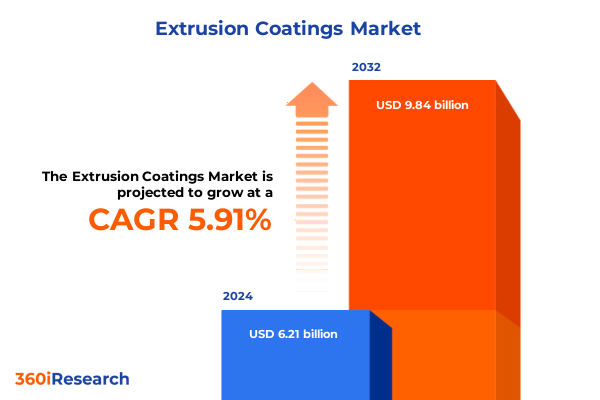

The Extrusion Coatings Market size was estimated at USD 6.52 billion in 2025 and expected to reach USD 6.84 billion in 2026, at a CAGR of 6.06% to reach USD 9.84 billion by 2032.

Unveiling the Multifaceted Extrusion Coatings Industry Landscape Amidst Accelerating Sustainability, Technological Innovations, and Market Transformation

The extrusion coatings industry stands at the confluence of technological innovation, sustainability imperatives, and shifting end-market demands, making it one of the most dynamic segments within the global coatings arena. Historically rooted in the need for cost-effective protection and functionality in packaging, construction, automotive, and medical applications, extrusion coatings have evolved far beyond simple moisture barriers. Today's market is defined by a relentless pursuit of high-performance, multi-layered systems that deliver enhanced barrier properties, improved mechanical strength, and customization to meet stringent regulatory and consumer standards.

As the industry embraces a broader focus on environmental stewardship, manufacturers are accelerating their transition to eco-friendly formulations. From bio-based polymers to waterborne and powder coating systems, the drive toward reduced volatile organic compound emissions and heightened recyclability has become paramount. Simultaneously, advancements in catalyst technology, digitalization of process controls, and innovative die designs have unlocked new levels of precision and efficiency, enabling thinner coatings and downguaging without compromising performance.

In parallel, the interplay of global trade policies, supply chain disruptions, and raw material cost volatility has underscored the need for strategic agility. Companies are increasingly leveraging vertically integrated models and long-term partnerships with resin producers to stabilize feedstock availability. Coupled with growing consumer demand for sustainable packaging, as well as regulatory mandates across major markets, the extrusion coatings sector is poised for a transformative phase, characterized by accelerated innovation and nuanced market segmentation.

This executive summary delves into the pivotal forces reshaping the extrusion coatings landscape, examining emerging technologies, policy impacts, segmentation dynamics, regional growth differentials, leading corporate strategies, and actionable recommendations. By understanding these drivers, industry stakeholders can navigate complexities and harness opportunities for durable competitiveness.

Navigating the Transformative Shifts Reshaping Extrusion Coatings through Sustainable Materials, Advanced Technologies, and Regulatory Drivers

Over the past several years, the extrusion coatings industry has undergone profound shifts driven by the convergence of sustainability priorities, process innovations, and regulatory pressures. A key catalyst for change has been the global emphasis on reducing environmental footprints, prompting a significant transition from solvent-based systems toward water-based, powder, and bio-based coatings. These alternative formulations not only lower volatile organic compound emissions but also align with circular economy principles by incorporating recycled content, thereby reducing dependency on virgin feedstocks and mitigating waste streams in packaging and industrial applications.

Technological breakthroughs have further accelerated industry transformation. The integration of digital manufacturing platforms, including IoT-enabled sensors and AI-driven quality control algorithms, has enhanced precision in temperature regulation, melt flow optimization, and die design, enabling manufacturers to produce ultra-thin coatings that maximize substrate performance while conserving material. Concurrently, multi-layer extrusion techniques allow for customized barrier architectures, combining polymers with complementary properties in a single pass to achieve superior moisture, oxygen, and aroma resistance, critical for demanding food, pharmaceutical, and medical packaging use cases.

Moreover, the pursuit of high-performance materials has spurred the development of advanced bio-based resins and biodegradable polymers. Recent introductions of polyhydroxyalkanoate blends and certified bio-content extrusion coating grades illustrate how chemical innovators are leveraging renewable feedstocks to meet both ecological objectives and stringent functional requirements. For example, a leading global producer has achieved ASTM D6866 certification for a high-barrier biodegradable resin that rivals conventional polyethylene in sealing strength and thermal stability, underscoring the feasibility of sustainable alternatives without sacrificing product integrity. As these trends coalesce, the extrusion coatings sector is being redefined by a dual mandate: elevate performance while reducing environmental impact, setting the stage for next-generation applications and enhanced market resilience.

Assessing the Cumulative Impact of United States Tariff Policies on Extrusion Coating Supply Chains and Cost Structures through 2025

United States trade policies have exerted a cumulative impact on extrusion coatings supply chains and cost structures, with tariff measures under Section 301 and Section 232 introducing layers of complexity that persisted into 2025. Since the initial imposition of Section 301 tariffs on certain polymer resins and chemical intermediates, manufacturers have grappled with fluctuating import duties, prompting recalibrations of sourcing strategies and pricing models. Raw material suppliers from China and other regions faced exclusion expirations, which USTR extended through August 31, 2025, to provide continuity for affected industries; however, uncertainty remains as stakeholders await the outcomes of the four-year statutory review that informs potential modifications or eliminations of existing duties.

Beyond Section 301, the application of Section 232 tariffs on steel and aluminum indirectly influenced extrusion coatings operations, given the interconnected nature of upstream metallized films and foil substrates used in barrier coatings. These measures elevated the cost base for composite packaging formats, driving some converters to explore alternative substrates or negotiate localized sourcing agreements to mitigate landed duty expenses. The net effect has been a reshaped landscape in which margin pressures have underscored the importance of integrated supply chain resilience and bilateral sourcing partnerships.

Looking ahead, the convergence of these trade actions with evolving environmental regulations and raw material market dynamics underscores the value of strategic planning. Companies that proactively monitor tariff developments, engage in exclusion proceedings, and diversify supplier portfolios are better positioned to absorb cost fluctuations and maintain competitive pricing. As the industry moves through 2025, the interplay between trade policy and sustainability initiatives will continue to define the contours of extrusion coatings economics and operational agility.

Unlocking Key Market Segmentation Insights for the Extrusion Coatings Industry Across Applications, Technologies, Substrates, and End-Use Industries

An examination of application segmentation reveals that adhesive coatings, encompassing pressure-sensitive and water-activated formulations, play a pivotal role in enabling versatile bonding solutions across diverse substrates. Pressure-sensitive adhesives deliver instant tack for flexible packaging lamination, while water-activated systems provide robust seals in paperboard applications, offering converters a spectrum of performance options tailored to end-use demands. Barrier coatings, particularly those designed for food and medical packaging, remain indispensable for ensuring product integrity and shelf life, leveraging high-barrier polymers to protect contents from moisture ingress and microbial contamination.

In the realm of functional coatings, extrusion delivers specialized attributes such as enhanced chemical resistance, UV protection, and temperature tolerance. Heat seal coatings, differentiated by high-temperature and low-temperature grades, cater to distinct processing conditions-high-temperature sealants facilitate rapid throughput in industrial packaging lines, whereas low-temperature options optimize energy efficiency in sensitive food packaging contexts. Lamination coatings, spanning film lamination, flexible packaging lamination, and paperboard lamination, underpin multi-layer structures that combine mechanical strength with barrier performance, reflecting the imperative for materials that balance durability and recyclability.

Technological segmentation underscores material innovation, as copolymers, ethylene vinyl acetate (EVA), metallocene, plastomer, and polyurethane platforms offer discrete performance profiles. Copolymers deliver balanced stiffness and flexibility, while EVA grades enhance sealability and processability. Metallocene catalysis has unlocked ultra-low-density and narrow distribution polymers for precise coating weights, and plastomers introduce elasticity and toughness. Polyurethane coatings, valued for their abrasion resistance and chemical stability, extend the application envelope into specialized industrial and construction domains.

The substrate landscape encompasses board, film, foil, and paper, with further differentiation such as folding carton board versus solid bleached board, and subcategories of film including BOPP, PE, PET, and PP, each selected based on tensile properties and barrier requirements. Coated paper and kraft paper provide cost-effective and sustainable alternatives in select markets. End-use segmentation spans agriculture, automotive, construction, medical, and packaging, with intricate sub-divisions-automotive exterior and interior coatings address aesthetic and protective needs, construction insulation and roofing coatings deliver weatherproofing, medical device and pharmaceutical packaging coatings ensure sterility, and beverage and food packaging coatings respond to evolving consumer safety and convenience trends.

Coating type segmentation-from powder to solvent-based, solvent-less, and water-based systems-further highlights the market’s versatility. Solvent-based aliphatic and aromatic variants offer chemical robustness, while water-based acrylic and polyurethane options address VOC reduction commitments. Each segment presents unique opportunities and challenges, demonstrating the criticality of aligning product portfolios with application-specific requirements and sustainability roadmaps.

This comprehensive research report categorizes the Extrusion Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Coating Type

- Technology

- Substrate

- Application

- End Use Industry

Revealing Pivotal Regional Dynamics Shaping the Future of Extrusion Coatings Markets in the Americas, Europe, Middle East & Africa, and Asia-Pacific

Regional dynamics in the extrusion coatings market illustrate distinct growth patterns and strategic imperatives. In the Americas, a mature manufacturing base and well-established packaging and construction sectors drive steady demand for extrusion coatings, with a pronounced emphasis on regulatory compliance and food safety standards. U.S. converters are increasingly adopting water-based and recyclable coating systems to meet federal and state-level environmental mandates, while Latin American markets present growth pockets driven by expanding e-commerce and food processing industries seeking cost-effective barrier solutions.

Europe, the Middle East & Africa region reflects a heterogeneous landscape, where Western Europe’s stringent circular economy regulations and recycled-content requirements incentivize innovations in bio-based and mono-material extrusion coatings. Key European markets are leading developments in multi-layer barrier films and certified compostable resins, supported by investments in advanced extrusion lines and circular end-of-life programs. In contrast, Middle Eastern markets are propelled by infrastructure expansion and customized construction coatings that offer thermal insulation properties, while African markets, though nascent, show emerging demand for low-cost packaging coatings aligned with local agribusiness growth.

Asia-Pacific remains the fastest-growing region, anchored by robust expansion in consumer packaged goods, pharmaceuticals, and single-serve food packaging demand. Rapid industrialization and rising disposable incomes in China and India sustain high-volume consumption of polyethylene-based extrusion coatings, while Southeast Asian economies are adopting metallocene and plastomer technologies to differentiate product offerings. Additionally, regional supply chain investments and local resin production facilities are improving feedstock accessibility, allowing converters to optimize costs and respond swiftly to shifting market requirements.

Across all regions, the interplay of sustainability targets, regulatory frameworks, and technological adoption shapes the extrusion coatings landscape, underscoring the need for market players to tailor strategies that address specific regional drivers while leveraging global best practices.

This comprehensive research report examines key regions that drive the evolution of the Extrusion Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Key Competitive Company Insights Driving Innovation, Sustainability, and Market Leadership in the Extrusion Coatings Sector

Leading companies in the extrusion coatings sector are differentiating through integrated sustainability initiatives, advanced material platforms, and strategic asset expansions. A prominent global materials science company has invested in a net-zero Scope 1 and 2 emissions integrated ethylene cracker and derivatives facility, underlining a commitment to decarbonized feedstock supply and operational efficiency that enhances its ability to offer competitively priced, eco-friendly polymer resins for coating applications. Meanwhile, chemical innovators have introduced biodegradable extrusion coating resins containing high percentages of biobased content, achieving ASTM certification and showcasing performance parity with conventional polymers for food-contact applications.

In parallel, major packaging solution providers are incorporating post-consumer recycled content into multi-layer extrusion processes, serving as a case study in aligning circular economy objectives with high-barrier performance, particularly in liquid packaging formats. Additionally, specialty polymer manufacturers have emphasized R&D collaborations with converter partners to refine catalyst systems and extrusion line configurations, enabling thinner coating weights and improved substrate adhesion, thereby enhancing material efficiency and reducing total cost of ownership.

Furthermore, a major European coatings conglomerate has leveraged its polyurethane expertise to launch solvent-less extrusion coating lines targeting automotive interior applications, achieving notable improvements in abrasion resistance and odor control. Across these cases, a common theme emerges: leading firms are harnessing vertical integration, strategic partnerships, and proprietary technologies to navigate raw material volatility, deliver on sustainability targets, and maintain leadership in an increasingly competitive environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Extrusion Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Arkema S.A.

- Borealis AG

- Celanese Corporation

- Chevron Phillips Chemical Company LLC

- Davis-Standard, LLC

- Dura Coat Products by Axalta Coating Systems Ltd.

- Eastman Chemical Company

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- Hanwha Group

- Kuraray Co., Ltd.

- LyondellBasell Industries N.V.

- NOVA Chemicals Corporation

- PPG Industries, Inc.

- Qenos Pty Ltd.

- Reliance Industries Limited

- Saudi Basic Industries Corporation

- Solvay SA

- The Dow Chemical Company

- The Lubrizol Corporation

- The Sherwin-Williams Company

- Toray Industries, Inc.

- Transcendia

- Westlake Corporation

Compelling Actionable Recommendations for Industry Leaders to Capitalize on Growth Opportunities and Navigate Challenges in Extrusion Coatings

To thrive in the evolving extrusion coatings market, industry leaders should prioritize a multi-pronged approach that integrates sustainability, technological modernization, and proactive policy engagement. First, companies must accelerate the adoption of eco-friendly coating systems-embracing bio-based polymers, recyclable mono-material laminates, and waterborne formulations-to meet tightening environmental regulations and consumer expectations. By establishing clear sustainability roadmaps and securing strategic partnerships with resin producers and recycling stakeholders, firms can mitigate risk and unlock long-term value through differentiated product offerings.

Second, investment in digitalization and advanced manufacturing capabilities is essential. Organizations should deploy IoT-enabled process controls, AI-driven predictive maintenance, and real-time quality analytics to optimize extrusion parameters, reduce waste, and enhance product consistency. Such digital initiatives not only drive operational excellence but also facilitate data-driven decision-making for portfolio optimization and capacity planning.

Third, engaging with trade authorities and participating in tariff exclusion proceedings is critical to managing cost structures amid shifting policy landscapes. Building cross-functional teams comprising supply chain, legal, and finance experts can streamline responsiveness to Section 301 and Section 232 developments, while exploring alternative sourcing networks and local production can hedge against import duty fluctuations.

Finally, firms should align R&D investments with segment-specific growth drivers. Tailoring product development to high-growth application niches-including medical device packaging, flexible e-commerce mailers, and automotive lightweighting-will ensure that new coatings address precise performance requirements. Collaborations with OEMs, end users, and academic research centers can accelerate innovation cycles and secure first-mover advantages in emerging market segments.

Detailing a Rigorous Research Methodology Integrating Primary Interviews, Secondary Analysis, and Data Triangulation for Extrusion Coatings Insights

This market analysis was underpinned by a blend of robust primary and secondary research methodologies, ensuring comprehensive and unbiased insights. The research team conducted in-depth interviews with C-level executives, technical directors, and procurement leaders across resin producers, converters, and end-use industries to capture firsthand perspectives on market dynamics, technology adoption, and strategic imperatives.

Complementing these primary engagements, the study incorporated extensive secondary research, including reviews of regulatory filings, company financial reports, patent databases, and technical journals. Industry conferences and trade association publications provided additional context on emerging trends, best practices, and competitive landscapes.

Data triangulation techniques were employed to reconcile quantitative estimates-such as segment shares, capacity utilization, and pricing benchmarks-with qualitative insights derived from expert interviews. A proprietary database of extrusion coating capacities and key technology adoption metrics served as the foundational dataset, enhanced through cross-verification against publicly disclosed production volumes and market intelligence sources.

This holistic research framework ensures that the findings reflect the latest developments, validated by multiple data sources, and grounded in practical industry applications. The methodology supports the credibility of the strategic recommendations, enabling stakeholders to make informed decisions with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Extrusion Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Extrusion Coatings Market, by Coating Type

- Extrusion Coatings Market, by Technology

- Extrusion Coatings Market, by Substrate

- Extrusion Coatings Market, by Application

- Extrusion Coatings Market, by End Use Industry

- Extrusion Coatings Market, by Region

- Extrusion Coatings Market, by Group

- Extrusion Coatings Market, by Country

- United States Extrusion Coatings Market

- China Extrusion Coatings Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Concluding Reflections on the Strategic Imperatives and Future Outlook within the Evolving Extrusion Coatings Landscape

In summary, the extrusion coatings market is navigating a pivotal juncture marked by sustainability mandates, technological advancements, and complex trade environments. The transition toward eco-friendly materials, including bio-based and recycled-content polymers, is redefining performance benchmarks, while digitalized manufacturing and multi-layer extrusion innovations are unlocking new operational efficiencies and product functionalities.

Concurrently, the lingering effects of U.S. tariff measures on polymers and substrate materials have reinforced the importance of supply chain agility and strategic sourcing to control costs. Regional growth differentials-driven by regulatory frameworks in Europe, infrastructural expansion in the Middle East & Africa, and high-volume demand in Asia-Pacific-highlight the need for geographically tailored approaches.

Competitive leadership is increasingly predicated on integrated sustainability strategies, proprietary technology platforms, and collaboration across the value chain. Organizations that align R&D efforts with high-growth segments, invest in digital transformation, and proactively engage in policy developments will be best positioned to capitalize on market opportunities and sustain long-term profitability.

As the industry continues to evolve, stakeholders must remain vigilant to emerging trends, maintain flexibility in their operational models, and forge partnerships that accelerate innovation and reinforce market resilience.

Engage with Ketan Rohom to Secure Your Comprehensive Extrusion Coatings Market Research Report and Accelerate Strategic Growth

To unlock the full breadth of analysis on extrusion coatings, we invite you to engage with Ketan Rohom, Associate Director, Sales & Marketing, who will guide you through the report’s detailed findings, proprietary insights, and actionable data. By partnering with Ketan, you will gain tailored access to in-depth market breakdowns, comprehensive company profiles, and expert interpretations of emerging trends, enabling your organization to craft informed strategies that capitalize on evolving opportunities.

Ketan’s expertise in delivering customized research solutions ensures you receive not only the latest intelligence but also strategic recommendations aligned with your business objectives. Reach out today to arrange a brief consultation, during which Ketan will outline how this market research report can be leveraged to accelerate growth, optimize operations, and safeguard competitive advantage in the dynamic extrusion coatings landscape.

- How big is the Extrusion Coatings Market?

- What is the Extrusion Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?