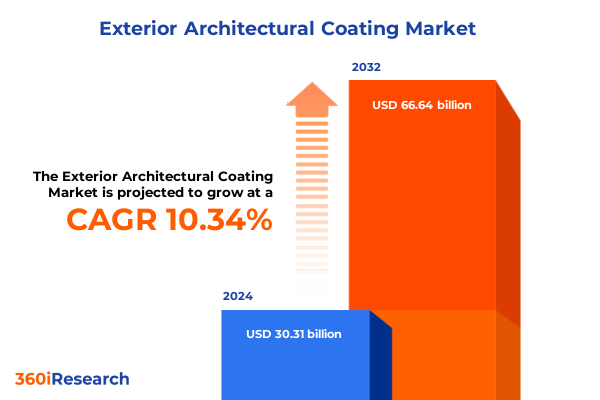

The Exterior Architectural Coating Market size was estimated at USD 33.19 billion in 2025 and expected to reach USD 36.34 billion in 2026, at a CAGR of 10.47% to reach USD 66.64 billion by 2032.

Exploring the Dynamic Evolution of Exterior Architectural Coatings Driven by Innovation, Sustainability, and Regulatory Transformations

Exploring the Dynamic Evolution of Exterior Architectural Coatings Driven by Innovation, Sustainability, and Regulatory Transformations

Exterior architectural coatings have emerged as a vital intersection of protection, aesthetics, and performance across building exteriors. What once began as simple pigment and binder mixtures to shield surfaces from moisture and UV radiation has evolved into advanced systems engineered for long-term durability, color retention, and environmental compliance. As urbanization accelerates and construction projects diversify from high-rise developments to heritage restorations, the role of these coatings extends far beyond basic weatherproofing, reflecting a deeper emphasis on sustainability, health, and design versatility.

Amid shifting regulatory frameworks and heightened environmental scrutiny, manufacturers and applicators have recalibrated their strategies to align with new standards for volatile organic compounds and lifecycle emissions. Collaborative innovation between raw material suppliers, formulators, and applicators has given rise to waterborne chemistries, high-solid and powder coatings, and specialized technologies such as energy-curable systems. This landscape is further shaped by clients demanding low-maintenance facades, self-cleaning capabilities, and enhanced thermal performance, prompting suppliers to reimagine coatings as multifunctional solutions rather than mere finishes.

Transitioning seamlessly from traditional solvent-based enamels to cutting-edge nano-enabled and infrared-reflective formulations underscores the sector’s ability to adapt. Concurrently, end users-ranging from property owners and general contractors to architects and facility managers-are increasingly drawn to coatings that contribute to building certifications, operational cost reduction, and improved occupant well-being.

Against this backdrop of intensifying architectural aspirations and regulatory mandates, this executive summary contextualizes the current state of exterior architectural coatings. The following sections dissect transformative trends, tariff pressures, segmentation dynamics, regional disparities, and leading corporate strategies, culminating in targeted recommendations and a robust methodology underpinning our insights.

Unraveling Fundamental Shifts Redefining Exterior Architectural Coatings Through Digitalization, Sustainable Practices, and Materials Innovation

Unraveling Fundamental Shifts Redefining Exterior Architectural Coatings Through Digitalization, Sustainable Practices, and Materials Innovation

The trajectory of exterior architectural coatings has been profoundly influenced by an industry-wide pivot toward sustainable and eco-conscious formulations. Manufacturers are hastening the adoption of water-based and powder-based systems, which not only slash volatile organic compound emissions but also cater to stringent green building benchmarks. Simultaneously, energy-curable coatings such as UV/EB technologies have gained momentum, offering solvent-free, rapid cure benefits that align with both environmental imperatives and production efficiency demands.

In parallel, advanced protective properties have risen to the forefront of product development. Exterior flat and nonflat coatings are now engineered to resist UV-induced chalking, thermal cycling, and mildew growth, while roof-specific formulations integrate infrared-reflective pigments to attenuate surface heat buildup. Regulatory imperatives, such as the EPA’s National VOC Emission Standards for Architectural Coatings, continue to drive reductions in allowable solvent content, prompting a shift toward high-solid and hybrid chemistries that meet performance targets without compromising compliance.

As digitalization reshapes customer engagement and product specification, color-matching software, AI-driven formulation tools, and cloud-based project management platforms are streamlining the painting process from design concept through final inspection. These digital advances bolster consistency, reduce waste, and accelerate time to market, while enabling remote monitoring of cure profiles and weather conditions to optimize application windows.

Moreover, materials innovation is uncovering new frontiers in nanotechnology, antimicrobial additives, and smart coatings that adapt to environmental stimuli. This wave of transformation is underpinned by supply chain realignments, which emphasize nearshoring of specialty resins, diversification of pigment sources, and strategic partnerships to mitigate risk. Together, these shifts herald a new era in which exterior architectural coatings transcend their conventional role to become integral components of high-performance, resilient, and sustainable building envelopes.

Assessing the Comprehensive Impact of 2025 U.S. Tariffs on Input Costs, Supply Chain Strategies, and Market Competitiveness in Exterior Coatings

Assessing the Comprehensive Impact of 2025 U.S. Tariffs on Input Costs, Supply Chain Strategies, and Market Competitiveness in Exterior Coatings

The reinstatement and expansion of Section 232 tariffs on steel and aluminum in early 2025 has had immediate ramifications for exterior coatings manufacturers, particularly those reliant on metal substrates for rollers, spray equipment, and aluminum-based pigments. The elimination of exemptions and the restoration of a 25 percent duty on steel imports in February, followed by an uptick to a 50 percent levy in June, elevated raw material costs and prompted many producers to reevaluate their metal sourcing strategies. As a result, components such as zinc and aluminum silicate pigments experienced cascading price adjustments, compelling formulators to explore alternative fillers and expand recycling initiatives.

Meanwhile, the conclusion of the USTR’s four-year review under Section 301 led to heightened duties on specific inputs like solar-grade polysilicon and tungsten products, with rates rising to 50 percent and 25 percent respectively on January 1, 2025. While polysilicon is primarily associated with photovoltaic modules, its insulation and reflective properties find niche applications in high-performance coatings, meaning that increased duties on these materials can indirectly influence specialty decorative and protective formulations.

Concurrently, the administration’s imposition of a 10 percent ad valorem tariff on all Chinese-origin goods under a fentanyl-related executive order, and the subsequent doubling of that surcharge to 20 percent, have compounded cost pressures on polymeric resins and additives sourced from East Asia. The elimination of the de minimis exemption further ensures that even low-value shipments are no longer shielded from full duty assessments, intensifying the incentive to localize procurement and to secure alternative compound libraries from regional suppliers.

Adding to these complexities, the February 1, 2025, enactment of 25 percent tariffs on chemical and coating imports from Canada and Mexico, alongside a 10 percent duty on Chinese coatings constituents, accelerated the shift toward North American production ‒ affecting everything from alkyd resins to silicone additives. Industry associations have highlighted the need for strategic inventory management, multi-sourcing protocols, and close engagement with customs brokers to navigate the evolving duty landscape without sacrificing delivery timelines or quality standards.

Together, these tariff measures underscore the urgency of supply chain resilience, cost management, and regulatory acumen. As manufacturers adapt to a persistent environment of elevated duties, the ability to forecast input requirements, negotiate long-term contracts, and qualify local or nearshore suppliers will be paramount to sustaining competitive advantage in the exterior architectural coatings arena.

Deciphering Critical Segmentation Trends Shaping Product, Composition, Application, Distribution, and End-Use Dynamics Within Exterior Coatings

Deciphering Critical Segmentation Trends Shaping Product, Composition, Application, Distribution, and End-Use Dynamics Within Exterior Coatings

Exterior coatings tailored on the basis of product type – including acrylics renowned for UV stability, cost-effective alkyd resins, high-performance epoxies prized for chemical resistance, and weatherproof silicones – cater to distinct end-user requirements and climatic demands. Acrylics command significant uptake in residential projects for their balance of cost and longevity, while silicones gain ground in harsh UV environments for sealant and facade applications. This product-oriented differentiation remains a central axis of innovation, as formulators refine polymer backbones and crosslink density to enhance adhesion and gloss retention.

Composition-based segmentation further delineates market activity into high-solid coatings that reduce solvent emissions, powder coatings promoting virtually zero-VOC profiles, solvent-based systems offering established performance, and water-based alternatives that satisfy stringent environmental codes. Waterborne chemistries continue to displace conventional solvent systems, driven by regulatory caps on VOC content and a growing demand for low-odor, quick-dry solutions suitable for occupied structures.

The method of application – whether brush, roller, or spray – influences both formulation rheology and equipment investment. Brush and roller techniques remain prevalent for smaller-scale or precision work, whereas spray application dominates large-scale commercial and industrial projects to ensure uniform coverage and thicker film builds. Coatings optimized for airless spray delivery now incorporate anti-sag agents and advanced wetting promoters to achieve superior leveling and substrate penetration in demanding settings.

Distribution dynamics encompass direct sales channels enabling bespoke formulation support and bulk procurement, partnerships with distributors and dealers offering regional inventory depth, and the burgeoning role of online sales that bring quick access to packaged systems and touch-up solutions. The rise of digital commerce in coatings has expanded the reach of niche specialty products, while traditional channel partners continue to provide critical technical training and field support.

Market offerings span floor coatings – encompassing deck sealants and driveway finishes – to roof systems designed for concrete and metal substrates, and wall coatings formulated for exterior facades. The distinct performance criteria for each application drive R&D into adhesion enhancers, water impermeability, and thermal expansion compatibility. Finally, end-use segmentation across commercial, industrial, and residential sectors dictates volume requirements, specification protocols, and end-user expectations. Industrial facilities often stipulate high-durability epoxies and polyurethanes, while residential homeowners prioritize aesthetics, ease of application, and eco-friendly credentials. As these segmentation layers converge, they chart a multifaceted landscape in which coating suppliers must deftly align formulations with targeted performance and regulatory compliance.

This comprehensive research report categorizes the Exterior Architectural Coating market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Composition

- Application Method

- Distribution Channel

- Application

- End Use

Highlighting Strategic Regional Variations and Growth Opportunities Across the Americas, Europe Middle East Africa, and Asia Pacific Exterior Coatings Markets

Highlighting Strategic Regional Variations and Growth Opportunities Across the Americas, Europe Middle East Africa, and Asia Pacific Exterior Coatings Markets

In the Americas, the mature markets of the United States and Canada exhibit a strong appetite for renovation-driven exterior recoating projects and code-compliant low-VOC formulations. Municipal mandates targeting energy efficiency in building envelopes have spurred demand for cool roof systems and reflective wall coatings. Supply chain resilience is underscored by nearshore manufacturing of resins and pigment dispersion, supported by established distribution networks that service both urban centers and suburban developments.

Across Europe, regulatory rigor remains a defining force under REACH and the Construction Products Regulation, compelling formulators to secure CE marking and to adhere to detailed safety data protocols. The Middle East continues to invest in large-scale infrastructure and commercial real estate projects, prioritizing coatings that can withstand extreme temperatures and sand abrasion. Meanwhile, Africa’s nascent markets present long-term promise, with growth contingent on improved logistics, local manufacturing partnerships, and targeted product launches that address tropical climatic challenges.

Asia Pacific leads in urban expansion, driven by China, India, and Southeast Asia’s booming construction sectors. Domestic players in these regions capitalize on scale to bring competitively priced water-based and powder coating formulations to market, while global suppliers forge joint ventures and licensing agreements to gain regional footholds. In high-growth corridors, the intersection of rapid development and environmental stewardship has elevated interest in HVAC-compatible coatings, building-integrated photovoltaics, and antimicrobial exterior surfaces.

Taken together, these regional distinctions underscore a market characterized by regulatory complexity, climatic diversity, and evolving distribution paradigms. Successful participants will be those who can adapt formulations, service models, and strategic investments to the unique drivers of each geography.

This comprehensive research report examines key regions that drive the evolution of the Exterior Architectural Coating market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering the Strategic Moves and Innovation Portfolios of Leading Global Companies Steering the Exterior Architectural Coatings Landscape

Uncovering the Strategic Moves and Innovation Portfolios of Leading Global Companies Steering the Exterior Architectural Coatings Landscape

The Sherwin-Williams Company has pursued an aggressive M&A strategy, integrating specialty resin manufacturers and regional distributors to bolster its market coverage. Investments in its R&D centers have accelerated the launch of low-VOC exterior lines and advanced reflective roof coatings. By leveraging its distribution arm’s reach, Sherwin-Williams has enhanced technical support services, driving both professional specification and DIY acceptance across diverse segments.

PPG Industries has emphasized digital engagement, deploying color-visualization apps and e-commerce portals to reduce specification errors and augment field productivity. Its collaboration with architectural software platforms has enabled builders to integrate coating specifications directly into BIM workflows, while its continuous development of epoxy and polyurethane blends addresses the rigorous demands of industrial and infrastructure projects.

AkzoNobel has steered its market proposition toward sustainability, with flagship programs targeting cradle-to-cradle certification and carbon neutrality in manufacturing. By introducing high-solid, powder, and UV-curable systems under its flagship Dulux and International brands, the company has reinforced its commitment to green building agendas and LEED credits. Strategic alliances with raw material suppliers have ensured priority access to next-generation bio-based resins.

Nippon Paint and Asian Paints, dominant in Asia Pacific, have expanded through joint ventures and licensing in neighboring markets, while tailoring their product portfolios to local substrate preferences and climatic conditions. Their localized R&D facilities and production hubs facilitate cost-competitive offerings, particularly in large-scale urban housing and infrastructure contracts.

RPM International has leveraged its specialty coatings subsidiaries to target niche applications, such as corrosion-resistant roof coatings and antimicrobial facade treatments. The company’s decentralized model empowers business units to pursue targeted innovations, enabling rapid responses to specific customer needs and regulatory updates. These concerted efforts by leading players illustrate how strategic investment in innovation, digital tools, and sustainability initiatives defines competitive differentiation in the exterior architectural coatings sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Exterior Architectural Coating market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Asian Paints Limited

- BASF SE

- Behr Process LLC

- Benjamin Moore & Co.

- Cromology

- DAW SE

- Dunn-Edwards Corporation

- Hempel A/S

- Jotun A/S

- Kansai Paint Co., Ltd.

- Kelly-Moore Paint Company, Inc.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- The Sherwin-Williams Company

Formulating Impactful Strategic Recommendations to Propel Growth, Operational Excellence, and Sustainability in Exterior Coatings Enterprises

Formulating Impactful Strategic Recommendations to Propel Growth, Operational Excellence, and Sustainability in Exterior Coatings Enterprises

Companies should intensify investment in low-VOC and energy-curable chemistries that align with increasingly stringent environmental mandates, ensuring early compliance and reducing potential liabilities. By accelerating the transition to waterborne and high-solid formulations, organizations can secure leadership in green building segments and capture specification opportunities associated with energy-efficient facade systems.

To mitigate tariff-induced cost escalations, firms must diversify their raw material base through regional supply partnerships and strategic stockpiling agreements. Nearshore production of pigment dispersions, resins, and additives will enhance supply chain resilience and curtail lead times. In parallel, long-term supplier contracts with value-based pricing mechanisms can preserve gross margins in a climate of evolving duty structures.

Embracing digital platforms that facilitate color formulation, real-time weather monitoring, and project tracking will improve application accuracy and reduce rework. Integrating these tools into field operations fosters data-driven decision-making, enabling precise material usage forecasts and optimized crew deployment.

A robust portfolio segmentation strategy should prioritize high-value niches-such as reflective roof coatings, specialty deck finishes, and antimicrobial exterior surfaces-while sustaining core offerings for walls and facades. Tailoring marketing and training programs for each channel, whether professional applicators, distributors, or digital buyers, will maximize adoption and reinforce brand loyalty.

Finally, deepening collaboration with architectural and engineering firms to co-develop project-specific solutions can strengthen specification pipelines. Joint research initiatives with universities and materials institutes will yield breakthrough technologies, positioning companies at the vanguard of performance, sustainability, and aesthetic innovation.

Outlining a Robust Research Framework Integrating Primary Insights, Secondary Data Analysis, and Rigorous Validation for Market Intelligence

Outlining a Robust Research Framework Integrating Primary Insights, Secondary Data Analysis, and Rigorous Validation for Market Intelligence

Our research methodology combined primary interviews with senior executives across coatings manufacturers, raw material suppliers, and leading applicators, capturing firsthand perspectives on emerging formulations, regulatory pressures, and supply chain adjustments. These insights were supplemented by structured surveys of distributor networks to gauge inventory positioning, order volumes, and channel shifts.

Secondary data were sourced from regulatory databases, technical journals, industry association publications, and publicly available company disclosures, providing quantitative context on product launches, patent activity, and tariff announcements. We applied a triangulation approach, cross-referencing tariff schedules, government fact sheets, and trade press coverage to assemble an accurate timeline of duty changes and their projected impacts.

Analytical frameworks-such as Porter’s Five Forces and PESTLE-were utilized to assess competitive intensity and external drivers. Segmentation analysis incorporated categorical dimensions including product type, composition, application method, distribution channel, end-use, and geographic region, ensuring a holistic view of market dynamics.

Quality control measures included peer reviews by subject-matter experts and validation sessions with industry stakeholders. Data credibility was reinforced by reconciling discrepancies between proprietary research and publicly reported figures, while acknowledging any residual uncertainties or methodological limitations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Exterior Architectural Coating market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Exterior Architectural Coating Market, by Product Type

- Exterior Architectural Coating Market, by Composition

- Exterior Architectural Coating Market, by Application Method

- Exterior Architectural Coating Market, by Distribution Channel

- Exterior Architectural Coating Market, by Application

- Exterior Architectural Coating Market, by End Use

- Exterior Architectural Coating Market, by Region

- Exterior Architectural Coating Market, by Group

- Exterior Architectural Coating Market, by Country

- United States Exterior Architectural Coating Market

- China Exterior Architectural Coating Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding with Strategic Perspectives on Market Adaptation, Resilience, and Future Readiness in Exterior Architectural Coatings Sector

Concluding with Strategic Perspectives on Market Adaptation, Resilience, and Future Readiness in Exterior Architectural Coatings Sector

The exterior architectural coatings market stands at a juncture defined by accelerated technological progress, regulatory evolution, and trade policy complexities. The collective impetus toward sustainability has driven widespread adoption of low-VOC, waterborne, and energy-curable solutions, while advances in nanotechnology and IR-reflective additives continue to expand functional capabilities.

At the same time, the imposition of U.S. tariffs in 2025 has underscored the imperative for supply chain diversification and localized production strategies. Companies that proactively realign their procurement frameworks and solidify relationships with regional suppliers are better positioned to maintain cost competitiveness and service continuity.

Segmentation insights reveal that successful players will be those who deliver specialized formulations tailored to application-specific demands-whether protecting decks, driveways, concrete or metal roofs, or high-traffic commercial facades-while leveraging digital platforms to engage end users and streamline specification. Regional nuances in the Americas, EMEA, and Asia Pacific underscore the need for adaptable go-to-market approaches and strong channel partnerships.

Ultimately, industry leaders who integrate sustainability credentials, operational agility, and customer-centric innovation will define the contours of the next growth phase. By leveraging data-driven strategies, forging collaborative R&D alliances, and anticipating regulatory shifts, organizations will secure both immediate gains and long-term resilience in a market characterized by rapid transformation.

Initiating Direct Engagement with Ketan Rohom to Unlock Comprehensive Exterior Coatings Market Intelligence and Drive Strategic Decision-Making

We invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this market research report can inform and elevate your strategic initiatives in the exterior architectural coatings domain. Engaging with Ketan offers you tailored insights on performance formulations, regulatory dynamics, tariff implications, and regional growth factors. By partnering with an expert who understands both market intricacies and commercial objectives, you’ll gain the clarity and confidence required to navigate complex supply chains, optimize product portfolios, and accelerate entry into emerging geographies.

Reach out to Ketan Rohom to secure your copy of the comprehensive exterior architectural coatings market research report and unlock the full potential of actionable data, bespoke consultancy, and ongoing support. Whether you aim to refine your sustainability roadmap, fortify your competitive positioning, or identify new avenues for innovation, this report will serve as your definitive guide to informed decision-making and sustained growth.

- How big is the Exterior Architectural Coating Market?

- What is the Exterior Architectural Coating Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?