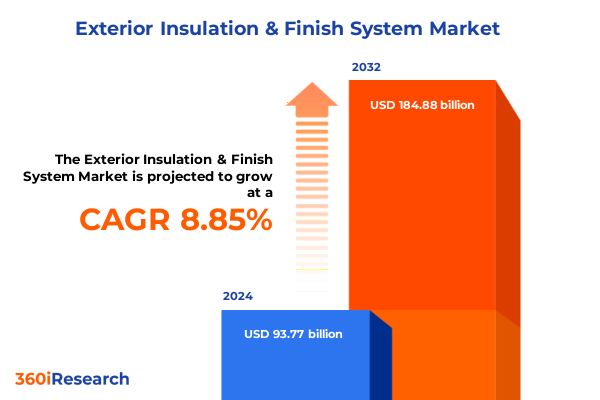

The Exterior Insulation & Finish System Market size was estimated at USD 102.18 billion in 2025 and expected to reach USD 111.34 billion in 2026, at a CAGR of 8.84% to reach USD 184.88 billion by 2032.

Navigating the Evolution of Exterior Insulation and Finish Systems with an Overview of Core Drivers Shaping Market Trajectories

The exterior insulation and finish systems sector stands at the forefront of global construction innovation, driven by the urgent need to enhance building performance, sustainability, and aesthetic appeal. As energy efficiency and carbon reduction imperatives intensify, this market is evolving beyond basic thermal solutions into a sophisticated ecosystem where advanced materials and integrated design strategies converge. In this introduction, we set the stage for a deep exploration of the forces propelling this evolution, highlighting the critical role of exterior systems in delivering resilience, cost effectiveness, and regulatory compliance.

Our analysis begins with an examination of the key drivers shaping demand for these composite systems. Building decarbonization mandates and net-zero targets are steering architects and developers toward systems that not only insulate but also offer durability against weather extremes. Technological breakthroughs in insulation materials and finishes are expanding performance envelopes, while regulatory frameworks are consistently raising the bar for thermal transmittance and fire safety. By unpacking these core trends, this section provides decision makers with a solid foundation for understanding how the exterior systems landscape is being transformed from the ground up.

Identifying the Pivotal Technological, Regulatory, and Sustainability Shifts Reshaping the Exterior Insulation and Finish System Ecosystem Today

In recent years, the exterior insulation and finish systems landscape has undergone transformative shifts that are redefining how stakeholders approach envelope design, material selection, and project execution. Disruptive technological advances, such as building information modeling and digital twin platforms, have enabled stakeholders to simulate system performance across climate scenarios and optimize component integration before ground is broken. This virtual-first mindset is accelerating project timelines and minimizing costly on-site errors, ultimately reshaping the entire development lifecycle.

Simultaneously, sustainability has moved from a peripheral consideration to a central requirement. Lifecycle assessments and embodied carbon protocols are now integral to procurement decisions, prompting innovation in bio-derived insulation foams and low-VOC finishes. These eco-centric materials also enjoy growing acceptance among certification bodies, further propelling their adoption. At the regulatory level, tightened building codes addressing energy consumption and fire retardancy have compelled manufacturers to invest heavily in research and development, elevating performance benchmarks and ushering in a new era of safety and efficiency.

Moreover, global supply chains are adapting to unprecedented volatility caused by geopolitical tensions and raw material scarcity. Forward-leaning organizations are forging regional partnerships and diversifying supplier portfolios to mitigate risk, while circular economy principles are gaining traction through the reuse and recycling of system components. As these cumulative shifts take hold, the EIFS sector is emerging as a dynamic, integrated arena where collaboration, cutting-edge science, and strategic agility converge to set new standards.

Assessing the Multifaceted Effects of 2025 United States Tariffs on Supply Chains, Cost Structures, and Industry Competitiveness in EIFS

The introduction of escalated United States tariffs in 2025 has had a profound influence on the economics of exterior insulation and finish systems. By targeting imported raw materials such as specialized polymers, expanded polystyrene beads, and key chemical additives used in fire-resistant facades, these trade measures have prompted manufacturers to reassess cost structures across the value chain. As import duties increased, domestic production gained relative appeal, accelerating investments in local manufacturing capacity to offset the margin pressures imposed by new levies.

Consequently, supplier relationships have evolved, with many system producers forging strategic alliances with regional processors to secure preferential pricing and stable lead times. This shift has bolstered supply chain resilience but also triggered a period of adjustment as procurement teams recalibrated their sourcing models. Meanwhile, project budgets have been reprioritized, and end users are seeking greater transparency around material origin and lifecycle footprints. In response, leading stakeholders are emphasizing vertically-integrated approaches that combine raw material production, lamination, and finishing under one umbrella to streamline costs and ensure compliance.

Looking ahead, the tariff-driven reconfiguration of global trade flows is set to persist as a critical variable for industry players. Organizations that proactively optimize their footprint by establishing manufacturing nodes in duty-favored zones will enjoy competitive advantages. Similarly, product innovation that reduces dependency on tariff-exposed inputs-through alternative formulations or increased recycled content-will be rewarded as market dynamics continue to reflect the interplay between policy imperatives and commercial strategy.

Uncovering Critical Market Segmentation Insights Drawn from Diverse End Use, Insulation Material, Finish Type, Application, System Type, and Distribution Dynamics

A nuanced understanding of market segmentation offers indispensable clarity for identifying growth pockets within the exterior insulation and finish systems arena. By examining end use categories such as commercial, industrial, institutional, and residential applications, stakeholders can prioritize resource allocation according to sector-specific demand patterns. Within commercial realms encompassing hospitality, office, and retail environments, the emphasis is on aesthetic versatility and energy management, driving preferences for high-end finishes and superior thermal performance.

Across industrial manufacturing and warehousing settings, system robustness and ease of maintenance dominate decision criteria, spurring interest in mineral wool and phenolic foam solutions that balance fire resilience with structural integrity. In the institutional domain, where education and healthcare facilities must comply with stringent safety and hygiene mandates, silicone-based finishes are increasingly favored for their antimicrobial properties and long-term resistance to environmental wear. Residential construction, split between multi-family and single-family segments, shows differentiated appetite for cost-effective expanded polystyrene versus premium polyurethane formulations, reflecting divergent budget considerations and performance expectations.

Material segmentation further reveals that polyisocyanurate foams are gaining traction due to their closed-cell structure and high R-values, while mineral wool continues to hold ground in applications requiring enhanced fire retardancy. Acrylic and synthetic finishes remain popular for their color stability and adhesion characteristics, although silicone finishes are capturing market share in regions with high moisture exposure. Meanwhile, new construction projects drive demand for one-coat systems that streamline installation, whereas renovation initiatives often leverage two-coat solutions to align with existing substrates. Finally, the choice of distribution channel-direct sales, distributor networks, or retail outlets-reflects organizational priorities around customer intimacy, geographic reach, and service capabilities.

This comprehensive research report categorizes the Exterior Insulation & Finish System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Insulation Material

- Finish Type

- System Type

- End Use

- Application

- Distribution Channel

Examining Distinct Regional Dynamics Shaping Demand and Innovation Across the Americas, Europe Middle East and Africa, and Asia Pacific Markets

Regional dynamics in the exterior insulation and finish systems market illustrate how localized drivers shape demand, innovation trajectories, and competitive landscapes. In the Americas, heightened sustainability mandates and weather-related resilience concerns have accelerated the adoption of high-performance insulation materials, especially in areas prone to extreme temperature fluctuations or natural disasters. Building codes in North America and key Latin American markets now require minimum thermal performance thresholds, stimulating retrofit activity in older building stock as well as new construction.

Conversely, Europe, the Middle East, and Africa exhibit a mosaic of regulations and architectural traditions, with Northern European nations leading in ultra-efficient material integration while Middle Eastern markets prioritize solar heat reflectivity and sand resistance. In Africa, infrastructure development and urbanization are fueling demand for cost-effective systems that also address humidity and termite exposure. Meanwhile, Asia-Pacific’s dynamic urban expansion is driving massive deployment of exterior systems in megaprojects, with a growing focus on green building certifications and smart facade solutions. This region’s emphasis on rapid construction cycles has elevated the popularity of pre-fabricated EIFS panels, enabling accelerated timelines without compromising performance standards.

Through these varied regional lenses, it becomes evident that success hinges on tailoring product portfolios and service models to align with local regulatory regimes, climatic challenges, and cultural preferences. Manufacturers that invest in regional application labs, training programs, and collaborative partnerships with architects and contractors will be strategically positioned to capture growth opportunities across these diverse geographies.

This comprehensive research report examines key regions that drive the evolution of the Exterior Insulation & Finish System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Competitive Positioning and Strategic Initiatives of Leading Exterior Insulation and Finish System Manufacturers Driving Market Differentiation

Competitive strategies among leading exterior insulation and finish system producers are defined by a combination of product innovation, integrated service offerings, and supply chain agility. Top manufacturers have differentiated themselves by developing proprietary insulating cores and finishes that exceed baseline regulatory requirements for fire safety and energy efficiency. These advances are often complemented by value-added services such as digital toolkits for architects, performance warranties, and training academies for installer networks, creating comprehensive ecosystems that foster customer loyalty.

Strategic acquisitions and joint ventures have also played a key role in consolidating expertise and expanding geographic footprints. By assimilating cutting-edge research entities and local spray-foam applicators, major players have accelerated time to market for new formulations and established direct access to critical installation channels. Additionally, investments in automated lamination and panel production lines have improved throughput and consistency, enabling rapid scale-up when demand surges. Through these multifaceted initiatives, industry leaders are reinforcing their market positions and setting higher benchmarks for responsiveness and end-to-end support.

This comprehensive research report delivers an in-depth overview of the principal market players in the Exterior Insulation & Finish System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adex Systems Inc.

- Allana Buick & Bers, Inc.

- Amvic Inc.

- BASF SE

- Compagnie de Saint-Gobain SA

- Dryvit Systems Inc.

- Durabond Products Ltd.

- Durock Alfacing International Limited

- Foundation Building Materials, LLC

- Kingspan Group plc

- Knauf Insulation GmbH

- MAPEI SpA

- Master Wall Inc.

- MUHU (China) Construction Materials Co., Ltd.

- Omega Products International, Inc.

- Owens Corning

- Parex USA, Inc.

- Rockwool International A/S

- RPM International Inc.

- Shingobee Builders, Inc.

- Sika AG

- Simpson Gumpertz & Heger Incorporated

- STO SE & Co. KGaA

- Terraco Group

- The Dow Chemical Company

- Wacker Chemie AG

Delivering Targeted Strategic Recommendations to Empower Industry Leaders with Innovative Approaches for Maximizing Growth and Operational Efficiency

Industry leaders seeking to capitalize on emerging opportunities in the EIFS market should prioritize a strategic mix of innovation, partnerships, and operational excellence. First, accelerating the development of low-embodied carbon formulations will enable organizations to preemptively address tightening sustainability regulations and secure green building endorsements. Concurrently, forging alliances with local cement and metal facade suppliers can facilitate integrated system offerings that reduce specification complexity and installation time.

Operationally, investing in flexible manufacturing capacity, including mobile fabrication units and regional finishing hubs, will enhance responsiveness to localized demand fluctuations and tariff-driven sourcing shifts. Companies should also expand their digital platforms to include real-time supply chain visibility tools and performance monitoring dashboards, empowering installers and project managers with actionable data. Finally, cultivating dedicated training and certification programs for contractors will ensure consistent installation quality and foster brand trust, establishing a virtuous cycle of advocacy and market penetration.

Detailing Rigorous Research Methodologies Combining Primary and Secondary Data Collection with Analytical Frameworks to Ensure Comprehensive Market Insights

Our research methodology combines rigorous primary and secondary data collection with robust analytical frameworks to deliver actionable market insights. Primary research involved in-depth interviews with executives, product engineers, and end-user procurement specialists across key regions to capture firsthand perspectives on performance requirements, regulatory challenges, and technology adoption trends. These qualitative insights were supplemented by quantitative surveys targeting architects, contractors, and building owners to validate preferences around system specifications and service expectations.

Secondary research encompassed a systematic review of industry publications, regulatory filings, and patent databases to trace technology roadmaps and anticipate upcoming code revisions. Advanced analytical techniques, including driver impact analysis and scenario modeling, were applied to evaluate the interdependencies between material innovations, supply chain dynamics, and policy influences. Cross-validation protocols were employed throughout to ensure consistency and reliability of findings, while sensitivity analyses were used to test the robustness of strategic recommendations under various market conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Exterior Insulation & Finish System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Exterior Insulation & Finish System Market, by Insulation Material

- Exterior Insulation & Finish System Market, by Finish Type

- Exterior Insulation & Finish System Market, by System Type

- Exterior Insulation & Finish System Market, by End Use

- Exterior Insulation & Finish System Market, by Application

- Exterior Insulation & Finish System Market, by Distribution Channel

- Exterior Insulation & Finish System Market, by Region

- Exterior Insulation & Finish System Market, by Group

- Exterior Insulation & Finish System Market, by Country

- United States Exterior Insulation & Finish System Market

- China Exterior Insulation & Finish System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Summarizing Strategic Takeaways and Critical Imperatives to Guide Stakeholders Navigating the Future Trajectory of Exterior Insulation and Finish Systems

In conclusion, the exterior insulation and finish systems market is poised at a critical inflection point where technological ingenuity, sustainability imperatives, and evolving trade policies intersect. Stakeholders who embrace integrated system designs, prioritize low-carbon materials, and cultivate resilient supply chains will stand apart in a rapidly maturing environment. Meanwhile, regional nuances-from the Americas’ retrofit focus to Asia-Pacific’s megaproject expansion-underscore the importance of geographic adaptability.

Ultimately, success hinges on a holistic approach that marries product innovation with service excellence and strategic agility. By aligning organizational priorities with the sector’s transformative currents, market participants can unlock new value propositions, mitigate emerging risks, and chart a course toward enduring growth and market leadership.

Connect Directly with Associate Director Sales and Marketing to Acquire Comprehensive EIFS Market Intelligence and Accelerate Strategic Decision Making

To explore detailed insights into the external insulation and finish systems market and engage directly for tailored intelligence and strategic guidance, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s extensive expertise and consultative approach will ensure you receive targeted recommendations that align with your organization’s unique needs and objectives. Engage today to secure your comprehensive market research report and unlock the data-driven perspectives necessary to position your business for sustained competitive advantage

- How big is the Exterior Insulation & Finish System Market?

- What is the Exterior Insulation & Finish System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?