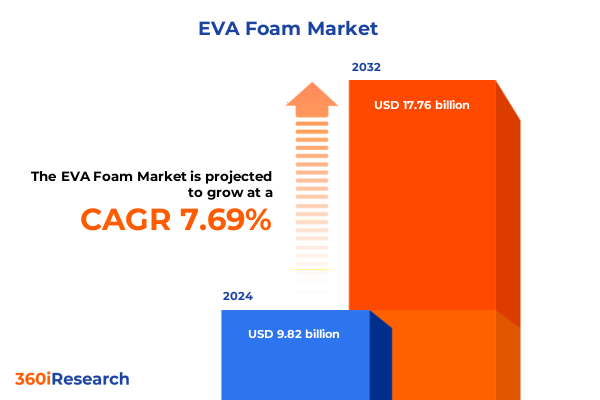

The EVA Foam Market size was estimated at USD 10.42 billion in 2025 and expected to reach USD 11.07 billion in 2026, at a CAGR of 7.90% to reach USD 17.76 billion by 2032.

Understanding the Evolution and Strategic Importance of Ethylene Vinyl Acetate Foam as a High-Performance Material Enabling Innovation Across Varied Industries

Ethylene vinyl acetate foam has emerged as a cornerstone material in numerous manufacturing and application sectors, distinguished by its exceptional flexibility, resilience, and cushioning properties. Its molecular structure, combining ethylene and vinyl acetate monomers, results in a closed-cell matrix that delivers both mechanical robustness and thermal insulation, fueling its widespread adoption across diverse industries. Over the past decade, innovations in foam extrusion and crosslinking techniques have accelerated its performance profile, enabling end users to achieve superior comfort in footwear, enhanced protective capabilities in packaging, and reliable sealing solutions in construction. As sustainability imperatives take center stage, this versatile polymer has also attracted attention for its potential in producing recyclable and low-emissions end products, aligning material development trajectories with global environmental targets.

Against this backdrop of technological progress and ecological responsibility, the current analysis seeks to illuminate the strategic importance of ethylene vinyl acetate foam market dynamics and emerging pathways for value creation. This report navigates the material’s evolution, articulates the forces shaping future demand, and outlines actionable insights that decision-makers can leverage to maintain a competitive edge. By connecting the dots between advanced manufacturing processes, regulatory trends, and end-market requirements, the introduction sets the stage for a deep dive into transformative shifts, tariff impacts, segmentation nuances, and tailored recommendations, providing a comprehensive lens on this high-performance material.

How Technological Advancements, Sustainability Imperatives, and Digital Fabrication Are Transforming the Ethylene Vinyl Acetate Foam Landscape

The ethylene vinyl acetate foam landscape is undergoing a profound metamorphosis driven by concurrent technological breakthroughs, evolving sustainability mandates, and the integration of digital fabrication processes. In material science laboratories, researchers are developing novel cross-linking methods that enhance mechanical properties while reducing energy consumption during production. These innovations are complemented by advanced foaming techniques that precisely control cell size distribution, yielding consistent product performance across applications from footwear insoles to automotive interior panels.

Sustainability has emerged as a transformative shift, with brands and regulatory bodies pushing for materials that deliver a smaller environmental footprint. Consequently, bio-based feedstocks and closed-loop recycling processes are being piloted to curtail reliance on virgin petrochemicals. Emerging policies incentivize manufacturers to adopt low-emission production technologies, spurring the development of low resilience foam grades that provide comparable performance with reduced energy requirements. Meanwhile, digital fabrication technologies, such as additive manufacturing and machine-vision-guided extrusion, enable customized foam geometries for bespoke medical prosthetic liners and sports equipment enhancements.

Together, these converging forces signal a future in which ethylene vinyl acetate foam will not just be chosen for its material attributes but also for its contribution to circular economy objectives and digital manufacturing ecosystems. As stakeholder expectations evolve, companies that embrace these transformative shifts will be best positioned to capitalize on next-generation product opportunities and secure leadership in a dynamic marketplace.

Assessing the Layered Effects of 2025 United States Tariffs on Ethylene Vinyl Acetate Foam Supply Chains, Pricing Structures, and Market Dynamics

The imposition of new United States tariffs in 2025 has introduced a ripple effect across ethylene vinyl acetate foam supply chains, reshaping cost structures and prompting strategic realignments. At the heart of this cumulative impact is the increased import levy on key raw materials and foam extrusion machinery sourced from major international suppliers. As a result, domestic processors are encountering higher input costs, which in turn are translating into adjusted pricing strategies for end-product manufacturers.

Faced with these elevated costs, companies are exploring alternative sourcing arrangements and forging partnerships with local raw material producers to mitigate tariff burdens. In parallel, some foam producers are accelerating investments in domestic extrusion and cross-linking capacity to reduce dependence on imported components. This capacity realignment not only addresses immediate cost pressures but also enhances supply chain resilience by localizing critical production stages. Moreover, the tariff-induced fluctuations have stimulated conversations around near-shoring and regional consolidation of manufacturing footprints.

The combined effect of these measures underscores a shifting landscape where price sensitivity coexists with strategic imperatives for supply chain security and operational agility. Industry stakeholders that proactively adapt their procurement strategies, optimize production footprints, and foster collaborative partnerships will navigate the tariff environment more effectively, safeguarding profitability and maintaining market access in an increasingly complex trade climate.

Unlocking Critical Insights from Application, Type, Distribution Channel, Density, and Thickness Segmentation to Navigate Complex Ethylene Vinyl Acetate Foam Markets

Ethylene vinyl acetate foam applications reveal a rich tapestry of end uses spanning automotive, construction, consumer goods, footwear, medical, packaging, and sports equipment. In automotive, exteriors demand durable sealing and impact resistance, while interiors leverage EVA’s cushioning comfort and vibration dampening. Construction sectors rely on insulation and sealing capabilities to enhance energy efficiency and structural integrity. Consumer furniture pads and toy manufacturers capitalize on the material’s soft-touch attributes and safety profile for contact surfaces. Footwear designers integrate EVA in insoles for shock absorption and in uppers to improve flexibility and gait support. In medical realms, orthopedic supports and prosthetic liners benefit from conformable comfort and skin-friendly characteristics. Packaging applications focus on cushioning fragile items during transit and form-fitting protective wrappings. Athletes and fitness enthusiasts encounter EVA in exercise mats and protective gear, where impact attenuation and durability are paramount.

Diversity also extends to foam types, with cross-linked grades offering high resilience for demanding performance requirements and open-cell variants providing breathable cushioning. Low resilience foams find niche roles where comfort and energy damping take precedence over mechanical rebound. Distribution channel dynamics present both direct arrangements and indirect models, supported by offline retail and wholesale networks as well as online sales through e-commerce platforms and manufacturer websites. Varying density profiles allow high density foams to serve load-bearing applications, medium density grades for balanced performance, and low density foams for lightweight cushioning. Thickness variations from thin liners to thick structural pads enable designers to tailor material properties across end uses.

Appreciating these segmentation insights equips stakeholders with the ability to align product development strategies with nuanced market demands. By understanding how application requirements intersect with foam type, distribution pathways, density, and thickness, decision makers can better anticipate customer needs and refine their value propositions in a competitive marketplace.

This comprehensive research report categorizes the EVA Foam market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Density

- Thickness

- Application

- Distribution Channel

Exploring Regional Dynamics Shaping Demand, Innovation, and Competitive Positioning Across the Americas, Europe Middle East Africa, and Asia Pacific

Regional dynamics in ethylene vinyl acetate foam reflect the interplay of industrial capacity, regulatory environments, and evolving end-market demands across the Americas, Europe Middle East & Africa, and Asia Pacific. In the Americas, market growth is underpinned by strong automotive and footwear manufacturing hubs, where demand for lightweight cushioning and interior comfort components continues to rise. Energy efficiency initiatives in North America bolster construction-grade insulation and sealing applications, while consumer preference trends in Latin America drive increased adoption of EVA for protective packaging and sports gear.

Europe Middle East & Africa demonstrates a dual focus on sustainability and regulatory compliance, with stringent emissions standards prompting material innovation and adoption of bio-based EVA alternatives. The region’s established medical device sector fuels demand for orthopedic supports and prosthetic liners, leveraging the material’s conformability and biocompatibility. Meanwhile, rapid infrastructure development across key Middle Eastern markets is generating fresh requirements for sealing and insulation solutions.

The Asia Pacific region stands out as a center for foam manufacturing excellence, supported by robust chemical feedstock availability and advanced extrusion capabilities. Footwear production concentrations in Southeast Asia sustain high volumes of EVA insole and upper applications, while China’s electronics and consumer goods industries drive demand for precision-cut cushioning components. E-commerce proliferation across the region is also reshaping distribution channels, as manufacturers optimize online direct-to-consumer models alongside traditional retail and wholesale networks.

Navigating these regional nuances allows companies to tailor go-to-market strategies, align product portfolios with local requirements, and capitalize on emerging growth pockets, thereby strengthening their competitive positioning on a global scale.

This comprehensive research report examines key regions that drive the evolution of the EVA Foam market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants Driving Innovation, Partnership Strategies, and Competitive Differentiation in the Ethylene Vinyl Acetate Foam Market

Leading players in the ethylene vinyl acetate foam industry are distinguished by their integrated value chains, technological innovation roadmaps, and strategic partnerships. These companies are consistently advancing material formulations through collaborative research with university laboratories and specialized research institutes, bringing next-generation foam grades to market with enhanced mechanical performance, sustainability attributes, and processing efficiency. They also leverage co-development agreements with end-use equipment manufacturers, ensuring seamless integration of EVA foam components into automotive assembly lines, construction systems, and medical device production.

A common thread among these industry participants is the pursuit of operational excellence through digitalization. Advanced process control systems monitor extrusion parameters in real time, optimizing cross-link density and foam cell structure to minimize variability. Additionally, robust quality management frameworks, including in-line inspection technologies and traceability solutions, ensure product consistency across global manufacturing sites. Strategic joint ventures and licensing arrangements further extend their geographic reach, while enabling access to localized feedstock sources and value-added services.

Through ongoing investment in sustainability, digital transformation, and collaborative innovation, these key companies are shaping the competitive landscape in ethylene vinyl acetate foam. Their practices set benchmarks for material performance, environmental stewardship, and customer centricity that others in the sector seek to emulate.

This comprehensive research report delivers an in-depth overview of the principal market players in the EVA Foam market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema S.A.

- BASF SE

- Braskem S.A.

- Celanese Corporation

- Chevron Phillips Chemical Company LLC

- China Petroleum & Chemical Corporation

- Covestro AG

- Daikin Industries, Ltd

- Dow Inc

- EVA Airways Corporation (materials division)

- ExxonMobil Chemical Company

- Formosa Plastics Corporation

- Hanwha Solutions Corporation

- INEOS Group Holdings S.A.

- Kumho Petrochemical Co., Ltd

- LG Chem Ltd

- LyondellBasell Industries N.V.

- Mitsui Chemicals Inc

- PetroChina Company Limited

- Reliance Industries Limited

- SABIC

- Sumitomo Chemical Co., Ltd

- TotalEnergies SE

- Versalis S.p.A.

- Westlake Corporation

Strategic Roadmap for Industry Leaders to Capitalize on Emerging Opportunities, Mitigate Risks, and Strengthen Competitive Advantage in EVA Foam Markets

Industry leaders should pursue a multifaceted strategy to harness emerging opportunities and mitigate risks within the ethylene vinyl acetate foam sector. Prioritizing investment in green chemistry initiatives and closed-loop recycling programs will align product offerings with expanding sustainability mandates and consumer preferences for eco-friendly materials. Concurrently, strengthening domestic production capabilities through capacity expansion and near-shoring arrangements can reduce exposure to tariff volatility and supply chain disruptions.

Collaborative partnerships with equipment manufacturers and end-use customers should be deepened to co-create custom foam solutions that address specific performance or regulatory requirements. Embracing digital twins and predictive maintenance tools across extrusion and cross-linking operations will optimize throughput, minimize downtime, and maintain tight quality control. Furthermore, segmentation-driven product portfolios-tailored by application, foam type, distribution channel, density, and thickness-will empower sales and marketing teams to deliver targeted value propositions that resonate with diverse customer segments.

Regional market entry plans must account for local regulatory landscapes, distribution infrastructures, and consumer behavior patterns. Companies should also invest in talent development and specialized training programs to build expertise in advanced material design, digital manufacturing, and sustainability reporting. By executing these recommendations in an integrated manner, industry leaders will enhance resilience, unlock new revenue streams, and secure lasting competitive advantage in an evolving ethylene vinyl acetate foam marketplace.

Rigorous, Multilayered Research Methodology Combining Primary Interviews, Secondary Data Analysis, Qualitative Insights, and Validation Processes

This study employed a rigorous, multistage research methodology to ensure the credibility and relevance of insights presented. In the initial phase, primary data was gathered through in-depth interviews with material scientists, manufacturing executives, and end-user product designers to capture qualitative perspectives on performance requirements, innovation drivers, and emerging trends. These insights were complemented by secondary data collection from a curated mix of industry publications, technical white papers, patent databases, and public regulatory filings to map competitive landscapes and technology trajectories.

Subsequent rounds of data triangulation involved cross-referencing interview findings with production and consumption patterns observed in trade associations, customs databases, and production technology reports. A combination of thematic analysis and scenario planning techniques was applied to distill the influence of policy changes, tariff measures, and sustainability frameworks on market dynamics. Finally, validation workshops with leading industry stakeholders ensured the robustness of conclusions and the alignment of strategic recommendations with real-world business imperatives.

Through this comprehensive methodology, the report synthesizes qualitative and quantitative evidence into coherent narratives and actionable insights, enabling decision makers to navigate the complexities of the ethylene vinyl acetate foam ecosystem with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our EVA Foam market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- EVA Foam Market, by Type

- EVA Foam Market, by Density

- EVA Foam Market, by Thickness

- EVA Foam Market, by Application

- EVA Foam Market, by Distribution Channel

- EVA Foam Market, by Region

- EVA Foam Market, by Group

- EVA Foam Market, by Country

- United States EVA Foam Market

- China EVA Foam Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Summarizing Key Findings, Strategic Implications, and Future Considerations for Stakeholders Engaged in Ethylene Vinyl Acetate Foam Value Chains

In conclusion, ethylene vinyl acetate foam stands at the intersection of high-performance material science and evolving market imperatives, positioning it for sustained relevance across diverse end-use sectors. Technological advancements in cross-linking and foaming techniques are unlocking new performance thresholds, while sustainability imperatives are driving cradle-to-cradle innovations and circular economy initiatives. The 2025 tariff landscape has prompted strategic realignments in sourcing and production footprints, underscoring the need for agile procurement and local manufacturing strategies.

Segmentation across application, foam type, distribution channel, density, and thickness provides a nuanced framework for aligning product development with specific market demands. Regional variations in regulatory environments, consumer trends, and supply chain infrastructures further shape competitive positioning, calling for tailored market entry and growth plans. Leading companies are setting benchmarks through integrated innovation ecosystems, digital manufacturing adoption, and strategic partnerships, offering a blueprint for operational excellence and sustainable growth.

By synthesizing these insights, stakeholders can make informed decisions on technology investments, supply chain optimization, and go-to-market strategies. The substantive challenges and emergent opportunities outlined herein pave the way for proactive strategies that will define the future trajectory of the ethylene vinyl acetate foam market.

Connect with Ketan Rohom to Acquire a Comprehensive Market Research Report Delivering In-Depth Analysis, Strategic Perspectives, and Actionable Insights

Engaging with Ketan Rohom, Associate Director of Sales and Marketing, will provide you with personalized guidance on securing the comprehensive market research report that delivers the strategic analysis and deep-dive insights you need. You will gain access to an extensive examination of ethylene vinyl acetate foam applications, the latest trends in material innovation, and detailed competitive profiling that underpins informed decision making. Collaboration with an expert point of contact ensures that your organization obtains tailored interpretations of the data, enabling you to identify growth levers, optimize supply chain strategies, and refine product development roadmaps. Reach out to explore customized consultancy options, learn about value-added deliverables, and expedite your time to insight in a rapidly evolving market landscape where staying ahead of technological shifts is essential

- How big is the EVA Foam Market?

- What is the EVA Foam Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?