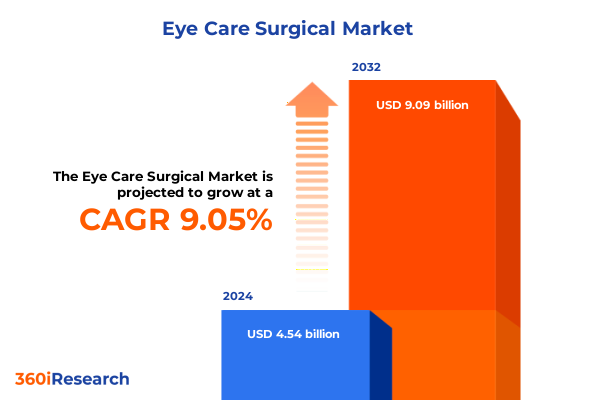

The Eye Care Surgical Market size was estimated at USD 4.94 billion in 2025 and expected to reach USD 5.37 billion in 2026, at a CAGR of 9.10% to reach USD 9.09 billion by 2032.

Comprehensive examination of evolving eye care surgical landscape emphasizing strategic rationale value proposition and emerging technological imperatives

The following report presents a comprehensive examination of the evolving eye care surgical landscape, establishing the strategic rationale and value proposition that underpins its growing criticality. In recent years, demographic shifts have resulted in a substantial increase in age-related ocular disorders, prompting healthcare providers and industry stakeholders to prioritize surgical interventions as central elements of patient care journeys. Furthermore, rapid advancements in surgical techniques-from manual small incision procedures to laser-based platforms-have driven a paradigm shift in both clinical outcomes and practice economics. As a result, strategic decision-makers face an imperative to understand the convergence of clinical efficacy, cost management, and patient satisfaction.

Building on an extensive review of academic literature, regulatory developments, and clinical trial outcomes, this introduction elucidates the core themes that resonate throughout the report. The interplay of technological innovation, policy frameworks, and evolving patient expectations serves as the bedrock for subsequent analyses, ensuring that readers are equipped with the context necessary to navigate complex market dynamics. By framing the report’s scope within these interconnected dimensions, stakeholders can appreciate the foundational trends that will shape long-term value creation in ophthalmic surgery.

Insights into paradigm shifting advancements in surgical techniques device innovations and patient care models reshaping the eye care operative environment

The eye care surgery sector is undergoing transformative shifts fueled by a fusion of innovative device design, procedural refinements, and digital integration. Most notably, the proliferation of femtosecond laser platforms and excimer technologies has redefined precision standards in refractive and cataract procedures, enabling surgeons to achieve unprecedented levels of patient-specific customization. Simultaneously, the rise of minimally invasive glaucoma surgery techniques is lowering the threshold for early intervention, effectively broadening the patient pool that can benefit from surgical correction.

Emerging software-driven capabilities such as artificial intelligence–based diagnostics and intraoperative guidance systems are accelerating the path from preoperative planning to real-time adjustments, thereby enhancing both safety and efficiency. Beyond the operating suite, novel viscoelastic formulations and advanced intraocular lens materials are improving postoperative outcomes, reducing complication rates and accelerating visual rehabilitation. As these cumulative innovations coalesce, the industry is poised for a new era in which traditional boundaries between procedure categories and device classes become increasingly porous.

Assessing multidimensional economic geopolitical and regulatory consequences stemming from cumulative United States tariff measures impacting ophthalmic surgical supply chains

In 2025, a series of revised United States tariff measures targeting imported medical devices and surgical consumables has exerted multidimensional effects on ophthalmic supply chains and cost structures. These policy actions, which introduced additional duties on key components such as intraocular lenses and viscoelastic agents, have catalyzed a reassessment of global sourcing strategies. As import costs escalated, manufacturers and distributors began to explore alternative procurement hubs, resulting in the realignment of logistics networks and the establishment of near-shore partnerships.

Concurrently, the tariff landscape has prompted accelerated investments in domestic manufacturing initiatives. Strategic alliances between technology providers and contract manufacturing organizations have emerged as critical mechanisms to mitigate duty burdens while ensuring regulatory compliance. This shift has not only shielded certain market segments from price volatility but also invigorated local innovation ecosystems. Although initial overheads have risen in response to facility expansion, the longer-term effect is an enhancement of supply chain resilience and a greater capacity for rapid scale-up in response to evolving clinical demand.

Revealing segmentation across procedure types product categories end users and technology platforms driving diverse expansion pathways in ophthalmic surgery

Revealing segmentation across procedure types product categories end users and technology platforms driving diverse expansion pathways in ophthalmic surgery necessitates a nuanced exploration of distinct market drivers. When examining the domain of procedure types, cataract interventions remain a cornerstone of surgical volume, encompassing extracapsular extraction intracapsular extraction and advanced phacoemulsification techniques. Glaucoma operations are diversifying with minimally invasive glaucoma surgery trabeculectomy and tube shunt procedures each addressing varying stages of disease severity. In the field of refractive corrections, Lasek Lasik and Prk approaches are attracting different patient demographics based on recovery time and visual goals, while vitreoretinal surgeries such as macular surgery pars plana vitrectomy and retinal detachment repair continue to advance through specialized instrumentation.

Product category segmentation further illuminates the trajectory of market evolution. Intraocular lenses have diversified into monofocal multifocal and toric variants, reflecting a patient-centric shift toward refractive precision and reduced spectacle dependence. Surgical instruments are undergoing ergonomic and material innovations to bolster procedural accuracy, and viscoelastic formulations-cohesive and dispersive-are tailored to optimize anterior chamber stability across procedure types. From an end user standpoint, ambulatory surgical centers hospitals and dedicated ophthalmic clinics each maintain unique operational models, reimbursement frameworks and capacity constraints that influence product adoption and service delivery.

Finally, technology segmentation highlights a critical dichotomy between incision-based and laser-based modalities. Manual small incision processes designed for resource-constrained settings coexist alongside high-throughput phacoemulsification units in tertiary care centers. Laser-based platforms-excimer for corneal reshaping and femtosecond for capsulotomy and lens fragmentation-are redefining procedural workflows, driving a competitive dynamic focused on cross-platform integration and system interoperability.

This comprehensive research report categorizes the Eye Care Surgical market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Procedure Type

- Technology

- End User

Exploring distinct regional market dynamics in the Americas Europe Middle East Africa and Asia Pacific that shape strategic investment frameworks

Exploring distinct regional market dynamics in the Americas Europe Middle East Africa and Asia Pacific that shape strategic investment frameworks reveals pronounced variations in adoption rates reimbursement policies and competitive landscapes. In the Americas, particularly the United States, a mature healthcare infrastructure and favorable reimbursement environment have sustained robust demand for premium intraocular lenses and minimally invasive procedures. Canada’s single-payer system, by contrast, emphasizes cost-effectiveness, fostering growth in high-efficiency phacoemulsification and generic viscoelastic products.

Across Europe Middle East and Africa, regulatory harmonization within the European Union coexists with localized policies in the Middle East and early-stage markets in Africa. This regional complexity incentivizes modular platform strategies and tiered product offerings to accommodate differential pricing tolerances. In the Asia Pacific region, rapid clinical capacity expansion in countries such as China and India is underpinned by government-led eye care initiatives, catalyzing large-scale adoption of refractive and cataract procedures. Furthermore, emerging markets in Southeast Asia are demonstrating agile uptake of portable surgical systems and tele-ophthalmology linkages, reflecting a dual imperative to expand access while maintaining quality standards.

This comprehensive research report examines key regions that drive the evolution of the Eye Care Surgical market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Characterizing competitive strategies innovation portfolios and alliances among leading manufacturers propelling breakthroughs in eye care surgical technologies

Characterizing competitive strategies innovation portfolios and alliances among leading manufacturers propelling breakthroughs in eye care surgical technologies demonstrates the intensity of current market competition. Industry stalwarts are focusing on differentiated product launches that combine advanced optics and biomaterials, while a surge of mid-tier entrants seeks to disrupt cost structures through lean manufacturing and targeted distribution channels. Collaborative ecosystems are emerging between established device companies and digital health providers to embed telemetry and performance analytics into surgical platforms, enhancing procedural oversight and enabling data-driven service models.

In addition to organic R&D initiatives, mergers and acquisitions continue to reshape the competitive topology as firms aim to broaden their portfolios. Strategic partnerships with academic research centers and specialized contract manufacturers have become instrumental in accelerating time-to-market for next-generation offerings. Together with focused marketing campaigns tailored to key opinion leaders and high-volume surgical centers, these approaches underscore an industry-wide shift toward integrated solution ecosystems that address the full patient pathway from preoperative assessment through postoperative follow-up.

This comprehensive research report delivers an in-depth overview of the principal market players in the Eye Care Surgical market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alcon Inc.

- Bausch + Lomb Corporation

- Carl Zeiss Meditec AG

- Ellex Medical Pty Ltd

- HOYA Corporation

- Iridex Corporation

- Johnson & Johnson Vision Care, Inc.

- LENSAR, Inc.

- NIDEK Co., Ltd.

- Topcon Corporation

Delivering actionable strategic guidance and operational best practices for stakeholders to strengthen resilience accelerate growth in eye care surgery

Delivering actionable strategic guidance and operational best practices for stakeholders to strengthen resilience accelerate growth in eye care surgery requires a multifaceted approach. First, companies should optimize their supply chains by diversifying sourcing, establishing flexible manufacturing footprints and leveraging predictive analytics to anticipate component availability. In parallel, prioritizing investments in laser-based platforms and digital integration can bolster clinical differentiation and unlock new service offerings that command premium pricing.

For healthcare providers and distributors, forging closer partnerships with regulatory agencies and professional societies is essential to streamline product approvals and align on outcome metrics. Emphasizing training programs with immersive simulation and telementoring can accelerate surgeon proficiency, reducing procedural variability and enhancing patient satisfaction. Finally, leveraging real-world evidence through longitudinal outcome tracking will enable stakeholders to refine product designs, improve reimbursement negotiations and sustain competitive advantage in an increasingly outcome-oriented environment.

Outlining integrated qualitative expert consultations quantitative data analyses and rigorous validation procedures supported by robust analytical frameworks

Outlining integrated qualitative expert consultations quantitative data analyses and rigorous validation procedures supported by robust analytical frameworks establishes the foundation of this study’s integrity. Secondary research encompassed a thorough review of peer-reviewed journals, clinical trial registries and regulatory filings to capture recent advancements and policy shifts. Concurrently, primary research involved in-depth interviews with leading ophthalmic surgeons, device innovators and supply chain executives to glean real-world perspectives on emerging trends and operational challenges.

The data collected through these channels underwent a stringent triangulation process, aligning insights across disparate sources to ensure consistency and mitigate bias. Advanced analytical tools were applied to categorize findings, identify correlation patterns and validate thematic conclusions. Throughout the research lifecycle, methodological rigor was maintained via cross-functional peer reviews, ensuring that each insight presented is both actionable and empirically substantiated.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Eye Care Surgical market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Eye Care Surgical Market, by Procedure Type

- Eye Care Surgical Market, by Technology

- Eye Care Surgical Market, by End User

- Eye Care Surgical Market, by Region

- Eye Care Surgical Market, by Group

- Eye Care Surgical Market, by Country

- United States Eye Care Surgical Market

- China Eye Care Surgical Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1590 ]

Summarizing critical discoveries and strategic considerations that underscore the significance of advanced surgical innovations in modern eye care

Summarizing critical discoveries and strategic considerations that underscore the significance of advanced surgical innovations in modern eye care highlights the transformative potential of ongoing technological and procedural evolution. By delving into nuanced segmentation across procedure types product categories end users and technology modalities, stakeholders can pinpoint high-impact growth corridors and tailor their investment strategies accordingly. The analysis of regional dynamics further emphasizes the need for adaptive market entry models that align with local regulatory, reimbursement and infrastructure realities.

Finally, the exploration of competitive strategies and actionable recommendations provides a roadmap for industry players to enhance resilience, foster innovation and achieve sustainable performance. Collectively, these insights serve as a strategic compass, guiding decision-makers through the complexities of the ophthalmic surgery market and enabling the creation of differentiated value propositions in a rapidly evolving environment.

Encouraging immediate engagement with Ketan Rohom Associate Director Sales Marketing to secure comprehensive ophthalmic surgery market intelligence

To gain deeper insights and secure unparalleled market intelligence on the dynamic landscape of ophthalmic surgery, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through tailored data deliverables, ensuring your strategic initiatives align with emerging clinical innovations and market shifts. Engage now to accelerate decision-making, mitigate risks, and capitalize on transformative opportunities within the eye care surgical sector.

- How big is the Eye Care Surgical Market?

- What is the Eye Care Surgical Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?