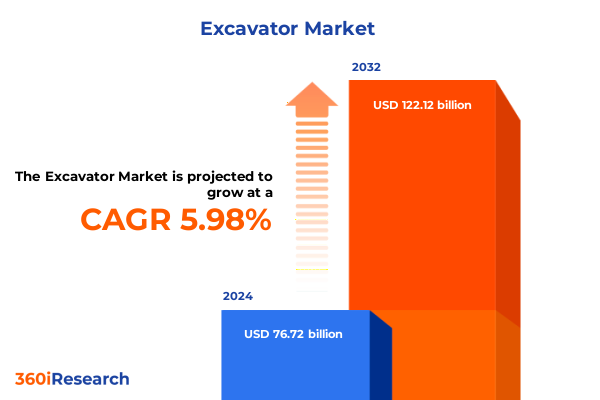

The Excavator Market size was estimated at USD 81.27 billion in 2025 and expected to reach USD 86.10 billion in 2026, at a CAGR of 5.98% to reach USD 122.12 billion by 2032.

Pioneering the Future of Excavators Through Innovation, Sustainability, and Digital Transformation Across Global Construction Landscapes

Excavators stand at the forefront of modern construction and infrastructure development, playing an indispensable role in earthmoving, resource extraction, and site preparation. As the global landscape embraces large-scale public works and private sector investments, the demand for versatile, efficient excavation equipment continues to intensify. These machines have evolved far beyond their origins as simple hydraulic diggers; today’s excavators integrate advanced telematics, precision control systems, and sustainability-focused powertrains that redefine operational expectations.

Looking ahead, stakeholders across manufacturing, fleet management, and financing must understand the converging forces driving this sector. Rapid urbanization in emerging economies is spurring demand for mini excavators that can navigate confined spaces, while large-scale mining and infrastructure projects are fueling growth in crawler and long reach variants. Simultaneously, environmental regulations and customer preferences are catalyzing the shift toward electric and hybrid propulsion systems. This introduction frames the broader context in which innovation, regulation, and economic drivers converge to shape the future of excavator technology and deployment.

Embracing Automation, Electrification, and Data-Driven Technologies That Are Redefining Efficiency and Productivity in Excavator Operations Worldwide

The excavator industry is undergoing a profound metamorphosis driven by the intersection of automation, electrification, and connectivity. Autonomous operation features, once confined to research labs, are now finding real-world applications on construction sites, enabling machines to perform repetitive tasks with minimal human intervention. This shift not only enhances safety by reducing operator exposure in hazardous conditions but also optimizes fuel consumption through predictive algorithms that adjust digging patterns in real time.

Concurrently, the electrification trend is reshaping the propulsion landscape, with battery electric models beginning to rival diesel counterparts on performance metrics. Fuel cell prototypes demonstrate potential for extended operation, while hybrid configurations bridge the gap by delivering emission reductions without sacrificing uptime. Telematics solutions further propel digital transformation by collecting granular performance data, which manufacturers and fleet managers leverage to refine maintenance schedules and drive continuous improvement. Together, these advancements chart a clear path toward higher productivity, lower total cost of ownership, and a more sustainable footprint for excavator fleets worldwide.

Analyzing the Comprehensive Effects of United States Tariff Measures Implemented in 2025 on Excavator Imports Supply Chains and Industry Margins

In 2025, new United States tariff directives targeting imported construction equipment have introduced notable ripples across the excavator supply chain and cost structures. By imposing additional duties on certain foreign-manufactured machines, these measures have prompted original equipment manufacturers to reevaluate sourcing strategies and consider shifting component production to regions exempt from tariffs. Early responses include the relocation of key hydraulic components and electronic subsystems to factories in non-targeted countries, a strategic move aimed at mitigating duty exposure.

The tariff adjustments have also influenced dealer networks and end users, who face elevated acquisition costs that may delay procurement cycles or trigger demand for used machinery. To counteract margin pressures, some manufacturers are absorbing portions of the tariff impact through selective price optimization and product bundling, offering service packages and extended warranties to maintain value propositions. Over time, these dynamics are expected to reshape competitive positioning, as OEMs with diversified manufacturing footprints and robust aftersales support emerge stronger in a higher-tariff environment. This cumulative impact analysis underscores the strategic importance of agile supply chains and adaptive pricing models.

Uncovering Deep Insights Into Excavator Market Segmentation Based on Type Propulsion Application Power Output and End Use to Drive Strategic Decisions

Diving into market segmentation reveals critical insights that inform strategic decision-making at every level of the excavator value chain. When examining equipment by type, crawler excavators continue to dominate large-scale infrastructure and mining operations, whereas long reach machines are increasingly preferred for specialized dredging and demolition tasks. Mini excavators have captured significant interest among urban contractors due to their maneuverability and reduced footprint, and wheeled variants deliver on-road mobility advantages for utility and municipal applications.

Propulsion-based segmentation highlights the growing tapestry of diesel, electric, and hybrid powertrains. Diesel remains the backbone for heavy-duty applications, though battery electric machines have made substantive inroads in noise-sensitive and emission-regulated sites. Fuel cell electric prototypes signal future possibilities in zero-carbon operation, while hybrid models-combining battery electric and diesel systems-offer flexible performance profiles that optimize fuel consumption under variable load conditions.

Application-focused analysis underscores the diverse roles excavators fulfill across agriculture, construction, forestry, mining, and utility projects. Crop farming and livestock enterprises utilize compact machines for land preparation and feedlot maintenance, while demolition, earthmoving, and infrastructure support define the construction segment. Forestry operations benefit from biomass harvesting and logging configurations, and mining firms require bespoke setups for surface excavation and underground tunneling. Utility providers deploy excavators in electric, gas, and water network installations, underscoring the machine’s versatility.

Power output differentiation delineates fleets into under 20 ton, 20–40 ton, and above 40 ton classes. Smaller units excel in confined or precision tasks, mid-range excavators are prized for their balance of mobility and digging force, and high-tonnage machines tackle the most demanding earthmoving challenges. End use segmentation further refines market understanding, spanning agricultural, commercial, industrial, and residential contexts. Crop and livestock operations demand tailored attachments and durability, while hospitality, office, and retail developments in the commercial sector emphasize speed and finish quality. Industrial applications include manufacturing, mining, and petrochemical projects requiring heavy-lift capacities. In residential construction, single-family and multi-family projects call for compact footprints and minimal-site disturbance.

This comprehensive research report categorizes the Excavator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Propulsion

- Application

- Power Output

- End Use

Examining Regional Dynamics and Opportunities for Excavator Deployment Across the Americas Europe Middle East Africa and Asia Pacific Territories

Regional dynamics shape both current performance and future potential for excavator adoption. In the Americas, infrastructure modernization and renewable energy projects stimulate demand, particularly for diesel and hybrid fleets in North America, while Latin America exhibits growing interest in mini excavators for urban redevelopment. Transitioning southward, construction booms in emerging economies are fostering local assembly hubs to reduce import dependencies and tariffs.

Europe, Middle East, and Africa present a mosaic of regulatory environments and project profiles. Stricter emissions standards in Western Europe accelerate the shift toward electric models and telematics integration. Meanwhile, Gulf countries invest heavily in urban expansion and energy infrastructure, driving significant procurement of high-power crawler excavators. African nations, buoyed by mining concessions and transportation corridor initiatives, are gradually adopting modern fleets, often through partnerships between global OEMs and local distributors.

Asia-Pacific remains a powerhouse of excavator consumption, with China, Japan, and India leading in volume and innovation. In Southeast Asia, urban infrastructure programs and agricultural mechanization trends underpin demand for compact units. Oceania’s diverse landscape calls for a blend of wheeled and crawler machines tailored to construction, mining, and forestry operations. Across all regions, the imperative to reduce carbon footprints, improve fuel efficiency, and enhance machine connectivity continues to drive purchasing decisions and product development roadmaps.

This comprehensive research report examines key regions that drive the evolution of the Excavator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Leading Excavator Manufacturers and Emerging Competitors Driving Innovation, Efficiency, and Global Market Penetration Strategies

The competitive arena features established leaders alongside nimble challengers shaping the excavator ecosystem. Caterpillar and Komatsu persist as market pillars, leveraging extensive distribution networks, comprehensive service offerings, and continuous product refinements. Their investments in smart machine technologies and modular component designs underscore a commitment to evolving customer demands.

Liebherr and Volvo Construction Equipment differentiate through premium fit, finish, and advanced operator assistance systems that prioritize safety and precision. Hitachi Construction Machinery’s emphasis on telematics and predictive maintenance platforms enhances fleet uptime, while Doosan and Hyundai introduce value-driven models that balance cost-efficiency with feature-rich packages. SANY and XCMG, emerging from China’s burgeoning industrial base, are expanding global footprints by establishing local manufacturing and aftermarket facilities, challenging incumbents on price competitiveness and rapid delivery.

New entrants focused on electrification are reshaping product roadmaps. Manufacturers specializing in battery electric and fuel cell excavators partner with energy storage and hydrogen technology firms to pilot zero-emission solutions in Europe and North America. This wave of collaboration signals a broader industry trend toward cross-sector alliances, where traditional OEMs, technology providers, and infrastructure stakeholders coalesce to accelerate the transition to sustainable excavation operations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Excavator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Caterpillar Inc.

- Deere & Company

- Hitachi Construction Machinery Co., Ltd.

- Hyundai Construction Equipment Co., Ltd.

- Kobelco Construction Machinery Co., Ltd.

- Komatsu Ltd.

- Liebherr-International AG

- SANY Heavy Industry Co., Ltd.

- Volvo Construction Equipment AB

- Xuzhou Construction Machinery Group Co., Ltd.

Strategic Actionable Recommendations to Enhance Competitiveness Sustainability and Technological Advancement in Excavator Businesses Worldwide

Industry leaders can navigate the evolving landscape by adopting a multifaceted approach that balances technological innovation with operational pragmatism. Prioritizing the integration of autonomous and semi-autonomous features in select machine lines can create demonstrable value through reduced operating costs and enhanced safety records. These capabilities should be complemented by robust training programs that ensure operators maximize efficiency gains.

To address the growing emphasis on sustainability, stakeholders must accelerate investment in electric and hybrid propulsion systems, focusing on partnerships with energy storage suppliers and infrastructure developers. Standardizing battery interfaces and charging protocols can alleviate concerns around equipment interoperability and downtime. In parallel, leveraging telematics data to optimize service schedules and machine utilization rates will strengthen aftermarket revenue streams and bolster customer loyalty.

Strategic geographic diversification of manufacturing and assembly footprints will help mitigate tariff exposures and logistical bottlenecks. By aligning production closer to key end markets, organizations can reduce lead times and enhance responsiveness to localized demand fluctuations. Finally, fostering collaborative ecosystems through joint ventures and open innovation platforms will amplify R&D capacity, enabling faster development cycles for next-generation excavator technologies.

Detailing the Rigorous Research Methodology Employed to Collect Validate and Analyze Excavator Market Data Ensuring Robustness and Credibility

Our research methodology combined extensive primary and secondary data collection to ensure a comprehensive understanding of the excavator landscape. Primary interviews were conducted with OEM executives, fleet managers, and end users across multiple regions, providing qualitative depth and firsthand perspectives on technology adoption, procurement challenges, and service expectations.

Secondary research involved the systematic review of industry journals, trade publications, regulatory filings, and corporate disclosures, which informed trend analysis and competitive benchmarking. Data triangulation techniques were applied to validate findings, correlating shipment figures, order backlogs, and aftersales service metrics. Quantitative modeling was used to map relationships between machine specifications, application requirements, and regional regulatory frameworks.

A rigorous validation phase included expert panel reviews and iterative feedback loops, ensuring that conclusions accurately reflect market realities. Methodological protocols adhered to strict data governance and ethical standards, guaranteeing the integrity and reproducibility of insights. This robust foundation underpins the report’s credibility and supports informed decision-making for industry stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Excavator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Excavator Market, by Type

- Excavator Market, by Propulsion

- Excavator Market, by Application

- Excavator Market, by Power Output

- Excavator Market, by End Use

- Excavator Market, by Region

- Excavator Market, by Group

- Excavator Market, by Country

- United States Excavator Market

- China Excavator Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Summarizing Key Findings Trends and Strategic Imperatives That Will Shape the Future of Excavator Industry and Market Evolution

The excavator market is at a pivotal juncture, shaped by technological breakthroughs, regulatory pressures, and dynamic regional priorities. Autonomous and electric machines are no longer futuristic concepts; they represent the next frontier for productivity gains and environmental stewardship. At the same time, tariff-induced cost fluctuations and shifting supply chain configurations underscore the need for agility in sourcing and pricing strategies.

Segmentation analysis highlights the importance of tailored solutions across diverse applications, from precision agriculture and urban redevelopment to large-scale mining and energy infrastructure projects. Regional nuances in emissions regulations and project financing structures further complicate the competitive landscape, demanding a localized approach to product development and customer engagement.

Ultimately, success in this evolving environment will depend on the ability to harness data-driven insights, foster cross-industry collaborations, and implement forward-looking sustainability initiatives. Market leaders who embrace these imperatives will be positioned to capitalize on emerging opportunities, secure long-term growth, and define the next chapter in excavator innovation.

Get in Touch With Ketan Rohom to Secure Advance Access to the Comprehensive Excavator Market Research Report and Elevate Your Competitive Advantage

To explore deeper into the evolving excavator market and secure unmatched insights that can fuel your strategic roadmap, reach out directly to Ketan Rohom (Associate Director, Sales & Marketing). By partnering with our research team, you gain expedited access to the comprehensive excavator industry report, complete with in-depth analyses of transformational trends, tariff impacts, regional differentiators, and key competitive dynamics. Contact Ketan to arrange a personalized walkthrough of the findings, discuss tailored data requirements, and unlock exclusive avenues for enhancing your market positioning. Whether you’re evaluating fleet modernization, expanding into new territories, or optimizing product portfolios, this report will equip your organization with the directional clarity required to achieve sustainable growth and competitive differentiation in the excavator sector. Secure your copy today to stay ahead of industry shifts and capitalize on emerging opportunities with precision and foresight.

- How big is the Excavator Market?

- What is the Excavator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?