EV Cable Markets

Industry leaders should prioritize a multifaceted approach to navigate the dynamic high-voltage cable landscape and secure sustainable growth. First, intensifying R&D expenditure on nanomaterial-enhanced conductors and thermally integrated insulations will establish performance benchmarks that meet the rigorous demands of ultra-fast charging and high-voltage systems. Aligning product roadmaps with anticipated regulatory shifts-especially in emissions and safety standards-will mitigate compliance risk and unlock first-mover advantages.

Second, enhancing supply chain resilience through dual-sourcing strategies and targeted localization efforts can reduce vulnerability to tariff fluctuations and logistical disruptions. Collaborating closely with OEMs on modular cable kits and pre-formed harness solutions will streamline assembly processes and foster deeper integration within vehicle manufacturing workflows. Lastly, forging cross-sector partnerships-spanning material suppliers, battery producers, and charging infrastructure developers-will enable holistic optimization of power transmission solutions, reinforcing value propositions that drive customer adoption and long-term loyalty.

Outlining a Robust Multi-Source Research Methodology Employing Primary Interviews, Secondary Data Analysis, and Market Triangulation Techniques

The research methodology underpinning this report integrates primary and secondary data sources to deliver a comprehensive and balanced market perspective. Primary insights were garnered through in-depth interviews with key stakeholders, including cable manufacturers, automaker engineering leads, material scientists, and electrification infrastructure specialists. These conversations provided nuanced understanding of emerging trends, technology deployment timelines, and supply chain dynamics.

Supplementing this, secondary research drew upon peer-reviewed journals, industry association publications, government policy documents, and trade press articles. These references were systematically analyzed to verify factual accuracy and contextualize market developments. Data triangulation techniques were employed to reconcile disparate data points, ensuring consistency and reliability of qualitative observations. Finally, expert validation sessions were conducted with thought leaders in electric vehicle electrification to refine findings and validate strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our EV High Voltage Cable market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- EV High Voltage Cable Market, by Conductor Material

- EV High Voltage Cable Market, by Insulation Material

- EV High Voltage Cable Market, by Voltage Range

- EV High Voltage Cable Market, by Cable Type

- EV High Voltage Cable Market, by Construction Type

- EV High Voltage Cable Market, by Application

- EV High Voltage Cable Market, by End User

- EV High Voltage Cable Market, by Region

- EV High Voltage Cable Market, by Group

- EV High Voltage Cable Market, by Country

- United States EV High Voltage Cable Market

- China EV High Voltage Cable Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Summarizing the Strategic Imperatives and Future Outlook for High-Voltage Cables in Electric Vehicles Amidst Shifting Technological and Policy Landscapes

High-voltage cabling stands at the nexus of electric vehicle performance, safety, and manufacturing efficiency. As EV adoption accelerates, the convergence of advanced materials, innovative design, and evolving regulatory frameworks will define the competitive landscape. While the 2025 tariff environment and regional policy divergences introduce complexity, they also present opportunities for agile suppliers to differentiate through technology leadership and localized production.

Strategic segmentation insights reveal that tailored cable solutions-aligned with specific application, material, and end-user requirements-will drive differentiated value propositions. Moreover, the ongoing shift toward higher voltage architectures and ultra-fast charging underscores the need for continuous innovation in conductor and insulation technologies. By embracing collaborative ecosystems, reinforcing supply chain resilience, and aligning product development with emerging standards, the industry can navigate headwinds and capitalize on the transformative potential of electrified mobility.

Contact Ketan Rohom to Secure the Comprehensive High-Voltage Cable Market Report Offering Data-Driven Insights to Propel Your EV Strategy

Unlock unparalleled market intelligence tailored to the evolving demands of electric vehicle high-voltage cable design, material selection, and regulatory compliance by engaging with our comprehensive report. Ketan Rohom, Associate Director of Sales & Marketing, stands ready to guide you through customized insights that will inform your strategic roadmap and drive competitive advantage. Reach out to explore how this in-depth analysis can empower your team to navigate tariff challenges, capitalize on emerging technological breakthroughs, and optimize regional market entry strategies. Elevate your decision-making with data-driven recommendations and partner with a resource committed to your success in the dynamic EV infrastructure landscape

- How big is the EV High Voltage Cable Market?

- What is the EV High Voltage Cable Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?