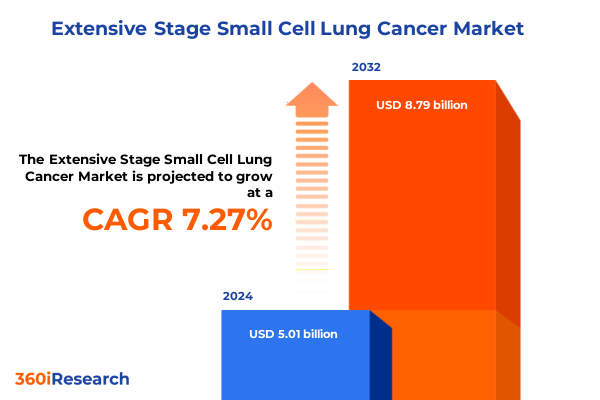

The Extensive Stage Small Cell Lung Cancer Market size was estimated at USD 5.36 billion in 2025 and expected to reach USD 5.74 billion in 2026, at a CAGR of 7.31% to reach USD 8.79 billion by 2032.

Navigating the Critical Challenges and Emerging Therapeutic Frontiers in the Diagnosis and Treatment Landscape of Extensive-Stage Small Cell Lung Cancer

Small cell lung cancer that has progressed to an extensive-stage diagnosis represents one of the most aggressive thoracic malignancies, characterized by rapid doubling times and a propensity for early dissemination. These tumors, accounting for approximately 15% of lung cancer cases, exhibit a clinical course in which disease spread beyond the ipsilateral hemithorax leads to a median survival of only six to twelve months under traditional chemotherapy regimens, underscoring a critical need for therapeutic innovation and deeper insight into patient outcomes.

Despite advances in diagnostic imaging and supportive care, overall five-year survival rates for extensive-stage small cell lung cancer remain dismally low, rarely exceeding single digits. Without treatment, patients face a median survival of just two to four months, and even with platinum-based chemotherapy-once the cornerstone of care-the five-year relative survival plateaus below 10%. This stark reality highlights the urgency for targeted research that unpacks evolving treatment paradigms and emerging clinical evidence to inform strategic planning across stakeholders in biopharma, healthcare delivery and policy domains.

In recent years, an evolving armamentarium of immune checkpoint inhibitors, bispecific antibodies and novel combination regimens has sparked renewed optimism. Landmark data showcasing improvements in progression-free and overall survival have challenged historical treatment ceilings and opened dialogue around personalized approaches, patient stratification and integrated care pathways. As these therapies transition from clinical trials into practice, it becomes imperative to synthesize the transformative shifts, supply chain considerations and stakeholder perspectives that define today’s extensive-stage small cell lung cancer ecosystem.

Understanding How Breakthrough Immunotherapies and Multimodal Regimens Are Reshaping Care Standards and Patient Outcomes in Extensive-Stage Small Cell Lung Cancer

Therapeutic innovation in extensive-stage small cell lung cancer has been defined by the integration of immuno-oncology agents with established chemotherapeutic backbones, fundamentally reshaping first-line and maintenance treatment standards. Early clinical trials combining anti-PD-L1 antibodies with platinum–etoposide regimens established a new benchmark, setting the stage for subsequent breakthroughs that extend survival and delay progression beyond historically accepted limits. Notably, results from the Phase III IMforte study demonstrated that adding lurbinectedin to atezolizumab maintenance achieved a 46% reduction in the risk of disease progression or death, reinforcing the potential of maintenance immunotherapy strategies.

Further amplifying this momentum, the randomized ETER701 trial introduced an antiangiogenic agent alongside a novel PD-1 inhibitor, anlotinib plus benmelstobart, in a four-drug regimen that delivered the longest progression-free and overall survival outcomes ever reported in extensive-stage settings. These findings not only underscore the viability of multi-mechanistic combinations but also illustrate how augmenting cytotoxic chemotherapy with targeted and immune-modulating compounds can unlock synergistic benefits, heralding a new era of treatment customization.

Concurrently, the advent of bispecific T-cell engagers has expanded the scope of immunotherapeutic intervention. Tarlatamab (Imdelltra), a first-in-class DLL3 × CD3 engager, received accelerated approval after clinical data revealed a 40% reduction in mortality risk and improved tolerability compared to salvage chemotherapy. This milestone affirms the role of next-generation biologics in addressing the unmet needs of patients whose disease has progressed following standard platinum-based regimens. Collectively, these advances mark a paradigm shift from one-size-fits-all protocols to multi-agent, biology-driven regimens that prioritize both efficacy and quality of life.

Evaluating the Cumulative Impact of 2025 U.S. Pharmaceutical Tariff Policies on Treatment Accessibility and Supply Chains for Advanced Small Cell Lung Cancer

The imposition of broad-based tariffs on pharmaceutical imports in 2025 has introduced significant headwinds for treatment delivery and supply chain resilience in extensive-stage small cell lung cancer. A global 10% levy on nearly all imported goods-including active pharmaceutical ingredients (APIs) and essential biologic components-has raised manufacturing costs, prompting leading drugmakers to reevaluate sourcing strategies and manufacturing footprints to attenuate potential price escalations for patients and health systems alike.

Beyond a uniform global tariff, differentiated duties of up to 25% on APIs sourced from key suppliers in China and India have exerted additional cost pressures on both generic chemotherapy agents and innovative immuno-oncology drugs. As generics account for approximately 90% of U.S. prescriptions, even modest tariff-induced price increases can reverberate through hospital stewards, oncology clinics and outpatient care providers, potentially constraining formulary decisions and limiting access to critical maintenance or salvage therapies for vulnerable patient groups.

Amid these evolving trade dynamics, pharmaceutical manufacturers and distributors have accelerated plans to expand domestic manufacturing capacity, leveraging investment incentives and public–private partnerships to localize production of both small molecules and complex biologics. While such initiatives aim to secure long-term supply chain stability, transitional disruptions-manifesting as intermittent shortages of intravenous chemotherapeutic infusions and delays in biologic availability-underscore the necessity for integrated risk management frameworks. Ultimately, navigating the cumulative impact of 2025 U.S. tariffs demands agile supply chain diversification, proactive stakeholder collaboration and strategic pricing models to safeguard patient access in an increasingly protectionist policy environment.

Uncovering Key Patient and Channel Segmentation Insights Informing Personalized Treatment Approaches and Distribution Strategies in ES-SCLC

Insight into treatment type segmentation reveals that traditional chemotherapy remains foundational, encompassing alkylating agents, platinum complexes and topoisomerase inhibitors, yet its combination with immunotherapy and targeted therapy has become more nuanced. Immunotherapy segments now include CTLA-4 inhibitors, PD-1 inhibitors and PD-L1 inhibitors, offering diverse immune checkpoint blockade options. Meanwhile, targeted therapy subsegments-PARP inhibitors and tyrosine kinase inhibitors-address specific molecular vulnerabilities, underscoring an era of precision interventions.

Equally critical are distribution channel dynamics where hospital pharmacies continue to serve as primary treatment hubs for high-acuity infusions, while online pharmacies are gaining traction for oral-oncology agents in maintenance phases. Retail pharmacies also play an increasing role in facilitating patient adherence through oral dosing options, demonstrating the fluid movement of therapies across outpatient and community-based settings.

End user insights illustrate that home healthcare settings are expanding their scope to administer supportive and palliative infusions, complementing the specialized care provided by hospitals and the focused expertise of oncology clinics. This diversified end-user environment reflects an overarching trend toward patient-centric care, with treatment delivered in modalities that align with individual preferences and clinical imperatives.

Mode of administration remains a defining factor in treatment planning: intravenous regimens dominate first-line and maintenance protocols for their rapid pharmacokinetic delivery, whereas oral therapies offer convenience and continuity, particularly for targeted and some immunotherapeutic agents that support extended outpatient management.

This comprehensive research report categorizes the Extensive Stage Small Cell Lung Cancer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Treatment Type

- Mode Of Administration

- Prescription Type

- Distribution Channel

- End User

Analyzing Regional Dynamics Across the Americas, Europe Middle East Africa, and Asia-Pacific to Uncover Distinct Patterns in ES-SCLC Treatment and Access

In the Americas, extensive-stage small cell lung cancer management is characterized by rapid adoption of novel immuno-oncology therapies approved by the FDA, alongside concerted efforts to decentralize care delivery into outpatient infusion centers and home health services. The region’s robust private and public payer frameworks, combined with active clinical trial networks, fuel early access programs and real-world evidence generation, enhancing therapeutic uptake in community oncology settings.

Across Europe, the Middle East and Africa, market dynamics are shaped by diverse regulatory landscapes and reimbursement pathways. Regions within the European Union benefit from centralized EMA approvals-such as the recent endorsement of serplulimab in the European Union-while Middle Eastern and African markets navigate varied healthcare infrastructure capabilities. Cost-containment policies and health technology assessments influence formulary placement, prompting manufacturers to adopt outcome-based pricing and risk-sharing agreements to address budgetary pressures.

In Asia-Pacific, an escalating incidence of small cell lung cancer-driven by rising smoking rates in select countries-coincides with accelerated clinical and commercial collaborations. Nations such as China and Japan are expanding domestic R&D ecosystems, exemplified by local development of anti-PD-1 agents and partnerships with global biopharma. Meanwhile, regulatory agencies in emerging Asia-Pacific markets are streamlining approval pathways to facilitate access to breakthrough therapies, albeit within resource-constrained healthcare delivery environments that necessitate strategic prioritization of high-value treatments.

This comprehensive research report examines key regions that drive the evolution of the Extensive Stage Small Cell Lung Cancer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Pipeline Innovations from Leading Biopharmaceutical Companies Driving Advances in ES-SCLC Therapy Development

Leading biopharmaceutical companies are driving the ES-SCLC evolution through differentiated pipelines and strategic partnerships. Amgen’s bispecific antibody, tarlatamab (Imdelltra), has demonstrated significant survival improvements and manageable safety profiles, securing its position as a pivotal third-line option following platinum-based chemotherapy failure. With a 40% reduction in risk of death, this therapy underlines Amgen’s commitment to innovative biotherapeutics-anchored by accelerated regulatory pathways and robust Phase III data.

Roche has leveraged its immuno-oncology portfolio by combining atezolizumab with lurbinectedin, achieving landmark maintenance outcomes in the IMforte study. This complementary approach exemplifies how incumbent immunotherapy frameworks can integrate targeted agents to yield substantive gains in progression-free survival, reinforcing Roche’s role as a catalyst for combination innovation.

AstraZeneca’s established expertise in PD-L1 blockade is further exemplified by durvalumab (Imfinzi), which recently extended its label into limited-stage small cell lung cancer based on compelling post-chemoradiation maintenance benefits. Concurrently, burgeoning players such as Henlius have secured marketing authorization for serplulimab in the European Union, reflecting the globalization of PD-1 inhibitor development and expanding the field’s competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Extensive Stage Small Cell Lung Cancer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Amgen Inc.

- Astellas Pharma Inc.

- AstraZeneca PLC

- BeOne Medicines Ltd.

- Boehringer Ingelheim GmbH

- Bristol Myers Squibb Company

- Daiichi Sankyo Company, Limited

- Eisai Co., Ltd.

- Eli Lilly & Company Ltd.

- Exelixis, Inc.

- F. Hoffmann-La Roche AG

- Gilead Sciences, Inc.

- GlaxoSmithKline PLC

- Incyte Corporation

- Jazz Pharmaceuticals plc

- Jiangsu Hengrui Pharmaceuticals Co., Ltd.

- Johnson & Johnson Services, Inc.

- Merck KGaA

- Nektar Therapeutics

- Nippon Kayaku Co.,Ltd.

- Novartis AG

- Pfizer, Inc.

- Sandoz AG

- Sanofi S.A.

- Shanghai Henlius Biotech, Inc.

- Shanghai Junshi Biosciences Co. Ltd.

- Takeda Pharmaceutical Co. Ltd.

Delivering Actionable Strategic Recommendations for Industry Leaders to Accelerate Innovation, Optimize Supply Chains and Improve Patient Outcomes in ES-SCLC

Industry leaders should prioritize integrated supply chain strategies to mitigate tariff-related disruptions by forging partnerships with domestic API and biologics manufacturers. By diversifying sourcing across multiple geographies and investing in onshore capacity, stakeholders can stabilize production pipelines and safeguard against future policy volatility.

Simultaneously, clinical development teams must embrace adaptive trial designs that accelerate proof-of-concept for combination regimens. Leveraging real-world evidence and biomarker-driven substudies will refine patient selection, enhance trial efficiency and support value-based contracting with payers in an environment of increasing outcome scrutiny.

Commercial organizations are advised to deploy omnichannel engagement models that align distribution channels with patient treatment pathways. Establishing seamless transitions between hospital-based infusions, home health services and online pharmacy fulfillment will improve adherence and patient satisfaction across diverse care settings.

Finally, strategic alliances between pharmaceutical innovators and healthcare providers can facilitate risk-sharing agreements, early access programs and joint R&D initiatives. Collaborative frameworks that integrate payers, providers and patient advocacy groups will be instrumental in aligning therapeutic value with reimbursement models, ultimately driving sustainable access to breakthrough ES-SCLC therapies.

Detailing a Robust Mixed-Methods Research Methodology Incorporating Primary Interviews, Secondary Data, and Expert Panels for ES-SCLC Insights

This report synthesizes insights from a comprehensive mixed-methods research design, beginning with in-depth interviews conducted among clinical thought leaders, hospital pharmacists and oncology trial investigators across key geographies. These primary data were coupled with a systematic review of peer-reviewed literature, conference proceedings and regulatory filings to validate emerging trends and therapeutic milestones.

Secondary data sources included public health databases, regulatory authority archives and industry publications to contextualize market dynamics, tariff impacts and regional policy shifts. Each data point was triangulated through cross-verification with proprietary databases and financial disclosures to ensure analytical rigor and minimize bias.

An advisory panel of subject matter experts in thoracic oncology, pharmacoeconomics and supply chain management reviewed preliminary findings, offering critical feedback that shaped the segmentation framework, risk assessment models and actionable recommendations. Methodological limitations-such as variability in reporting standards and evolving policy landscapes-were addressed through sensitivity analyses and iterative stakeholder consultations to maintain robustness.

Together, these methodological components coalesce into a transparent and replicable research construct, equipping decision-makers with credible insights into the technical, commercial and strategic dimensions of the extensive-stage small cell lung cancer landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Extensive Stage Small Cell Lung Cancer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Extensive Stage Small Cell Lung Cancer Market, by Treatment Type

- Extensive Stage Small Cell Lung Cancer Market, by Mode Of Administration

- Extensive Stage Small Cell Lung Cancer Market, by Prescription Type

- Extensive Stage Small Cell Lung Cancer Market, by Distribution Channel

- Extensive Stage Small Cell Lung Cancer Market, by End User

- Extensive Stage Small Cell Lung Cancer Market, by Region

- Extensive Stage Small Cell Lung Cancer Market, by Group

- Extensive Stage Small Cell Lung Cancer Market, by Country

- United States Extensive Stage Small Cell Lung Cancer Market

- China Extensive Stage Small Cell Lung Cancer Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Converging Insights to Articulate Strategic Conclusions on Opportunities and Challenges in the Future Landscape of Extensive-Stage Small Cell Lung Cancer

Bridging decades of therapeutic stagnation in extensive-stage small cell lung cancer, the convergence of immunotherapies, targeted agents and innovative combination regimens marks a transformative inflection point. While historical survival metrics underscored the aggressive nature of the disease, recent clinical breakthroughs have shifted paradigms-establishing new benchmarks for progression-free and overall survival.

Simultaneously, geopolitical developments and tariff policies have recalibrated supply chain imperatives, prompting stakeholders to adopt resilient sourcing strategies and invest in onshore manufacturing. This heightened focus on supply chain agility must coexist with continued innovation in drug development to ensure that regulatory milestones translate into tangible patient benefits.

Segmentation analyses reveal nuanced opportunities to tailor treatment delivery across diverse distribution and end-user channels, underscoring the importance of patient-centric models that balance clinical efficacy with logistical feasibility. Regional insights further emphasize the need for adaptable commercialization strategies, reflective of varying reimbursement architectures and healthcare infrastructure capacities.

Ultimately, the strategic landscape of extensive-stage small cell lung cancer offers a confluence of scientific promise and market complexity. Stakeholders equipped with the insights and recommendations from this report will be best positioned to navigate evolving therapeutic frontiers, optimize operational resilience and improve outcomes for patients facing this formidable disease.

Connect with Ketan Rohom to Secure This Comprehensive ES-SCLC Market Research Report and Empower Your Strategic Decision-Making Today

To explore these comprehensive findings and tailor them to your organization’s objectives, connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan will guide you through how this report’s in-depth analyses, expert interviews and strategic recommendations can empower your next moves in research, pipeline prioritization, and commercial execution. Reach out today to secure immediate access and begin leveraging insights that will shape your success in the evolving extensive-stage small cell lung cancer landscape.

- How big is the Extensive Stage Small Cell Lung Cancer Market?

- What is the Extensive Stage Small Cell Lung Cancer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?