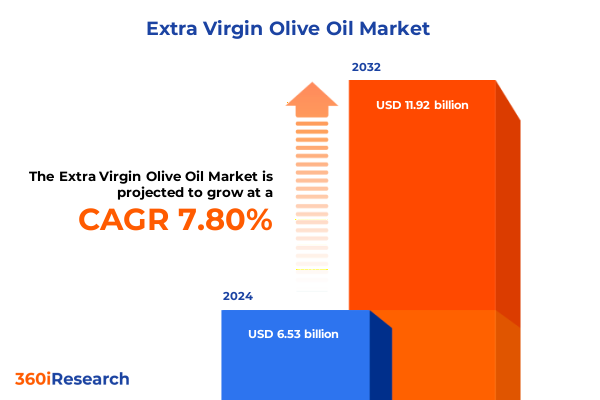

The Extra Virgin Olive Oil Market size was estimated at USD 7.04 billion in 2025 and expected to reach USD 7.54 billion in 2026, at a CAGR of 7.80% to reach USD 11.92 billion by 2032.

Exploring the evolution of the extra virgin olive oil market through shifting consumer health preferences, premiumization trends, and sustainability practices

The evolution of the extra virgin olive oil market reflects a profound shift in consumer priorities toward health and authenticity. With mounting evidence supporting the cardiovascular benefits of monounsaturated fats and polyphenols, shoppers are aligning their purchasing behavior with dietary patterns that emphasize clean labels and functional wellness attributes. Beyond simply choosing an oil for cooking, modern consumers view extra virgin olive oil as a premium ingredient that can enhance both health outcomes and culinary experiences. Consequently, brand owners and distributors are placing unprecedented emphasis on antioxidant levels, acidity metrics, and certification standards to differentiate products and foster trust among discerning buyers.

In parallel, the burgeoning interest in terroir and provenance has elevated the role of origin stories. From hillside groves in Tuscany to family estates in California’s Central Valley, the narrative surrounding harvest practices, grove management, and mill technology plays a pivotal role in shaping perceptions of quality. Producers are investing in traceability platforms that allow end users to follow the journey from grove to bottle, thereby underscoring transparency and forging emotional connections. This strategic emphasis on provenance is complemented by artisanal packaging innovations that communicate a brand’s heritage while aligning with contemporary design sensibilities.

As digital channels become integral to premium food retailing, direct-to-consumer models and e-commerce marketplaces have emerged as catalysts for growth. Digital storefronts enable brands to engage with niche audiences through personalized experiences, curated subscriptions, and interactive content on health benefits and recipe pairings. Against this backdrop, the extra virgin olive oil landscape is transitioning from a commoditized supply chain to an era where data-driven brand narratives and consumer engagement are integral to market success.

Uncovering the seismic shifts reshaping the extra virgin olive oil industry from digital channel expansion to sustainable production and transparency demands

The extra virgin olive oil sector is undergoing transformative shifts that span technological, environmental, and regulatory dimensions. Digitization of the supply chain has accelerated with blockchain pilots ensuring traceability from harvest through milling. In turn, consumers are empowered to verify authenticity and assess quality attributes in real time, which has driven wider adoption of tamper-evident seals and smart labels embedded with QR codes. Meanwhile, social media platforms serve as influential channels for product discovery, fostering the rise of flavor-driven micro-brands specializing in specialty infusions and limited-edition bottlings.

Sustainability considerations have become central to competitive positioning. GRO (Global Redesign for Organic) standards, carbon neutrality commitments, and regenerative agriculture practices are increasingly mandatory to secure placement in premium retail channels. Producers are adopting water-efficient irrigation techniques and soil health programs that reduce environmental footprints while enhancing olive tree resilience against climate variability. These efforts are complemented by investments in closed-loop milling operations that repurpose pomace and wastewater, underscoring circular economy principles.

Regulatory developments are reshaping global trade flows and labeling requirements. Stricter definitions for “extra virgin” grade, alignment with international standardization bodies, and enhanced mandatory country-of-origin disclosures reflect growing scrutiny across regions. As a result, importers and exporters must adapt packaging designs and compliance protocols to avoid costly penalties and maintain consumer confidence. Taken together, these trends signal a sector entering a new phase of sophistication, where digital, environmental, and regulatory imperatives converge to redefine how extra virgin olive oil is produced, marketed, and consumed.

Analyzing the cumulative impact of United States tariffs on extra virgin olive oil imports and domestic production shifting through 2025

Since the imposition of ad valorem duties on European olive oil imports under the United States’ Section 301 tariffs in 2020, the cumulative impact on the extra virgin olive oil market has been substantial. With a 25 percent tariff still in effect in 2025, importers have encountered significant cost pressures that have been partially absorbed through tightened margins and partially passed on to end users in the form of higher shelf prices. This tariff regime has catalyzed a strategic realignment among distributors, who are now diversifying suppliers away from traditional European origins toward emerging producers in North America and Western Asia.

Domestically, this trade barrier has provided fertile ground for U.S. producers to expand acreage, invest in advanced groves, and scale cold-pressed extraction capacity. California-based brands have stepped up marketing initiatives that emphasize local sourcing, reduced transportation emissions, and shorter supply chains-attributes that resonate strongly with eco-conscious consumers. While the higher domestic yield has helped alleviate some supply constraints, the premium price positioning of U.S.-grown extra virgin olive oil means that cost-sensitive segments have increasingly shifted to alternative oils or lower-grade options.

Despite the challenges posed by elevated import duties, some European exporters have offset tariff burdens through value engineering, such as adjusting bottle sizes, optimizing packaging materials, and introducing blended offerings that balance imported olive oil with lower-cost domestic varieties. Looking ahead, the persistence of these tariffs continues to influence portfolio strategies, procurement decisions, and consumer pricing dynamics, underscoring the need for supply chain agility and nimble market responses.

Illuminating critical segmentation insights in distribution, packaging, product categories, price tiers, end users, application areas, and extraction methods

The extra virgin olive oil market spans a diverse set of distribution channels that include direct sales, foodservice operators, digital commerce through brand websites and e-commerce marketplaces, as well as specialty outlets ranging from delicatessens to gourmet food retailers and organic-only shops, alongside the traditional supermarket and hypermarket formats. Packaging plays an equally pivotal role in influencing purchasing behavior, with offerings in bulk formats coexisting alongside glass bottles available in volumes from 250 milliliters up to and beyond one liter, as well as PET bottles, pouches, and tin cans tailored to varying consumer preferences.

Within product categories, conventional oils compete alongside organic and infused variants, with flavor innovations ranging from chili and citrus to garlic and herb infusions that press culinary boundaries. Pricing tiers capture economy, standard, and premium segments, ensuring that cost-conscious consumers and high-end shoppers alike find suitable products. End-user applications further segment the market into household kitchens and commercial kitchens at food manufacturers, hotels, and restaurants. Beyond culinary uses, the oil finds its way into cosmetic shelves in hair care and skin care formulations, into industrial processes for biofuel and lubrication, and into pharmaceutical contexts as nutraceutical supplements and topical treatments. Extraction methods underpin quality distinctions, with centrifugal extraction and traditional cold-pressed techniques delivering unique sensory and chemical profiles that inform both labeling and consumer education initiatives.

This comprehensive research report categorizes the Extra Virgin Olive Oil market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Category

- Packaging Type

- Price Range

- Extraction Process

- Origin

- Application

- Distribution Channel

Revealing regional dynamics in the extra virgin olive oil sector across Americas, Europe Middle East & Africa, and Asia-Pacific markets

Regional dynamics in the extra virgin olive oil sector reveal nuanced patterns across the Americas, Europe Middle East & Africa, and the Asia-Pacific region. In the Americas, the United States leads consumption volumes, buoyed by health-driven demand and a surging premium segment that favors domestic brands with transparent supply chains. Canada and Brazil have emerged as growth hot spots, while Mexico and Chile continue to expand production capacity and refine export strategies targeting North American buyers.

In Europe Middle East & Africa, Spain, Italy, and Greece remain the foundational trio for olive oil production, backed by established appellation systems and geographic indication protections. These countries have defended market share through investments in cold-chain logistics and coordinated marketing campaigns that underscore heritage and quality. Meanwhile, North African producers in Morocco, Tunisia, and Algeria are scaling operations to challenge incumbents, offering competitive pricing and leveraging proximity to European markets. The Middle East, driven by elevated per capita consumption in countries such as Lebanon and Jordan, sustains a stable demand base focused on culinary traditions and local cuisine.

In the Asia-Pacific region, rapid urbanization in China and India is driving imports of premium and organic extra virgin olive oil. Japan and South Korea maintain steady demand among health-conscious segments, while Australia continues to expand its domestic production footprint through boutique groves and boutique pressing facilities. Across these markets, digital sales platforms enable wide reach and education about Mediterranean-style diets, further accelerating category penetration.

This comprehensive research report examines key regions that drive the evolution of the Extra Virgin Olive Oil market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting strategic moves and market positioning of leading extra virgin olive oil producers shaping global competitiveness

Leading producers in the extra virgin olive oil space are leveraging strategic maneuvers to fortify their positions amid evolving market dynamics. Traditional giants such as multinational bottlers and co-op groups are pursuing vertical integration, acquiring olive groves and milling facilities to secure raw material supply and protect margin stability. At the same time, established brands have forged partnerships with boutique groves in emerging regions and launched sub-brands that target niche consumer preferences for single-estate and award-winning harvests.

Notable U.S. producers have capitalized on tariff-induced advantages by scaling planting programs and enhancing extraction technology to drive down costs while preserving quality. These players have also accelerated investments in digital marketing, social media storytelling, and subscription offerings to build direct relationships with end users. European incumbents are responding by optimizing their global footprint, shifting production closer to key demand centers in North America and Asia-Pacific, and co-packing with regional partners to mitigate duty impacts.

Innovation leadership has emerged from both heritage brands and agile disruptors, particularly those that emphasize cold-pressed and high-polyphenol formulations. Certification credentials-from organic to PDO/PGI-are now table stakes in premium segments, and winners are those who can convey authenticity through immersive brand experiences. Collaborations with culinary influencers, beverage companies, and wellness platforms further underscore a multidimensional approach to marketing, positioning extra virgin olive oil as an essential ingredient across lifestyle touchpoints.

This comprehensive research report delivers an in-depth overview of the principal market players in the Extra Virgin Olive Oil market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- California Olive Ranch by Gladstone Land Corporation

- Carbonell

- COLAVITA Spa

- Costco Wholesale Corporation

- DEOLEO S.A.

- Grupo Ybarra Alimentación

- GRUPO YBARRA ALIMENTACIÓN, SL

- Jaencoop

- Oliviers & Co.

- Salov S.p.A.

- SERVICENTAL AGROSEVILLA S.L.

- Sovena Group

- Star Fine Foods by Borges International Group

- The Honest Company

Proposing actionable strategies for industry leaders to capitalize on emerging trends, optimize operations, and drive sustainable growth

Industry leaders should prioritize end-to-end traceability by adopting blockchain-enabled tracking systems that validate origin, harvest date, and milling details, thereby reinforcing consumer trust. Parallel to this, streamlining the direct-to-consumer model through optimized subscription offerings and tailored digital content will support premium price strategies and bolster customer loyalty. Brands can also capitalize on product innovation by developing novel flavored infusions and limited-edition seasonal releases to sustain consumer engagement and command higher margins.

Sustainability must remain a core pillar of operational strategy, with investments in regenerative agriculture practices and energy-efficient milling operations to reduce environmental impact. Packaging innovations-such as lightweight glass, recyclable plastics, and closure enhancements-will address growing concerns around waste and carbon footprint. In parallel, forging strategic alliances with foodservice providers and cosmetic manufacturers can unlock new channels and diversify revenue streams. To counterbalance tariff volatility, a diversified sourcing strategy that blends domestic and international supply will enhance resilience and supply chain agility.

Finally, aligning product portfolios with evolving regulatory requirements-particularly around labeling standards and chemical composition thresholds-will mitigate compliance risk and maintain market access. By deploying data analytics to understand consumer preferences across distribution channels, price tiers, and regional markets, decision-makers can fine-tune their offerings and optimize channel investments for maximum ROI.

Detailing the rigorous research methodology underpinning the study, from data collection approaches to analytical frameworks ensuring accuracy

This study integrates both primary and secondary research methodologies to deliver robust and actionable insights. Primary research comprised in-depth interviews with olive grove owners, mill operators, importers, and retail executives, ensuring firsthand perspectives on production constraints, pricing pressures, and distribution challenges. Complementing these interviews, surveys of end-consumers provided quantitative understanding of usage patterns, purchase drivers, and flavor preferences across key markets.

Secondary research sources included trade association publications, government customs data, academic journals on oil chemistry and health outcomes, and industry white papers on sustainability best practices. Data triangulation techniques were employed to reconcile disparities between import-export statistics and consumption estimates, while a proprietary market segmentation framework-informed by distribution channels, packaging formats, product categories, price ranges, end-user segments, application areas, and extraction processes-structured the analysis.

Expert validation panels, composed of agronomists, food scientists, and regulatory specialists, reviewed preliminary findings to confirm technical accuracy and relevance. All data inputs underwent rigorous quality assurance protocols, and regional market contributions were assessed through a blend of top-down and bottom-up approaches to reflect real-world trade flows and consumption patterns.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Extra Virgin Olive Oil market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Extra Virgin Olive Oil Market, by Product Category

- Extra Virgin Olive Oil Market, by Packaging Type

- Extra Virgin Olive Oil Market, by Price Range

- Extra Virgin Olive Oil Market, by Extraction Process

- Extra Virgin Olive Oil Market, by Origin

- Extra Virgin Olive Oil Market, by Application

- Extra Virgin Olive Oil Market, by Distribution Channel

- Extra Virgin Olive Oil Market, by Region

- Extra Virgin Olive Oil Market, by Group

- Extra Virgin Olive Oil Market, by Country

- United States Extra Virgin Olive Oil Market

- China Extra Virgin Olive Oil Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Summarizing key takeaways and future outlook to guide stakeholders in navigating the evolving extra virgin olive oil market landscape

The extra virgin olive oil market stands at a critical juncture, driven by health-conscious consumers, emerging digital channels, and an escalating focus on sustainability. Premiumization continues to redefine quality benchmarks, with provenance and traceability becoming indispensable to brand differentiation. The persistence of U.S. tariffs on European imports has reconfigured supply chain strategies, spurring growth among domestic producers and fostering innovative cost-mitigation tactics among importers.

Segmentation analysis underscores the diversity of opportunity across distribution models, packaging formats, and end-use applications, spanning household kitchens, foodservice establishments, cosmetic formulations, and pharmaceutical applications. Regional insights highlight the dominance of traditional producers in Europe Middle East & Africa alongside burgeoning demand in North America and Asia-Pacific markets. Leading companies are responding through vertical integration, strategic partnerships, and brand storytelling that marries authenticity with digital engagement.

Looking forward, success in this landscape will hinge on agility and foresight: leveraging emerging technologies for traceability, calibrating product portfolios to consumer flavor innovations, and embracing sustainable practices to meet regulatory and environmental imperatives. Stakeholders who can deftly navigate tariff challenges, harness rich consumer data, and deliver compelling provenance narratives will be best positioned to capture value in an evolving extra virgin olive oil marketplace.

Connect with Ketan Rohom to access comprehensive insights and secure your copy of the detailed extra virgin olive oil market research report today

To explore the full breadth of insights, strategic analyses, and detailed market intelligence on the extra virgin olive oil sector, reach out directly to Ketan Rohom at Associate Director of Sales & Marketing. His expertise will guide you through the comprehensive findings and replicate the depth of analysis you need to inform your critical business decisions. By engaging with Ketan, you can secure immediate access to the full report and leverage actionable data on consumer trends, tariff impacts, regional dynamics, and competitive strategies. Don’t miss the opportunity to empower your organization with the latest intelligence-connect with Ketan Rohom now to purchase your copy of this indispensable market research study

- How big is the Extra Virgin Olive Oil Market?

- What is the Extra Virgin Olive Oil Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?