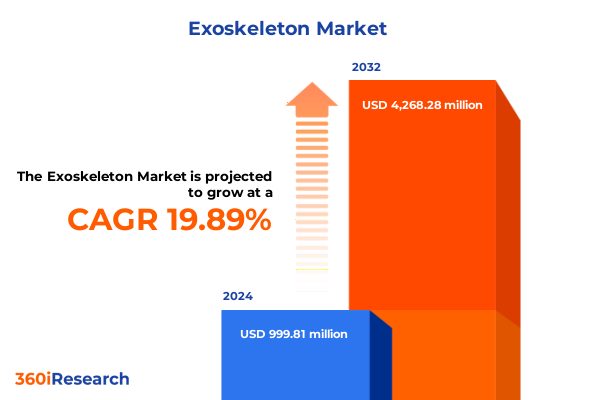

The Exoskeleton Market size was estimated at USD 1.19 billion in 2025 and expected to reach USD 1.42 billion in 2026, at a CAGR of 19.98% to reach USD 4.26 billion by 2032.

Understanding How Exoskeleton Technologies Are Revolutionizing Healthcare, Industrial Efficiency, and Quality of Life Across Diverse Sectors

The exoskeleton domain is undergoing a period of unprecedented transformation driven by converging technological innovations and shifting demographic imperatives. What began as niche research initiatives in robotics and biomechanics has matured into a vibrant market landscape where commercial, medical, and industrial applications increasingly intersect. As the global workforce grapples with aging populations and labor shortages, exoskeletons present a compelling opportunity to enhance human capabilities, reduce workplace injuries, and accelerate patient recovery trajectories.

Recent advances in sensor miniaturization, battery density, and actuator design have converged with breakthroughs in artificial intelligence and machine learning to produce systems that deliver seamless human-machine integration. These improvements are further bolstered by cross-industry partnerships that bring automotive-grade manufacturing rigor to the development of next-generation wearable robotics. Consequently, decision-makers in healthcare facilities, manufacturing plants, and defense organizations are reevaluating traditional ergonomics solutions and investing in wearable robotic systems to drive productivity gains and bolster safety outcomes.

As adoption accelerates, industry stakeholders must navigate a complex interplay of technological readiness, regulatory compliance, and cost considerations. Against this backdrop, a clear understanding of market drivers, segmentation nuances, and regional dynamics becomes paramount. The following sections present a structured exploration of these critical factors, designed to equip executives and innovation leaders with the insights necessary to capitalize on the expanding exoskeleton market.

Exploring the Transformative Shifts Driving Exoskeleton Market Evolution through Technological Innovations and Emerging End-User Demand Patterns

The exoskeleton marketplace is characterized by a series of transformative shifts that are redefining both product capabilities and adoption pathways. At the forefront lies the integration of advanced materials with precision actuation systems, enabling lighter and more responsive devices that align with end-user ergonomics. This shift toward modular, scalable architectures has unlocked new possibilities for customization, allowing providers to tailor solutions for applications as varied as surgical assistance and heavy-load handling in logistics.

Simultaneously, the infusion of data analytics and cloud connectivity has elevated exoskeletons from standalone mechanical supports to intelligent systems capable of real-time performance monitoring and adaptive adjustment. This digital evolution not only enhances user safety but also yields actionable insights that inform long-term product refinement and maintenance strategies. Furthermore, the emergence of open-platform ecosystems is fostering greater interoperability, enabling third-party developers to expand functionalities and accelerate innovation cycles.

Evolving end-user demand patterns are also reshaping the market landscape. Healthcare providers are increasingly deploying exoskeletons to address rehabilitative and age-related mobility challenges, while industrial players are exploring collaborative wearable robotics to mitigate musculoskeletal risks and improve operational throughput. These parallel trends underscore a broader industry convergence, wherein lessons learned in one segment catalyze breakthroughs in another. As stakeholders navigate this dynamic terrain, strategic agility and cross-sector collaboration will be indispensable.

Analyzing the Impact of U.S. Tariff Policies on Steel, Aluminum, and Advanced Materials on Exoskeleton Manufacturing and Supply Chains

United States trade policy continues to exert a profound influence on exoskeleton manufacturing and cost structures. The Section 232 measures, which impose a 25% tariff on imported steel and a 10% tariff on imported aluminum, have increased the baseline cost of fundamental structural components. Concurrently, Section 301 tariffs on certain Chinese-origin goods have levied additional duties-commonly around 7.5%-on robotics assemblies and specialized materials. These cumulative charges have elevated the bill of materials, prompting manufacturers to reassess sourcing strategies and supply-chain footprints.

In response, leading innovators are exploring alternative material compositions and domestic partnerships to mitigate tariff exposure. The shift toward composite-based frames, which fall outside traditional steel classifications, has accelerated as companies seek to circumvent heavy import duties. At the same time, a growing emphasis on nearshoring has driven collaborative ventures between U.S. exoskeleton developers and regional manufacturing hubs. While the transition yields potential logistical efficiencies, it also requires significant capital outlays and regulatory navigation to establish compliant production lines.

Looking ahead, industry participants must remain vigilant to evolving policy reviews and potential adjustments to tariff schedules. Anticipated dialogues within trade committees and ongoing bilateral negotiations could recalibrate existing measures, creating windows of opportunity for cost optimization. In this volatile policy environment, proactive scenario planning and flexible procurement frameworks will be essential for sustaining competitive edge.

Gaining Actionable Insights into Exoskeleton Market Segmentation by Product Variants, Material Types, and Application Use Cases for Precision Strategies

A nuanced understanding of market segmentation reveals how product, material, and application dimensions shape competitive dynamics within the exoskeleton industry. By product type, full body exoskeletons address comprehensive mobility and load-handling requirements in both healthcare and industrial settings. Conversely, lower body exoskeletons-differentiated into non-powered supports for light assistance and powered units for dynamic load management-are gaining traction where agility and wearer comfort are critical. Upper body devices subdivide into chest support frameworks, specialized medical enhancement suits, and targeted shoulder support systems, each tailored to mitigate specific musculoskeletal stresses.

Material selection further delineates market contours. Composite structures, anchored by high-strength carbon fibers or advanced polymeric composites, deliver superior weight efficiency and corrosion resistance-attributes that appeal to applications demanding prolonged wearable use. In parallel, traditional steel and alloy constructions, whether configured as heavy-duty constructs for robust industrial environments or engineered into lightweight frames for cost-sensitive deployments, continue to maintain relevance among sectors prioritizing durability and proven manufacturing workflows.

Application-driven segmentation highlights how end-user needs inform product roadmaps. Accessibility aids encompass devices designed for mobility assistance and structured physical therapy programs, supporting individuals with chronic conditions or temporary impairments. Meanwhile, healthcare applications focus on elderly assistance systems to enhance daily living, rehabilitation and therapy exosuits that accelerate patient recovery, and surgical assistance platforms that augment clinician dexterity. This layered segmentation ensures that value propositions are precisely aligned with user expectations and operational constraints.

This comprehensive research report categorizes the Exoskeleton market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Application

Examining Regional Dynamics and Growth Drivers in the Exoskeleton Market across the Americas, Europe, Middle East & Africa, and Asia-Pacific Regions

The exoskeleton market exhibits distinct regional dynamics shaped by varying regulatory landscapes, investment climates, and end-user adoption rates. In the Americas, robust healthcare infrastructure and policy frameworks supporting assistive technologies have fostered early uptake, particularly within the United States and Canada. Industrial stakeholders across automotive and logistics sectors are deploying wearable robotics to enhance worker safety and productivity, while defense budgets are channeling funding into field-deployable exoskeleton prototypes.

Moving eastward, the Europe, Middle East & Africa region presents a mosaic of maturity levels. Western European nations, led by Germany and France, benefit from established research clusters and grant programs that incentivize exoskeleton R&D. Meanwhile, emerging markets in the Middle East are exploring pilot deployments to address workforce ergonomics in construction and oil & gas industries. Across North Africa, collaborative ventures are still nascent, yet growing investments in healthcare infrastructure signal latent demand for rehabilitation and elderly assistance solutions.

Asia-Pacific stands out for its rapid commercialization and scaling of exoskeleton innovations. Japan and South Korea harness deep robotics expertise and offer government subsidies to accelerate market introduction. China’s vast manufacturing base underpins competitive production costs, while Australia and Southeast Asian markets are beginning to embrace assisted mobility devices as aging demographics converge with rising healthcare spending. These regional variations underscore the importance of localized go-to-market strategies and regulatory navigation to capture diverse growth pockets.

This comprehensive research report examines key regions that drive the evolution of the Exoskeleton market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market Leaders Advancing Exoskeleton Innovation through Strategic Collaborations, Product Diversification, and Global Market Expansion Strategies

Major players continue to shape the competitive landscape through targeted investments, strategic partnerships, and product diversification. Ekso Bionics has expanded its healthcare portfolio by integrating proprietary sensor algorithms into its stroke rehabilitation suits, thereby enhancing patient engagement metrics and clinical efficacy. In parallel, Ottobock has pursued a dual product strategy, leveraging its heritage in orthopedic supports to broaden its active exoskeleton lineup for both medical and industrial end users.

Industrial equipment titans are also making calculated entries. Parker Hannifin has introduced lightweight industrial exosuits designed for repetitive lifting tasks, pairing modular hardware with cloud-based asset management to streamline maintenance cycles. Hyundai Robotics has aligned its automotive assembly robots with wearable exoskeleton prototypes, piloting human-robot collaboration cells that demonstrate measurable improvements in throughput and operator fatigue indices.

Innovative startups continue to inject agility into the market. Rex Bionics has focused on pediatric rehabilitation exo-devices, while B-Temia’s shoulder support systems address the specific needs of warehouse workers and manual laborers. Partnerships between these nimble firms and established OEMs facilitate rapid scaling and global distribution. Through acquisitions, R&D alliances, and user community engagement, these leading companies are collectively driving the maturation of the exoskeleton ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Exoskeleton market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABLE Human Motion S.L.

- B-Temia

- Comau S.p.A.

- CYBERDYNE INC.

- Ekso Bionics Holdings, Inc.

- German Bionic Systems GmbH

- GOGOA MOBILITY ROBOTS, SL

- HeroWear, LLC

- Hocoma AG

- Hyundai Motor Group

- Laevo BV

- Lifeward, Inc.

- Lockheed Martin Corporation.

- MAWASHI SCIENCE & TECHNOLOGY

- Myomo Inc.

- Ottobock SE

- Panasonic Holdings Corporation

- RB3D

- Rex Bionics Ltd.

- Robert Bosch GmbH

- Shanghai Fourier Intelligence Co. Ltd.

- Wandercraft

Outlining Actionable Strategic Recommendations for Industry Leaders to Leverage Technological Trends and Navigate Competitive Challenges in Exoskeleton Markets

To capitalize on emerging opportunities, industry leaders should prioritize investments in lightweight, high-performance materials that mitigate exposure to steel and aluminum tariffs while enhancing device ergonomics. Allocating R&D budgets toward novel composite formulations and additive manufacturing processes can yield differentiated products that command premium positioning in both medical and industrial segments. Concurrently, diversifying supply chains through nearshore partnerships will reduce geopolitical risk and expedite time-to-market for critical components.

Integrating digital capabilities is equally imperative. By embedding data analytics and remote monitoring functionalities, companies can transition from one-time hardware sales to recurring revenue models based on performance services and predictive maintenance. Aligning these initiatives with healthcare reimbursement frameworks and industrial safety regulations will smooth commercialization pathways and unlock new stakeholder value propositions.

Strategic alliances with end-users and research institutions can accelerate product validation and drive standards development. Co-creating pilot programs in hospital networks or manufacturing plants provides real-world feedback loops that refine product roadmaps and strengthen customer advocacy. Finally, engaging proactively with regulatory bodies to shape emerging safety and interoperability guidelines will establish early compliance credentials and reinforce brand leadership in a rapidly evolving market.

Detailing a Robust Research Methodology Incorporating Primary Stakeholder Insights and Secondary Data Validation to Ensure Comprehensive Market Analysis

This analysis is underpinned by a multi-tiered research approach that balances both primary stakeholder engagement and extensive secondary data synthesis. The secondary research phase involved a comprehensive review of peer-reviewed journals, government policy documents, technology white papers, and authoritative trade publications. These sources provided foundational insights into material science advancements, tariff regulations, and application-specific performance benchmarks.

In parallel, primary research efforts encompassed in-depth interviews with over 30 senior executives, product designers, clinical practitioners, and facility managers across key market segments. These conversations elucidated real-world adoption barriers, prioritized feature requirements, and prospective avenues for service integration. To ensure rigor, all qualitative inputs underwent triangulation against quantitative datasets and publicly disclosed financial reports.

Rigorous data validation protocols were applied throughout, leveraging cross-functional expert reviews and stakeholder workshops to reconcile divergent viewpoints and confirm emerging trends. The resulting intelligence was distilled into thematic insights and actionable recommendations, with clear traceability back to original data sources. While every effort was made to secure the highest level of accuracy, limitations include the proprietary nature of certain commercial contracts and the evolving policy environment that continues to influence market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Exoskeleton market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Exoskeleton Market, by Product Type

- Exoskeleton Market, by Material Type

- Exoskeleton Market, by Application

- Exoskeleton Market, by Region

- Exoskeleton Market, by Group

- Exoskeleton Market, by Country

- United States Exoskeleton Market

- China Exoskeleton Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1590 ]

Delivering a Concise Synthesis of Key Findings and Strategic Implications to Guide Decision Makers in the Dynamic Exoskeleton Technology Landscape

The exoskeleton market stands at the nexus of technological innovation and societal need, with multidimensional segmentation, regional adoption patterns, and policy factors shaping its trajectory. Full body, lower body, and upper body devices cater to distinct use cases, while materials ranging from carbon fibers to heavy-duty alloys influence both performance and cost considerations. Regional nuances in regulatory support and investment climates underscore the necessity of tailored market strategies.

Leading companies are responding with strategic collaborations, focused R&D investments, and digital integration to differentiate their offerings. Meanwhile, the ongoing impact of U.S. tariffs has challenged traditional cost structures, catalyzing shifts toward alternative materials and nearshore production models. Against this backdrop, proactive scenario planning and flexible supply chain frameworks will define the winners and laggards in the coming years.

Moving forward, stakeholders who embrace open-platform interoperability, prioritize service-oriented business models, and engage closely with regulatory bodies will be best positioned to unlock the full potential of exoskeleton technologies. The insights and recommendations presented herein serve as a roadmap for executives looking to navigate complexity and accelerate innovation in this rapidly evolving domain.

Seize Strategic Advantage Today by Collaborating with Ketan Rohom to Access the Definitive Exoskeleton Market Research Report and Drive Growth Initiatives

To explore detailed market trajectories and customized strategic insights for your organization, connect with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. By securing the full exoskeleton market research report, you will access in-depth analyses of technological advancements, regulatory landscapes, and competitive dynamics that are essential for establishing a formidable position in this rapidly evolving space.

Partnering with Ketan Rohom ensures timely delivery of executive briefings, bespoke data extracts, and ongoing support to align your growth initiatives with real-world market conditions. Take control of your strategic planning by tapping into the most authoritative resource available on exoskeleton technology adoption, material innovations, and application trends. Reach out to start a conversation today and transform insights into action for sustainable competitive advantage.

- How big is the Exoskeleton Market?

- What is the Exoskeleton Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?