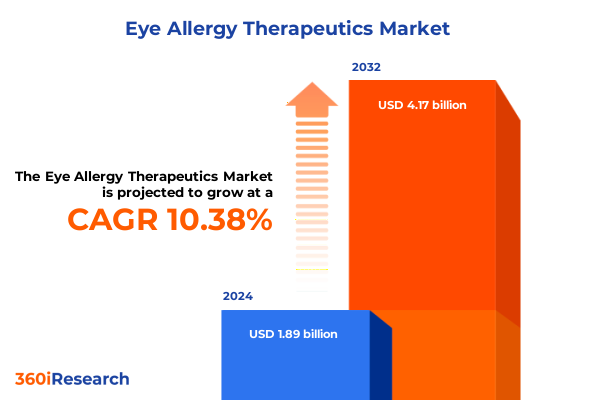

The Eye Allergy Therapeutics Market size was estimated at USD 2.07 billion in 2025 and expected to reach USD 2.27 billion in 2026, at a CAGR of 10.51% to reach USD 4.17 billion by 2032.

Unveiling the Complex Dynamics Driving the Eye Allergy Therapeutics Market’s Future Trajectory in a Changing Healthcare Environment

The field of eye allergy therapeutics has undergone significant transformation driven by rising prevalence, evolving treatment modalities, and shifting patient expectations. Allergic conjunctivitis, the most common form of ocular allergy, affects up to one quarter of the U.S. population annually, resulting in persistent symptoms such as itching, redness, and tearing that degrade quality of life and reduce productivity. Emerging evidence indicates that environmental factors including air pollution, urbanization, and climate change have contributed to a steady increase in cases of both seasonal and perennial ocular allergies, with estimates ranging from 50 to 85 million Americans experiencing symptoms in a given year. Globally, up to 40 percent of allergic rhinitis patients report concomitant ocular involvement, underscoring the interconnected nature of atopic disorders and the need for targeted therapeutic solutions.

Amid this persistent clinical burden, the eye allergy therapeutics market has expanded to encompass a spectrum of pharmacologic classes, delivery formats, and distribution channels. Innovations in dual-action agents that combine antihistaminic and mast cell stabilizing effects have sought to deliver rapid onset relief while suppressing late-phase inflammatory responses. Meanwhile, the Rx-to-OTC switch of prescription-strength formulations has broadened patient access to advanced therapies, reflecting growing consumer demand for convenient, non-prescription options. Concurrently, stakeholders are paying greater attention to formulation tolerability, preservative-free delivery, and novel sustained-release systems to improve patient adherence and long-term outcomes. In this dynamic environment, a comprehensive examination of market drivers, regulatory shifts, and competitive strategies is essential to guide evidence-based decision-making and chart a path for future growth.

Identifying Transformative Shifts Reshaping the Eye Allergy Therapeutics Landscape Amid Rapid Technological and Regulatory Advances

Recent years have witnessed a surge in novel pharmaceutical and delivery innovations that are reshaping the eye allergy therapeutics landscape. Leading companies have prioritized the development of advanced formulations designed to prolong drug residence, optimize dosing frequency, and enhance tolerability. A notable milestone was the FDA approval of olopatadine 0.7% ophthalmic solution, which provided demonstrable 24-hour itch relief in clinical trials and underscored the therapeutic value of higher-concentration antihistamine agents. In parallel, the Rx-to-OTC switch of this formulation under the Pataday brand has unlocked broader patient access to prescription-grade relief without compromising safety or efficacy. Beyond traditional eye drops, early-stage platforms featuring collagen-mimetic peptides and nanocarrier-based sustained-release technologies have garnered industry accolades for their potential to provide extended symptom control after a single administration. These advances are complemented by the exploration of off-label immunomodulators, such as topical calcineurin inhibitors, in managing severe or steroid-dependent cases, reflecting an ongoing quest to address refractory disease phenotypes.

Digital health innovations have also begun to leave an imprint on ocular allergy management. Telemedicine and remote patient monitoring have demonstrated value in triaging seasonal exacerbations, enabling allergists and ophthalmologists to deliver virtual consultations for symptom assessment and medication adjustments with high patient satisfaction. Electronic symptom diaries, smartphone–powered ocular imaging, andAI–driven decision support tools are emerging as adjuncts that may facilitate earlier detection of flare-ups, personalize treatment regimens based on environmental triggers, and optimize follow-up care. Regulatory bodies have shown increasing receptivity to real-world evidence generated through digital platforms, which could accelerate approval pathways for next-generation therapies.

Strategic alliances and cross-sector partnerships are amplifying the pace of innovation across the eye allergy space. Global pharmaceutical leaders are forging licensing agreements with biotech upstarts to access proprietary molecule libraries and novel drug delivery systems, particularly those originating in Asia-Pacific markets. While dependency on Chinese API manufacturing remains high, firms are pursuing diversified supply chain strategies and collaborative R&D models to uphold resilience in the face of evolving trade policies and tariff considerations.

Assessing the Cumulative Impact of 2025 United States Tariffs on the Eye Allergy Therapeutics Supply Chain and Market Accessibility

In April 2025, the introduction of a blanket 10 percent tariff on imported goods, including critical active pharmaceutical ingredients (APIs), delivered an immediate cost burden on manufacturers of generic and branded eye allergy therapeutics. More pronounced were the sector-specific duties of 20 to 25 percent imposed on APIs sourced from China and India, which supply roughly 40 percent of U.S. generic drug ingredients. These measures have strained operating margins and prompted companies to reassess established sourcing arrangements. As a result, U.S.-based producers are accelerating onshoring initiatives and entering public–private partnerships to expand domestic API capacity, aiming to mitigate exposure to future tariff escalations and enhance supply chain transparency.

The 245 percent retaliatory tariff levied on Chinese-origin drug ingredients under Section 301 has further disrupted import-dependent segments, particularly in the generic antihistamine and mast cell stabilizer categories where cost sensitivity is paramount. Manufacturers reliant on Chinese intermediates have seen production costs surge, forcing some to absorb price increases while others explore alternative suppliers in Europe and Southeast Asia. This reconfiguration of supplier networks, though essential for risk management, has led to intermittent delays and tighter inventories, affecting drug availability during peak allergy seasons.

Despite these challenges, a subset of pharmaceutical imports has temporarily benefited from case-specific tariff exemptions granted through U.S.–China negotiations, offering partial relief for certain antibody-based therapies and specialty excipients. Furthermore, a 90-day mutual reduction agreement implemented in May 2025 lowered the reciprocal tariff from 125 to 10 percent, providing short-term respite for imported raw materials before scheduled restoration in August. However, the prospect of renewed Section 232 investigations and potential expansion of national security tariffs looms, reinforcing the urgency for companies to invest in flexible procurement strategies, dynamic pricing models, and robust inventory management to safeguard market continuity.

Unlocking Key Segmentation Insights to Navigate the Diverse Product, Distribution, Administration, and End User Dimensions of Eye Allergy Therapeutics

Product type remains a critical determinant of therapeutic positioning and patient adherence. Antihistamines constitute the first-line intervention for most mild-to-moderate cases, prized for rapid symptom relief and a favorable safety profile. Dual-action agents that combine histamine receptor blockade with mast cell stabilization are increasingly preferred, as they target both immediate itching and the late-phase inflammatory cascade, reducing the need for adjunctive therapy. Corticosteroids, while reserved for severe or refractory allergic conjunctivitis due to their potent anti-inflammatory effects, are utilized judiciously in pulsed regimens to minimize intraocular pressure elevation and cataract risk. Mast cell stabilizers and nonsteroidal anti-inflammatory drugs provide supplementary benefit in chronic forms of ocular allergy, but their slower onset of action has prompted formulators to integrate them with antihistaminic agents to deliver quicker onset while maintaining prophylactic control.

Distribution channels are undergoing a notable realignment. Traditional retail pharmacies continue to dominate point-of-care access for eye drops and gels, but the rise of ecommerce platforms offers an expanding conduit for direct-to-consumer supply. Hospital pharmacies retain their prominence for specialty treatments and acute care dispensing, whereas third-party online pharmacies have gained traction by offering home delivery, subscription services, and telepharmacy support. Chain pharmacy networks leverage scale to negotiate favorable formulary placement, while independent outlets deliver personalized counseling and niche product portfolios. Hospital online pharmacies are emerging as a specialized arm of institutional distribution, catering to patients requiring continuity of care post-discharge.

Route of administration plays a pivotal role in patient preference and adherence. Eye drops remain the dominant format, balancing ease of use with effective ocular surface exposure. Gels, formulated for extended retention time, serve patients who require prolonged dosing intervals, while ointments are reserved for nocturnal application due to transient visual blurring. Novel sustained-release inserts and contact lenses represent investigational avenues to further extend therapeutic coverage and reduce dosing frequency, though regulatory approvals and patient acceptance are still evolving.

End-user segmentation highlights the importance of demographic-specific needs. Adults aged 18 to 65 account for the bulk of prescription and OTC purchases, driven by a combination of seasonal exposures and workplace productivity demands. Seniors over 65 demonstrate heightened vulnerability to irritant-induced inflammation and may require formulations with lower preservative concentrations to accommodate ocular surface fragility. Pediatric cohorts aged 2 to 12 exhibit unique dosing and safety considerations; formulations for this group emphasize gentle tolerability and simplified regimens. Infants under 2, while representing a small but significant population, are managed under pediatric-specific protocols with close medical supervision.

This comprehensive research report categorizes the Eye Allergy Therapeutics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Route Of Administration

- Distribution Channel

- End User

Mapping Critical Regional Insights That Illustrate Major Market Dynamics Across Americas, EMEA, and Asia Pacific Territories

The Americas region continues to anchor global market growth, driven by strong healthcare infrastructure, high consumer awareness, and favorable insurance reimbursement policies. In the United States, allergic conjunctivitis is the most frequent ocular condition, affecting more than six million individuals annually and generating direct costs ranging from $377 million to $857 million per year. The maturation of over-the-counter channels, including national retail chains and digital pharmacies, has streamlined patient access to both historic and next-generation therapies. Moreover, the adoption of Rx-to-OTC switches for prescription-grade antihistamines underlines a broader shift toward self-managed care, reinforcing the region’s leadership in both innovation and market penetration.

In Europe, Middle East & Africa, prevalence rates exhibit notable geographic variation. In the United Kingdom, data from primary care clinics indicate that approximately eight percent of patients report ocular allergy symptoms annually, often self-managed via pharmacy-supplied antihistamines and mast cell stabilizers. In Mediterranean countries and parts of the Middle East, vernal keratoconjunctivitis carries disproportionate clinical significance, with allergic sensitization rates exceeding 50 percent in specialized clinics and an estimated 18 percent self-reported prevalence in community surveys �═turn6search1� and �═turn7search6�. These trends reflect both environmental triggers, such as pollen and dust storms, and evolving healthcare policies that promote pharmacy-led minor ailment management.

Asia-Pacific represents the fastest-growing regional market, propelled by high population density, emerging middle-class cohorts, and accelerating healthcare investments. In China’s urban centers, nearly 28 percent of schoolchildren report ocular allergy symptoms during peak seasons, while adult prevalence hovers around 30 percent, highlighting a significant public health burden �═turn7search3�. Japan’s extensive pollen seasons, driven by cedar and cypress pollens, affect over a quarter of the population each spring, sustaining robust demand for specialty eye drops and driving local manufacturers to develop preservative-free and cooling-effect formulations �═turn7search1�. Across the region, expanding distribution networks, progressive regulatory frameworks, and rising digital literacy are converging to amplify market opportunities.

This comprehensive research report examines key regions that drive the evolution of the Eye Allergy Therapeutics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Key Company Strategies and Alliances Driving Innovation and Competitive Advantage in the Eye Allergy Therapeutics Market

Alcon has solidified its leadership through strategic Rx-to-OTC conversions, most notably transitioning prescription olopatadine formulations into widely accessible OTC products. The successful roll-out of Pataday Once Daily Relief Extra Strength, formerly Pazeo, underscores Alcon’s ability to leverage clinical data in support of regulatory approvals and consumer education initiatives. This portfolio expansion has maintained the #1 market position for doctor-prescribed active ingredients, while enabling omnichannel distribution across retail and digital platforms.

Bausch + Lomb is extending its presence beyond its established dry eye portfolio by exploring anti-inflammatory agents with crossover potential in ocular allergy. The company’s recent publication of clinical data demonstrating significant biomarker improvements with lifitegrast 5.0 percent underscores a commitment to pipeline diversification and immunomodulation strategies. While lifitegrast remains indicated for dry eye disease, investigational studies are assessing its capacity to modulate inflammatory pathways common to allergic conjunctivitis, signaling a potential new avenue for lifecycle management �═turn2search3�.

Regional champions such as Santen Pharmaceutical and Johnson & Johnson are also advancing localized innovation. Santen has prioritized the development of preservative-free dual-action drops tailored to sensitive ocular surfaces, capitalizing on strong domestic distribution networks in Japan and neighboring markets. Meanwhile, Johnson & Johnson’s launch of the ACUVUE Theravision contact lens, which delivers ketotifen directly from the lens matrix, represents a pioneering drug-device combination designed to address seasonal allergen exposure in daily-use modalities �═turn5search0�.

This comprehensive research report delivers an in-depth overview of the principal market players in the Eye Allergy Therapeutics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Alcon Inc.

- Bausch + Lomb Corporation

- F. Hoffmann-La Roche Ltd.

- Hikma Pharmaceuticals

- Johnson & Johnson Vision Care, Inc.

- Merck & Co., Inc.

- Regeneron Pharmaceuticals

- Sandoz International GmbH

- Sanofi SA

- Santen Pharmaceutical Co., Ltd.

- Sun Pharmaceutical Industries

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Formulating Actionable Recommendations for Industry Leaders to Capitalize on Emerging Trends and Strengthen Positioning in Eye Allergy Therapeutics

Industry leaders should prioritize diversification of supply chains by establishing parallel sourcing networks and engaging in public-private partnerships to expand domestic API manufacturing. This dual approach will mitigate exposure to future tariff escalations while reinforcing supply chain security for critical antihistamine and dual-action agents.

Concurrently, organizations ought to accelerate investments in digital health platforms that augment traditional care pathways. Integrating telemedicine consultations, remote symptom monitoring, and AI-driven decision support can enhance patient adherence, capture real-world evidence for regulatory submissions, and foster differentiated value propositions in both B2B and B2C channels.

Fostering strategic collaborations with biotech innovators and academic centers will enable in-licensing of novel sustained-release and immunomodulatory technologies. By aligning R&D pipelines with emerging trends in peptide-based delivery, contact-lens drug elution, and topical biologics, companies can secure first-mover advantages and establish robust intellectual property positions.

Finally, stakeholders should engage policymakers to advocate for evidence-based tariff exemptions and expedited regulatory pathways for critical ocular allergy therapies. Demonstrating the public health imperative of uninterrupted access to affordable treatments will support favorable policy outcomes and safeguard patient access during periods of trade and political uncertainty.

Detailing Robust Research Methodology Underpinning Comprehensive Analysis of the Eye Allergy Therapeutics Market’s Insights and Validation Processes

This report’s findings are grounded in a rigorous mixed-method research framework designed to ensure comprehensive coverage of the eye allergy therapeutics ecosystem. Primary research included in-depth interviews with key opinion leaders, including ophthalmologists, allergists, formulary managers, and supply chain executives, providing qualitative insights on unmet needs and strategic priorities. Simultaneously, a series of structured surveys captured quantitative data on prescribing patterns, distribution dynamics, and untapped market segments.

Secondary research encompassed systematic reviews of peer-reviewed journals, government publications, regulatory filings, and industry reports. Major databases including MEDLINE, PubMed, and proprietary patent registries were mined to track therapeutic innovations, formulary milestones, and pipeline developments. Data triangulation techniques were applied to cross-validate findings across sources and ensure analytical precision.

Finally, expert validation workshops convened senior stakeholders from across the value chain to review preliminary insights and model assumptions. This iterative validation process refined scenario analyses, stress-tested supply chain implications, and aligned the report’s conclusions with real-world market dynamics, culminating in a robust, actionable intelligence product.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Eye Allergy Therapeutics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Eye Allergy Therapeutics Market, by Product Type

- Eye Allergy Therapeutics Market, by Route Of Administration

- Eye Allergy Therapeutics Market, by Distribution Channel

- Eye Allergy Therapeutics Market, by End User

- Eye Allergy Therapeutics Market, by Region

- Eye Allergy Therapeutics Market, by Group

- Eye Allergy Therapeutics Market, by Country

- United States Eye Allergy Therapeutics Market

- China Eye Allergy Therapeutics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Concluding with Strategic Perspectives that Synthesize Key Findings and Frame Future Directions in Eye Allergy Therapeutics Research and Market Engagement

The landscape of eye allergy therapeutics is marked by dynamic interplay between clinical needs, regulatory frameworks, and technological innovation. Recent advancements in dual-action formulations and sustained-release delivery have expanded treatment options, while digital health platforms are redefining patient engagement and evidence generation. Concurrently, geopolitical developments and tariff policies have reshaped supply chain strategies, underscoring the importance of procurement flexibility and domestic manufacturing capacity.

Looking ahead, the convergence of telemedicine, AI-enabled diagnostics, and novel immunomodulatory agents promises to further transform care paradigms for ocular allergy sufferers. By embracing supply chain resiliency, fostering strategic partnerships, and advocating for policy clarity, stakeholders can capitalize on these inflection points to drive sustainable growth and improve patient outcomes. This synthesis of market drivers and actionable recommendations provides a roadmap for navigating an increasingly complex and opportunity-rich therapeutic domain.

Empower Your Strategic Decisions Today by Securing Direct Access to Expert Market Intelligence from Ketan Rohom via Report Purchase Prompt

To explore deeper insights and secure your competitive edge, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Take the next step to transform your strategic planning with this comprehensive market research report and ensure your organization’s success in the evolving eye allergy therapeutics landscape. Contact Ketan today to purchase your copy and gain exclusive access to actionable intelligence.

- How big is the Eye Allergy Therapeutics Market?

- What is the Eye Allergy Therapeutics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?