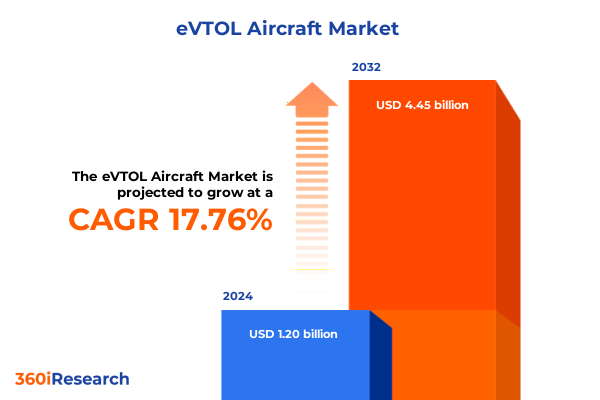

The eVTOL Aircraft Market size was estimated at USD 1.20 billion in 2024 and expected to reach USD 1.40 billion in 2025, at a CAGR of 17.76% to reach USD 4.45 billion by 2032.

Emergence of Electric Vertical Flight as a Cornerstone of Next-Generation Urban Mobility and Sustainable Transportation Ecosystems Driving Future Airborne Infrastructure Worldwide

The advent of electric vertical takeoff and landing aircraft marks a pivotal moment in the evolution of urban mobility. As cities around the globe grapple with mounting traffic congestion, rising carbon emissions, and the demand for more efficient transportation networks, eVTOL solutions have emerged as a credible alternative. Leveraging cutting-edge electric propulsion systems, these aircraft promise to reshape the tapestry of public and private transit by offering swift point-to-point aerial connectivity. This shift transcends traditional notions of aviation, opening pathways for a new class of airborne vehicles that can operate flexibly within densely populated urban airspaces.

Simultaneously, the convergence of advanced battery technology and automated flight controls has accelerated pilot programs and proof-of-concept demonstrations. Early deployments have underscored the potential for reduced noise footprints and lower operational costs relative to rotorcraft and helicopters. As a result, municipal authorities, infrastructure developers, and mobility operators are exploring integrated vertiport networks to support high-frequency flight corridors. In parallel, environmental stakeholders are championing eVTOL as a means to advance sustainability agendas, given the zero-emission profile achievable through renewable energy sources. Consequently, the introduction of electric vertical flight represents not only a technological breakthrough but also a transformative catalyst for sustainable transportation ecosystems, signaling the dawn of a new airborne infrastructure paradigm.

Revolutionary Convergence of Technological Breakthroughs, Safety Innovations, Regulatory Evolution, Network Optimization, and Infrastructure Advancements Remodeling the Operational Landscape of eVTOL Aviation Worldwide

The eVTOL domain is undergoing a seismic transformation driven by rapid technological breakthroughs, evolving regulatory frameworks, and concerted infrastructure investment strategies. Firstly, propulsion innovations-ranging from high-density lithium-ion batteries to emerging hydrogen fuel cell configurations-are redefining performance benchmarks, enabling extended range capabilities and shorter turnaround times. These advances are complemented by strides in autonomous flight controls, which promise to elevate safety margins, optimize air traffic management, and reduce reliance on pilot intervention.

Moreover, regulatory bodies across key geographies are transitioning from conceptual guidance to actionable certification pathways. In the United States, the Federal Aviation Administration has signaled a proactive stance by issuing preliminary airworthiness standards tailored to multi-rotor and tilt-wing platforms. Similarly, European and Asia-Pacific authorities are convening joint working groups to harmonize interoperability standards and data-sharing protocols. Such regulatory evolution fosters investor confidence and accelerates market entry timelines.

Parallel to these developments, the build-out of vertiport infrastructure is gaining momentum. Public-private collaborations are mobilizing capital for dedicated vertiport networks, equipped with charging stations and airborne traffic coordination systems. Collectively, these shifts not only validate the business case for electric vertical lift but also chart a clear trajectory for scalable deployment, setting the stage for a reimagined aviation ecosystem that can seamlessly integrate into urban and regional transport architectures.

Assessing the Comprehensive Economic and Strategic Consequences of Newly Imposed 2025 United States Tariffs on eVTOL Manufacturing and Supply Chains

The introduction of targeted United States tariffs in early 2025 has exerted a material influence on the eVTOL sector’s global supply chain dynamics. By imposing duties on key components-most notably electric motors, battery cells, and avionics modules sourced from major overseas suppliers-manufacturers have encountered elevated input costs. This shift has prompted a strategic realignment, as original equipment manufacturers (OEMs) and tier-one suppliers seek to mitigate tariff exposure through domestic sourcing and nearshore partnerships.

In response, several leading eVTOL developers have accelerated investments in localized production hubs, forging alliances with established North American battery plants and avionics integrators. While these efforts have gradually defrayed the incremental cost burden, they also underscore the imperative for cross-border collaboration agreements to ensure steady component flow. Furthermore, the tariff regime has catalyzed broader discussions around supply chain resilience, driving increased emphasis on dual-sourcing strategies and inventory buffer planning.

At a strategic level, the tariff landscape has fostered a more nuanced understanding of trade-policy risk, compelling stakeholders to integrate tariff scenario modeling into their procurement frameworks. As a result, the 2025 United States tariff adjustments have not only reshaped cost structures but also reinforced the importance of agile manufacturing networks and risk-mitigation protocols within the nascent eVTOL ecosystem.

Unveiling Critical Insights and Performance Dynamics Across Aircraft Types, Propulsion Technologies, Operational Ranges, Modes, Applications, and End-User Industries in eVTOL Markets

A nuanced examination of segmentation layers reveals how diverse market dimensions interact to influence strategic opportunities and technical priorities. When evaluating by aircraft type, the industry distinguishes between lift-plus-cruise configurations that prioritize efficient cruise phases, multirotor platforms capable of precise vertical operations, and tiltrotor or tiltwing designs that blend vertical lift with fixed-wing speed advantages. These distinctions shape development roadmaps, as each configuration carries unique engineering, certification, and maintenance imperatives. Transitioning to propulsion typologies, fully electric powertrains still command significant interest for their zero-emission profiles, while hybrid electric solutions offer intermediate range enhancements and greater flexibility. Emerging hydrogen-powered systems, though in earlier development stages, present long-term promise for high-endurance applications and rapid refueling cycles.

Operation range segmentation further stratifies the value proposition: vehicles optimized for distances under two hundred kilometers prioritize lightweight structures and optimized battery cycles, whereas platforms targeting extended missions beyond this threshold must integrate advanced energy management and thermal control subsystems. Concurrently, the differentiation between manned and unmanned operations informs the design of human-machine interfaces, redundancy requirements, and remote piloting frameworks. Application-based segmentation illuminates how use cases such as air taxi services, cargo and package delivery, defense and special missions, environmental monitoring through mapping and surveying, and tourism or recreational flights each impose distinct payload, endurance, and certification criteria. Lastly, by end-user industry, the priorities of agriculture and forestry for aerial crop monitoring, construction and mining for site surveying, environmental research for data collection, medical and healthcare for urgent patient transport, military and defense for tactical reconnaissance, retail and consumer goods for last-mile logistics, and tourism and hospitality for experiential sightseeing collectively underscore the multifaceted demand matrix driving platform customization.

This comprehensive research report categorizes the eVTOL Aircraft market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Aircraft Type

- Propulsion Type

- Operation Range

- Operation Mode

- Application

- End-User Industry

Exploring Divergent Growth Patterns, Strategic Regulatory Frameworks, Infrastructure Readiness, and Investment Dynamics Across Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional imperatives and capabilities vary markedly across the Americas, Europe Middle East & Africa, and Asia-Pacific, each presenting distinct regulatory, infrastructural, and investment profiles. In the Americas, policy momentum is strongest in North America, where federal agencies and metropolitan jurisdictions have launched pilot corridors and subsidized vertiport feasibility studies. Infrastructure funding is increasingly directed toward electrification hubs and vertiport certification programs, laying the groundwork for high-volume operations. Meanwhile, Latin American stakeholders are evaluating eVTOL for connectivity in remote regions, where rugged terrain and limited road networks amplify the value proposition of vertical flight.

Across Europe Middle East & Africa, a tapestry of regulatory approaches mirrors regional diversity. European Union initiatives emphasize cross-border certification harmonization and the integration of unmanned traffic management systems, whereas select Middle Eastern nations are allocating sovereign wealth to smart city projects with embedded eVTOL vertiports. African airlines and logistics firms, meanwhile, are piloting cargo and medical evacuation services, leveraging vertical flight to overcome infrastructure gaps.

The Asia-Pacific region stands out for its aggressive adoption of aerial taxi schemes and industrial applications. National innovation programs in design hubs such as Japan and South Korea have yielded prototype approvals, while Southeast Asian city-states are formalizing airspace corridors above urban centers. In parallel, Australia and New Zealand are exploring emergency response use cases to service sparsely populated territories. Collectively, these regional dynamics underscore not only diverse market readiness but also the catalytic role of local policy frameworks and infrastructure investments in shaping eVTOL trajectories.

This comprehensive research report examines key regions that drive the evolution of the eVTOL Aircraft market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Positioning, Innovation Trajectories, Collaborative Partnerships, Operational Scale, and Regulatory Compliance of Leading Players Shaping the Future of eVTOL Industry Competitiveness

A review of industry-leading entities reveals distinct strategic postures that are influencing competitive dynamics and innovation pathways. Several prominent OEMs have established vertically integrated supply chains, maintaining end-to-end control over electric motor fabrication, battery assembly, and airframe production. This holistic model has enabled accelerated prototype iterations and simplified certification workflows, though it demands substantial capital allocation. Conversely, a cohort of nimble startups is adopting an open-architecture ethos, leveraging strategic partnerships with component specialists to optimize propulsion, avionics, and autonomy subsystems without heavy in-house manufacturing commitments.

Collaborative consortia between traditional aerospace giants and emerging technology firms have further enriched the ecosystem, with joint ventures targeting scale efficiencies and shared R&D investments. Notably, alliances are forming around software and digital services, encompassing flight management platforms, predictive maintenance analytics, and integrated traffic management solutions. These partnerships reflect an industry recognition that hardware performance must be complemented by robust operational ecosystems.

In addition, strategic moves such as exclusive supply agreements, equity investments, and cross-licensing pacts are reshaping the competitive map. Companies are increasingly prioritizing regulatory engagement to secure early certification milestones and stakeholder endorsement. Whether through solo development or collaborative networks, these varied approaches attest to a maturation of the sector, as leading players refine their core competencies to capture emerging opportunities within the dynamic eVTOL environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the eVTOL Aircraft market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AeroVironment, Inc.

- AIR VEV, Ltd.

- Airbus SE

- Arc Aero Systems

- Archer Aviation Inc.

- BETA Technologies, Inc.

- Chengdu JOUAV Automation Tech Co.,Ltd.

- EHang Holdings Limited

- Elbit Systems Ltd.

- Elroy Air, Inc.

- Embraer S.A.

- GAO Tek Inc.

- Honda Motor Co., Ltd.

- Israel Aerospace Industries Ltd.

- Jaunt Air Mobility LLC by The AIRO Group

- Joby Aviation, Inc.

- LIFT Aircraft Inc.

- Moog Inc.

- Moya Aero

- Overair, Inc.

- Piasecki Aircraft Corporation

- Supernal, LLC by Hyundai Motor Group

- Textron, Inc.

- The Boeing Company

- Urban Aeronautics

- Vertical Aerospace Ltd.

- Volocopter GmbH

- Wingtra AG

- Wisk Aero LLC by The Boeing Company

- Xi'an Supersonic Aviation Technology Co., Ltd.

- Zhejiang Geely Holding Group Co., Ltd.

Delivering Tactical and Strategic Recommendations for Industry Leaders to Capitalize on Technological Advances, Regulatory Shifts, and Market Opportunities in eVTOL Sector

To thrive in the emergent eVTOL ecosystem, industry leaders must adopt a multifaceted approach that balances technological innovation with strategic foresight. Organizations should prioritize the establishment of scalable manufacturing capabilities through hybrid onshore and nearshore production models, safeguarding against tariff disruptions while maintaining cost discipline. Concurrently, fostering deep partnerships with propulsion and avionics specialists will accelerate system integration, enabling rapid iteration cycles without overextending internal resources.

Engagement with regulatory bodies should be proactive and sustained, with dedicated teams interfacing to influence certification roadmaps and to cultivate transparent safety data exchanges. By contributing to industry-wide standards working groups, companies can help shape regulations that facilitate streamlined approvals and cross-border interoperability. At the same time, investment in autonomous flight control validation and unmanned traffic management trials will be critical to unlocking operational efficiencies and broader market acceptance.

Finally, leaders must cultivate robust data analytics capabilities to inform demand modeling and to refine service offerings. Leveraging real-time operational metrics will enhance predictive maintenance, optimize energy consumption, and support adaptive pricing strategies. By integrating these recommendations, organizations can position themselves at the forefront of the aerial mobility revolution, securing sustainable growth and competitive predominance in the evolving eVTOL landscape.

Detailing Robust Multi-Source Research Frameworks, Data Collection Protocols, Analytical Approaches, and Triangulation Techniques Ensuring Comprehensive Validation of eVTOL Market Insights

This analysis is underpinned by an extensive multi-source research framework designed to ensure rigor and credibility. Primary data collection involved confidential interviews with executives, engineers, and regulatory officials across leading aerospace firms, vertiport developers, and government agencies. These dialogue sessions yielded nuanced perspectives on technical roadblocks, certification timelines, and infrastructure readiness.

Complementing this, a systematic review of public filings, patent databases, and legislative records provided quantitative context for tariff policies, funding allocations, and standardization initiatives. Secondary sources encompassed academic studies on electric propulsion, industry white papers on autonomy and traffic management, and technical reports on battery and hydrogen fuel cell performance. To reconcile variations in data quality and scope, findings were subjected to triangulation techniques, cross-referencing disparate inputs to isolate convergent themes and to flag potential outliers.

Analytical approaches included scenario mapping to assess tariff impact sensitivity, comparative benchmarking of aircraft configurations, and network simulations to evaluate vertiport throughput. This methodological rigor ensures that insights presented herein are rooted in validated evidence, offering stakeholders a robust foundation for strategic decision-making within the dynamic eVTOL arena.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our eVTOL Aircraft market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- eVTOL Aircraft Market, by Aircraft Type

- eVTOL Aircraft Market, by Propulsion Type

- eVTOL Aircraft Market, by Operation Range

- eVTOL Aircraft Market, by Operation Mode

- eVTOL Aircraft Market, by Application

- eVTOL Aircraft Market, by End-User Industry

- eVTOL Aircraft Market, by Region

- eVTOL Aircraft Market, by Group

- eVTOL Aircraft Market, by Country

- United States eVTOL Aircraft Market

- China eVTOL Aircraft Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Summarizing Key Takeaways, Strategic Implications, Operational Insights, and Future Outlook to Inform Decision-Making and Drive Sustainable Growth in the eVTOL Industry Ecosystem

The convergence of advanced propulsion systems, adaptive regulatory frameworks, and vertiport infrastructure investment is redefining the trajectory of urban and regional air mobility. Stakeholders across the value chain are poised to capitalize on the promise of eVTOL, provided they navigate evolving trade policies and operational complexities with agility. Essential takeaways include the criticality of diversified supply networks to mitigate tariff-induced cost fluctuations, the importance of collaborative certification initiatives to accelerate market entry, and the strategic value of data-driven operational optimization.

Moreover, segmentation analyses underline the need for tailored platform designs that align with specific use cases, whether short-haul passenger transit or specialized cargo missions. Regional assessments further highlight how localized policy incentives and infrastructure readiness shape deployment timelines and investment priorities. Meanwhile, competitive dynamics reveal that success in this sector hinges on both technical excellence and the ability to orchestrate partnerships across hardware, software, and service domains.

By synthesizing these insights, decision-makers are equipped to craft strategic roadmaps that balance near-term commercialization goals with long-term ecosystem development. The future of aerial mobility is within reach, contingent upon informed collaboration and decisive action that harness the full potential of electric vertical flight.

Engage with Associate Director Ketan Rohom to Unlock Tailored Insights and Secure Exclusive Access to Comprehensive eVTOL Market Research Reports

Unlock unparalleled market insights and tailored strategic support by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing. Through a personalized consultation, industry stakeholders can explore how emerging trends in electric vertical takeoff and landing technology align with organizational priorities and operational goals. Ketan Rohom’s extensive expertise in aviation research and market intelligence ensures that each briefing delivers actionable intelligence, from regulatory developments to competitive landscapes.

By scheduling a one-on-one session, decision-makers will gain privileged access to exclusive data modules, in-depth analysis of tariff impacts, and forward-looking perspectives designed to advance business objectives. This direct engagement streamlines the assimilation of critical findings into strategic roadmaps, empowering teams to capitalize on opportunities and preempt challenges within the rapidly evolving eVTOL sector.

Take the next step toward securing a competitive advantage: connect with Ketan Rohom to purchase the comprehensive eVTOL market research report, customized to address unique business imperatives. Ensure your organization is equipped with the definitive resource for understanding technological breakthroughs, policy shifts, and regional dynamics essential for driving success in the next era of aerial mobility.

- How big is the eVTOL Aircraft Market?

- What is the eVTOL Aircraft Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?