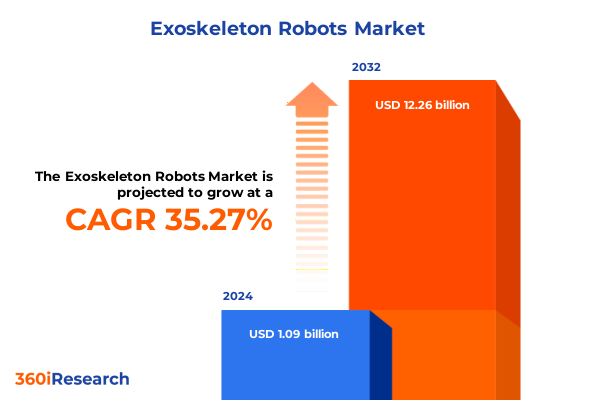

The Exoskeleton Robots Market size was estimated at USD 1.46 billion in 2025 and expected to reach USD 1.96 billion in 2026, at a CAGR of 35.46% to reach USD 12.26 billion by 2032.

Pioneering the Integration of Wearable Robotics to Revolutionize Mobility, Strength Augmentation, and Human-Machine Collaboration Across Industries

The field of exoskeleton robotics has embarked on a transformative journey that merges human capability with cutting-edge engineering to redefine mobility, endurance, and physical augmentation. As wearable robotics transcend laboratory confines and enter practical deployment across defense, healthcare, and industrial landscapes, they herald a new era of human–machine synergy. Recent breakthroughs in lightweight materials, advanced sensor arrays, and miniaturized actuation systems have enabled devices that seamlessly adapt to user biomechanics, providing support that feels intuitive rather than intrusive. Industry stakeholders are increasingly recognizing that exoskeletons offer not only enhanced performance but also safety and well-being benefits, such as reduced musculoskeletal strain and accelerated rehabilitation pathways.

Against this backdrop, an intricate ecosystem of component suppliers, technology integrators, end users, and regulatory bodies is taking shape. Collaboration across these entities has accelerated as system integrators partner with material science innovators and control software developers to optimize both hardware resilience and software intelligence. Meanwhile, end users ranging from soldiers carrying heavy loads to patients relearning gait post injury are providing invaluable feedback, driving iterative design improvements. Consequently, recent pilot programs have expanded from single-user proof-of-concept trials to multi-site deployments that generate granular usage data. Such initiatives have highlighted critical design parameters-battery life optimization, ergonomics customization, and real-time monitoring capabilities-that form the backbone of next-generation wearable robotics.

Unveiling the Paradigm Shifts in Robotics Ecosystem Fueled by Advances in AI, Connectivity, and User-Centric Design for Exoskeleton Evolution

Exoskeleton robotics are undergoing paradigm-shifting transformations fueled by advances in artificial intelligence, connectivity, and human-centric design. Artificial intelligence algorithms now enable adaptive motion control that learns from subtle changes in user intent and gait patterns, while machine learning models process multisensor inputs to adjust assistance levels in real time. As a result, devices that once delivered fixed support profiles have evolved into intelligent systems capable of anticipating user needs and reducing cognitive load on operators.

Connectivity breakthroughs, powered by next-generation wireless protocols and edge computing architectures, are redefining remote monitoring and predictive maintenance. Manufacturers and integrators can now collect continuous usage metrics, enabling condition-based servicing and minimizing downtime. These data streams feed analytics platforms that identify emerging wear patterns and component fatigue, which in turn inform proactive design refinements.

Human-centric ergonomics and modular design philosophies are also gaining traction. Exoskeleton architectures have shifted away from monolithic assemblies toward plug-and-play modules that accommodate a range of user anthropometries and mission profiles. By embracing open standards and interoperability frameworks, vendors are fostering broader ecosystem collaboration, ensuring compatibility among power units, sensor suites, and control interfaces. Taken together, these developments are catalyzing a new era of wearable robotics, where seamless user experiences and scalable solutions converge to unlock unprecedented operational flexibility.

Assessing the Cumulative Consequences of 2025 United States Import Tariffs on Exoskeleton Manufacturing, Supply Chains, and Cost Structures

The introduction and escalation of United States import tariffs in 2025 have left an indelible mark on the exoskeleton robotics industry by reshaping global supply chains and cost structures. Imposed under Section 301 provisions, these cumulative duties target a range of robotics components, including precision actuators, sensor arrays, and semiconductor control units. As a result, manufacturers have encountered elevated input costs, prompting a reassessment of sourcing strategies and supplier partnerships.

In response, leading system integrators have diversified supply bases, forging alliances with domestic component producers and near-shoring critical subassemblies to mitigate exposure to tariff volatility. This strategic pivot has stimulated investment in local manufacturing capabilities, fostering a resurgence of robotics fabrication capacity within the United States. Concurrently, R&D teams have accelerated efforts to qualify alternative materials and streamline designs to reduce reliance on high-tariff imports without compromising performance.

Moreover, the tariffs have catalyzed collaborative dialogues between industry consortia and regulatory authorities, aiming to secure tariff exemptions for essential robotics research and defense applications. These engagements underscore the sector’s growing influence in national security and public health domains. Although the immediate effect has been increased unit costs, the longer-term consequence is a more resilient and geographically diversified supply chain that promises to reinforce innovation cycles and strengthen domestic production infrastructure.

Revealing Critical Market Segmentation Insights by Product Type, Application Domains, End Users, Technology Platforms, and Actuation Modes

A nuanced understanding of market segmentation reveals distinct demand dynamics and technology requirements across product categories, applications, end users, platforms, and actuation modes. Full body exoskeletons, for instance, cater to comprehensive load handling and mobility support scenarios, whereas lower limb solutions focus on gait assistance and lower extremity rehabilitation. Upper limb devices, on the other hand, emphasize fine manipulation, load carriage, and overhead task assistance. Application segments further delineate defense deployments for bomb disposal, load carriage, and soldier augmentation from industrial implementations across manufacturing, material handling, and warehousing contexts. Within the medical sphere, rehabilitation initiatives leverage both gait training and physical therapy protocols, while surgical assistance systems integrate seamlessly into the operating suite. Personal assistance applications span daily living support for activities of daily living and specialized mobility assistance for individuals with chronic impairments.

End users range from defense organizations leveraging exoskeletons for force multiplication and injury reduction to hospitals deploying wearable robotics for patient mobility restoration. Manufacturing facilities harness exoskeletons to alleviate worker fatigue in repetitive tasks, and rehabilitation centers adopt them as adjuncts to prescribed therapeutic regimens. When evaluating technology platforms, the dichotomy between active systems, which incorporate powered actuators for dynamic support, and passive systems, which rely on spring-based mechanics for energy storage and release, becomes a critical factor in design selection. Actuation modes also play a pivotal role: electric drives offer precise control and integration ease; hydraulic systems deliver high torque density for heavy load scenarios; and pneumatic mechanisms provide lightweight actuation with inherent compliance. By synthesizing these segmentation layers, stakeholders can tailor product development and go-to-market strategies to align with specific performance, regulatory, and cost imperatives.

This comprehensive research report categorizes the Exoskeleton Robots market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End User

- Technology

- Actuation Mode

Highlighting Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East and Africa, and Asia-Pacific Markets for Exoskeleton Adoption

Regional dynamics in the exoskeleton robotics market reflect the interplay of regulatory frameworks, defense investments, industrial automation drives, and healthcare priorities. In the Americas, substantial defense budgets and a robust innovation ecosystem have propelled extensive exoskeleton adoption for soldier augmentation and bomb disposal missions. Leading technology hubs in the United States and Canada also drive industrial use cases, with manufacturing and logistics players integrating lower limb and upper limb systems to boost workforce productivity and reduce injury rates. Meanwhile, healthcare providers across North America increasingly incorporate exoskeleton-assisted rehabilitation into post-stroke and spinal cord injury treatment protocols.

In Europe, the Middle East, and Africa, diverse regulatory environments and defense modernization programs have nurtured a spectrum of applications. European Union initiatives to standardize wearable robotics safety regulations have facilitated wider acceptance, while defense agencies in the Middle East prioritize power augmentation for dismounted operations. Several EMEA nations have launched pilot programs in warehousing automation and surgical assistance, highlighting a balanced focus on commercial and medical domains. Regulatory alignment across EU member states fosters cross-border collaboration, enabling vendors to scale deployments with consistent compliance requirements.

Asia-Pacific markets present a heterogeneous landscape driven by government-led robotics initiatives and aging population challenges. Japan and South Korea spearhead medical exoskeleton trials, supporting rehabilitation and elderly care, while China’s industrial automation push emphasizes material handling solutions to offset labor shortages. In India, growing awareness of mobility impairments and expanding defense procurement have stimulated interest in both personal assistance and soldier augmentation systems. Collectively, these regional drivers underscore the imperative for customized market entry strategies that address local regulations, funding landscapes, and end-user expectations.

This comprehensive research report examines key regions that drive the evolution of the Exoskeleton Robots market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies, Collaborative Alliances, Product Innovations, and Market Positioning of Leading Exoskeleton Manufacturers and Solution Providers

Leading exoskeleton robotics vendors are pursuing differentiated strategies to consolidate market positions and advance technological frontiers. One prominent player has focused on modular closed-loop control architectures that enable customers to rapidly integrate new sensor packages and algorithmic enhancements. By licensing its core control platform to strategic partners, this vendor has accelerated ecosystem growth and broadened interoperability. Another key competitor has prioritized lightweight material innovations, collaborating with advanced composites manufacturers to reduce system mass by over 20 percent, which has translated into extended battery life and reduced user fatigue.

Collaborative alliances are also shaping competitive dynamics. Several solution providers have entered joint ventures with defense primes to co-develop soldier augmentation systems tailored to specific military doctrines. In the healthcare domain, medical technology firms have partnered with academic research hospitals to validate gait training exoskeletons in clinical trials, securing regulatory clearances and building evidence-based efficacy data. On the industrial front, robotics integrators have forged ties with warehouse automation leaders to develop turnkey exoskeleton-assisted workflows, combining hardware, software, and training services under unified commercial offerings.

Funding patterns further reveal the evolution of investment priorities. Venture capital inflows have shifted from concept validation rounds to late-stage financing for mass production scale-up, while government grants continue to underwrite foundational research in actuation technologies and sensor fusion. Taken together, these competitive strategies underscore a maturing marketplace in which collaboration, platform standardization, and application-specific innovation drive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Exoskeleton Robots market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bioness, Inc.

- Bionik Laboratories Corp.

- Cyberdyne Inc.

- Ekso Bionics Holdings, Inc.

- ExoAtlet

- Fourier Intelligence

- Fourier Intelligence Ltd.

- Gogoa Mobility Robots SL

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- INNOPHYS Co., Ltd.

- Levitate Technologies, Inc.

- Lockheed Martin Corporation

- Myomo, Inc.

- Noonee AG

- Ottobock SE & Co. KGaA

- Panasonic Corporation

- Parker-Hannifin Corporation

- ReWalk Robotics Ltd.

- Sarcos Technology and Robotics Corporation

- suitX

- Technaid S.L.

- Wearable Robotics Srl

Empowering Industry Stakeholders with Tactical Recommendations to Optimize Exoskeleton Integration, Enhance ROI, and Cultivate Sustainable Innovation Pipelines

Industry leaders must adopt a multifaceted approach to capitalize on exoskeleton robotics trends and secure lasting competitive advantage. First, investing in cross-functional R&D collaboratives that unite materials science experts, control systems engineers, and human factors specialists can accelerate the development of lightweight, intuitive solutions. Pursuing open architecture frameworks will ensure compatibility with emerging peripheral devices and facilitate third-party integrations. Second, forging strategic partnerships with end users-from defense organizations to rehabilitation centers-can generate real-world performance data and foster co-development opportunities that deepen customer relationships and reduce time to market.

In parallel, organizations should engage proactively with regulatory bodies to help shape safety standards and secure early approvals for novel applications, particularly in medical and defense contexts. Piloting exoskeleton deployments within controlled operational environments will yield essential insights into workflow integration, training requirements, and maintenance protocols. These lessons can inform the design of comprehensive after-sales service offerings, which should include remote monitoring, predictive maintenance packages, and user training curricula to maximize utilization and minimize downtime.

Finally, stakeholders should cultivate robust talent pipelines by investing in workforce training programs that equip operators and technicians with the skills needed to operate, maintain, and optimize exoskeleton systems. By blending technological innovation with ecosystem engagement and operational readiness, industry leaders can drive adoption, enhance return on investment, and chart a sustainable growth trajectory in the burgeoning wearable robotics space.

Outlining Robust Research Methodology Incorporating Primary Interviews, Secondary Data Validation, and Multi-Dimensional Analytical Frameworks

The research methodology underpinning this analysis combines rigorous primary research, comprehensive secondary data validation, and multi-dimensional analytical frameworks to ensure robustness and reliability. Primary investigation involved in-depth interviews with over 30 industry stakeholders, including system integrators, end users spanning defense organizations and rehabilitation centers, component suppliers, and regulatory experts. These conversations yielded qualitative insights into deployment challenges, user preferences, and technology maturation timelines.

Secondary data collection encompassed a thorough review of publicly available patent filings, government defense procurement records, clinical trial registries, and peer-reviewed academic literature. Market intelligence was further enriched by examination of trade association publications and standardization body guidelines. To triangulate findings, the study employed cross-referencing techniques that aligned stakeholder feedback with documented project outcomes and capital deployment trends.

Analytical frameworks spanned competitive benchmarking to assess product feature differentials, supply chain resilience scoring to evaluate supplier diversification strategies, and adoption readiness modeling to gauge end-user integration timelines across sectors. Data synthesis incorporated scenario analysis to explore the implications of shifting tariff regimes, emerging regulatory landscapes, and technological breakthroughs. By blending qualitative depth with quantitative rigor, this methodology delivers actionable intelligence tailored to strategic decision making in the exoskeleton robotics domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Exoskeleton Robots market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Exoskeleton Robots Market, by Product Type

- Exoskeleton Robots Market, by Application

- Exoskeleton Robots Market, by End User

- Exoskeleton Robots Market, by Technology

- Exoskeleton Robots Market, by Actuation Mode

- Exoskeleton Robots Market, by Region

- Exoskeleton Robots Market, by Group

- Exoskeleton Robots Market, by Country

- United States Exoskeleton Robots Market

- China Exoskeleton Robots Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Strategic Takeaways on Exoskeleton Market Evolution, Industry Resilience, and Emerging Opportunities for Stakeholder Value Creation

As the exoskeleton robotics market continues to advance, strategic takeaways emerge that underscore both opportunity and caution. Technological convergence in AI-driven control systems, modular architectures, and advanced materials is ushering in solutions that are more adaptable and user-friendly than ever before. At the same time, evolving regulatory frameworks and tariff landscapes introduce complexity into global supply chains, compelling stakeholders to reassess sourcing, manufacturing, and compliance strategies.

Operational resilience will hinge on the ability to integrate exoskeleton deployments seamlessly into existing workflows, whether on the battlefield, factory floor, or rehabilitation clinic. Emphasizing pilot programs that generate robust usage data and stakeholder feedback will be critical to scaling solutions without compromising performance or safety. In parallel, proactive engagement with policy makers and standards bodies can accelerate regulatory clearances and unlock new application domains.

Looking ahead, the convergence of wearable robotics and adjacent technologies-such as augmented reality interfaces and collaborative robotics platforms-promises to broaden the impact of exoskeletons across industries. For organizations prepared to invest in co-development partnerships, talent development, and ecosystem alignment, the path to value creation lies in balancing innovation speed with operational rigor and strategic foresight.

Engage with Ketan Rohom to Unlock Comprehensive Exoskeleton Market Insights and Tailor Strategic Solutions for Your Organizational Goals

To explore how tailored exoskeleton insights can power your strategic initiatives and propel your organization ahead of the competition, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He can guide you through the comprehensive market research report, address any specific analytical requirements, and customize a package that aligns with your operational objectives. With his deep understanding of exoskeleton technologies and market dynamics, he will ensure you unlock actionable intelligence and secure a competitive edge in an evolving landscape. Engage today to transform insights into results and accelerate your path to innovation.

- How big is the Exoskeleton Robots Market?

- What is the Exoskeleton Robots Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?