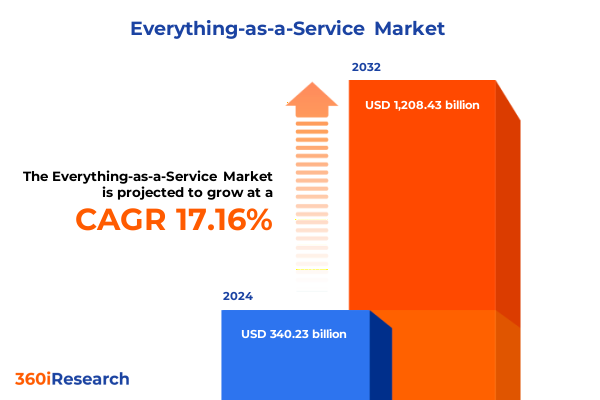

The Everything-as-a-Service Market size was estimated at USD 395.43 billion in 2025 and expected to reach USD 459.59 billion in 2026, at a CAGR of 17.30% to reach USD 1,208.43 billion by 2032.

Entering the Everything-as-a-Service era where cloud, data, and AI converge to redefine digital operating models and enterprise value creation

The convergence of cloud computing, ubiquitous connectivity, and subscription-based business models has propelled Everything-as-a-Service from an emerging concept to a foundational paradigm for digital enterprise. Organizations across banking, healthcare, manufacturing, retail, government, and technology now view services delivered over the network-not products delivered on-premise-as the default way to access compute, applications, communications, and business capabilities.

Within this context, the Everything-as-a-Service landscape encompasses a spectrum of offerings. Device-as-a-Service reframes endpoints and workplace technology as managed, lifecycle-based subscriptions. Infrastructure-as-a-Service exposes elastic compute, storage, and networking primitives over the cloud. Platform-as-a-Service accelerates application, data, and integration development. Software-as-a-Service delivers collaboration, content management, customer relationship management, and enterprise resource planning through always-on, browser-based applications. Network-as-a-Service virtualizes connectivity and security, while unified communications delivered as a service integrates voice, video, messaging, and contact center capabilities into a cohesive, cloud-native experience.

As organizations progress in their digital transformation journeys, XaaS is no longer viewed solely as a cost-optimization lever. It has become a strategic enabler of speed, resilience, and innovation. Executives increasingly measure success not just in terms of infrastructure offload, but also by time-to-market for new digital services, the ability to orchestrate data and AI across ecosystems, and the flexibility to adapt operating models to volatile macroeconomic and regulatory conditions.

This executive summary frames the Everything-as-a-Service market through the lens of structural shifts, policy headwinds, segmentation dynamics, and regional and competitive patterns. It highlights how new tariffs, evolving deployment choices, and changing buyer expectations are reshaping the economics of service delivery, and it outlines practical considerations for leaders seeking to position their organizations for long-term advantage in this rapidly evolving domain.

Transformative shifts are turning Everything-as-a-Service into a composable fabric spanning infrastructure, platforms, software, networks, and communications

The Everything-as-a-Service landscape is undergoing a profound transformation, driven by the normalization of cloud-native architectures, the rapid diffusion of artificial intelligence, and growing expectations for outcomes rather than tools. Organizations are moving from isolated SaaS purchases to integrated portfolios spanning Device-as-a-Service, Infrastructure-as-a-Service, Platform-as-a-Service, Software-as-a-Service, Network-as-a-Service, and unified communications delivered as a service. This integration is shifting the focus from individual products to end-to-end experience, data, and security architectures.

Within Infrastructure-as-a-Service, the mix of compute, networking, and storage is changing as enterprises modernize workloads. Compute consumption is tilting from traditional virtual machines toward containers, which better support microservices and DevSecOps practices. Networking services are evolving beyond basic connectivity into capabilities such as content delivery networks and virtual private clouds that optimize latency, security, and traffic management for distributed applications. Storage requirements are also bifurcating between block storage, used for high-performance transactional workloads, and object storage, which underpins analytics, backup, and unstructured data platforms.

Platform-as-a-Service is increasingly the glue that binds infrastructure and applications, with organizations adopting application platforms, data platforms, and integration platforms to accelerate development and simplify governance. In parallel, Software-as-a-Service categories are expanding and deepening. Collaboration and content management tools have become the default workplace interface, while customer relationship management and enterprise resource planning have fragmented into specialized clouds for marketing, sales, service, finance, human resources, and supply chain. These specialized platforms are increasingly infused with AI to automate workflows, personalize engagement, and provide predictive insight.

Across the landscape, buyers are insisting on interoperability, open APIs, and unified identity and policy controls. Security, observability, and compliance capabilities must span multiple service types and deployments, from public cloud to private environments and hybrid configurations. This has elevated the importance of Network-as-a-Service and unified communications delivered as a service, as secure connectivity and frictionless communication are prerequisites for realizing the full value of distributed digital operations.

Together, these shifts are transforming Everything-as-a-Service from a collection of discrete offerings into a layered, composable fabric that underpins modern enterprises. Providers that can orchestrate services across layers, simplify integration, and tie their value propositions to measurable business outcomes are emerging as strategic partners rather than commodity vendors.

United States tariff shifts through 2025 reshape hardware economics and strategic risk for Everything-as-a-Service providers across the digital value chain

Tariff policy in the United States has become an increasingly important factor shaping the economics and risk profile of the Everything-as-a-Service ecosystem. In 2024, the administration announced a substantial escalation of Section 301 tariffs on a range of Chinese-origin goods, including semiconductors, batteries, solar cells, steel, aluminum, and selected medical products, with phased increases extending into 2026. Although these measures are not targeted at digital services directly, they have significant second-order effects on the cost of building and operating the physical infrastructure that underpins cloud and XaaS offerings.

For service providers that rely on Infrastructure-as-a-Service, the most consequential development for 2025 is the scheduled increase in tariffs on certain imported semiconductors from 25% to 50%. Servers, networking equipment, and storage systems all incorporate these components. Higher input costs are already prompting hyperscale and regional providers to revisit procurement strategies, diversify suppliers, and explore alternative manufacturing geographies. These shifts can temporarily disrupt equipment availability and lengthen deployment timelines for new data centers, with knock-on implications for the elasticity and pricing of compute, networking, and storage services.

The cumulative impact of these tariffs is most visible in capital-intensive service layers. Infrastructure-as-a-Service providers must absorb higher costs in compute, networking, and storage while maintaining competitive pricing and service-level commitments. Platform-as-a-Service and Software-as-a-Service vendors face more indirect exposure, but they are nevertheless affected through increases in underlying cloud infrastructure pricing, changes in device costs for end users, and higher expenses for specialized hardware used in AI and high-performance analytics workloads. Analyses of recent tariff regimes have already highlighted rising data center construction and equipment costs, and industry commentary is increasingly focused on how this may slow the rollout of AI-centric infrastructure in the absence of efficiency gains elsewhere.

At the same time, the international rules governing digital trade continue to evolve. Under the World Trade Organization’s work programme on e-commerce, members agreed in 2024 to extend the longstanding moratorium on customs duties for electronic transmissions until the next ministerial conference or March 31, 2026, whichever comes first. This means cross-border delivery of software, platforms, and data services remains shielded from customs tariffs in the near term, even as hardware inputs face rising duties. However, the moratorium’s finite horizon introduces strategic uncertainty, particularly for providers with significant international revenue.

In aggregate, the 2025 tariff environment reinforces several imperatives for XaaS providers. Diversified hardware sourcing, closer collaboration with original design manufacturers, and scenario planning for further trade disruptions are now essential components of risk management. Financial teams must refine cost modeling and pricing strategies to decide where to absorb cost increases and where to pass them through. Finally, providers should anticipate growing scrutiny from enterprise customers, who will seek assurances that tariff-induced volatility will not compromise service availability, performance, or total cost of ownership over the duration of multiyear contracts.

Segmentation insights reveal how service types, pricing, deployment, industries, and organization size interact to shape Everything-as-a-Service adoption

Segmentation by service type reveals pronounced differences in maturity, innovation pace, and buyer expectations across the Everything-as-a-Service spectrum. Device-as-a-Service is gaining traction as enterprises seek to standardize endpoint fleets, simplify lifecycle management, and align workplace technology spending with headcount dynamics. Infrastructure-as-a-Service remains foundational, but its internal structure is evolving: compute consumption is increasingly split between container-based environments optimized for microservices and traditional virtual machines that continue to host legacy workloads; networking services are differentiating through advanced capabilities such as content delivery networks and virtual private clouds that embed security and traffic engineering; and storage strategies are balancing block storage for performance-critical databases with object storage that enables scalable analytics, archival, and content services.

Platform-as-a-Service exhibits strong pull from developers and data teams who require standardized, managed environments. Application platforms streamline the build, test, and deployment cycle for custom software, while data platforms provide governed environments for analytics, machine learning, and real-time decisioning. Integration platforms have become strategically important as organizations stitch together an expanding array of SaaS offerings, on-premise systems, and partner APIs into cohesive workflows.

Within Software-as-a-Service, collaboration and content management tools have become embedded in daily work patterns, positioning them as gateways for additional services such as security, compliance, and analytics. Customer relationship management is fragmenting into specialized clouds for marketing, sales, and service, each layering automation, personalization, and AI-driven recommendations onto core customer data. Enterprise resource planning continues to migrate from monolithic on-premise deployments toward modular cloud suites spanning finance, human resources, and supply chain, enabling organizations to modernize at different speeds across back-office functions without disrupting operations.

The pricing model segmentation underscores how monetization strategies shape adoption. Freemium approaches remain effective for collaboration and certain developer-oriented offerings, where rapid user acquisition and network effects are critical. Pay-per-use models are most closely associated with Infrastructure-as-a-Service and Platform-as-a-Service, especially for compute, storage, and integration workloads where usage can be metered precisely. Subscription-based pricing predominates in Software-as-a-Service, Device-as-a-Service, and unified communications delivered as a service, providing predictable recurring revenue and enabling outcome-focused service-level agreements.

Deployment model segmentation highlights continuing demand for flexibility. Public cloud deployments dominate for greenfield and customer-facing digital services where scalability and global reach are priorities. Private cloud deployments persist in regulated sectors and for workloads with stringent latency, security, or data residency requirements. Hybrid cloud strategies that deliberately combine public and private environments have become the norm for large enterprises, allowing them to optimize cost, performance, and compliance across heterogeneous portfolios.

Industry vertical segmentation reveals distinct digitalization priorities. In banking, capital markets, and insurance, Everything-as-a-Service is used to modernize core systems, comply with evolving regulatory expectations, and launch digital-first products without rebuilding entire technology stacks. Government and public sector organizations are increasingly adopting secure cloud and communications services for citizen engagement and mission-critical operations. In healthcare, hospitals focus on clinical workflow modernization, electronic records, and telehealth, while pharma and biotech companies emphasize data platforms for research, trials, and supply-chain integrity. Manufacturing environments show different adoption paths in discrete and process segments, with the former emphasizing product lifecycle management and smart factory initiatives, and the latter focusing on continuous process optimization and quality control. Retail and consumer goods players are leveraging XaaS to unify brick-and-mortar and e-commerce operations, integrating marketing, sales, and service platforms with supply chain and inventory systems.

Organization size segmentation also matters. Large enterprises, including both corporate entities and multinationals, tend to pursue complex hybrid architectures, negotiate bespoke commercial terms, and demand enterprise-grade security, integration, and support. Small and medium businesses, including both medium and small firms, typically favor turnkey cloud-native solutions with simple subscription or pay-per-use pricing, relying heavily on Software-as-a-Service and Unified Communications-as-a-Service to access capabilities that would be impractical to build in-house. Understanding these nuanced patterns across service types, pricing, deployment, industries, and organization sizes is central to designing differentiated offerings and go-to-market strategies in the Everything-as-a-Service domain.

This comprehensive research report categorizes the Everything-as-a-Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Deployment Model

- Industry Vertical

- Organization Size

Regional dynamics across the Americas, Europe–Middle East–Africa, and Asia-Pacific redefine priorities and opportunities in the Everything-as-a-Service market

Regional dynamics exert a decisive influence on how Everything-as-a-Service is adopted, packaged, and monetized. In the Americas, the United States remains a critical anchor market, characterized by high adoption of public cloud and Software-as-a-Service, a dense ecosystem of platform and integration providers, and strong demand for advanced analytics and AI delivered as services. Enterprises in this region tend to experiment early with new models such as Device-as-a-Service and Network-as-a-Service, particularly in technology, financial services, and digital-native sectors. Latin American markets are expanding from a smaller base, with growing appetite for cloud-based collaboration, payments, and commerce platforms as local providers and hyperscalers invest in regional data centers and connectivity.

Across Europe, Middle East, and Africa, regulatory frameworks and infrastructure diversity create a multi-speed Everything-as-a-Service environment. European organizations operate under stringent data protection and sovereignty regimes, driving strong interest in hybrid and multi-cloud deployments, regional data platforms, and sovereign cloud offerings. Adoption of unified communications and collaboration services is well advanced, but many enterprises continue to modernize complex legacy environments, particularly in manufacturing and public sector. In the Middle East, ambitious national transformation programs and investments in smart cities are accelerating demand for cloud infrastructure, platforms, and Software-as-a-Service, often delivered through partnerships between global providers and regional telecom operators. In Africa, mobile-first usage patterns, growing fintech ecosystems, and improved connectivity are enabling leapfrogging into cloud-based services for payments, commerce, education, and government.

Asia-Pacific presents some of the most dynamic growth patterns for Everything-as-a-Service. Large economies with strong technology sectors are driving demand for Infrastructure-as-a-Service, Platform-as-a-Service, and advanced Software-as-a-Service capabilities, often coupled with local data residency requirements. India’s expanding digital public infrastructure and startup ecosystem are stimulating rapid adoption of cloud services among small and medium businesses as well as large enterprises. Southeast Asian markets combine young, digital-native populations with rising investment in logistics, payments, and omnichannel retail platforms delivered as services. In more mature markets such as Japan and South Korea, XaaS adoption is intertwined with advanced manufacturing, robotics, and 5G deployment, leading to increased interest in edge computing and Network-as-a-Service models.

Across regions, the interplay between local regulation, connectivity, and industry structure shapes the relative emphasis on different service types. The Americas tend to lead in early adoption of new Everything-as-a-Service categories and AI-rich offerings. Europe, Middle East, and Africa emphasize trust, compliance, and hybrid architectures, giving rise to specialized providers focused on security, sovereignty, and vertical solutions. Asia-Pacific combines scale, innovation, and heterogeneity, making it a proving ground for new models such as super-app ecosystems, embedded financial and retail services, and industry-specific platforms that are then exported globally. Providers that adapt their portfolios, partnerships, and go-to-market strategies to these regional realities will be best positioned to capture sustained value.

This comprehensive research report examines key regions that drive the evolution of the Everything-as-a-Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evolving competitive strategies show hyperscalers, software vendors, telcos, and specialists converging to shape the Everything-as-a-Service ecosystem

The competitive landscape in Everything-as-a-Service is characterized by a blend of hyperscale cloud providers, enterprise software vendors, telecom operators, hardware manufacturers, and specialized service providers, all converging on overlapping value pools. Hyperscale platforms have extended far beyond core Infrastructure-as-a-Service into a continuum of services that include Platform-as-a-Service offerings for application, data, and integration workloads, along with rapidly expanding portfolios of managed databases, AI and machine learning tools, security services, and observability solutions. These players increasingly frame themselves as ecosystems, courting independent software vendors and system integrators to build differentiated solutions on top of their platforms.

Enterprise software providers, many of which originated in on-premise license models, are now firmly committed to Software-as-a-Service as their primary delivery and innovation pathway. They are modernizing long-standing enterprise resource planning and customer relationship management suites into modular clouds encompassing finance, human resources, supply chain, marketing, sales, and service. Their competitive advantage often lies in deep domain functionality, strong installed bases, and established partner networks, but they must continuously evolve architectures and commercial models to meet expectations for openness, integration, and continuous delivery.

Telecommunication operators and network specialists are repositioning themselves through Network-as-a-Service and unified communications delivered as a service. By combining connectivity, security, and collaboration capabilities, they are seeking to move up the value stack, providing managed services that integrate with cloud platforms and enterprise applications. Partnerships with hyperscale cloud providers and device manufacturers are common as these companies aim to deliver end-to-end solutions that span connectivity, devices, and applications.

Hardware manufacturers and device vendors are embracing Device-as-a-Service and related lifecycle services to counteract commoditization and align with customers’ shift toward operational expenditure models. By bundling devices with deployment, security, analytics, and refresh services, they can generate recurring revenue streams and strengthen customer relationships. In parallel, a diverse set of specialized providers has emerged around areas such as security-as-a-service, observability-as-a-service, industry-specific platforms, and integration and automation services, often targeting niches that require deep domain expertise or regulatory knowledge.

Across all categories, leading companies share several strategic traits. They invest heavily in AI to enhance their offerings, focusing on features such as intelligent automation, predictive analytics, and natural-language interfaces. They build robust partner ecosystems to extend reach and innovation, including alliances with consulting firms, system integrators, independent software vendors, and managed service providers. They prioritize trust, security, and compliance as differentiators, especially in regulated industries and regions with strict data protection requirements. Finally, they are experimenting with new commercial models, from usage-based pricing and freemium tiers to outcome-linked contracts that tie a portion of fees to business results achieved by customers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Everything-as-a-Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Adobe Inc.

- Alibaba Group Holding Limited

- Amazon Web Services, Inc.

- AT&T Inc.

- Cisco Systems, Inc.

- Dell Technologies Inc.

- Google LLC

- HCL Technologies Limited

- Hewlett Packard Enterprise Company

- HP Inc.

- International Business Machines Corporation

- Lenovo Group Limited

- Microsoft Corporation

- Nokia Corporation

- Oracle Corporation

- Orange Business

- Salesforce, Inc.

- SAP SE

- ServiceNow, Inc.

- VMware, Inc.

Actionable strategies enable industry leaders to align portfolios, pricing, architectures, and governance with the realities of Everything-as-a-Service

Industry leaders seeking to capture value in the Everything-as-a-Service landscape must translate market insight into concrete strategic moves. The first priority is to clarify the role of XaaS within the broader business model. Organizations should map which capabilities are best consumed as services and which should remain in-house, aligning these decisions with differentiation strategies, regulatory obligations, and talent constraints. This exercise should extend across Device-as-a-Service, Infrastructure-as-a-Service, Platform-as-a-Service, Software-as-a-Service, Network-as-a-Service, and unified communications, with clear principles for when to standardize, when to customize, and when to partner.

Commercial strategy requires equal rigor. Providers should proactively harmonize pricing architectures across freemium, pay-per-use, and subscription models, ensuring that tiers, metrics, and entitlements are coherent from a customer perspective. This includes designing offers that make it easy for small and medium businesses to adopt standardized packages while providing enterprise customers with levers for governance, performance, and cost optimization. Embedding observability and financial operations capabilities into offerings can help customers understand and control consumption, strengthening trust and enabling upsell to higher-value services.

Technology and architecture decisions must support agility and resilience. Investing in cloud-native, API-first platforms that span application, data, and integration layers can accelerate innovation and reduce integration friction. At the same time, leaders should plan for multi-cloud and hybrid deployment models, both to meet customer requirements and to mitigate vendor and policy risk. This includes building abstraction layers for identity, observability, and security that work consistently across different infrastructure providers and regions.

Operational resilience and compliance have become strategic differentiators. Executives should build structured frameworks to monitor regulatory developments, including tariff policy, data protection rules, and sector-specific mandates, and to translate them into product and sourcing decisions. Diversifying hardware supply chains, designing for data residency flexibility, and preparing for potential changes in cross-border digital trade rules will help ensure continuity and protect margins.

Finally, leaders must anchor their XaaS strategies in customer outcomes. This involves tightening feedback loops between product, sales, customer success, and support teams; investing in adoption and value realization programs; and co-innovating with key customers and partners, particularly in vertical solutions for banking, healthcare, manufacturing, retail, and public sector. Organizations that can consistently demonstrate measurable business impact-from faster time-to-market and reduced operational risk to improved customer engagement and employee productivity-will be best positioned to turn Everything-as-a-Service from a technology shift into a durable competitive advantage.

Robust research methodology integrates secondary intelligence, primary insights, and structured segmentation to illuminate Everything-as-a-Service dynamics

The insights presented in this executive summary are grounded in a structured research methodology designed to capture both the breadth and depth of the Everything-as-a-Service landscape. The analytical process began with extensive secondary research across a diverse array of sources, including regulatory and policy documents, standard-setting bodies, academic and technical publications, financial disclosures and capital-markets communications from leading providers, and thought leadership issued by technology companies and industry associations. This breadth ensured a robust view of technology trends, regulatory developments, and evolving business models.

To complement secondary sources, the research incorporated targeted primary insights from stakeholders across the value chain. Interviews and discussions with executives, product leaders, architects, procurement specialists, and implementation partners provided grounded perspectives on adoption drivers, barriers, and emerging use cases. These conversations spanned multiple regions and industries, including banking and financial services, government and public sector, healthcare providers and life sciences companies, information technology and telecom operators, manufacturers in both discrete and process industries, and retailers and consumer goods producers.

Segmentation was developed iteratively, using both top-down industry frameworks and bottom-up validation. Service types were categorized into Device-as-a-Service, Infrastructure-as-a-Service, Platform-as-a-Service, Software-as-a-Service, Network-as-a-Service, and unified communications delivered as a service, with further granularity introduced where it reflected clear differences in technology, usage, or commercial models. Pricing, deployment, industry vertical, and organization size segmentations were cross-validated against observed buying patterns and provider portfolios. Regional analysis distinguished the Americas, Europe–Middle East–Africa, and Asia-Pacific, reflecting differences in regulation, infrastructure, and market structure.

Analytical techniques included qualitative trend analysis, value-chain mapping, and scenario exploration to understand how technology, regulation, and macroeconomic factors might interact over the medium term. Particular attention was given to the implications of evolving tariff regimes, data protection rules, and digital trade policies for infrastructure sourcing and cross-border service delivery. Triangulation across multiple data points and stakeholder perspectives was used to reduce bias and increase confidence in the structural conclusions, while acknowledging that specific metrics such as growth rates and market shares are subject to change as the environment evolves.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Everything-as-a-Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Everything-as-a-Service Market, by Service Type

- Everything-as-a-Service Market, by Deployment Model

- Everything-as-a-Service Market, by Industry Vertical

- Everything-as-a-Service Market, by Organization Size

- Everything-as-a-Service Market, by Region

- Everything-as-a-Service Market, by Group

- Everything-as-a-Service Market, by Country

- United States Everything-as-a-Service Market

- China Everything-as-a-Service Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3021 ]

Conclusion underscores Everything-as-a-Service as a strategic operating model shaped by regulation, segmentation diversity, and evolving enterprise priorities

The Everything-as-a-Service paradigm has moved from the periphery of enterprise technology strategy to its center, reshaping how organizations consume capabilities, structure operations, and pursue innovation. What began as discrete experiments with Software-as-a-Service and selective cloud infrastructure deployments has evolved into a comprehensive rethinking of technology as a portfolio of services spanning devices, infrastructure, platforms, networks, and communications. This shift is reinforced by the maturation of cloud-native architectures, the rise of AI and data-driven decision-making, and the continued appeal of operating expenditure models that align costs with usage and outcomes.

At the same time, the environment in which XaaS providers and customers operate is becoming more complex. Tariff policies, such as the planned 2025 increases on certain semiconductor imports, raise questions about the cost and resilience of the hardware that underpins cloud and data platforms. Digital trade rules, data protection regulations, and sector-specific mandates continue to evolve, with important regional differences across the Americas, Europe–Middle East–Africa, and Asia-Pacific. These forces demand greater sophistication in sourcing strategies, architecture design, and risk management.

Segmentation analysis underscores that there is no single Everything-as-a-Service market, but rather a mosaic of interconnected segments defined by service type, pricing model, deployment pattern, industry, organization size, and geography. Adoption patterns in banking, healthcare, manufacturing, retail, and public sector differ markedly, as do the requirements of large multinationals compared with small and medium businesses. Providers that recognize and address this diversity through tailored offerings, flexible commercial terms, and ecosystem partnerships will continue to gain strategic importance.

Looking ahead, the winners in this landscape will be those who can combine technological excellence with deep understanding of customer context and regulatory constraints. They will orchestrate services across layers, embed security and compliance into their propositions, and demonstrate clear, measurable business outcomes. For decision-makers, the challenge is not simply to consume more services, but to build coherent strategies that harness Everything-as-a-Service as a foundation for resilience, innovation, and sustainable growth.

This executive summary provides a high-level view of the forces at work. The full market research report offers further granularity on provider positioning, use-case evolution, and detailed segmentation dynamics, equipping leaders with the insight required to navigate uncertainty and make confident, long-term decisions.

Partner with Ketan Rohom to translate Everything-as-a-Service insights into decisive action by securing the full market intelligence report

The strategic choices that organizations make in the next planning cycle will determine whether they lead or lag in the shift toward Everything-as-a-Service. Unlocking that advantage requires not only a clear view of technology and regulatory trends, but also granular insight into how service types, pricing models, deployment strategies, industries, company sizes, and regions interact to shape demand and profitability.

To translate this executive overview into decisive action, decision-makers are encouraged to engage directly with Ketan Rohom, Associate Director, Sales & Marketing. Through a focused discussion, Ketan can help you identify which parts of the full market research report are most relevant to your portfolio, where your current strategy may be misaligned with emerging demand, and how to prioritize investments across service lines and geographies.

By purchasing the complete report, leaders gain access to deeper segmentation analytics, detailed competitive benchmarking, and scenario-based implications of regulatory and tariff developments. Ketan can also facilitate tailored briefing sessions for executive teams, help align findings with ongoing strategic initiatives, and outline options for custom analysis that addresses your specific questions about the Everything-as-a-Service landscape.

Now is the moment to move from awareness to action. Initiate a conversation with Ketan Rohom to secure the full report, equip your organization with robust evidence and structured insight, and position your business to capture outsized value as XaaS becomes the operating fabric of digital enterprise.

- How big is the Everything-as-a-Service Market?

- What is the Everything-as-a-Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?