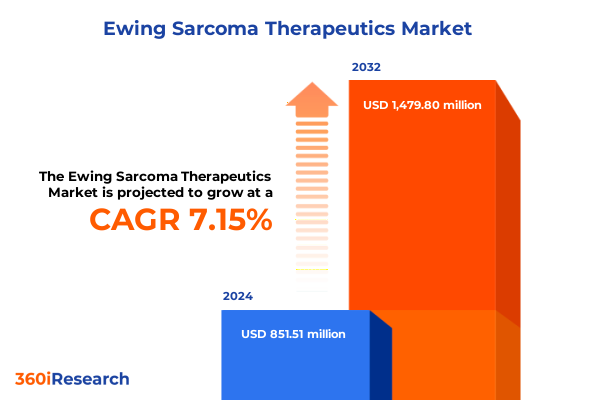

The Ewing Sarcoma Therapeutics Market size was estimated at USD 851.51 million in 2024 and expected to reach USD 909.92 million in 2025, at a CAGR of 7.15% to reach USD 1,479.80 million by 2032.

Unlocking the Future of Ewing Sarcoma Care through Cutting-Edge Research Advances and Strategic Therapeutic Innovations That Address Critical Unmet Needs

Ewing sarcoma represents one of the most aggressive forms of pediatric bone cancer, demanding a multifaceted approach to treatment that transcends conventional chemotherapy and surgical interventions. Over the past decade, researchers have made remarkable strides in decoding the molecular drivers of Ewing sarcoma, unveiling fusion proteins like EWS–FLI1 that serve as the cornerstone of disease pathogenesis. This breakthrough has catalyzed a series of preclinical studies exploring novel targeted therapies and immunotherapeutic modalities aimed at disrupting oncogenic signaling pathways with greater precision and fewer off-target effects.

In parallel, advances in genomic profiling and next-generation sequencing have empowered clinicians to stratify patients more accurately, enabling personalized treatment regimens that adapt to the evolving tumor landscape. As the community moves toward precision oncology, there is growing interest in harnessing immune checkpoint inhibitors, CAR T-cell technologies, and monoclonal antibody platforms to elicit durable responses. These emerging strategies, in conjunction with refinements in radiotherapy planning and limb-sparing surgical techniques, have begun to reshape the standard of care and offer renewed hope for improved survival rates and quality of life for affected patients.

Against this backdrop, the Ewing sarcoma therapeutics market is poised for transformational growth, fueled by robust R&D investment, cross-sector collaborations, and regulatory incentives for orphan drug development. Stakeholders across academia, biotechnology, and pharmaceutical industries are increasingly aligned on the imperative to accelerate clinical translation, reduce time to market, and expand access to novel agents. This report sets the stage for a deep dive into the current state of play, outlining critical milestones, unmet clinical needs, and the strategic imperatives driving the next wave of innovation in Ewing sarcoma care.

Revolutionary Breakthroughs and Transformative Paradigm Shifts Reshaping Ewing Sarcoma Treatment Strategies across Research and Clinical Practice

The Ewing sarcoma landscape has undergone a profound metamorphosis as breakthroughs in molecular biology and immunology redefine therapeutic frontiers. Historically reliant on multi-agent chemotherapy, clinicians are now integrating precision-guided targeted therapies designed to inhibit EWS–FLI1 fusion activity and downstream effectors. Concurrently, the advent of CAR T-cell constructs engineered to recognize Ewing sarcoma–specific antigens and the repurposing of immune checkpoint inhibitors have introduced compelling avenues for durable antitumor responses.

These therapeutic advancements are complemented by significant progress in early detection and diagnostic imaging, enabling interventions at more treatable stages. Innovations such as liquid biopsy assays for circulating tumor DNA and advanced PET/MRI fusion techniques support real-time monitoring of treatment efficacy and relapse detection. Moreover, the emphasis on combination regimens that synergize targeted agents with immunomodulators underscores a shift toward personalized multimodal strategies that aim to minimize toxicity while maximizing clinical benefit.

On the regulatory front, expedited approval pathways for orphan indications and adaptive trial designs are accelerating the transition from bench to bedside. Collaborative consortia and public-private partnerships are pooling resources, harmonizing protocols, and fostering an environment where data sharing catalyzes rapid iteration. Together, these transformative shifts are laying the groundwork for a more dynamic, patient-centric ecosystem that holds promise for fundamentally altering the trajectory of Ewing sarcoma management.

Analyzing the Far-Reaching Consequences of 2025 United States Import Tariffs on Ewing Sarcoma Therapeutics Supply Chains and Costs

Since April 2025, the United States has imposed a universal 10% global tariff on most imported goods, including critical active pharmaceutical ingredients (APIs) and intermediates vital to oncologic drug manufacturing. This policy, introduced to bolster domestic production capabilities, has had immediate cost implications for companies reliant on APIs sourced from Asia, where 40% of generic oncology drugs’ raw materials originate. Moreover, targeted tariffs ranging from 20% on APIs from India to 25% on those from China have applied direct inflationary pressure on Ewing sarcoma therapeutic components, driving up manufacturing expenses for both branded and generic pipeline candidates.

Beyond APIs, finished pharmaceutical products face proposed duties of up to 25%, a measure championed by U.S. policymakers aiming to reduce reliance on foreign suppliers. Independent analyses conducted by Ernst & Young estimate that a uniform 25% tariff on imported finished medicines could translate into a 12.9% increase in U.S. drug prices if passed in full to consumers. Given the high cost sensitivity of rare disease markets and the comparatively narrow profit margins for specialized therapies, these tariffs threaten to inflate treatment costs, constrain patient access, and disrupt clinical trial supply continuity for Ewing sarcoma candidates still navigating late-stage development.

Compounding these challenges is the potential violation of World Trade Organization exemptions that traditionally shield pharmaceutical products from import duties. Experts warn that imposition of stringent tariffs may contravene WTO rules, inviting retaliatory measures from key trade partners and further fracturing global supply chains. Industry stakeholders caution that escalating costs for generic inputs may reverberate throughout the healthcare ecosystem, leading insurers to raise premiums and hospitals to pass along higher expenses to patients, thus undermining progress in rare oncology care delivery.

In aggregate, the cumulative impact of 2025 U.S. tariffs introduces a complex matrix of operational and financial headwinds for Ewing sarcoma therapeutic developers. Supply chain realignment, increased import duties, and potential trade disputes necessitate strategic sourcing diversification and deeper investment in domestic manufacturing infrastructure. As stakeholders reassess risk mitigation strategies, the evolving tariff environment demands vigilant monitoring and adaptive planning to safeguard critical therapeutic pipelines and maintain momentum toward improved patient outcomes.

Illuminating Critical Market Segmentation Insights Revealing Diverse Treatment Modalities Patient Populations End Users and Distribution Channels

A nuanced understanding of treatment modality segmentation reveals a market defined by distinct therapeutic approaches ranging from high-intensity cytotoxic regimens to precision-guided molecular therapies. Within chemotherapy, the delineation between high-dose protocols and standard regimens underscores a balance between maximizing tumor cytoreduction and managing systemic toxicity. Immunotherapy segmentation further bifurcates into CAR T-cell constructs engineered to target tumor-specific antigens and checkpoint blockade strategies designed to unleash endogenous T-cell responses. Radiotherapy practices are similarly diverse, spanning the localized precision of brachytherapy to the versatile applications of external beam platforms. Surgical interventions contrast aggressive limb amputation with limb salvage operations that integrate reconstructive techniques to preserve function. Finally, targeted therapy segmentation captures the promise of monoclonal antibodies against oncogenic drivers and small molecule inhibitors that selectively disrupt intracellular signaling.

The patient population segmentation highlights the divergent needs of newly diagnosed versus relapsed refractory cohorts, each stratified by age group to reflect the unique biological and psychosocial considerations of pediatric, adolescent and young adult, and adult populations. Newly diagnosed patients often undergo intensive frontline protocols tailored to stage and molecular risk factors, whereas relapsed refractory cases navigate salvage regimens that may incorporate novel agents under compassionate use or clinical trial provisions. The end-user landscape is equally multifaceted: ambulatory care centers provide streamlined outpatient infusion services, hospitals deliver comprehensive inpatient management, and specialty clinics offer tailored multidisciplinary care for complex cases. Distribution channel segmentation completes the market map, tracing therapeutic flows from hospital pharmacies to online platforms and retail outlets, each calibrated to meet the needs of different stakeholders, whether hospital systems, community practitioners, or patients seeking convenient access.

This layered segmentation framework informs strategic decision making by illuminating the interplay between modality preferences, patient demographics, treatment logistics, and channel dynamics. By weaving these segments into holistic market insights, stakeholders can tailor development strategies, optimize commercialization pathways, and enhance patient engagement across the continuum of Ewing sarcoma care.

This comprehensive research report categorizes the Ewing Sarcoma Therapeutics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapy Type

- Drug Class

- Route Of Administration

- End User

- Distribution Channel

- Age Group

Exploring Regional Dynamics and Strategic Growth Drivers Shaping the Ewing Sarcoma Therapeutics Market across Americas EMEA and Asia-Pacific

Geographic dynamics play a pivotal role in shaping the competitive landscape for Ewing sarcoma therapeutics, with the Americas market distinguished by robust regulatory incentives for orphan drug development, extensive clinical trial networks, and significant philanthropic funding to support patient advocacy initiatives. The regulatory environment in the United States and Canada incentivizes accelerated approval pathways, fostering an ecosystem where innovative therapies can reach the clinic with greater speed and regulatory flexibility.

In contrast, the Europe, Middle East and Africa region is characterized by a tapestry of national reimbursement frameworks and rare disease policies that vary widely but often converge on providing premium pricing for breakthrough therapies. European Union directives and regional consortia facilitate cross-border clinical collaboration, enabling patient recruitment at scale despite population dispersion. Meanwhile, Middle Eastern and African markets are in nascent stages of rare oncology infrastructure development, with emerging centers of excellence and public-private partnerships working to elevate diagnostic capabilities and treatment access.

Asia-Pacific markets exhibit diverse trajectories, from mature healthcare ecosystems in Japan and Australia-where precision medicine initiatives and advanced manufacturing capacities drive early adoption of next-generation therapeutics-to rapidly evolving environments in China and India, where policy reforms, expanding insurance coverage, and investments in biotech innovation are accelerating local R&D and commercialization. In aggregate, regional insights underscore the necessity of tailored market entry strategies that align with distinct regulatory, economic, and healthcare delivery contexts, ensuring sustainable growth and patient access across geographies.

This comprehensive research report examines key regions that drive the evolution of the Ewing Sarcoma Therapeutics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders and Pioneering Innovators Driving Research Development and Competitive Positioning in Ewing Sarcoma Therapies

The competitive landscape for Ewing sarcoma therapeutics is anchored by a blend of large pharmaceutical corporations and agile biotechnology firms. Multinational organizations leverage their scale to drive extensive clinical development programs, invest in high-throughput screening platforms, and establish global manufacturing footprints. Conversely, specialized biotech innovators harness deep scientific expertise to pursue first-in-class modalities, often collaborating with academic institutions and leveraging orphan drug incentives to de-risk early-stage projects.

Key players prioritize portfolio diversification, spanning small molecule inhibitors targeting fusion oncoproteins to immune-based strategies such as CAR T-cell therapies and antibody-drug conjugates. Strategic partnerships, licensing agreements, and mergers and acquisitions remain integral to expanding R&D pipelines and accessing complementary technologies. Concurrently, a new wave of emerging biotechs is distinguished by precision oncology platforms, novel delivery mechanisms, and integrated diagnostics that promise to refine patient selection and enhance therapeutic efficacy.

As these companies navigate regulatory pathways, market access negotiations, and competitive positioning, their priorities converge around accelerating clinical proof-of-concept, securing favorable reimbursement, and building robust real-world evidence. Through targeted investment in strategic alliances, technology platforms, and patient-centric initiatives, leading industry stakeholders are poised to shape the next generation of Ewing sarcoma treatment paradigms and deliver transformative outcomes for patients.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ewing Sarcoma Therapeutics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AbbVie Inc.

- Actuate Therapeutics, Inc.

- Amgen Inc.

- APTADEL THERAPEUTICS SL

- Baxter International Inc.

- Bayer AG

- Bristol-Myers Squibb Company

- Cellectar Biosciences Inc.

- Eisai Co., Ltd.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd.

- Fresenius Kabi AG

- Fusion Pharmaceuticals Inc. by AstraZeneca PLC

- GlaxoSmithKline PLC

- Gradalis Inc.

- Jazz Pharmaceuticals, Inc.

- Johnson and Johnson Services, Inc.

- Merck & Co., Inc.

- Novartis AG

- Oncternal Therapeutics, Inc.

- PeriNess Ltd.

- Pfizer Inc.

- Pharma Mar, S.A.

- Salarius Pharmaceuticals, Inc.

- Sanofi S.A.

- SEED Therapeutics, Inc.

- Sumitomo Pharma Oncology, Inc.

- Xenetic Biosciences, Inc.

Strategic Actionable Recommendations Empowering Industry Leaders to Navigate Challenges Accelerate Innovation and Optimize Market Positioning in Ewing Sarcoma

Industry leaders must prioritize strategic collaboration across the value chain to mitigate supply chain vulnerabilities, diversify API sourcing, and reinforce domestic manufacturing capabilities. Establishing long-term agreements with contract development and manufacturing organizations can secure critical production capacity, while parallel investments in API synthesis and formulation technologies will reduce dependency on high-tariff jurisdictions.

Accelerating innovation requires a dual focus on enhancing clinical trial agility and augmenting patient engagement. Implementing decentralized trial designs, leveraging digital health platforms, and integrating real-world data capture will streamline recruitment and foster adaptive protocol adjustments. Moreover, partnerships with patient advocacy groups and rare disease networks can amplify trial awareness, ensure patient retention, and align research priorities with evolving needs.

To maximize market access, companies should engage proactively with regulatory agencies to explore expedited pathways, negotiate early pricing agreements, and develop pharmacoeconomic models that demonstrate value across diverse healthcare systems. Investments in health technology assessments, payer dialogue, and outcome-based contracting will lay the groundwork for sustainable reimbursement and facilitate uptake in both established and emerging regions.

Finally, fostering a culture of continuous learning and cross-sector collaboration will be essential. Convening multidisciplinary consortia, investing in translational research hubs, and adopting open-innovation frameworks will accelerate knowledge exchange and drive the discovery of next-generation therapies, ultimately enhancing patient outcomes and securing a leadership position in the Ewing sarcoma therapeutics market.

Comprehensive Research Methodology Detailing Rigorous Data Collection Analysis and Validation Processes Underpinning the Ewing Sarcoma Therapeutics Market Study

This study integrates a comprehensive research framework encompassing both secondary and primary data sources. Secondary research involved exhaustive analysis of peer-reviewed journals, regulatory filings, clinical trial registries, and industry white papers to establish a foundational understanding of therapeutic modalities, market dynamics, and competitive activity. Proprietary databases and specialized biotech intelligence platforms provided insights into R&D pipelines, patent landscapes, and manufacturing capabilities.

Primary research comprised in-depth interviews with leading oncologists, pharmaceutical executives, regulatory affairs experts, and patient advocacy representatives. These qualitative interactions offered nuanced perspectives on clinical adoption barriers, reimbursement strategies, and emerging therapeutic trends. Quantitative validation was achieved through structured surveys targeting key opinion leaders and decision-makers in top oncology centers across the Americas, Europe, and Asia-Pacific.

Data triangulation methods ensured consistency and accuracy, reconciling disparate information streams to produce reliable market narratives. Rigorous cross-verification protocols were employed, including iterative reviews with external experts and scenario analyses to test underlying assumptions. The result is a robust, multi-dimensional view of the Ewing sarcoma therapeutics market, grounded in methodological rigor and validated by domain authorities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ewing Sarcoma Therapeutics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ewing Sarcoma Therapeutics Market, by Therapy Type

- Ewing Sarcoma Therapeutics Market, by Drug Class

- Ewing Sarcoma Therapeutics Market, by Route Of Administration

- Ewing Sarcoma Therapeutics Market, by End User

- Ewing Sarcoma Therapeutics Market, by Distribution Channel

- Ewing Sarcoma Therapeutics Market, by Age Group

- Ewing Sarcoma Therapeutics Market, by Region

- Ewing Sarcoma Therapeutics Market, by Group

- Ewing Sarcoma Therapeutics Market, by Country

- United States Ewing Sarcoma Therapeutics Market

- China Ewing Sarcoma Therapeutics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Consolidating Principal Findings and Implications of Ewing Sarcoma Therapeutics Research to Inform Decision Making and Drive Future Strategies

In synthesizing the myriad insights from molecular breakthroughs to market dynamics and regulatory influences, a cohesive narrative emerges: the Ewing sarcoma therapeutics landscape is at a pivotal juncture. Targeted therapies and immuno-oncology approaches are unlocking new mechanisms of action, while diagnostic innovations enable precision treatment tailoring. Concurrently, geopolitical factors such as tariffs and supply chain realignments compel strategic agility, underscoring the importance of diversified sourcing and domestic manufacturing investments.

The segmentation matrix illuminates opportunities across treatment modalities and patient cohorts, guiding stakeholders toward optimized development pathways and market entry strategies. Regional analyses reveal distinct growth catalysts-from orphan drug incentives in the Americas to cross-border collaboration frameworks in EMEA and emergent biotech ecosystems in Asia-Pacific. Competitive profiling highlights a convergence of scale and specialization, with established pharmas and nimble biotechs co-creating the next generation of Ewing sarcoma solutions.

Ultimately, this report offers decision-makers a holistic blueprint to navigate complexity, harness innovation, and deliver tangible improvements in patient care. By aligning R&D priorities with strategic recommendations, industry participants can accelerate progress, overcome systemic challenges, and realize the full potential of transformative therapies for Ewing sarcoma.

Take the Next Step to Access the Definitive Ewing Sarcoma Therapeutics Report by Partnering with Ketan Rohom to Unlock Critical Market Insights

Discover unparalleled insights into the Ewing Sarcoma Therapeutics landscape and gain a competitive edge by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise and dedication will facilitate access to the comprehensive report, providing strategic guidance on emerging treatments, regulatory changes, key market drivers, and competitor strategies. Reach out today to explore tailored solutions, secure your copy, and drive informed decision-making for optimized patient outcomes and sustainable growth in this critical rare disease sector.

- How big is the Ewing Sarcoma Therapeutics Market?

- What is the Ewing Sarcoma Therapeutics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?