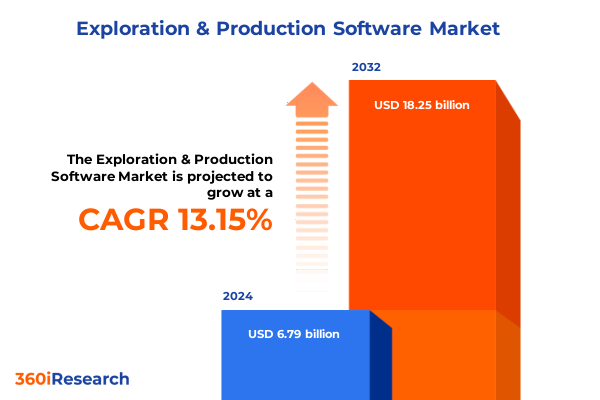

The Exploration & Production Software Market size was estimated at USD 7.59 billion in 2025 and expected to reach USD 8.50 billion in 2026, at a CAGR of 13.34% to reach USD 18.25 billion by 2032.

Emerging Exploration and Production Software Innovations Driving Operational Efficiency, Data-Driven Decisions, and Collaborative Workflows for Upstream Operators Worldwide

The digital revolution in upstream oil and gas is accelerating demand for sophisticated exploration and production software that can process vast volumes of subsurface data, optimize operational workflows, and enable predictive insights. Companies are increasingly under pressure to reduce cycle times for drilling programs, enhance reservoir recovery factors, and ensure compliance with evolving environmental and safety regulations. As a result, software solutions that integrate real-time monitoring, advanced analytics, and collaborative platforms have become strategic assets for leading operators.

Furthermore, artificial intelligence and machine learning are driving a paradigm shift in how decisions are made in exploration and production. By transforming gigabytes of seismic and well log data into actionable intelligence, these technologies empower engineers to anticipate drilling anomalies, optimize well placements, and increase production efficiency. In fact, industry benchmarking reveals that a mere ten percentage point improvement in production efficiency, achieved through data-driven automation, can translate to a bottom-line impact of up to $260 million on a single brownfield asset. Moreover, operators leveraging AI-powered drilling guidance have reported up to a 25 percent increase in drilling tempo, significantly accelerating time to first oil and reducing nonproductive time.

In addition to subsurface optimization, modern E&P software platforms facilitate cross-disciplinary collaboration by unifying geoscience, engineering, and operations data onto a single environment. This cohesive approach not only enhances decision quality but also accelerates project delivery by breaking down traditional silos. As a result, companies that invest in integrated digital ecosystems are better positioned to navigate price volatility, regulatory complexities, and sustainability imperatives while maintaining operational excellence.

Revolutionary Technological and Digital Transformations Reshaping Subsurface Modeling, Real-Time Monitoring, and Predictive Analytics in Upstream Operations

Exploration and production software has undergone revolutionary transformations as emerging technologies converge to reshape upstream operations. Automation of routine tasks, from rig sensor monitoring to digital log interpretation, is enhancing operational precision and enabling faster decision loops. McKinsey research indicates that digital automation across production assets can improve output by ten percentage points, potentially yielding hundreds of millions in additional value per asset. Simultaneously, the integration of machine learning algorithms into drilling control systems has empowered operators to predict drilling challenges and adjust trajectories in real time, resulting in productivity gains of up to 25 percent in major operating basins.

Moreover, advanced analytics and digital twins are redefining how reservoirs are modeled and managed. Virtual replicas of physical assets enable what-if scenarios for asset performance, helping engineers to optimize maintenance schedules and reduce unplanned downtime. In parallel, cloud computing is facilitating the deployment of scalable software solutions that can process petabytes of subsurface and production data without the need for extensive on-premises infrastructure. This shift to cloud-native architectures not only drives down IT overhead but also accelerates time to insight by offering on-demand computing resources and collaborative data environments.

Lastly, the rise of generative AI promises to further accelerate subsurface interpretation and project planning by automating the generation of geological models, drilling plans, and production forecasts. As organizations experiment with conversational analytics and zero-code AI frameworks, they stand to unlock new efficiencies that were previously unattainable. This confluence of automation, cloud, AI, and digital twin technologies represents a transformation that is not incremental but truly paradigmatic for the upstream sector.

Assessing the Cumulative Consequences of 2025 United States Tariffs on Digital Infrastructure Costs and Deployment Strategies for E&P Software

The introduction of new tariff measures by the United States in early 2025 has created a complex cost environment for organizations deploying on-premises hardware to support exploration and production software. On April 2, 2025, an executive order imposed a 10 percent reciprocal tariff on the import of virtually all goods, including servers and networking equipment critical to data center operations. However, a week later on April 9, 2025, reciprocal tariffs on China-origin exports jumped to 125 percent on top of existing Section 301, Section 232, and IEEPA tariffs-resulting in combined rates as high as 170 percent for certain technology products. This sudden escalation in duties prompted major hardware vendors and distributors to revise pricing for enterprise-grade components.

Meanwhile, in response to public and industry pressure, the United States and China reached a preliminary trade agreement on May 12, 2025, which reduced reciprocal tariffs on China-origin goods back to 10 percent effective May 14, 2025. Despite this partial rollback, the period of heightened tariffs had already driven price increases for key infrastructure. Leading enterprise vendors reported hardware cost hikes of 10 to 20 percent for core networking and server platforms-from high-performance routers to blade servers-impacting capital planning and total cost of ownership.

These fluctuations underscore the importance of strategic procurement planning and flexible deployment strategies for E&P software environments. Organizations with cloud-first or hybrid cloud architectures have been able to mitigate hardware cost volatility by shifting processing workloads to service providers whose scale and geographic distribution offer greater tariff insulation. As a result, many operators are re-evaluating their on-premises footprints in favor of cloud-based and software-as-a-service models that can absorb import duty fluctuations and minimize capital exposure.

In-Depth Market Segmentation Insights Revealing How End Users, Component Models, Deployment Types, and Application Categories Drive Value Creation

Market segmentation reveals distinct value drivers and adoption patterns that vary by end user, component model, deployment approach, and application focus. Government and research institutions often prioritize data management and integration capabilities that support large-scale geoscience databases and collaboration across academic and regulatory stakeholders. By contrast, oil and gas operators emphasize production optimization and reservoir simulation modules that can directly impact recovery factors and field economics. Service companies, including drilling contractors and engineering firms, look for scalable applications in drilling and completion as well as predictive maintenance to improve equipment utilization and minimize nonproductive time.

When evaluating component models, maintenance and support services remain critical for ensuring software platforms operate reliably in mission-critical environments. Conversely, software license agreements provide flexibility in accessing advanced modules, with many organizations opting for modular licensing structures that align costs to usage patterns and project lifecycles. In terms of deployment, cloud-based implementations offer rapid scalability and global accessibility, enabling remote teams to collaborate on subsurface interpretation and production analytics. On-premises deployments, while requiring more capital investment, deliver stringent data sovereignty controls and low-latency access for real-time monitoring systems operating in remote field locations.

Applications further differentiate market requirements. Data management and integration solutions now encompass both analytics and visualization layers that transform raw sensor and log data into intuitive dashboards. Drilling and completion software extends from well planning and monitoring workflows to precise borehole trajectory design. Production optimization modules integrate artificial lift optimization with flow assurance monitoring to maximize throughput and reduce downtime. Reservoir simulation platforms offer both conventional and fracture-enhanced recovery scenario modeling. Seismic interpretation and data processing tools support 2D and 3D workflows, while well testing and intervention suites facilitate everything from coiled tubing operations to drill stem testing. Together, these segments underscore the multifaceted nature of the E&P software market and highlight the need for integrated yet flexible solution portfolios.

This comprehensive research report categorizes the Exploration & Production Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Type

- Application Type

Critical Regional Dynamics Across Americas, Europe Middle East Africa, and Asia-Pacific Influencing Exploration and Production Software Adoption and Growth

Regional market dynamics continue to evolve as operators seek software solutions tailored to local operating conditions, regulatory frameworks, and infrastructure availability. In the Americas, rapid adoption of cloud-based collaboration platforms and advanced drilling optimization tools is driven by prolific shale developments and digital transformation initiatives among leading independent and national oil companies. Furthermore, proximity to technology hubs and strategic partnerships with cloud service providers has enabled operators to deploy next-generation analytics and AI modules more rapidly than in other regions.

Across Europe, the Middle East, and Africa, the focus is on maximizing recovery from mature fields, reducing carbon footprints, and integrating renewable energy sources into oil and gas operations. National oil companies and large independents in the Middle East are investing heavily in reservoir simulation and digital twin technologies to extend field life and improve asset reliability in high-temperature, high-pressure environments. Meanwhile, Europe’s stringent environmental regulations have spurred demand for emissions monitoring, leak detection, and sustainability reporting applications within E&P software platforms.

Asia-Pacific presents a diverse landscape, from greenfield exploration in Southeast Asia to deepwater projects off Australia’s coast. Operators in this region are leveraging modular, cloud-enabled platforms that can adapt to varying connectivity constraints and data privacy requirements. Additionally, service companies in the Asia-Pacific are increasingly collaborating with local research institutions to develop customized analytics models that reflect unique geological characteristics, thereby driving demand for configurable software suites that can accommodate regional subsurface complexities.

This comprehensive research report examines key regions that drive the evolution of the Exploration & Production Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Moves and Innovation Focus of Leading Exploration and Production Software Providers Shaping Competitive Dynamics and Customer Adoption Trends

Leading technology providers are continuously enhancing their solution portfolios through strategic partnerships, acquisitions, and R&D investments. Major oilfield service firms have integrated proprietary analytics engines and cloud platforms into their software offerings, creating end-to-end services that span data acquisition, processing, and interpretation. Meanwhile, pure-play software vendors are expanding AI-driven modules for drilling optimization, artificial lift management, and remote monitoring to differentiate on technical prowess.

In addition, enterprise software incumbents are developing specialized upstream modules that leverage their established cloud infrastructures and cybersecurity frameworks. By embedding geoscience-specific machine learning models into broader industrial IoT and digital twin platforms, these companies are appealing to operators seeking unified digital ecosystems that encompass both upstream and midstream operations. As a result, competition has intensified around open architecture standards and application programming interfaces to facilitate data interoperability across hydrocarbon value chains.

Smaller, specialized firms have also gained traction by focusing on niche applications such as fracture simulation, subsea intervention planning, and real-time emissions monitoring. Their agility in adopting bleeding-edge AI algorithms and flexible licensing models has enabled them to secure partnerships with innovative operators in regions prioritizing digital transformation. Collectively, these competitive dynamics highlight a market characterised by collaborative alliances, technology convergence, and relentless innovation aimed at addressing the evolving challenges of upstream exploration and production.

This comprehensive research report delivers an in-depth overview of the principal market players in the Exploration & Production Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aspen Technology, Inc.

- Aveva Group plc

- Baker Hughes Company

- Bentley Systems, Incorporated

- CGG SA

- Emerson Electric Co.

- Halliburton Company

- Hexagon AB

- IHS Markit Ltd.

- Kongsberg Gruppen ASA

- Paradigm Ltd.

- Pason Systems Inc.

- Peloton

- S&P Global Inc.

- Schlumberger Limited

- TDE Group GmbH

Strategic Imperatives and Recommended Actions for Industry Leaders to Enhance Digital Capabilities, Mitigate Risks, and Foster Sustainable Innovation

Executives should consider adopting a cloud-first strategy that distributes data processing and analytics across geographically diverse data centers, thereby insulating digital infrastructure from hardware tariff fluctuations and ensuring seamless global collaboration. Moreover, integrating AI-driven optimization modules into core workflows for drilling, reservoir management, and production operations can yield immediate gains in efficiency and decision speed. It is also critical to negotiate modular licensing agreements that align costs to consumption patterns and project timelines, providing financial flexibility and scalability.

In parallel, establishing a center of excellence for digital twin development enables organizations to pilot virtual asset models, quantify performance improvements, and accelerate broader rollouts. By engaging with software providers to co-develop custom AI workflows-such as predictive maintenance for critical field equipment and automated geological interpretation-operators can tailor solutions to their unique reservoir characteristics. Furthermore, building cross-functional teams that unite geoscientists, engineers, IT specialists, and data scientists fosters deeper collaboration, unlocks new synergies, and reduces time to insight.

Finally, industry leaders should invest in robust change management programs that address cultural, skill, and governance challenges associated with digital transformation. By providing ongoing training on emerging software capabilities and implementing data governance frameworks, companies can ensure high user adoption rates, preserve data integrity, and realize sustainable, long-term value from their exploration and production software investments.

Robust Research Methodology Framework Outlining Primary and Secondary Data Collection, Validation Processes, and Analytical Approaches for Market Accuracy

This research utilizes a rigorous methodology combining both primary and secondary data sources to ensure accuracy and reliability. Primary insights were gathered through in-depth interviews with senior executives, domain experts, and end users across various segments of the exploration and production value chain. These discussions provided firsthand perspectives on deployment challenges, adoption drivers, and emerging requirements.

Secondary research encompassed an exhaustive review of industry publications, technology white papers, regulatory filings, and reputable consulting reports to contextualize market developments and validate qualitative inputs. Data triangulation techniques were employed to reconcile discrepancies across sources and enhance overall confidence in the findings. Historical trends were analyzed alongside recent tariff announcements and technological milestones to present a balanced view of cost dynamics and innovation trajectories.

Quantitative analysis was underpinned by segmentation frameworks covering end user profiles, component models, deployment types, application areas, and regional markets. Expert panels were convened to review preliminary conclusions, refine forecast assumptions, and ensure alignment with current commercial realities. The resulting methodology provides a transparent, repeatable process for delivering actionable market intelligence that supports strategic decision making in the exploration and production software domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Exploration & Production Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Exploration & Production Software Market, by Component

- Exploration & Production Software Market, by Deployment Type

- Exploration & Production Software Market, by Application Type

- Exploration & Production Software Market, by Region

- Exploration & Production Software Market, by Group

- Exploration & Production Software Market, by Country

- United States Exploration & Production Software Market

- China Exploration & Production Software Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1590 ]

Concluding Insights Synthesizing Market Trends, Tariff Impacts, Segmentation Analysis, Regional Dynamics, and Competitive Strategies in Upstream Software

The exploration and production software landscape is being reshaped by a confluence of technological innovations, shifting trade policies, and evolving market needs. Organizations that embrace advanced analytics, cloud-native architectures, and AI-powered optimization stand to achieve significant operational improvements, from reduced drilling cycle times to enhanced reservoir recovery rates. Meanwhile, the recent volatility in hardware tariffs underscores the importance of flexible deployment strategies and strategic procurement planning.

Segmentation insights reveal a diverse market where end user priorities vary according to operational mandates, component preferences, and data sovereignty requirements. Regional dynamics further influence adoption patterns, with the Americas focused on shale-driven efficiency gains, EMEA emphasizing mature field optimization and sustainability, and Asia-Pacific balancing connectivity constraints with rapid digital modernization.

Competitive intensity is rising as major service providers, software specialists, and enterprise technology companies vie for market share through partnerships, acquisitions, and open architecture initiatives. To maintain momentum, industry leaders must implement actionable recommendations that include cloud-first strategies, digital twin centers of excellence, modular licensing, and comprehensive change management programs.

In summary, the path forward in exploration and production software lies at the intersection of digital innovation and pragmatic risk management. Companies that navigate this dual imperative effectively will unlock new levels of productivity, resilience, and long-term value creation.

Engage with Our Associate Director of Sales and Marketing to Acquire Comprehensive Market Research on Exploration and Production Software

Ready to deepen your understanding of the exploration and production software market and gain a competitive edge? Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to explore how our comprehensive market research report can inform your strategic decisions. Ketan brings a deep understanding of the upstream digital landscape and can guide you through tailored insights that address your organization’s unique requirements. Take the next step toward data-driven excellence in your exploration and production initiatives by connecting with Ketan today

- How big is the Exploration & Production Software Market?

- What is the Exploration & Production Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?