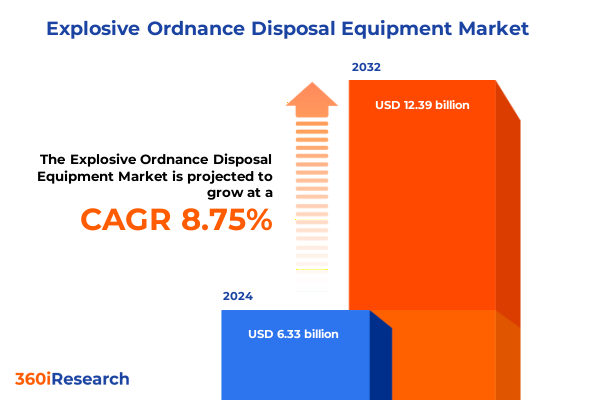

The Explosive Ordnance Disposal Equipment Market size was estimated at USD 6.81 billion in 2025 and expected to reach USD 7.34 billion in 2026, at a CAGR of 8.91% to reach USD 12.39 billion by 2032.

Unveiling the Evolving Demands and Critical Challenges Shaping the Future of Explosive Ordnance Disposal Equipment in Modern Defense and Security Operations

The realm of explosive ordnance disposal equipment is witnessing a pivotal evolution as the intersection of advanced threats and emerging technologies redefines operational paradigms. In an era marked by asymmetric warfare, global counterterrorism initiatives, and heightened homeland security concerns, the requirement for robust, adaptable, and intelligent disposal solutions has never been more critical. Traditional manual techniques are increasingly supplemented or replaced by sophisticated systems designed to mitigate risks and enhance precision under the most hazardous conditions.

Over the past few years, defense and security organizations have intensified investments in research and development to address both conventional explosive ordnance threats and the rising incidence of improvised explosive devices. This commitment has given rise to a diverse suite of tools, ranging from bomb disposal robots with autonomous capabilities to sensor suites capable of detecting chemical, radiological, and mechanical hazards with unprecedented sensitivity. As such, the market dynamics for explosive ordnance disposal equipment are now shaped by the confluence of technological breakthroughs, regulatory imperatives, and evolving mission requirements.

Exploring the Technological Breakthroughs and Operational Paradigm Changes Driving Innovation and Efficacy in Explosive Ordnance Disposal Equipment Across Conflict Zones

The landscape of explosive ordnance disposal is undergoing transformative shifts driven by the integration of cutting-edge technologies and new operational doctrines. Artificial intelligence and machine learning have become cornerstones of innovation, enabling robots to navigate complex terrains, analyze sensor inputs in real time, and autonomously prioritize threat responses. By reducing operator workload and enhancing decision support, these intelligent systems are elevating mission success rates and operator safety to new heights.

Concurrently, advances in sensor technology-spanning multispectral imaging, high-resolution X-ray inspection, and chemical detection-are delivering unprecedented levels of situational awareness. Modern EOD platforms synthesize data from diverse sensors to construct a comprehensive threat profile, allowing operators to visualize concealed hazards and execute neutralization tasks with greater confidence and precision. These innovations, coupled with modular design philosophies, enable rapid reconfiguration of equipment to suit mission-specific requirements, promoting versatility across counterterrorism, hazardous material handling, and mine clearance operations.

Moreover, the operational paradigm is shifting towards networked, collaborative platforms where ground robots, aerial drones, and command-and-control systems work in unison. This integrated approach not only accelerates response times but also provides layered redundancy, ensuring that critical disposal tasks can continue uninterrupted even if one asset is compromised. As a result, agencies are increasingly adopting integrated EOD ecosystems that leverage data connectivity, real-time analytics, and cross-domain interoperability to tackle the most sophisticated explosive threats.

Analyzing the Multilayered Effects of 2025 United States Tariff Implementations on the Production, Procurement, and Supply Chain Dynamics of EOD Equipment

The United States’ tariff measures implemented throughout 2025 have introduced complex headwinds for the production and procurement of explosive ordnance disposal equipment. A universal tariff of 10% on all imports, effective April 5, 2025, has applied additional financial burdens on critical components such as actuators, control modules, and sensor arrays, thereby increasing the baseline cost for domestic manufacturers and end users alike. Compounding this, the removal of de minimis import thresholds for goods arriving from China and Hong Kong, effective May 2, 2025, has eliminated a common avenue for low-value component sourcing, pushing organizations toward higher-cost supply channels and elongating procurement cycles.

Furthermore, longstanding Section 301 duties have continued to impose a 25% tariff on many electronics and chemical sensing modules sourced from China, resulting in cumulative duty rates that can exceed 35% on these integral parts. These multilayered tariffs have disrupted supply chain efficiencies, prompting both machinery suppliers and defense contractors to reevaluate their sourcing strategies. In response, several market participants have initiated shifts toward increased localization of critical subassemblies and strategic stockpiling of key technologies to hedge against future tariff escalations.

While these policy measures aim to bolster domestic manufacturing, they have also triggered concerns about short-term supply constraints and project delays. Procurement officers report extended lead times for ground-penetrating radar units and specialized metal detectors, as suppliers adjust to new tariff schedules and certification requirements. Consequently, operational readiness could be impacted if mitigations are not implemented in a timely manner, underscoring the need for agile supply chain management and proactive regulatory navigation.

In-Depth Exploration of Equipment Types, End-User Applications, Technological Frameworks, and Operational Scenarios Defining Market Segmentation of EOD Solutions

Market segmentation of explosive ordnance disposal solutions reveals four primary dimensions that encapsulate the full spectrum of operational and technological considerations. Firstly, categorization by equipment type highlights the prominence of bomb disposal robots, detection equipment, neutralization tools, and protective suits, with detection technologies further subdivided into chemical sensing, ground penetrating radar, metal detectors, and X-ray inspection modalities. This segmentation underscores tailored design principles, since each equipment category addresses specific operational challenges-from remote manipulation of live ordnance to early identification of concealed threats.

In parallel, analysis based on end users distinguishes the deployment needs of homeland security agencies, law enforcement entities, military forces, and private contracting firms. Each stakeholder group follows distinct procurement cycles, regulatory frameworks, and mission objectives, shaping unique product requirements and service offerings. For instance, military operations may emphasize ruggedized, high-endurance platforms, whereas law enforcement agencies prioritize rapid deployment and ease of use in urban scenarios.

Examining the market through the lens of technology further accentuates the role of chemical sensing, ground radar, metal detection, and X-ray inspection as foundational pillars. Innovations in these technological streams drive cross-cutting improvements in detection accuracy, environmental adaptability, and data integration, bolstering the overall efficacy of EOD systems regardless of their intended mission.

Finally, segmentation by application-comprising counterterrorism activities, hazardous material handling, military operations, and mine clearance-demonstrates how end-market use cases inform feature sets, regulatory compliance, and lifecycle support models. Collectively, these four segmentation frameworks enable a nuanced understanding of market needs and opportunities, guiding product development roadmaps and strategic positioning efforts.

This comprehensive research report categorizes the Explosive Ordnance Disposal Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Technology

- End User

- Application

Regional Dynamics and Strategic Priorities in the Americas, EMEA, and Asia-Pacific Shaping the Deployment, Development, and Procurement of EOD Equipment

The Americas region remains a principal driver of demand for explosive ordnance disposal equipment, buoyed by extensive defense budgets and robust homeland security programs within the United States and Canada. North American defense forces continue to modernize their EOD portfolios, emphasizing interoperable robotic platforms and enhanced sensor integration, while regional manufacturers capitalize on government procurement incentives to expand domestic production capabilities.

Europe, the Middle East, and Africa (EMEA) present a multifaceted landscape where evolving security dynamics and peacekeeping deployments shape market growth. In Western Europe, NATO-led standardization initiatives have prompted member states to procure systems that conform to unified operational criteria, fostering cross-border collaboration. Simultaneously, Middle Eastern nations are upgrading their EOD arsenals to counter asymmetric threats, and African peacekeeping contingents rely on portable detection and neutralization tools to ensure civilian safety in conflict-affected zones.

Asia-Pacific is emerging as a vibrant market, driven by rising defense expenditures in countries such as India, Japan, and Australia, alongside ongoing territorial security challenges in the region. Procurement strategies often emphasize the acquisition of multirole robotic systems and advanced detection suites to safeguard critical infrastructure and maritime interests. Additionally, burgeoning domestic defense industries are forging partnerships with global technology providers, aiming to co-develop and localize EOD solutions tailored to regional operational theaters.

This comprehensive research report examines key regions that drive the evolution of the Explosive Ordnance Disposal Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players, Their Strategic Initiatives, Collaborative Ventures, and Competitive Positioning Within the Global EOD Equipment Market

Leading companies in the explosive ordnance disposal equipment sector are advancing their market positions through investments in research collaborations, strategic acquisitions, and portfolio diversification. Some prominent innovators have introduced platform-agnostic software that enables seamless integration of new sensor types and AI-powered analytics, positioning themselves at the forefront of the digital transformation in EOD operations.

Meanwhile, robotics specialists continue to refine locomotive architectures, exploring hybrid mobility designs that merge tracked, wheeled, and legged configurations to navigate complex terrain. These developments are often bolstered by pilot programs conducted in collaboration with defense research laboratories, resulting in iterative enhancements that address real-world field feedback.

On the detection technologies front, several sensor manufacturers are forging alliances with material science institutions to accelerate the rollout of next-generation chemical and radiological detectors. Such partnerships aim to reduce detection thresholds and improve false-alarm mitigation, thereby increasing operational efficiency and safety margins.

In addition, service-oriented business models are gaining traction, with some firms offering as-a-service rental arrangements for EOD equipment. This approach provides end users with flexible access to the latest technologies without the capital expenditure burden and aligns vendor incentives with performance-based maintenance and training services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Explosive Ordnance Disposal Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Precision Limited

- Armtrac Limited

- ASCAN International, Inc.

- Caretta Technologies R&D S.r.l.

- CBRNergetics Limited

- Chemring Group PLC

- DCD Protected Mobility

- DuPont de Nemours, Inc.

- ELP GmbH

- Holdfast Systems

- iRobot Corporation

- KIRINTEC Ltd

- Med-Eng Holdings ULC

- NABCO Systems, LLC

- NIC Instruments Ltd.

- Northrop Grumman Corporation

- PKI Electronic Intelligence GmbH

- Point Blank Enterprises, Inc.

- Primetake Ltd

- Reamda Ltd.

- Safariland, LLC

- Scanna MSC Ltd.

- SCOPEX S.A.R.L.

- Thermo Fisher Scientific Inc.

Strategic Imperatives and Operational Guidance for Industry Leaders to Enhance Innovation, Supply Chain Resilience, and Market Leadership in EOD Solutions

Industry leaders should prioritize the development of modular, AI-enabled platforms that accommodate rapid sensor swaps and mission-specific toolkits. By adopting open architecture standards and investing in software-defined systems, organizations can ensure future compatibility and reduce upgrade cycles. Additionally, establishing diversified supply chains with dual-sourced critical components will mitigate tariff-induced cost fluctuations and bolster production continuity.

Moreover, companies are advised to deepen partnerships with academic and defense research institutions to co-develop breakthroughs in autonomous navigation and advanced threat discrimination. Collaborative ecosystem models can accelerate technology maturation while distributing development risks. Integrating lifecycle support services-such as predictive maintenance analytics and virtual-reality-based training-will further differentiate offerings and enhance customer loyalty.

To capitalize on regional growth pockets, market participants should align their product roadmaps with localized regulatory frameworks and end-user procurement cycles. Tailoring solutions for emerging markets, particularly in the Asia-Pacific and EMEA regions, can unlock new revenue streams and strengthen global footprint. Finally, adopting as-a-service and managed solutions models will attract budget-constrained agencies by lowering entry barriers and aligning costs with usage patterns, fostering long-term strategic relationships.

Comprehensive Research Framework Detailing Data Collection, Expert Consultations, Analytical Approaches, and Validation Techniques Underpinning the EOD Equipment Study

This study employs a rigorous research framework combining primary and secondary data sources to underpin its findings. Primary research involved in-depth interviews with EOD operators, procurement officers, and technical experts from military and civilian agencies, yielding qualitative insights into operational challenges and technology adoption drivers. Secondary research encompassed analysis of government procurement records, patent filings, regulatory documents, and open-source literature to map historical developments and current trends.

Quantitative data was collected through a comprehensive database of equipment specifications, product launches, and known contract awards. Triangulation methods were applied to reconcile disparate data points, ensuring consistency and reliability. Key performance indicators-such as response time improvements and detection accuracy gains-were assessed through case studies and field trial reports.

Market segmentation frameworks were validated through expert panels, while competitive benchmarking incorporated public financial disclosures and press releases. All data inputs underwent multiple validation rounds, facilitated by cross-functional analysts and domain specialists, to confirm contextual relevance and factual integrity. This methodological rigor ensures that the insights presented are both actionable and grounded in empirical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Explosive Ordnance Disposal Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Explosive Ordnance Disposal Equipment Market, by Equipment Type

- Explosive Ordnance Disposal Equipment Market, by Technology

- Explosive Ordnance Disposal Equipment Market, by End User

- Explosive Ordnance Disposal Equipment Market, by Application

- Explosive Ordnance Disposal Equipment Market, by Region

- Explosive Ordnance Disposal Equipment Market, by Group

- Explosive Ordnance Disposal Equipment Market, by Country

- United States Explosive Ordnance Disposal Equipment Market

- China Explosive Ordnance Disposal Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Critical Findings and Strategic Insights to Reinforce Decision-Making for Stakeholders Navigating the Evolving Explosive Ordnance Disposal Equipment Landscape

The evolving threat environment and rapid technological progress are reshaping how explosive ordnance disposal is approached by defense and security stakeholders worldwide. From the infusion of artificial intelligence and advanced sensors to the strategic impact of trade policies, stakeholders must navigate a complex interplay of innovation, regulation, and operational imperatives. By leveraging nuanced market segmentation, region-specific strategies, and insights into leading vendor approaches, decision makers can better align their procurement and development roadmaps with mission requirements and risk profiles.

Furthermore, the cumulative effects of tariff adjustments underscore the importance of supply chain agility and proactive sourcing strategies. The rise of modular, software-centric platforms and as-a-service delivery models presents new avenues for managing total cost of ownership while preserving access to cutting-edge capabilities. Ultimately, stakeholders who embrace collaborative ecosystems and data-driven decision making will be best positioned to advance the safety, effectiveness, and resilience of their explosive ordnance disposal operations.

Engage with Ketan Rohom to Secure Definitive Market Intelligence Report and Accelerate Strategic Decisions in Explosive Ordnance Disposal Equipment Today

To learn more about how these insights can guide your strategic decisions and operational planning, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Your next step towards informed procurement and technology adoption is just a conversation away. Secure access to the most comprehensive market research report on explosive ordnance disposal equipment today and position your organization at the forefront of defense and security innovation.

- How big is the Explosive Ordnance Disposal Equipment Market?

- What is the Explosive Ordnance Disposal Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?